Have you ever wondered why a stock starts the day at one price but ends at another? When I first started trading, I was obsessed with the price at market open. It felt like a signal — a pulse check — on the entire day ahead. I didn’t realize then how much the opening stock price could tell me about market sentiment, volatility, or even trader psychology.

But here’s the thing: most new traders either ignore it or misunderstand it. They chase after headlines or rely on closing prices without realizing the market often shows its hand the moment it opens.

Over the years, I’ve learned that knowing how to interpret the opening price can change your whole strategy. So if you’re trying to decode the first minutes of market action, or just want to stop feeling confused when prices jump or gap at the open, this one’s for you.

- What the open stock price really means and how it’s set

- How it compares to the previous close and what causes those wild gaps

- Real examples, including OPEN stock on July 22, 2025

- How to use opening prices in technical analysis and trading strategies

- Common mistakes traders make about the open price

You’re about to gain insight into the first and most telling number of the trading day — the open price. With charts, real data, and a straight-up explanation, we’ll make sure you don’t miss what matters.

What Is the Open Stock Price?

The open stock price is the very first traded price of a stock when the market opens for the day. For U.S. stocks, that’s 9:30 AM Eastern Time on regular trading days. This price isn’t random. It reflects where buyers and sellers agree to meet after all the overnight news, earnings reports, and pre-market trades have shaken out.

Back when I was still green, I assumed the open price was just where it left off the day before. That couldn’t be more wrong. What really happens is this: the market goes through something called a price discovery process during pre-market hours. Orders pile up, and an auction determines the price where the most trades can happen — that’s your opening price.

How Is the Opening Price Calculated?

Most people don’t realize the open is calculated using an auction model, especially on the NYSE. Here’s how it goes down:

Before the bell, market makers look at limit orders, market orders, and pre-market activity to figure out where demand and supply meet. They’re looking for that one price where the largest volume can clear. Think of it like an auctioneer shouting out, “Who’s buying? Who’s selling?” — and finally settling on the best match for both.

This process is especially important for stocks with high volatility or news catalysts. I’ve seen stocks open with huge gaps simply because of an after-hours earnings surprise. That auction can get intense.

Open Price vs. Previous Close

Let’s clear this up. The previous close is the last traded price from the day before. The open price is the first traded price today. They’re often different — and sometimes dramatically so. Why? News. Market sentiment. Global events. Overnight trading. All of it creates new expectations that push the stock higher or lower before the open bell.

Take Opendoor Technologies Inc. (OPEN) for example. On July 22, 2025, the previous close was $2.88. But when the market opened the next day, it hit $2.54. That’s a huge gap down — nearly 12%! Clearly, something moved the needle while the regular market was sleeping.

Why the Opening Price Matters

Opening prices aren’t just numbers on a chart. They can give you early signals for the entire trading day. When I plan my trading day, I always look at the open vs. the previous close to check for sentiment shifts or breakout signals.

If you’re into technical analysis, the open price is one of the anchors for the day’s candlestick. It helps define price patterns, gaps, and sometimes, entire strategies like the Opening Range Breakout (ORB).

Gap Up and Gap Down: Volatility Signals

Ever hear the term “gap up”? That’s when the open price is higher than the previous close. A “gap down” is the opposite. These gaps are red flags — or green lights — depending on your strategy. I once saw a biotech stock gap up 18% after FDA approval, only to retrace 10% by noon. If you’re not paying attention at the open, you’re trading blind.

Here’s what happened with OPEN:

| Stock | Previous Close | Open Price | Gap % |

|---|---|---|---|

| OPEN (Opendoor) | $2.88 | $2.54 | -11.8% |

| OS (OneStream) | $25.12 | $25.02 | -0.4% |

Big gaps often mean big opportunity — but also big risk. These signals are the kind that seasoned traders live for. When OPEN dropped at the bell, anyone holding from the day before instantly faced a loss. But if you were watching closely, it was also a shorting opportunity.

Common Investor Misconceptions

There’s one myth I keep hearing: “I thought the open price is always the same as last night’s close.” That couldn’t be further from the truth. Markets breathe. They move 24/7. News happens while we sleep. That’s why the open is so important — it reflects everything the market has digested overnight.

And no, the opening price isn’t set by the exchange randomly. It’s the result of real buyer and seller activity. So next time you see a big price change at the open, don’t panic — analyze it.

Real-World Examples of Opening Prices

Let’s look closer at some specific examples that highlight how the open price affects trading decisions. Remember, Opendoor (OPEN) opened at $2.54 on July 22, 2025. It had closed the day before at $2.88. That’s a textbook “gap down” scenario — possibly due to bearish pre-market sentiment or disappointing earnings whisper numbers.

Now compare that to OneStream (OS). It opened at $25.02 after closing at $25.12. Barely a move. That tells me there wasn’t any big news or sentiment shift — at least nothing that shocked the market.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Expert-Trader-Strategies-Opening-Price-Principle-2021-01-f45a90c4d171473095a00d3b9ddb209d.jpg)

Day-Over-Day Volatility Patterns

Sometimes, you’ll spot stocks that consistently open strong and fade — or weak and rally. Recognizing those habits can shape your trading edge. Personally, I love tracking stocks like these with a simple spreadsheet. Over time, patterns emerge that can’t be unseen.

The key? Watch the open. Journal the gap. Pay attention to volume. There’s no substitute for first-hand data and screen time.

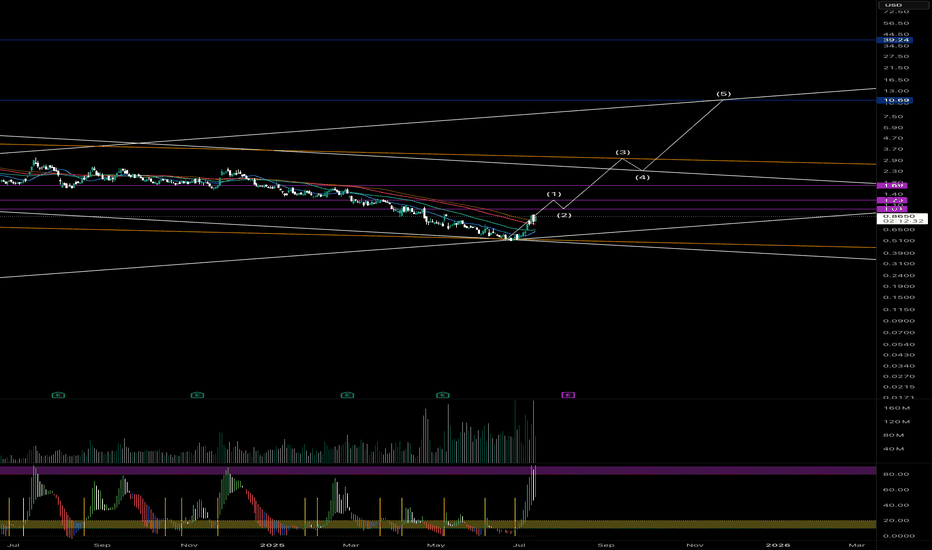

Analyzing Stock Charts at Open

When I analyze charts, I always look at what the candlestick at open is doing. That one candle — the first 5 or 15 minutes — can tell you a LOT. If the stock gaps up but the first candle is red and closes near the bottom, that’s weakness. If it gaps down and the candle is strong and green? You might be looking at a reversal.

I’ve used this to trade intraday reversals dozens of times. You can also use the opening price to mark key support and resistance zones. Price often revisits that level, and when it does — it’s like a magnet or a brick wall. You’ve gotta watch how the price reacts.

If you’re on TradingView, plot the opening price as a horizontal line and see how the price respects or rejects it throughout the day. Trust me, it’s eye-opening.

Factors That Influence Opening Prices

Why does the open price move so dramatically sometimes? I’ve been there — holding a stock that tanked at the open because of bad overnight news. Here’s what I’ve learned to check before the bell:

After-Hours News and Earnings Reports

Any news released after the market closes can shake things up. This includes earnings results, guidance changes, analyst upgrades/downgrades, and even CEO resignations. These events move pre-market sentiment, which directly impacts the next day’s open.

Economic Events and Global Market Reaction

When global markets like Asia or Europe open earlier and move sharply, U.S. stocks feel the ripple effect. Economic data like jobs reports, inflation numbers, or interest rate announcements also drive overnight trading and pre-market positioning.

Order Book Imbalances and Volume

Sometimes it’s not news, but sheer imbalance in buy and sell orders that causes a volatile open. When one side of the order book dominates, the opening auction tilts heavily. I saw this firsthand during the 2020 crash — even blue-chip stocks opened with jaw-dropping gaps simply due to volume pressure.

FAQ

What time is the stock market open?

For U.S. markets like NYSE and NASDAQ, the regular session opens at 9:30 AM Eastern Time and closes at 4:00 PM ET. But remember — pre-market and after-hours trading also impact prices before and after these hours.

Can the opening price be the highest of the day?

Absolutely. I’ve traded days where the open was the top tick, especially on gap-ups that quickly faded. That’s why watching early price action is so important — it tells you whether bulls or bears are really in control.

Why does the opening price differ from the last close?

Overnight news, global events, and order flow all shift sentiment. This causes the price at open to often move away from the previous close. It’s a direct reflection of what changed while markets were closed.

Does pre-market trading affect the opening price?

Yes. Pre-market orders and trades help build the price discovery process. Market makers factor in this data to calculate where the most trades can execute at the open. It’s like a preview of what’s to come.

Recap of Key Points

The opening price isn’t just a number. It’s the market’s first reaction to everything that happened overnight. You’ve learned how it’s calculated, why it moves, and how to use it as a powerful tool in your trading strategy. Whether it’s gap trading, breakout setups, or just understanding sentiment — the open gives you a head start.

If you’ve ever felt unsure what a stock’s first move of the day means — now you’ve got clarity. This price isn’t random. It’s strategic, telling, and often, predictive. And if you’re paying attention, it might just give you an edge that others miss.

The market speaks loudly at the open. You just have to listen. Next time the bell rings, don’t look away — look closer. That first price holds more weight than most traders realize. And now? You’re not one of them.