Some days, you just feel the pulse of the market racing. Today was one of those days. I was glued to my screen during pre-market hours, watching Garden Stage Limited (GSIW) light up the ticker with a massive 66% spike. It’s that electric moment every trader lives for—spotting a rocket before it takes off.

But the problem? If you’re not tracking these moves daily, you’ll miss out. I’ve missed plenty myself. I remember watching American Eagle Outfitters surge and realizing too late it had popped over 20% because of a surprise earnings beat. That’s when I committed to building a daily habit of monitoring top gainers—and sharing the insights that matter.

In today’s report, I’m highlighting:

- The top 10 gainers during regular trading

- Pre-market risers and what drove them

- After-hours movers with notable surges

- Sector trends and volume surges to watch

Let’s get into the heat map of today’s breakout momentum—and how you can use this list to spot your next trade, sharpen your analysis, or just keep a finger on the market’s pulse.

Biggest Gainers in Regular Trading

There was serious movement in both large and small caps today. I started my morning scanning the live volume leaders, and one thing was clear: traders were piling into volatility.

Top 10 Intraday Gainers (Sorted by % Change)

| Rank | Symbol | Company Name | % Change | Latest Price | Market Cap |

|---|---|---|---|---|---|

| 1 | GSIW | Garden Stage Limited | +66.23% | $0.29 | $6.28M |

| 2 | IXHL | Incannex Healthcare Inc. | +29.70% | $1.31 | $94.63M |

| 3 | ORIS | Oriental Rise Holdings Ltd. | +25.86% | $0.22 | $3.83M |

| 4 | MXL | MaxLinear, Inc. | +23.04% | $18.85 | $1.32B |

| 5 | AEO | American Eagle Outfitters | +22.27% | $13.23 | $1.87B |

Sector Momentum and Standouts

Retail and semiconductors took the spotlight today. MaxLinear (MXL), for example, got a tailwind from renewed AI-chip demand chatter. I spotted early bullish options activity on this one—something I always monitor when watching tech tickers.

American Eagle’s pop surprised me. It’s not every day that a clothing retailer climbs over 20% in one session. Their earnings call hinted at higher digital margins and improving inventory rotation, which clearly resonated with institutions and retail traders alike.

Why These Stocks Moved

Digging into the triggers, the patterns were clear:

Earnings Surprises

Lamb Weston (LW) jumped nearly 15% after blowing past EPS expectations. Their potato products are in everything—from fast food to premium retail. When restaurants bounce back, LW tends to follow.

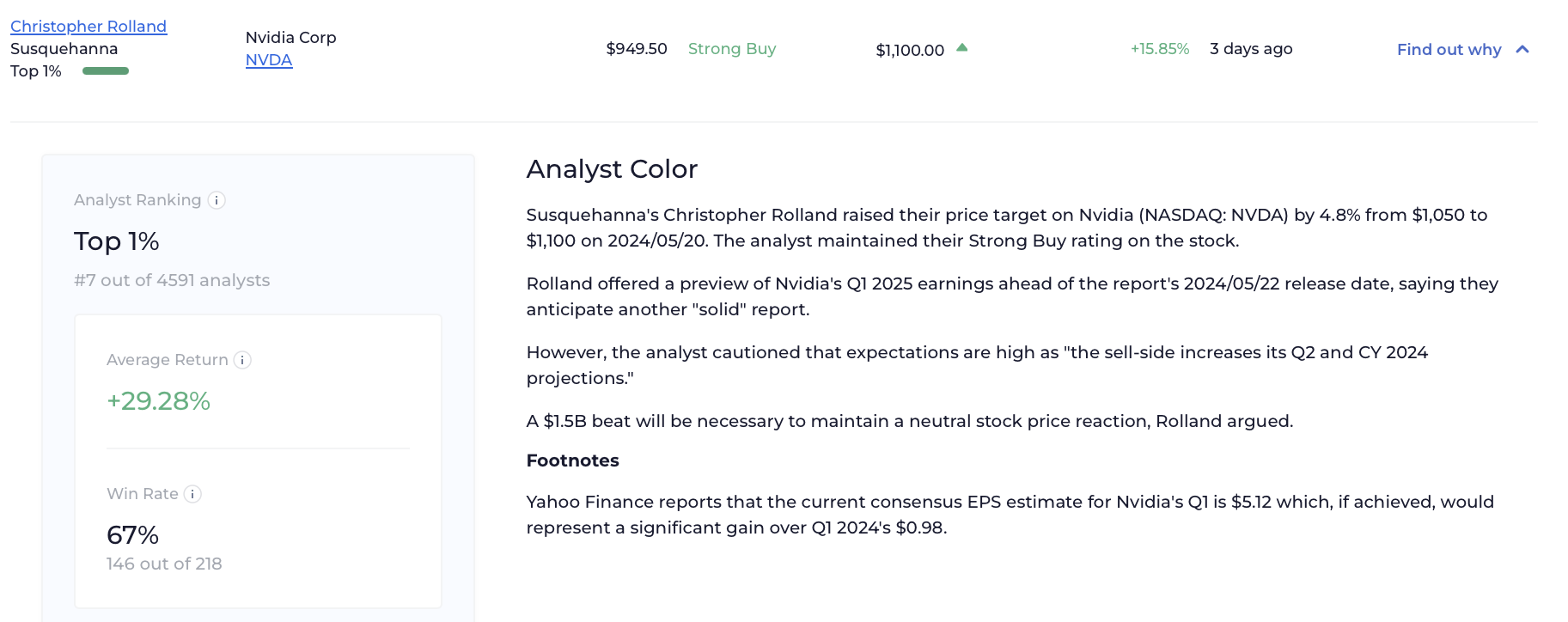

M&A Buzz and Analyst Ratings

Thermo Fisher (TMO) rallied 12% in post-earnings response coupled with a Goldman Sachs upgrade. When a stock this large gets that much analyst love, I take notes—and sometimes positions.

Technical Breakouts

Garden Stage Limited (GSIW) broke out of its base after a long downtrend. I wouldn’t touch this one personally, but if you’re into microcaps with low floats, this kind of 60% move is textbook for momentum scalping.

:max_bytes(150000):strip_icc()/ENPH_2025-06-26_13-58-02-26787074d73840628e13f6d4e6c58cd3.png)

Pre-Market Stock Gainers

Before the opening bell, I like to browse the biggest volume movers. That’s where I found Lamb Weston (LW) already up 8% pre-market. The reason? Strong guidance for 2025 and whispers of institutional buying based on agri-food demand cycles.

Early Risers Worth Watching

Here’s what stood out before 9:30 AM:

LW – Lamb Weston Holdings

This frozen food giant showed pre-market strength on the back of upgraded revenue guidance and surprising margins. Their mention of “AI-enhanced logistics” even raised some AI-adjacent buzz in chatrooms.

GEV – GE Vernova LLC

GE’s clean energy spin-off soared over 9% early as solar stimulus proposals gained traction in Congress. When I see political tailwinds and large-cap infrastructure bets, I dig into filings fast.

VST – Vistra Energy

This one caught my eye due to energy sector sympathy plays. It moved quietly but steadily, up over 5% on strong grid demand signals in the Texas region. Sometimes boring stocks win quietly.

After-Hours Stock Gainers

When the market closes, the action doesn’t stop. I’ve always believed that post-market trading reveals where smart money is moving. Today was no exception. After hours, Thermo Fisher (TMO) and ICON plc (ICLR) both lit up my watchlist.

Post-Market Movers with Big Surges

Thermo Fisher Scientific (TMO)

This healthcare behemoth soared another 12% in after-hours, driven by stronger-than-expected earnings and upbeat forward guidance. I tuned into their investor call—AI-powered diagnostics and new R&D investments were the main talking points. That’s fuel for long-term conviction plays.

ICON plc (ICLR)

With a 14% bump, ICLR benefited from a new partnership announcement with a leading biotech. I checked the volume—it was 5x the average in the after-market window. That tells me institutions were quietly positioning.

Amphenol (APH)

This one saw a 5% push post-bell. They’re a major player in connectors and sensors for automotive and telecom. News of an expansion into next-gen EV components sparked fresh interest.

Volatility and Volume Clues

Volume surges in after-hours are one of my favorite signals. Stocks like GSIW and BLMZ had wild swings, but I stayed out—they were too thinly traded and too easy to manipulate. I learned that the hard way years ago during a late-night trade gone wrong on a low-float biotech. Lesson learned: always check liquidity before clicking buy.

How to Use This Gainers List

If you’re new to trading, these lists may seem like just numbers—but they tell a story. I’ve used them to time entries, track sector momentum, and even avoid traps.

Tools That Help Me Track Gainers in Real-Time

I rely on TradingView, Market Chameleon, and Benzinga Pro. These platforms offer live gainers data and charting tools. I also keep a browser tab open with NASDAQ’s stock screener to cross-check volume and fundamentals.

Tips for Trading Top Gainers (Especially If You’re New)

Don’t chase blindly. Set alerts, watch the level 2 tape, and only enter if you understand the story behind the move. A strong catalyst (like earnings or news) is way more reliable than chatroom hype.

Red Flags and Traps to Avoid

Be wary of low-float penny stocks that spike without news. I’ve fallen for pump-and-dumps before. Now, I always verify with SEC filings and news sources like EDGAR before touching anything that’s moving “just because.”

FAQ

What is considered a “stock gainer”?

It’s a stock that rises in price significantly within a trading session—usually measured by % change from the previous close. I focus on those gaining 10% or more, especially if they also show volume spikes.

Why do some stocks spike after hours?

It’s usually due to earnings reports, big news announcements, or analyst upgrades released after the market closes. I use this period to monitor sentiment but rarely trade it unless there’s strong volume and clarity on the catalyst.

How accurate are pre-market stock movements?

They’re directional hints, not guarantees. Pre-market is often thinly traded, so prices can move sharply on low volume. I always wait until regular session opens before committing capital—unless I’m swinging from a known earnings winner.

Recap of Key Points

We covered the biggest movers today—from GSIW’s 66% moonshot to American Eagle’s earnings beat. We looked at pre-market triggers like LW and post-market surges from TMO. More than just names and numbers, these stocks moved for reasons you can track, learn from, and maybe even profit from.

Momentum isn’t random. It’s part math, part psychology, and a whole lot of watching closely. Use these gainer lists not just to trade, but to build your muscle of market observation. Every surge tells a story if you’re paying attention.

I’ve missed trades, chased green candles, and learned lessons—usually the hard way. But tracking top gainers daily is one habit that’s made me sharper. It can do the same for you. Stay curious, stay skeptical, and stay ready.