When I first heard Figma was going public, I got a little jolt of excitement. I’ve followed their journey since the Adobe acquisition news fell through. Now, with a rumored $16.5 billion valuation and a fresh IPO on the horizon, it feels like we’re watching something huge unfold. But there’s a lot to unpack—financials, risks, the tech space, and whether this stock is really worth your attention.

Figma’s IPO comes at a time when tech IPOs are rare and scrutiny is sky-high. And if you’re like me, you’ve seen one too many startups overpromise and underdeliver.

So, how does Figma stack up?

In this article, I’ll break down:

- What Figma actually does and why it matters

- IPO facts like ticker, pricing, and proceeds

- My take on the financials and business model

- Risks I’m personally watching

- What makes this IPO different (hint: gross margins)

If you’re curious about the future of design tech or thinking about buying shares of Figma, this guide will help you walk in with clarity, not hype.

What is Figma?

I started using Figma when it first made waves in the UX/UI design world. It was cloud-first, collaborative, and just felt smoother than anything else out there. And I’m not alone in thinking that. Today, Figma is the go-to design tool for everything from product prototypes to full website mockups.

History of Figma

Figma was founded in 2012 by Dylan Field and Evan Wallace. The idea was bold at the time: build a fully browser-based design tool that teams could use together, in real time. It took years of quiet development before their public beta wowed the design world.

The company quickly gained traction. I remember the buzz around their Series D round, where they pulled in huge support from top-tier VCs. Then came the Adobe deal, which would’ve been one of the biggest software acquisitions ever—$20 billion. Regulators said no, and Figma stayed independent. That twist actually increased my confidence in their roadmap.

What Makes Figma Unique?

Unlike older tools like Adobe XD or Sketch, Figma lives in the cloud. No downloads, no syncing files. And its collaboration features? Magic. I’ve worked with devs and marketers live in the same file, leaving comments and changing layouts in seconds.

They’ve also leaned into AI. Their new features assist with mockups, text generation, and even UI wireframes. That makes them stand out in the “design with AI” race.

Figma IPO Details

Let’s talk numbers. Figma will trade on the NYSE under the ticker FIG. The IPO price is set between $25 and $28 per share, aiming to raise around $1 billion. That puts the valuation around $16.5 billion on a fully diluted basis, according to their SEC filing.

This IPO is being led by a heavy-hitting crew: Morgan Stanley, Goldman Sachs, Allen & Company, and JPMorgan. That kind of lineup usually points to strong institutional interest.

Use of IPO Proceeds

One thing I appreciate is their transparency. Figma plans to use the proceeds to pay off about $330 million in revolving credit. The rest will go to working capital and general corporate needs. That tells me they’re not just raising money to burn—it’s a move to clean up the balance sheet and boost long-term flexibility.

Financial Performance and Business Metrics

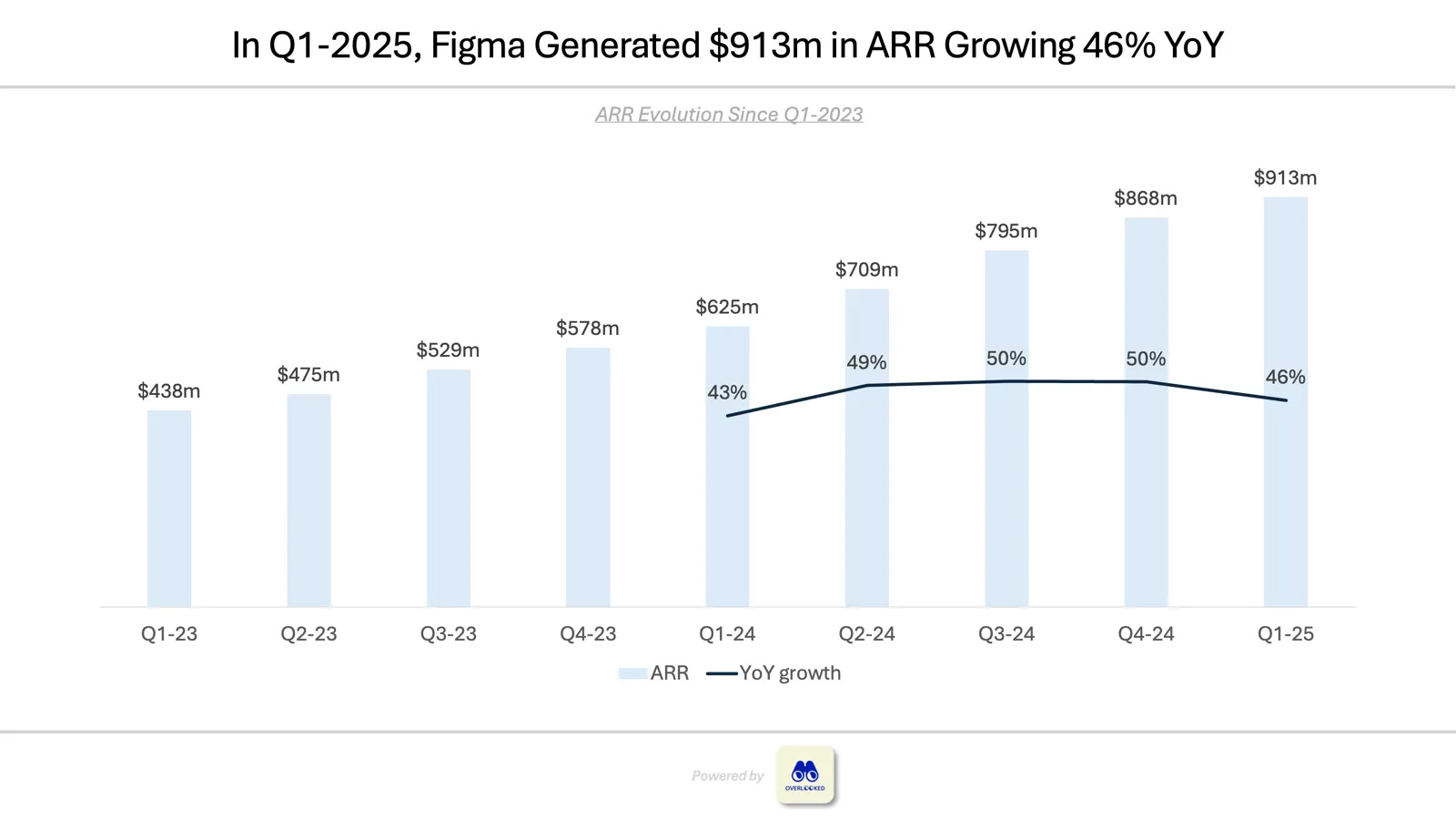

This is where Figma really shines. Their latest twelve-month revenue was a stunning $821 million, marking a 46% YoY increase. When I first saw that number, I had to double-check.

But what really impressed me? Their 91% gross margin. That’s elite, even for SaaS. Add an 18% adjusted operating margin on top, and you’re looking at a business that actually makes money. Imagine that—profitability in tech!

Market Position and Growth Potential

Figma serves 10,500 paying customers, including 95% of Fortune 500 companies. That’s wild. I’ve seen firsthand how product teams in fintech, healthcare, and SaaS all rely on it for design and prototyping.

The market for design and collaboration software is only expanding. With more companies embracing remote work and agile workflows, Figma is well-positioned. They’re also pushing into education and enterprise bundles, which could fuel the next growth wave.

| Metric | Figma | Adobe XD | Canva |

|---|---|---|---|

| Gross Margin | 91% | 76% | 82% |

| 2024 Revenue | $821M | ~$500M | ~$550M |

| Fortune 500 Penetration | 95% | Unknown | 35% |

Risks and Considerations

Now let’s take off the rose-colored glasses. There are some real risks with Figma’s stock.

Regulatory Landscape

We all saw the Adobe deal fall apart. The EU and UK watchdogs were clear: Figma’s market position is too dominant in some areas. That means more regulatory eyes going forward. And as someone who watches antitrust trends closely, I’ll be keeping tabs on this.

Market Volatility

IPO timing matters. Figma’s entry comes in a post-2022 world where investors are cautious. If the overall tech market stays choppy, even great companies can see early stumbles in share price.

Enterprise Dependency

Figma leans hard on large enterprise clients. That’s great for revenue, but risky if spending slows or big clients churn. I’d want to see diversification in their customer tiers over the next few quarters.

Investor Sentiment and Hype

Sentiment heading into the IPO is, frankly, sky-high. I’ve seen X (formerly Twitter) threads predicting that Figma stock could double or triple post-IPO. There’s also a strong belief among early tech investors that this is the next “Zoom moment” for productivity tools. But let’s be real — the market can be ruthless, and inflated expectations often lead to early corrections.

Still, what gives me some confidence is that this optimism isn’t coming from thin air. It’s rooted in a real product that solves a real problem for tens of thousands of teams globally. That’s rare.

When is Figma’s IPO?

Figma is expected to begin trading on the New York Stock Exchange under the ticker FIG by the end of July 2025. While the exact date hasn’t been finalized, multiple filings and investor briefings suggest the last week of the month is the most likely window.

How much is Figma worth?

At the high end of the IPO pricing range ($28 per share), Figma would be valued at approximately $16.5 billion on a fully diluted basis. That figure includes all outstanding shares, options, and preferred stock conversions. Personally, I find that valuation rich but justifiable considering their growth rate and gross margin profile.

Who owns Figma?

Figma is currently a private company, with majority ownership spread across founders Dylan Field and Evan Wallace, early venture capital backers like Greylock Partners and Index Ventures, and employees with equity stakes. Post-IPO, public investors will gain a significant slice, but control will likely remain with insiders for the foreseeable future.

Why did Adobe’s deal with Figma fall through?

Adobe announced plans in 2022 to acquire Figma for $20 billion. Regulators in the UK and EU raised serious antitrust concerns, arguing that the deal would limit innovation and consumer choice in the design software market. The companies ultimately abandoned the merger in 2023, and in my opinion, that was a blessing in disguise for Figma. It allowed them to maintain independence and avoid integration headaches.

Should I invest in Figma?

Here’s my honest take: Figma is one of the most compelling IPOs of 2025. The fundamentals are strong, the product is loved, and their margins are elite. But IPO investing always carries risk. If you’re in it for the long term and believe in the future of design collaboration and AI, then yes, this could be a smart addition to your portfolio. Just be prepared for volatility in the early weeks.

Final Thoughts on Figma Stock

Let’s quickly recap:

- Figma is going public under the ticker FIG on the NYSE

- Valuation could hit $16.5B based on a $25–$28 share price

- They’re profitable with a 91% gross margin and $821M in revenue

- The company serves 95% of Fortune 500 and is expanding globally

- Risks include market volatility and regulatory scrutiny

My final takeaway? Figma isn’t just another tech IPO. It’s a profitable, battle-tested company leading the charge in a space where collaboration, design, and AI intersect. That’s a rare mix. If you believe in the future of design tech — and you’re okay with short-term bumps — this one’s worth watching closely.

I’ll be keeping a close eye on trading volume in the first two weeks and watching for any earnings guidance they issue post-IPO. This story is just beginning, and I can’t wait to see where it goes.