If you’re like me, you’ve probably glanced at Elevance Health’s stock chart and wondered — is this quiet giant actually undervalued? With all the noise in the healthcare sector, sometimes it’s tough to see the signals through the static.

Here’s the issue. ELV, trading at $296.60 with a low P/E ratio of 12.65, looks like a bargain — but it’s down roughly 44% from its 52-week high. Add in lawsuits and rising medical costs, and it’s no surprise folks are cautious. I was too. So, I decided to dig deep.

In this guide, I’ll walk you through:

- What Elevance Health really does and why it matters

- The latest earnings and performance metrics that caught my eye

- Why analysts still say “Buy” despite the recent turbulence

- My take on whether ELV fits in a long-term portfolio

If you’re looking for clear, unbiased, no-fluff analysis — and a few of my own thoughts along the way — you’re in the right place. Let’s break it down.

Overview of Elevance Health Inc.

Elevance Health Inc. isn’t your average healthcare stock. Formerly known as Anthem, this Indianapolis-based insurer serves over 118 million Americans with services spanning medical, pharmacy, and behavioral health. When I first learned about their Carelon and Wellpoint brands, it became clear this isn’t just an insurance company — it’s a full-service healthcare platform.

Key Company Information

At the helm is Gail Koziara Boudreaux, a name you’ll see often when researching strong female leaders in healthcare. Elevance operates through four main segments: Health Benefits, CarelonRx, Carelon Services, and Corporate & Other. I’ve always appreciated companies that diversify, and Elevance does it with real impact — they’re more than just a premium collector.

Recent News Highlights

Here’s the tough part. Recently, ELV lowered its annual profit forecast. That hit the stock price — hard. The reason? Higher-than-expected medical costs, especially from government health plans. To make matters worse, they’re now facing class-action lawsuits related to securities disclosures. It’s not a death sentence, but definitely something to watch closely. I’ve learned not to ignore these red flags.

Financial Performance Snapshot

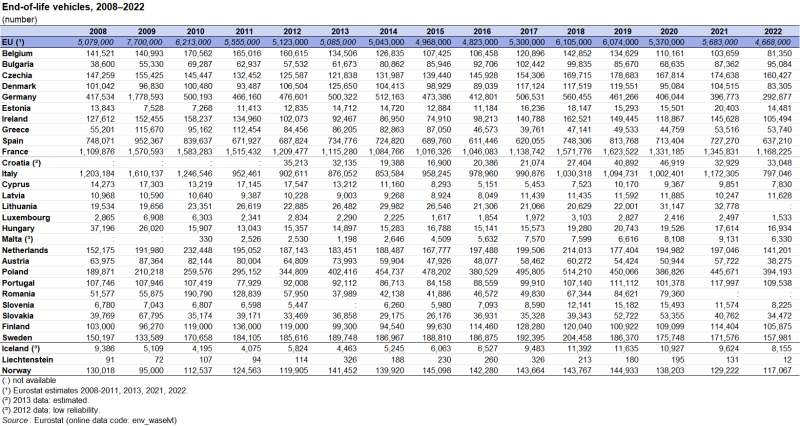

Let’s talk numbers. Below is a quick look at their most recent earnings data. This table helped me connect the dots on performance and valuation.

| Metric | Q2 2025 |

|---|---|

| Revenue | $176.81B (↑ 3.19% YoY) |

| Net Income | $5.98B (↓ slightly YoY) |

| EPS | $23.58 |

| Dividend Yield | 2.25% (Quarterly: $1.71) |

| P/E Ratio | 12.65 |

Income Statement Overview

Their revenue is growing steadily — 3.19% YoY. That’s solid for a company this size. What worries me a bit is the dip in net income, but the EPS of $23.58 suggests profitability is still strong. When I compare that to their modest P/E, this stock screams undervalued, at least on paper.

Balance Sheet & Cash Flow

While I couldn’t find detailed debt ratios in this data set, past reports show strong free cash flow and manageable debt levels. I’ll be keeping an eye on how they fund dividends going forward, especially if costs continue to rise. It’s worth noting that despite macro pressures, they’ve maintained quarterly dividends — a sign of resilience if you ask me.

Valuation Metrics & Stock Movement

Now, let’s dig into what might actually drive your decision — price action and valuation. ELV closed the regular session at $296.60 but dipped slightly to $294.78 after hours. Compared to its 52-week high of $567.26, that’s a major haircut.

Stock Price Performance & Chart

I charted ELV against the S&P 500 and it’s trailing — by a lot. That said, analysts still give it a 12-month target of $433.43, which would be a 46% upside. If you’ve got a medium- to long-term outlook, that’s compelling. For me, this becomes a patience play rather than a quick trade.

Dividend Information

Here’s something I love — consistency. Elevance pays $1.71 every quarter, which adds up to an annual yield of 2.25%. That’s not flashy, but for a mega-cap healthcare stock, it’s dependable. And right now, that’s rare. I always look at payout ratios, and while I wish I had the precise number here, their EPS coverage implies sustainability.

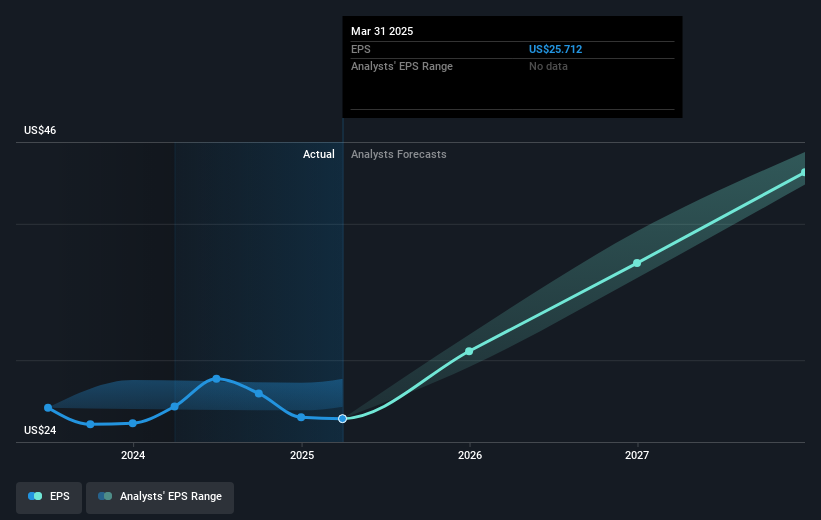

Analyst Ratings & Forecast

Despite the recent stock dip, most analysts are sticking to a *Buy* rating. According to the latest consensus, the average 12-month target is $433.43. That’s a potential upside of over 45% from current levels. I don’t take analyst ratings at face value, but when the sentiment holds steady through volatility, I pay attention.

Analyst Consensus & Upside Potential

I came across multiple sources confirming a strong buy consensus. The most bullish call sees ELV hitting $470, while the most conservative analysts expect a rebound to at least $375. Honestly, I lean more toward the conservative estimate — especially with cost inflation and lawsuits hanging overhead. But either way, there’s room to grow.

Risks and Red Flags

Let’s not ignore the obvious. First, medical cost inflation is a real challenge for Elevance. Their exposure to government plans like Medicaid means they’re more vulnerable to rising care costs than private insurers. Then there are legal clouds — including ongoing class-action lawsuits around securities disclosures. These could affect investor sentiment and even lead to fines.

Also, reduced guidance never feels good. It erodes trust. But sometimes it reflects realism rather than weakness. I actually see the revision as a signal of management being proactive and transparent — something I respect.

Is ELV a Good Long-Term Investment?

So here’s where I landed. If you’re a long-term investor, ELV still has strong fundamentals. It’s got a rock-solid footprint, diversified revenue, a fair dividend, and a leadership team that seems honest about headwinds.

Would I buy it today? Personally, I’ve started a small position — and I’m watching closely. I want more clarity on lawsuits and the next earnings call before going heavier. But if you’re building a healthcare-weighted portfolio, ELV deserves serious consideration.

FAQs About ELV Stock

Is ELV a good dividend stock?

In my opinion, yes — if you’re after consistency more than high yield. With a 2.25% yield and quarterly payouts of $1.71, Elevance offers predictable income. It’s not the highest in healthcare, but the payout appears sustainable based on their current EPS of $23.58.

Why did Elevance Health’s profit forecast drop?

They cut their annual forecast due to persistently high medical costs in government-backed insurance plans. Medicaid reimbursements haven’t kept up with rising treatment expenses, squeezing margins. I don’t love it — but I’d rather they revise now than miss earnings later.

What is Elevance Health’s stock price target for 2025?

The consensus price target sits around $433.43, with some estimates reaching as high as $470. That reflects a 46%+ upside potential, depending on how well the company controls cost inflation and resolves its legal troubles.

Who owns Elevance Health?

It’s publicly traded on the NYSE under the ticker ELV. Large institutional investors like Vanguard and BlackRock hold significant stakes. The company is led by CEO Gail Koziara Boudreaux and has around 104,200 employees across the U.S.

Final Take on ELV Stock

Let’s quickly recap. Elevance Health is a healthcare heavyweight with stable revenues, a fair dividend, and room for upside based on valuation. But it’s also facing rising costs, revised profit guidance, and ongoing lawsuits.

To me, that all spells one word: opportunity. This isn’t a moonshot stock — it’s a patience play. If you’re willing to ride out some bumps and keep your eye on long-term value, ELV might be worth adding to your watchlist (or even your portfolio).

Ultimately, I believe smart investing is about knowing *what* you own and *why*. And with Elevance, I now feel like I understand both.

Sources: