Starting your forex trading journey can feel like learning a new language. The markets are vast, and without the right tools, it’s easy to get lost. That’s where these essential forex trading tools come in. They’re your compass and guide, helping you navigate the world of forex and make smarter trading decisions. But how do you pick the right ones? Well, you’re in the right place.

The main challenge most beginners face is knowing where to start. The sheer number of tools available can be overwhelming, and it’s hard to figure out which ones are truly helpful. What you need is a set of tried-and-true tools that can enhance your trading experience, manage risks, and improve your decision-making process. Fortunately, I’ve broken it down for you. Let’s explore seven forex trading tools every beginner should use.

Key Tools You’ll Need:

- Forex Trading Platforms

- Charting Tools and Technical Analysis

- Economic Calendar and Market News Tools

- Risk Management Tools

- Trading Signals and Alerts

- Social Trading Platforms

By the end of this article, you’ll not only understand how these tools work, but you’ll also know how to make them work for you.

Forex Trading Platforms

When I first started trading, picking a platform was the first major decision I had to make. It’s the foundation of everything. Your trading platform is where you’ll execute trades, track price movements, and analyze the markets. Some platforms cater specifically to beginners, while others offer advanced tools for seasoned traders. Let’s go over some of the most popular platforms for beginners:

MetaTrader 4 & 5

MetaTrader is a staple in the trading world, especially for beginners. I used MetaTrader 4 (MT4) when I started, and it’s easy to see why it’s a favorite. MT4 and its newer version, MT5, allow traders to execute trades, analyze charts, and use custom indicators. The user-friendly interface and demo accounts make it an excellent starting point for beginners.

eToro

If you’re someone who likes to learn by watching others, eToro is a great option. eToro’s social trading features let you follow and copy trades from experienced traders. You can see exactly what they’re trading and even replicate their strategies, which is a fantastic way to learn the ropes quickly.

cTrader

cTrader is another great platform that caters to beginners. It offers more advanced charting tools while keeping the interface intuitive. It’s perfect if you want a platform that combines simplicity with powerful features for future growth.

Charting Tools and Technical Analysis

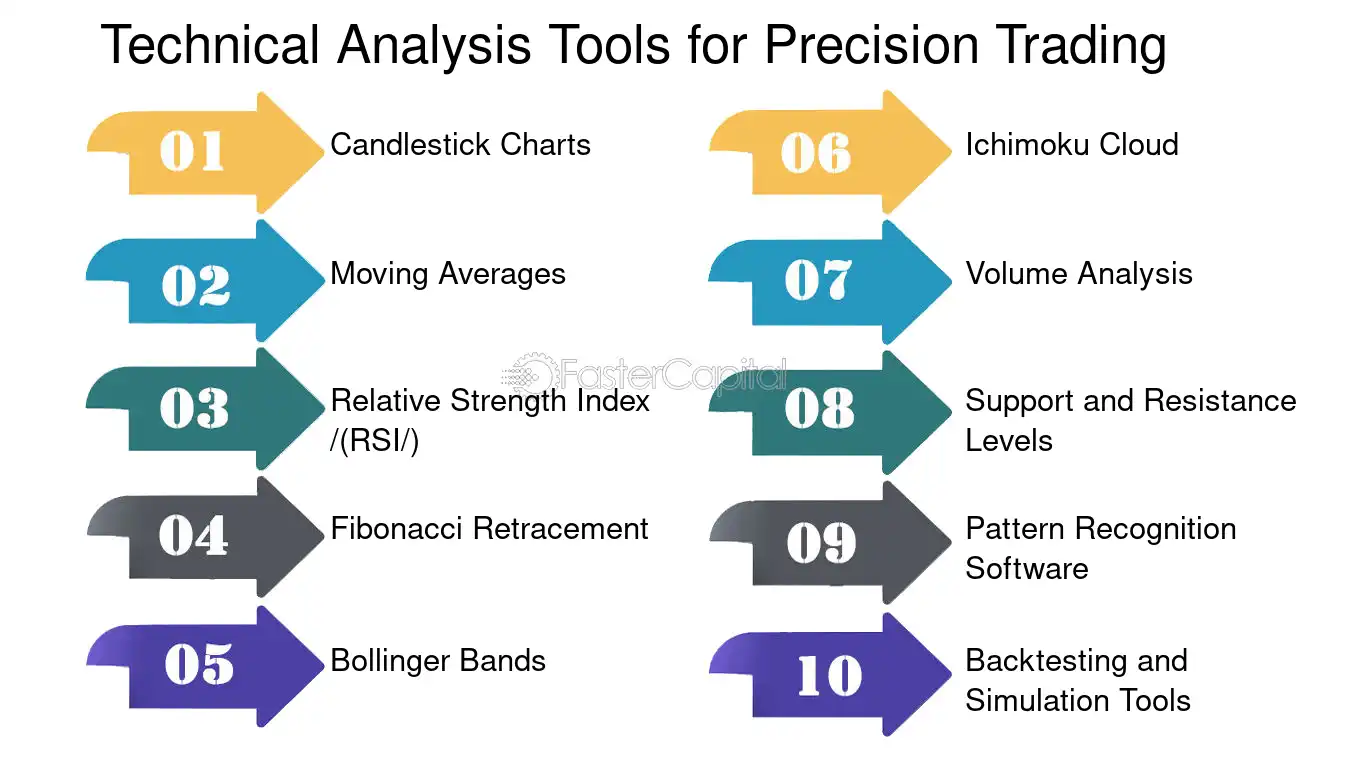

Technical analysis is the bread and butter of forex trading. I remember the first time I used charts to analyze market movements, and it felt like I had unlocked a whole new world. Charting tools help you visualize price trends, identify support and resistance levels, and make informed decisions. Let’s look at some of the best charting tools available:

:max_bytes(150000):strip_icc()/dotdash_RealFINAL_How_to_Build_A_Forex_Trading_Model_Jan_2020-02019399699842caa4005ac5847eec09.jpg)

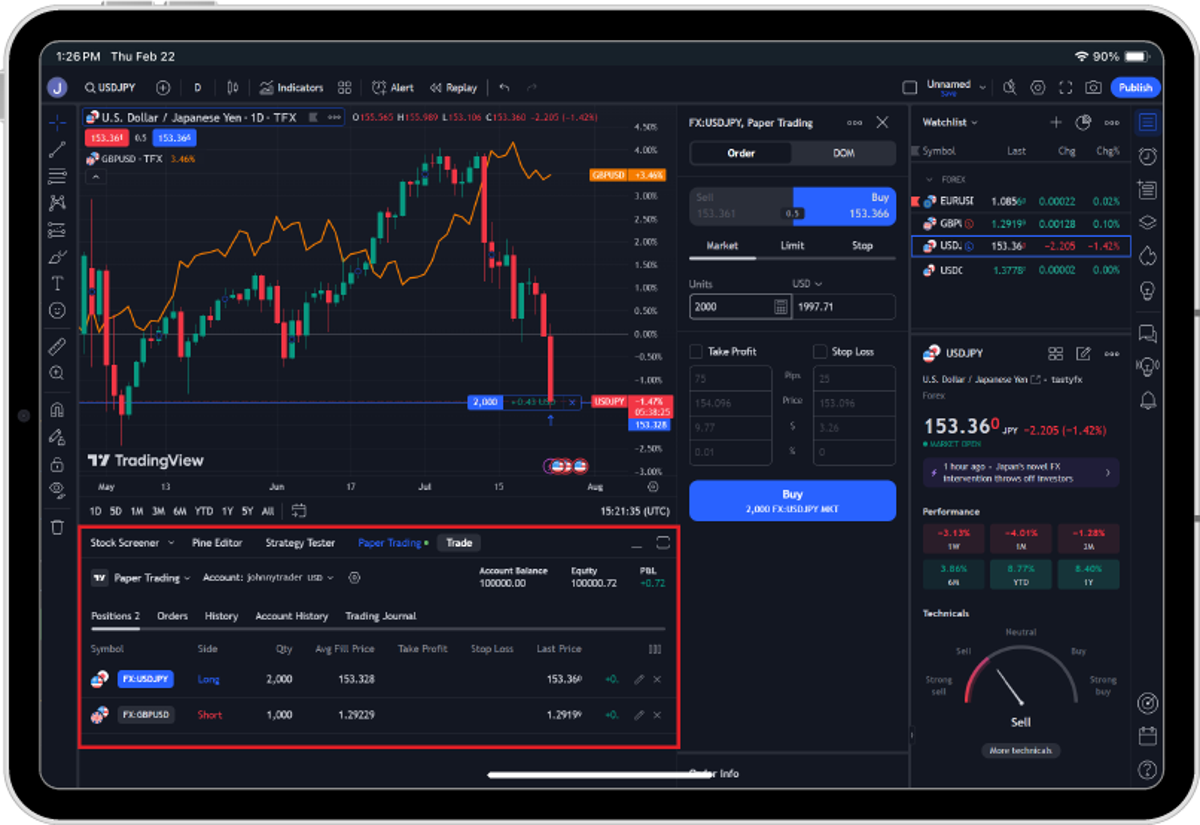

TradingView

TradingView is one of the most popular charting tools out there. It’s super intuitive, and you can easily customize it to suit your trading style. I love how TradingView allows you to set up multiple charts, so you can track different assets or timeframes simultaneously. It’s the tool I go to for detailed analysis and pattern recognition.

MetaTrader Charting Tools

While MetaTrader is known for its easy-to-use trading functionality, its built-in charting tools are also top-notch. You can apply technical indicators, draw trend lines, and get real-time data, all without needing third-party tools.

ProRealTime

If you want advanced charting features, ProRealTime is a great choice. The platform offers excellent backtesting capabilities, which allows you to test your strategies using historical data. It’s particularly helpful for traders who want to refine their trading strategies over time.

Economic Calendar and Market News Tools

As you grow in your trading journey, you’ll realize that staying on top of economic events is just as important as technical analysis. I can’t tell you how many times a major economic release, like an interest rate decision, has moved the markets. Using an economic calendar and staying updated on market news is crucial for making informed decisions.

Using an Economic Calendar

Economic calendars track all the major economic events that affect forex markets. These events include central bank meetings, GDP reports, and employment data. By using an economic calendar, you’ll know exactly when important news will be released and how it might affect currency pairs. I recommend checking the calendar daily to plan your trades accordingly.

Daily Market News

To be a successful trader, you need to understand the bigger picture. Reading daily market news helps you stay informed about what’s moving the markets. Whether it’s political events or economic data releases, keeping an eye on market news can give you a competitive edge. I use a combination of trusted financial news websites and Twitter accounts from well-known analysts to stay in the loop.

Risk Management Tools

One of the most critical lessons I’ve learned in my trading career is the importance of risk management. Without it, even the best trading strategy will fall apart. To manage risk effectively, you’ll need tools that help you set boundaries and protect your capital. Below are some of the most important risk management tools to use:

Stop-Loss and Take-Profit Orders

Stop-loss orders are your safety net. They automatically close your position if the market moves against you beyond a certain point. On the flip side, take-profit orders lock in profits by automatically closing your position once it reaches your desired profit level. I can’t tell you how many times these orders have saved me from significant losses and locked in profits before the market reversed.

Forex Calculators

Forex calculators are invaluable for calculating pip values, margin requirements, and potential profits or losses. Using these calculators allows you to assess your risk before entering a trade. For beginners, they simplify the complex calculations that would otherwise be intimidating.

Position Sizing

Position sizing is the most important aspect of risk management. The right position size can mean the difference between success and failure. Tools like position size calculators can help you determine the optimal amount to trade based on your risk tolerance and account size.

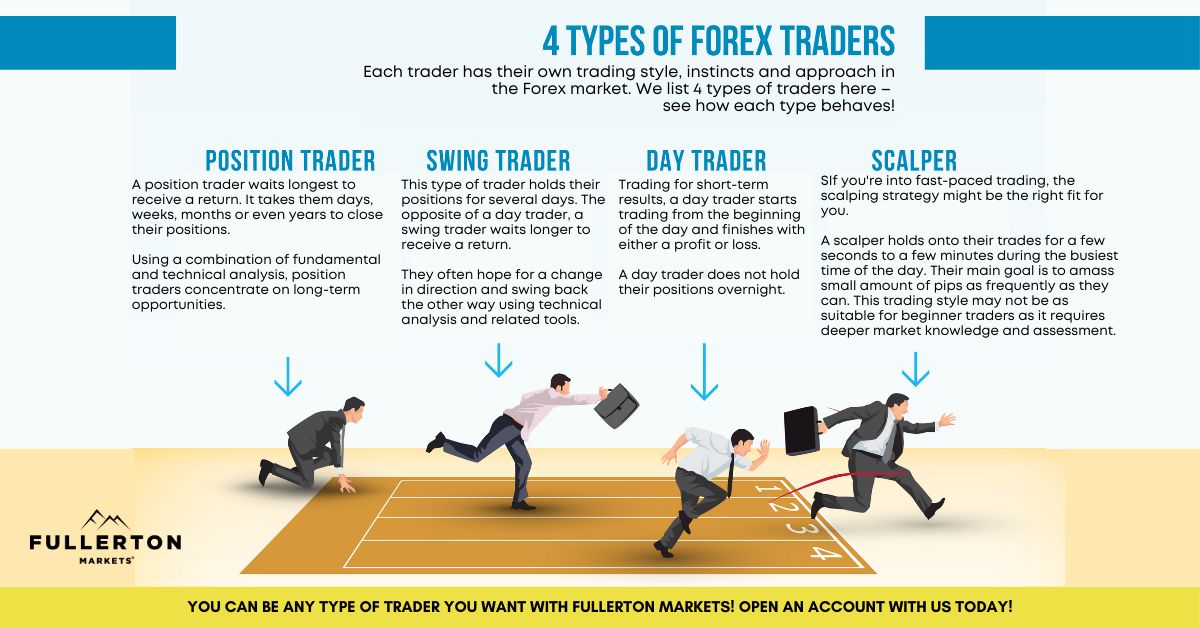

Trading Signals and Alerts

Trading signals and alerts are the tools that will keep you in the loop, even when you’re not actively watching the markets. As a beginner, these can be incredibly useful, and I’ve personally relied on them to catch opportunities I might have missed otherwise. These tools notify you of potential trade setups based on predetermined conditions, helping you make decisions even when you’re away from your charts.

Automated Trading Signals

Automated trading signals are provided by third-party services that use algorithms to analyze the markets. These services send alerts about potential buy or sell opportunities based on technical indicators or market conditions. I started using these when I wanted to avoid missing trades during my day job. The best part? You don’t have to monitor the charts constantly. You get notified when it’s time to act.

Setting Alerts on MetaTrader

MetaTrader offers an excellent feature for setting alerts directly on the platform. These alerts can notify you when price reaches a certain level, or when specific conditions are met, such as the crossing of key technical indicators. I use these alerts to manage my trades even when I’m away from the screen. It helps me stay on top of the market without feeling overwhelmed.

Social Trading Platforms

If you’ve ever felt unsure about your trading decisions, you’re not alone. Social trading is one of the ways I’ve personally overcome this uncertainty. It allows you to copy the trades of experienced traders, giving you a chance to learn while you trade. It’s a fantastic option for beginners who want to build confidence in their trades.

eToro Social Trading

eToro is probably the most well-known social trading platform. I’ve used it myself to copy successful traders. You can find traders whose strategies align with your goals, and eToro lets you copy their trades automatically. This feature is helpful for beginners who want to follow and learn from seasoned traders without making mistakes on their own. Plus, it’s a great learning experience to see how experts execute their strategies in real-time.

Copy Trading

Copy trading allows you to mimic the trades of top traders, using their strategies to guide your own. As someone who’s always wanted to learn faster, I found this tool invaluable in my early trading days. It takes the guesswork out of trading, and all you need to do is choose who to copy. Of course, you still have to manage risk, but it’s a fantastic way to gain experience quickly.

Integrating These Tools for Success

By now, you should have a pretty solid understanding of the essential tools you need for forex trading. The beauty of these tools is that they all work together to make you a better, more confident trader. I personally use a combination of a solid trading platform like MetaTrader, charting tools like TradingView, and automated alerts to stay on top of the markets.

Setting Up a Trading Routine

One thing I’ve learned over the years is that consistency is key. Setting up a routine that includes checking your economic calendar, analyzing charts, and setting up alerts can make a world of difference. It’s about creating habits that will keep you informed and prepared to act when the market moves in your favor.

Combining Social Trading with Technical Analysis

For a well-rounded approach, I suggest combining social trading with technical analysis. Social trading gives you insights into what experienced traders are doing, while technical analysis allows you to verify these trades against market trends. It’s a powerful combination that has helped me become a more confident and informed trader.

Epic Takeaway

So, there you have it! These tools will make your forex trading experience smoother, smarter, and more efficient. Whether you’re just starting out or looking to improve your current strategy, the right tools can transform the way you trade. Remember, consistency, practice, and using the right tools can help you achieve long-term success in forex.

Don’t rush—take your time exploring these tools. Practice using them with demo accounts, test different strategies, and refine your approach over time. The more familiar you become with the tools, the more confidence you’ll gain in your trading decisions.

The journey from beginner to seasoned trader is not easy, but with the right tools and mindset, you can definitely get there. Trading is as much about learning as it is about acting on what you’ve learned. Stay informed, keep practicing, and watch your trading skills grow.

FAQ

What are the best forex trading platforms for beginners?

The best forex trading platforms for beginners are MetaTrader 4 and 5, eToro, and cTrader. These platforms are user-friendly, offer demo accounts, and provide great resources for learning. I personally recommend MetaTrader 4 for those just starting because of its popularity and the abundance of tutorials available online.

How can I manage risk in forex trading?

Risk management in forex trading can be done using stop-loss orders, take-profit orders, and position sizing. Tools like forex calculators help determine the right amount to trade based on your risk tolerance. Setting clear boundaries on how much you’re willing to lose is a crucial step to protect your capital.

What are forex signals and how do they work?

Forex signals are notifications that alert you to potential trading opportunities based on specific market conditions or strategies. Automated signals are sent by third-party services, while you can also set your own alerts on platforms like MetaTrader. They help you stay updated without having to monitor the markets constantly.

What is copy trading and how does it work?

Copy trading allows you to mirror the trades of more experienced traders. You select a trader to copy, and their trades are automatically mirrored in your account. It’s an excellent way for beginners to learn by watching and following the strategies of successful traders, but always ensure you manage your risk when using this tool.