Ever felt like your trades are sabotaged by your own emotions? I have. I remember one of my first real-money trades on EUR/USD. I was up 25 pips. I didn’t close. I wanted more. Then, bam — it reversed. I lost 40 pips. That was the moment I knew: my strategy wasn’t the problem — I was.

Trading isn’t just charts and news. It’s a mental game. And if you don’t master your emotions, you’ll bleed out — even with the best indicators in the world.

So, what’s the fix? It’s trading psychology. You need rules. And you need to live by them, even when every part of you wants to do the opposite.

Here’s what we’ll dive into:

- Why your brain fights against your trading plan

- What emotional traps kill performance

- How 7 rules can bring discipline, calm, and long-term wins

By the time you’re done here, you’ll know what it takes to stay cool when the market gets wild — and how to actually enjoy trading again.

Why Trading Psychology Matters

If you’re reading this, chances are you’ve already felt the sting of a bad decision — one made not because your setup failed, but because you broke your own rules. I’ve done that more times than I’d like to admit. And trust me, it’s brutal.

But why does this happen? Because emotions like fear, greed, and revenge sneak in when money’s on the line. You’re not just analyzing charts — you’re battling yourself.

Common Psychological Pitfalls for New Traders

The top offenders? Impulsive entries, ignoring stop-losses, and chasing losses. I once added to a losing position out of pure frustration — “just one more lot, I’ll average down.” It wiped half my account. That’s called revenge trading, and it’s deadly.

Psychology vs. Strategy: What Holds You Back More?

Most beginners obsess over entries. I did too. But the truth? It’s your ability to execute a plan without flinching that builds success. Discipline beats prediction — every time.

Rule 1: Know Your Edge

This changed everything for me. Your “edge” is what gives you a statistical advantage. Maybe it’s a pattern, a news reaction, or how price behaves around levels. Without knowing your edge, you’re gambling.

Why Knowing Your Edge Builds Confidence

When I finally defined mine — a simple 5-min structure break + volume confirmation — I stopped second-guessing myself. I knew what I was looking for. That clarity was liberating. Confidence isn’t about winning — it’s about knowing what you should be doing.

Rule 2: Define Risk Before Every Trade

If you don’t know how much you’re willing to lose, you’re trading blind. Period. Before I learned this, I’d randomly throw in lot sizes. No structure. No logic. Just hope.

The Psychological Power of Setting Boundaries

Setting a fixed % risk per trade (mine is 1%) removed so much anxiety. Now, even when a trade goes against me, I’m chill — because I already made peace with the risk. That’s how you avoid panic and overtrading.

Rule 3: Fully Accept the Risk

Sounds simple, but it’s deep. Once your trade is live, the outcome is out of your hands. If you still care too much about what happens next, you haven’t accepted the risk — and that’s where regret, fear, and sabotage sneak in.

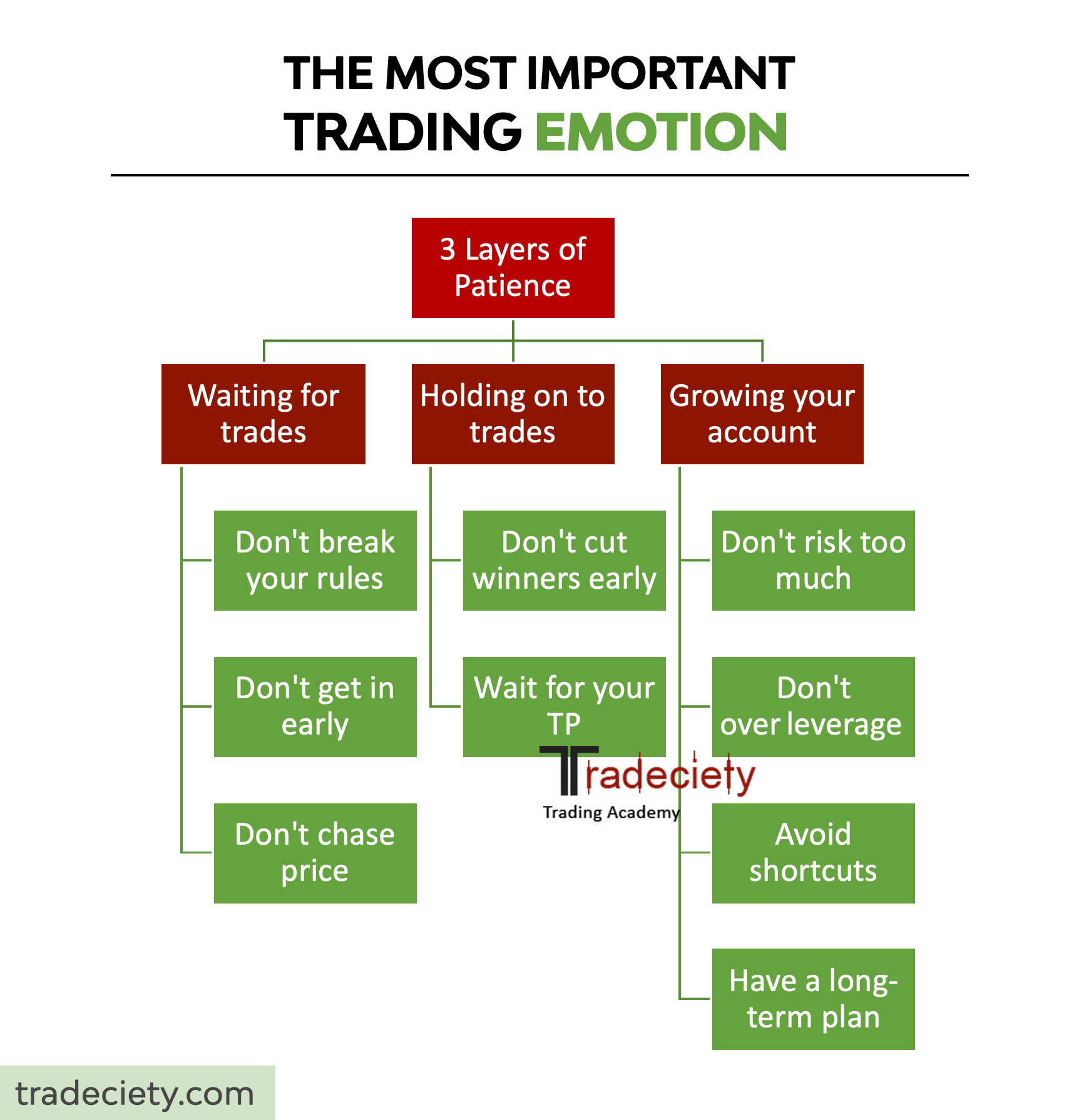

Letting Go of Fear and “Hope” Mindset

There was a time when I’d sit frozen, staring at the red. Hoping it’d come back. Sometimes it did. But most times, it got worse. I had to learn: Hope is not a strategy. Once the trade is on, I walk away — my stop is my insurance.

Rule 4: Act on Your Edge Without Hesitation

This one hit hard for me. There’s nothing worse than seeing your setup, hesitating, then watching price fly in your direction without you. I’ve missed too many perfect trades because I froze.

How Hesitation Hurts Profitable Setups

I used to doubt myself — “what if it’s a fakeout?” But after journaling 100 setups, I realized my edge was solid. So now, when it shows up, I strike. No drama. Just execution.

Rule 5: Take Profits When Available

Greed is sneaky. You see profit, and your brain whispers, “Hold a little longer.” But how many times have those gains vanished? I’ve ridden 40-pip winners back to breakeven — more times than I want to admit.

Greed Can Steal Your Gains

What helped me was pre-setting profit zones. I use 1:1.5 as my base. When it hits, I close partials and trail the rest. No more hoping. Just managing the plan. It’s not sexy — but it’s consistent.

Table: Emotional Responses vs Rational Actions in Trading

| Emotional Trigger | Typical Response | Rational Action |

|---|---|---|

| Fear after loss | Hesitate, skip setups | Review journal, trust edge |

| Greed during winning streak | Increase lot size impulsively | Stick to defined risk per trade |

| Frustration after missed entry | Revenge trade | Accept the miss, wait for next setup |

Rule 6: Monitor Your Emotions and Mistakes

This is where most people fall short — but it’s where I finally started making real progress. Keeping a trading journal sounded boring at first. But once I started recording not just my entries and exits, but also how I felt, everything changed.

The Role of Journaling and Self-Review

I started spotting patterns. Like how I always broke rules after three wins in a row. Or how I risked more after a big loss. Noticing these emotional triggers gave me the power to stop them before they wrecked my trades. If you’re not journaling, start today — even if it’s just in a Google Doc.

Rule 7: Let Go of the Outcome

This rule took the longest for me to accept. As traders, we want to be right. We want profits. But focusing on individual outcomes creates stress, frustration, and emotional rollercoasters. The key is letting go — and trusting the process.

Focus on Discipline, Not Results

I’ve had months where my win rate dropped but my discipline was perfect — and surprisingly, I still ended up profitable. Why? Because consistency compounds. Once I stopped judging success by single trades and focused on executing my plan flawlessly, trading became way less stressful.

FAQ: Trading Psychology for Beginners

What is the most important trading psychology rule?

Personally, it’s Rule 3: Fully Accept the Risk. Once I truly embraced the fact that losses are part of the game, my fear and overthinking vanished. When you stop clinging to outcomes, your mind gets free to focus on execution.

How do I control emotions when trading forex?

Track your emotional state during trades. Seriously, write it down. Practice breathing exercises before and after entering. Limit your exposure — don’t stare at the chart. And always know your risk ahead of time. Emotional control starts with preparation.

Can journaling really improve my trading psychology?

Yes — massively. Journaling helped me realize how often I was breaking rules without noticing. It let me track my habits and mental triggers. Once you see your patterns, you can fix them. It’s your mirror and your coach, all in one.

Why do traders keep losing despite good strategies?

Because psychology ruins good plans. Even with a strong edge, fear, greed, and ego can lead to impulsive exits or missed entries. A winning strategy without discipline is just theory. It’s how you trade that makes it profitable.

Recap of Key Points

We’ve walked through the 7 core rules that transformed my trading mindset:

- Know and trust your edge

- Define your risk ahead of time

- Accept that you can — and will — lose

- Act decisively when your setup shows

- Take profits, don’t hope for more

- Watch your emotions and document them

- Detach from outcomes and follow your plan

Final Takeaway

Trading isn’t just about strategy — it’s about how you handle yourself when things go sideways. Your mindset is the real edge. And if you train that like a skill, the profits will follow.

Closing Thought

You don’t have to be perfect. I’m not. But if you follow these rules with honesty and consistency, you’ll stop sabotaging your trades and start trading like a pro — one calm, disciplined decision at a time.