Trading is a rollercoaster of emotions, and anyone who’s been in the game long enough knows that losses are inevitable. The unpredictable nature of the markets means that even the most seasoned traders face losses. But what if I told you that your ability to cope with these losses could determine your long-term success?

The problem is that many traders let emotions take control after a loss. They may panic, revenge trade, or spiral into a cycle of poor decisions. But what if you could use psychological strategies to bounce back stronger? That’s exactly what we’re going to dive into today.

In this article, I’ll share practical tips on how to manage losses psychologically, and how doing so can ultimately enhance your trading performance. I’ve been there myself, and I know that developing mental resilience is key to surviving—and thriving—in the trading world.

Here’s what we’ll cover:

- Why acceptance and perspective are crucial for your mindset

- Emotional awareness and control to avoid poor decisions

- How structured reflection turns losses into learning experiences

- Building resilience and discipline through a growth mindset

- Using risk management to reduce psychological strain

At ChronosTrading, we value transparency and objectivity, which is why I’m offering you real, actionable advice based on tried and tested psychological strategies. Let’s get into it!

Acceptance and Perspective

It’s tempting to let a loss define your entire trading career. But the first step to overcoming this challenge is accepting losses as part of the journey. No trader wins all the time—that’s simply not how it works.

Why do I say this? Because when I first started trading, I made the mistake of internalizing every loss as a personal failure. It wasn’t until I learned to view losses as part of the learning process that I started to recover faster and make better decisions moving forward.

Losses are inevitable, but they don’t have to dictate your emotional state. You can bounce back from each setback and keep moving forward.

Maintaining Perspective

One loss doesn’t define you as a trader. When I feel the weight of a tough trade, I remind myself that trading is a long-term game. The goal isn’t to win every trade but to make sound, well-informed decisions over time.

Remember: losses happen to everyone. Even the top traders in the world face setbacks. Their success comes from how they deal with those setbacks—not from avoiding them altogether.

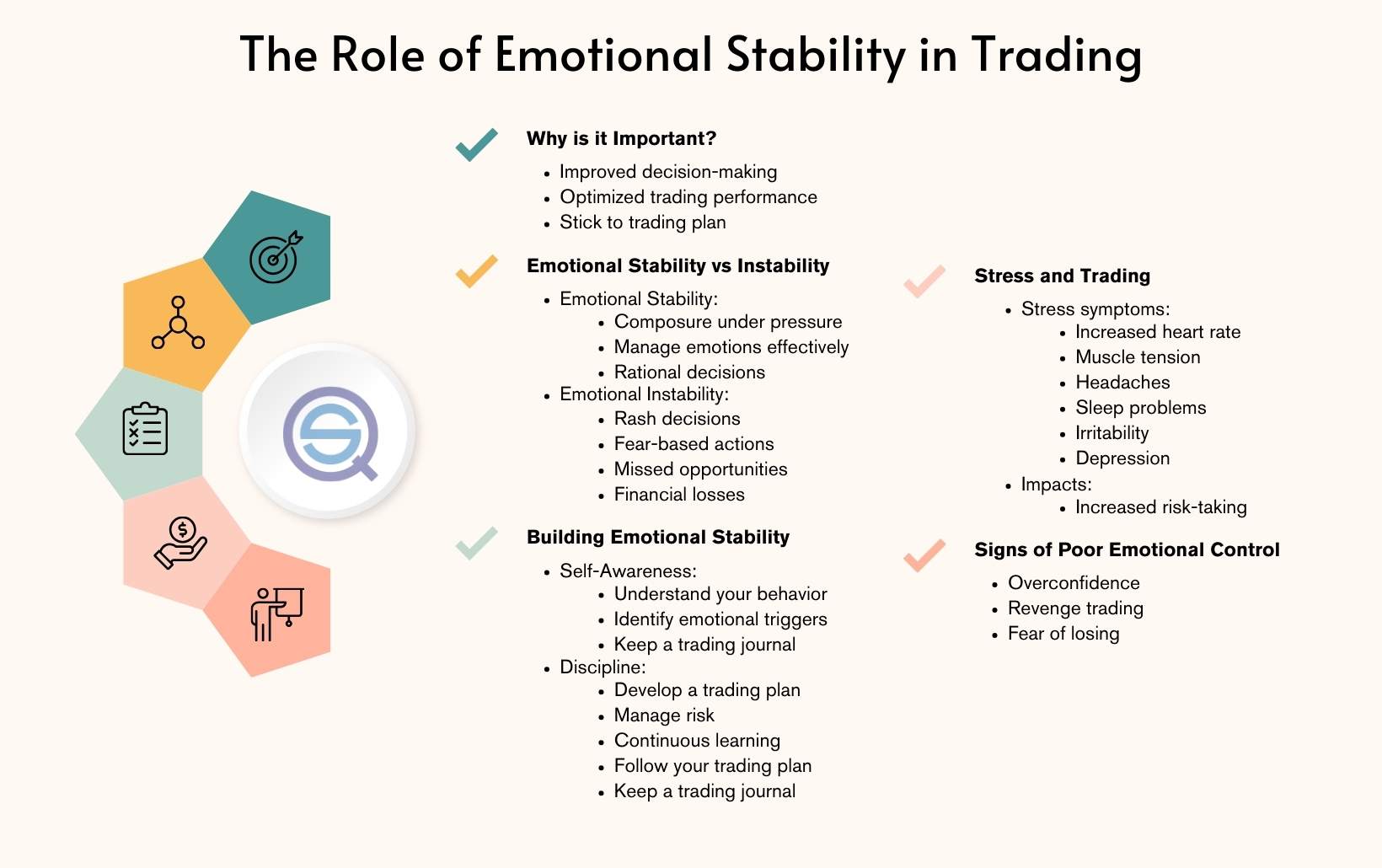

Emotional Awareness and Control

Trading is as much about the mind as it is about the markets. Emotional control is essential to avoid making impulsive decisions that could harm your portfolio. After all, trading isn’t just about reading charts—it’s about controlling your emotions during the ups and downs.

How do you know when your emotions are out of control? For me, it’s when I start to feel a tightness in my chest, or when my thoughts start racing. That’s the signal that I need to take a step back. This happens to every trader, and it’s a normal part of the process. The key is recognizing it and taking action before it leads to impulsive trades.

Monitor Your Emotions

The first step is awareness. Keep a journal or log your emotions before, during, and after each trade. This might sound simple, but it has helped me uncover patterns in my behavior. When I get too excited about a potential trade or too anxious about a loss, that’s when I need to pause and recalibrate.

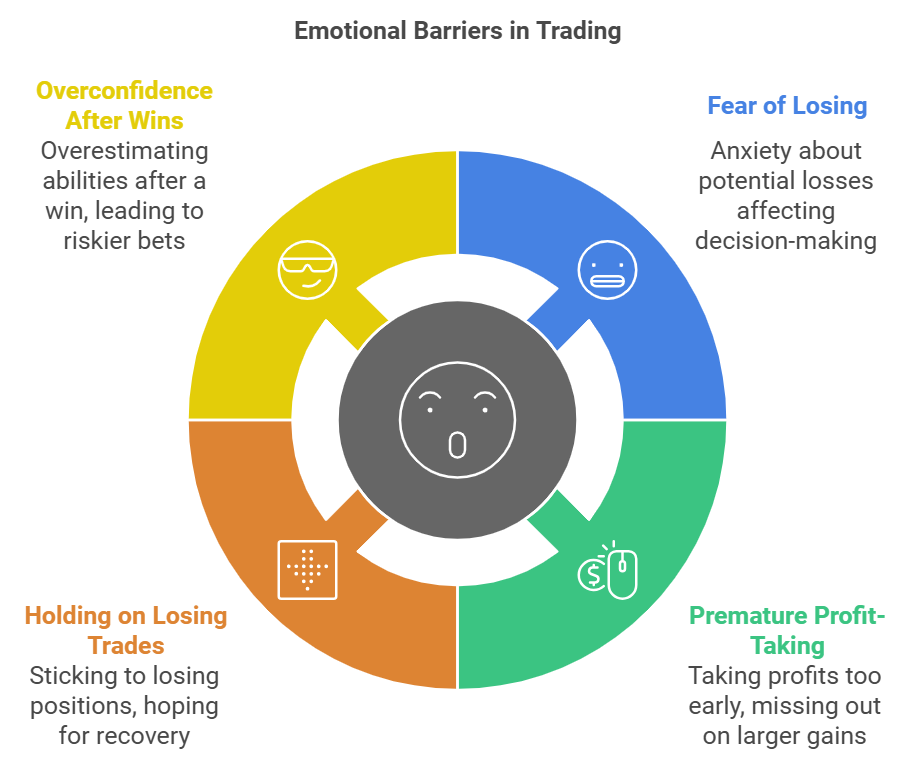

Avoid Revenge Trading

One of the most common mistakes traders make after a loss is revenge trading. We all know that urge to “make up” for a loss quickly, but this leads to high-risk trades that often result in even bigger losses. I’ve been there—and it’s brutal.

Take a break after a loss. Whether it’s for 10 minutes or an hour, allow your emotions to settle before jumping back in. This pause helps you reset, so you can approach the next trade with a clear mind.

Use Mindfulness and Self-Care

In my experience, self-care is just as important as technical analysis when it comes to trading. I know this might sound fluffy, but let me tell you—taking care of your mental health is crucial. Meditation, journaling, exercise, or even just taking a walk can help restore your emotional balance.

It’s important to develop strategies to manage stress. For instance, when I feel overwhelmed, I take a few minutes to meditate. It sounds simple, but it works wonders for my mindset.

Structured Reflection and Learning from Losses

After each loss, take time to reflect. This is not about beating yourself up, but about learning from your experience. Structured analysis is a powerful tool for turning losses into valuable lessons that shape your future trades.

Post-Trade Reviews

I like to do a deep dive after each trade, especially when I experience a loss. This review includes:

- What went well?

- What could have been improved?

- What was my emotional state during the trade?

- Did I follow my strategy or get distracted by emotions?

By analyzing these aspects, I can make adjustments and avoid repeating the same mistakes.

Separate Process from Outcome

One of the best pieces of advice I’ve ever received is to focus on the process, not the outcome. It’s easy to get wrapped up in whether you win or lose a trade, but the true success lies in sticking to your strategy. After all, a winning streak will come to an end, just like a losing streak will. The key is consistency over time.

When you focus on executing your strategy correctly, rather than obsessing over individual trade results, you set yourself up for long-term success.

Building Resilience and Discipline

Building emotional resilience is a cornerstone of successful trading. It’s not just about technical knowledge; it’s about your ability to bounce back after a loss and continue to execute your strategy effectively. Resilience and discipline go hand-in-hand when managing the psychological challenges that come with trading.

Have a Recovery Plan

After a series of losses, it’s important to have a plan to rebuild your confidence. When I face multiple losses in a row, I reduce my position size. This helps me regain my composure and stop the emotional spiral. It’s a small step that makes a huge difference in how I approach my next trade.

Adopt a Growth Mindset

Resilient traders view losses as opportunities for growth. This mindset shift can transform how you approach trading. Instead of seeing a loss as failure, look at it as a learning experience. What worked? What didn’t? How can you improve next time?

After my losses, I always ask myself these questions. It’s not about being perfect, but about improving continuously. This mindset shift has helped me grow into a more disciplined and emotionally strong trader.

Implementing Robust Risk Management

Risk management is not just a technical strategy—it’s a psychological one too. When you’re trading, especially after a loss, it’s easy to make emotional decisions that increase your exposure. That’s why robust risk management techniques are essential in keeping your emotional balance intact.

Proper Position Sizing

Position sizing is crucial in ensuring that no single trade will drastically affect your emotional state. By calculating position size based on your risk tolerance, you can manage losses without going into panic mode. I use the 1% rule, where I never risk more than 1% of my account on a single trade. This gives me peace of mind even during drawdowns.

Stop-Losses and Diversification

Stop-loss orders are a safety net that can prevent emotional decisions from turning into big losses. They act as a boundary for your emotions, helping you stick to your plan. Moreover, diversification reduces the impact of a single loss, helping you stay mentally strong during a losing streak.

Common Trading Psychology Pitfalls to Avoid

Trading psychology is filled with traps that can derail your performance. In my experience, avoiding these common pitfalls has been crucial to staying grounded and focused on my long-term goals.

Overtrading After Losses

One of the biggest mistakes you can make after a loss is to trade excessively in an attempt to “make up” for the loss. I’ve been there, trying to force the market to give back what I lost, only to dig myself into a deeper hole. It’s vital to resist the urge to overtrade after a loss. Take a break, evaluate your strategy, and return to the market when you’re in a calm state.

The Fear of Missing Out (FOMO)

It’s easy to fall into the trap of FOMO when you’re watching the market move without you. I’ve learned to remind myself that there will always be another opportunity. FOMO can cause you to take trades that don’t align with your strategy, leading to unnecessary losses.

Ego and Overconfidence

After a winning streak, it’s easy to get overconfident. I’ve fallen into the trap of thinking I’m invincible after a few successful trades. But overconfidence is dangerous. It can lead to taking bigger risks than you’re comfortable with. Stay humble, stick to your strategy, and remember that every trade is a new opportunity to improve.

Frequently Asked Questions

How can I stop making impulsive trades after a loss?

The best way to stop impulsive trading is to take a break. Step away from your computer, go for a walk, or do something to clear your head. When you come back, assess the market and your emotional state. Trading on impulse rarely leads to positive results. Give yourself the space to reset before returning to the market.

What psychological techniques can help me handle losses in trading?

Emotional control techniques like mindfulness, deep breathing, and journaling are all helpful in handling losses. By tracking your emotional state, you can identify triggers for impulsive decisions and take steps to prevent them. Additionally, reflecting on your trades and adopting a growth mindset will help you view losses as learning opportunities.

How do professional traders manage their emotions during a losing streak?

Professional traders know that losses are part of the game, so they focus on the process, not the outcome. They use strategies like lowering position sizes, diversifying their portfolios, and taking breaks after a series of losses. They also use risk management techniques like stop-losses to protect their capital and emotional well-being.

Is it normal to feel discouraged after a loss in trading?

Yes, it’s completely normal to feel discouraged after a loss. The key is not to let that feeling drive your decisions. Instead of letting it spiral, acknowledge it, take a break, and remind yourself that losses are part of the learning process. Every trader faces them, even the most successful ones.

Competitor Analysis

FXStreet provides a lot of market analysis, but they don’t delve into the psychological side of trading. ForexFactory has a strong community, but it lacks expert psychological advice tailored to traders facing emotional challenges. Meanwhile, BabyPips does offer educational content, but it’s more focused on the basics rather than helping traders develop emotional resilience.

At ChronosTrading, we’ve recognized that psychological resilience is just as important as technical analysis. That’s why we incorporate emotional control strategies into our educational content. By focusing on both the technical and psychological aspects of trading, we offer a more holistic approach to success in trading.

Epic Recap

We’ve covered a lot of ground today, from acceptance and perspective to emotional awareness and risk management. The key takeaway is that successful trading isn’t just about strategy—it’s about managing your mind. By developing emotional resilience, reflecting on your losses, and using solid risk management techniques, you’ll be better equipped to handle the inevitable ups and downs of trading.

My final takeaway? Trading is a journey. There will be bumps along the way, but how you handle the losses will shape your future success. Stick with it, stay disciplined, and keep learning. Remember: It’s not about avoiding losses, but about how you recover from them.

So, are you ready to embrace the psychology of trading and take your skills to the next level? Let’s get started, and turn those losses into learning experiences!