Finding a halal way to trade Forex is a challenge I faced early on when I began navigating the world of online trading. As someone who wanted to respect Islamic principles while still tapping into the opportunity of global markets, I realized that many brokers weren’t transparent, and most accounts charged interest—clearly not Shariah-compliant.

Many Muslim traders I’ve spoken to feel the same frustration. The problem is simple but serious: Riba—interest—makes most trading accounts impermissible under Islamic law. If you care about halal investing, then using a traditional account isn’t just problematic, it’s a deal-breaker.

The good news? A handful of brokers are doing it right. They’ve built swap-free Islamic accounts that stay within the bounds of Shariah while still offering competitive trading conditions.

Here’s what you’re about to explore:

- How Islamic trading accounts work and why they matter

- Detailed reviews of the top swap-free brokers for 2025

- Comparison of fees, platforms, and features (see table below)

- What you should watch out for—especially hidden restrictions

- My own experience applying for and trading with Islamic accounts

After reading this guide, you’ll have everything you need to choose the right halal broker—one that respects your values without sacrificing performance.

What Is a Swap-Free or Islamic Forex Account?

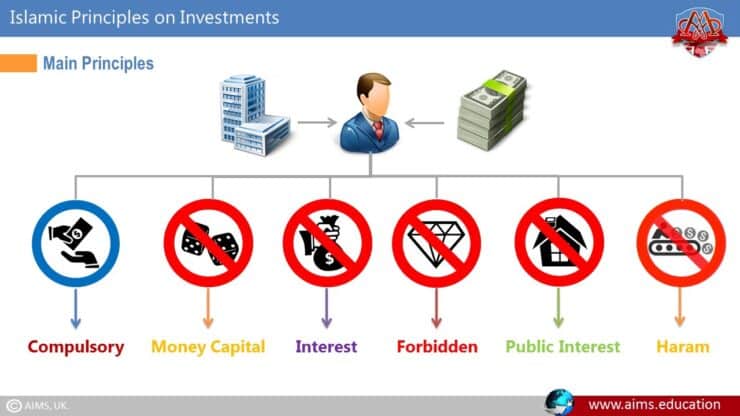

If you’re new to this, let’s break it down. A typical Forex account charges or pays interest when you hold positions overnight. That interest—called a swap or rollover fee—is where the problem starts for Muslims. In Islam, earning or paying interest (Riba) is not allowed. That’s where Islamic accounts come in.

Swap-free accounts eliminate this interest. Instead, brokers may charge an administrative fee to cover the cost of holding the trade. If done transparently and fairly, this is considered permissible in Islamic finance.

But not all brokers do this equally well.

Why Do Muslim Traders Need Swap-Free Accounts?

Let me be direct: if you’re serious about halal investing, trading with interest-based accounts isn’t an option. Even a small overnight swap could invalidate the permissibility of your trades.

I remember hesitating on my first live account until I found a broker that let me apply for Islamic status after verifying my account. Once approved, I felt a massive sense of relief knowing I was aligned with my values.

Whether you’re just starting or scaling your trades, this alignment matters—not just spiritually, but mentally too. Confidence in your setup lets you focus on the strategy, not the ethics.

How Do Brokers Replace Swaps?

Every broker has their own approach. Some replace swaps with a flat administrative fee. Others charge variable fees depending on the instrument or holding period. A few offer a grace window (like 5 or 7 days) before any fee is applied. This is a major area where brokers differ.

Below is a comparison of top swap-free brokers and how they handle fees, leverage, and platforms:

| Broker | Swap-Free Platform | Admin Fee | Leverage | Holding Period | Instruments |

|---|---|---|---|---|---|

| FP Markets | MT4, MT5 | $1 to $80 | Up to 1:500 | Unlimited | Forex, indices, stocks, commodities |

| ActivTrades | Proprietary, MT4/MT5 | None (no rollover) | 1:400 | Unlimited | Forex, crypto, indices, commodities |

| Fusion Markets | MT4, MT5 | None (first 7 days) | 1:500 | 7 days | Forex, crypto, stocks |

| BlackBull Markets | MT4, MT5 | Conditional | Up to 1:500 | Varies | Forex, indices, CFDs |

| HF Markets | MT4, MT5 | Carry charges apply after some days | 1:1000 | Several days | Forex, ETFs, indices |

| AvaTrade | MT4, AvaTradeGo | No interest (up to 5 days) | Up to 1:400 | 5 days | Forex, commodities, ETFs |

Best Islamic Forex Brokers Compared

FP Markets Review

I’ve traded with FP Markets personally, and what stood out immediately was how seamless the Islamic account application was. Their admin fees are clearly listed, and I loved the flexibility between Raw and Standard accounts. They don’t mess around with fine print—you know what you’re getting.

On MT4 and MT5, execution is lightning-fast. If you’re scalping or using EAs (expert advisors), it works beautifully. Just be mindful—admin fees can be high on certain exotic pairs.

ActivTrades Review

What makes ActivTrades shine is the zero-interest structure with no administrative fee and no minimum deposit. That’s rare.

They cover a huge range of instruments—yes, even crypto—under the Islamic account. Add to that strong regulation and €1M enhanced fund protection, and you’ve got serious peace of mind.

Fusion Markets Review

Fusion was my pick for testing a scalping EA on a micro account. Their 7-day swap-free window was perfect for short-term trades. No fees, no interest, no gotchas—for the first week, at least.

What I appreciate is they allow hedging and algo trading under Islamic rules, which not all brokers do. If you’re an active trader and want ultra-low spreads with no holding beyond a week, this might be your match.

BlackBull Markets Review

I know several traders who swear by BlackBull’s ECN Prime account. With spreads starting at 0.1 pips and leverage up to 1:500, it’s a strong choice if you want high-speed execution and tight pricing.

Islamic accounts here aren’t one-size-fits-all. You need to check the eligibility per region, and they may apply fees on certain instruments, so ask support directly—don’t just rely on the website.

HF Markets Review

HF Markets has been around a long time, and I’ve always respected how upfront they are about their swap-free terms. If you’re trading with them, know that while they remove rollover fees, they might apply carry charges after a few days. It’s not sneaky—they explain it right on the account page.

Their execution speed is excellent, and you can trade a wide variety of instruments. I had a smooth experience running longer-term trades, but I’d still recommend clarifying fee timelines directly with support if you’re swing trading.

AvaTrade Review

AvaTrade makes the whole Islamic account setup simple. You fund your account, request swap-free status, and usually get approval in 1–2 business days. I liked that they offer ETFs and commodities, which expands your halal investment options. Cryptos and some currency pairs are excluded, though.

I personally tested their AvaTradeGo app and found it really beginner-friendly. Great for mobile users, and their support team responded to my Islamic account questions fast—which I always appreciate.

What to Look For in a Halal Forex Broker

Not every swap-free account is truly Islamic. I’ve reviewed dozens of brokers, and here’s what I always check before recommending any of them to other Muslim traders.

Key Features That Matter to Muslim Traders

First, make sure the broker actually eliminates swaps—not just renames them. Some shady brokers just label interest fees as something else. The good ones are clear about what they charge and why.

Second, watch the account types. Some brokers offer swap-free only on specific platforms or exclude certain instruments. Check what’s available on MT4 or MT5, especially if you’re using custom indicators or bots.

Third, confirm how long you can hold trades. Some brokers allow indefinite holding periods with no swap, while others limit you to a few days before applying a charge.

Hidden Fees or Restrictions to Watch

Here’s what burned me once: I didn’t read the fine print and got charged an “admin” fee after five days. That’s still better than interest—but it was a surprise. Always read the terms or ask support directly.

Other restrictions I’ve seen include:

- Geographic limits—some brokers don’t offer Islamic accounts in Europe or the US

- Excluded instruments—crypto and exotic pairs are often blocked

- Delayed approvals—it might take 3–5 days after signup to activate Islamic status

Are Swap-Free Accounts Truly Halal?

This is a personal call—and one I made after doing some serious research. Based on discussions with scholars and what’s widely accepted in Islamic finance, swap-free accounts with transparent administrative fees are generally considered halal.

What’s not acceptable is when brokers hide interest behind tricky fee structures or don’t actually change anything except the label. If a broker offers clear documentation, isn’t charging disguised Riba, and has a legit approval process, I personally feel comfortable trading with them.

Still unsure? I recommend checking with your local scholar or Islamic finance advisor. And always request written details from your broker before opening a position.

FAQ: Islamic Forex Accounts

What makes a Forex account halal?

A halal Forex account must not charge or pay interest (Riba). That means no swap or rollover fees. Brokers typically replace these with flat administrative fees. Transparency and compliance with Islamic finance rules are key.

Do Islamic accounts charge fees?

Yes, most do—but not interest. Instead, they charge admin fees or apply charges after a grace period (e.g., 5–7 days). These fees are meant to cover holding costs, not to profit from money lending.

Can I hold positions indefinitely on a swap-free account?

That depends on the broker. Some allow unlimited holding, others apply fees after a set number of days. Fusion Markets gives 7 days with no charge, while HF Markets may apply carry fees after a few consecutive days.

Are cryptocurrencies allowed in Islamic Forex accounts?

Not always. Some brokers exclude cryptos entirely from swap-free accounts due to volatility and regulatory concerns. ActivTrades supports crypto in Islamic accounts, while AvaTrade excludes it.

Which broker is best for beginners seeking halal trading?

From my experience, AvaTrade is great for beginners thanks to its user-friendly platform and clear setup process. FP Markets is another solid choice with strong customer support and straightforward admin fees.

Final Takeaways on Choosing a Halal Forex Broker

Let’s recap. If you’re serious about Islamic finance and want to trade Forex without compromising your values, swap-free accounts are the way to go. But not all brokers are created equal.

Look for those who offer:

- True elimination of swaps—not just renamed fees

- Clear terms and transparent admin charges

- Flexible access to halal-approved instruments

- Fast and fair account approval process

In my own journey, I found confidence by digging deep into each broker’s policy, testing platforms myself, and—most importantly—asking hard questions. That’s what I encourage you to do too.

You deserve to trade with integrity, without worrying whether your broker is playing games with your beliefs. I hope this guide gives you the clarity and courage to choose wisely and trade confidently.