Trading can be an emotional rollercoaster, and while most traders focus on market trends, charts, and strategies, many often overlook the psychological side of trading. The truth is, your mindset plays a crucial role in how well you perform in the markets. Whether you’re a beginner or an experienced trader, self-sabotaging behaviors can creep into your decision-making process, often without you even realizing it. These behaviors can seriously harm your trading career and financial success. But here’s the good news: awareness is the first step to breaking free from them. In this guide, we’ll explore the seven most common ways traders self-sabotage and offer actionable tips to overcome these obstacles.

Here’s a quick look at the key topics we’ll cover:

- Overtrading and how to control impulsive trading habits.

- Revenge trading: why it never works and how to avoid it.

- Holding losing positions too long and how to make better exit decisions.

- The dangers of ignoring your trading plan and how to stick to it.

- Procrastination and perfectionism: breaking the cycle.

- Overcoming negative self-talk and self-doubt in trading.

- System-hopping and the importance of consistency in your trading strategy.

By recognizing these self-sabotaging behaviors and addressing them with the right strategies, you can become a more disciplined and successful trader. Ready to break the cycle? Let’s dive into the details!

Overtrading: How Impulsive Trading Can Destroy Your Profits

Have you ever felt that rush of excitement after a small win, only to find yourself impulsively jumping into more trades, thinking the next one will be even bigger? This is what we call overtrading, and it’s one of the most common ways traders shoot themselves in the foot.

What is Overtrading and Why It Happens

Overtrading occurs when you make more trades than you should, often driven by emotions rather than strategy. It typically happens when you’re either chasing after past losses or riding a short-term win streak. It’s easy to fall into the trap of thinking that more trades will lead to more profits, but in reality, overtrading is a recipe for disaster.

The Impact of Overtrading on Your Portfolio

Overtrading leads to unnecessary risk, increased transaction costs, and often leads to emotional burnout. If you’re trading excessively, your focus will shift from making calculated decisions to reacting to every market movement. This lack of discipline will reduce the overall profitability of your trading and could eventually lead to significant losses.

How to Develop a Comprehensive Trading Plan to Avoid Overtrading

The first step in controlling overtrading is creating a comprehensive trading plan. Your plan should outline your entry and exit strategies, risk management rules, and the maximum number of trades you’ll execute per day or week. By sticking to your plan, you’ll reduce the temptation to trade impulsively and make more deliberate decisions based on your strategy.

Revenge Trading: Why Trying to Win Back Lost Money Leads to Bigger Losses

We’ve all been there. After a loss, the urge to “make it back” can be overwhelming. Revenge trading is when you take trades impulsively, often outside of your strategy, in an attempt to recover lost money quickly. But here’s the harsh truth: revenge trading rarely works, and more often than not, it only compounds your losses.

The Psychology Behind Revenge Trading

Revenge trading happens when traders are emotionally impacted by losses. The emotional response is strong, and the mind tricks you into thinking that you need to “fix” the loss immediately. However, this approach is often fueled by fear and greed, not logic. It clouds your judgment and leads you to make impulsive trades that violate your trading plan.

How Revenge Trading Escalates Losses

Revenge trading typically leads to bigger mistakes. Instead of executing your well-thought-out plan, you might take on excessive risk or even trade against the trend. This only increases the probability of incurring even larger losses, further exacerbating the emotional stress and triggering the cycle of overtrading.

Developing the Right Mindset to Overcome Losses

The key to avoiding revenge trading is changing your mindset. Losses are part of the trading game, and every trader experiences them. Instead of trying to recover losses immediately, take a step back, reflect on your trade, and analyze what went wrong. Use losses as learning opportunities and focus on sticking to your strategy instead of chasing quick fixes.

Holding Losing Positions Too Long: The Dangers of Not Cutting Losses

We’ve all heard the saying, “It’ll come back up, just wait a little longer.” But holding onto losing positions in the hope that they’ll magically turn around is one of the most dangerous things a trader can do. This behavior often leads to even larger losses as you delay the inevitable.

Why Traders Avoid Closing Losing Trades

It’s easy to fall into the trap of “hope” when you’re down on a trade. You hope that the market will turn around, and you end up holding onto the position for far too long. This emotional attachment to the trade leads to poor decision-making, as traders often let their losses accumulate out of fear of locking in the loss.

The Financial and Emotional Toll of Holding On

Not only does holding losing positions lead to greater financial losses, but it also impacts your emotional well-being. The longer you hold a losing position, the more stress you endure. This can cloud your judgment and further affect your trading decisions, creating a vicious cycle of poor performance.

Tools to Help You Cut Losses Early

Setting strict stop-loss levels is one of the best tools to protect yourself from holding onto losing positions too long. By establishing a predetermined exit point, you can take emotion out of the equation. Using automated tools such as stop-loss orders helps you cut losses early and keeps your trading on track with your strategy.

Ignoring Your Trading Plan: The Cost of Going Off-Script

One of the most tempting mistakes in trading is deviating from your trading plan. It’s easy to let emotions drive your decisions, but doing so can lead to inconsistent results and poor performance. Ignoring your plan not only undermines your strategy but also sabotages your overall progress.

Why It’s Easy to Abandon Your Trading Plan

Trading plans often require discipline and patience, which can be challenging when the market is volatile. When emotions like fear, greed, or excitement kick in, it’s easy to throw the plan out the window. However, emotional decisions can result in missed opportunities or unnecessary risks that could have been avoided by following your plan.

How Straying from Your Plan Affects Consistency

Consistency is the key to long-term trading success, and deviating from your plan disrupts this. Without consistency, you risk making hasty decisions based on short-term fluctuations. This lack of stability can lead to uneven results, undermining your trading objectives and eroding your confidence over time.

How to Recommit to Your Trading Plan

To avoid straying from your plan, take a moment to step back and breathe. Revisit your strategy and remind yourself why you created the plan in the first place. Set specific milestones and review your performance regularly to stay on track. Embrace the discipline needed to follow your plan and remember: your strategy was designed to help you succeed over time, not in a single trade.

Procrastination and Perfectionism: How Delaying Trades Leads to Missed Opportunities

How many times have you hesitated, waiting for the “perfect” market conditions to execute a trade, only to miss your opportunity? Procrastination and perfectionism can be just as damaging to your trading as overtrading. The fear of making a mistake often paralyzes traders, leading to inaction.

Understanding the Roots of Procrastination in Trading

Procrastination in trading often stems from the fear of being wrong or making a mistake. You might find yourself analyzing a trade setup repeatedly, waiting for the perfect moment to act. But the truth is, in trading, there’s never a perfect moment. If you wait too long, you’ll miss out on the trade entirely.

The Dangers of Waiting for the “Perfect” Trade Setup

Perfectionism in trading creates a toxic cycle where you believe every decision must be flawless. This mindset leads to overanalyzing market data, endlessly tweaking your strategy, and ultimately missing out on profitable trades. Remember, no trade is perfect, and sometimes you have to make decisions with imperfect information.

Breaking Free from Perfectionism with Actionable Goals

Instead of aiming for perfection, focus on making consistent, calculated decisions. Set achievable goals for each trade and hold yourself accountable for executing them. By accepting that you can’t control every aspect of the market, you’ll become more comfortable taking action, even when conditions aren’t perfect.

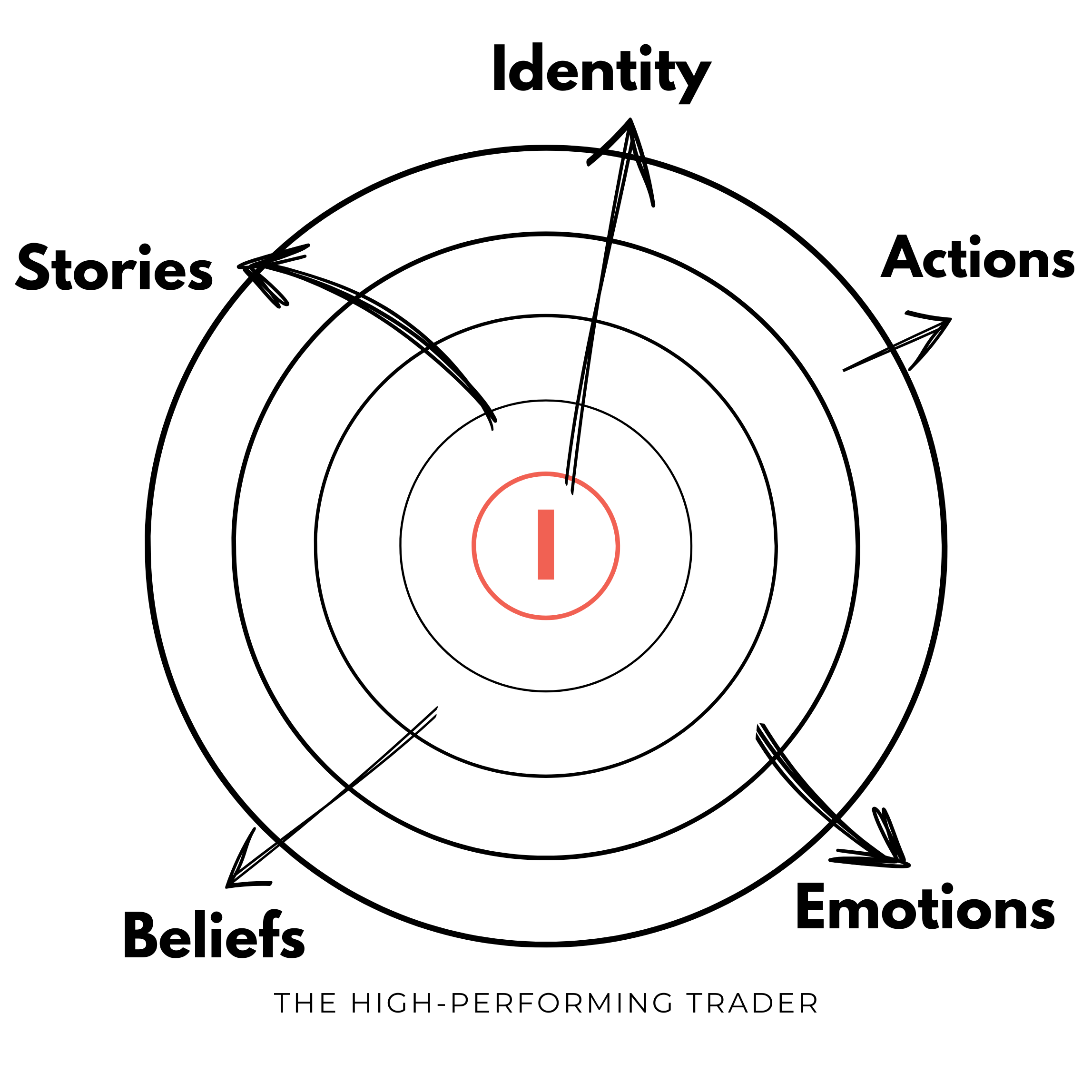

Negative Self-Talk and Self-Doubt: Building a Positive Mindset for Trading Success

How often do you hear that little voice in your head telling you that you’re not good enough or that you’ll never succeed in trading? Negative self-talk can be one of the most damaging forms of self-sabotage, and it affects traders at every level. The key to overcoming it is building confidence and a positive mindset.

The Impact of Negative Thoughts on Trading Decisions

Negative self-talk fuels self-doubt, making you question your abilities and judgment. This inner critic leads to hesitation and indecision, making it harder to take the necessary risks and actions for successful trading. When you believe you’re destined to fail, it influences your behavior, often leading to poor decisions.

How Self-Doubt Can Lead to Hesitation and Missed Opportunities

When you doubt your abilities, you hesitate to take trades or may overthink every decision. This indecision can result in missed opportunities, as the market moves quickly, and the best chances often pass when you’re unsure. Self-doubt can also lead you to second-guess successful trades, creating unnecessary stress.

Overcoming Negative Self-Talk with Affirmations and Reframing

The best way to combat negative self-talk is to replace it with positive affirmations. Practice reminding yourself of your strengths, experiences, and the fact that mistakes are part of the learning process. Reframe negative thoughts by focusing on the lessons you can learn from every trade, rather than dwelling on the outcome.

System-Hopping: Why Jumping from One Strategy to Another Isn’t the Answer

If you find yourself constantly jumping from one trading system to another, you’re engaging in a behavior known as system-hopping. This is a common mistake that many traders make, especially when they experience a few losses or frustrations with their current strategy. But system-hopping rarely leads to success and often results in greater losses.

What Is System-Hopping and Why Do Traders Do It?

System-hopping is when you continuously change your trading strategy in search of better results. This behavior usually happens when a trader is feeling frustrated or disheartened after a loss and believes that the next system will be the “magic solution” to their problems. However, the real issue lies in not giving a strategy enough time to prove itself.

The Risks of Constantly Changing Strategies

Changing strategies frequently prevents you from gaining expertise with any one approach. Each strategy requires time, testing, and adjustment, but switching strategies too often means you never fully master any of them. This lack of consistency can lead to confusion and a constant sense of failure.

How to Commit to a Strategy Long Enough to See Results

Instead of jumping from one strategy to another, choose a plan that aligns with your goals and risk tolerance. Give yourself time to evaluate the strategy’s effectiveness, and track your progress over a set period. Be patient and allow your strategy to work for you before making any significant changes.

FAQ

What should I do if I’ve just made a bad trade?

First, take a moment to reflect on what went wrong. Avoid revenge trading or impulsively trying to make up for the loss. Review your trading plan and adjust your approach if necessary. Acknowledge the loss, but don’t let it define your future trades.

How can I avoid making emotional trading decisions?

Emotional decisions are usually driven by fear or greed. To avoid this, create a trading plan with clear rules for entering and exiting trades. Stick to your plan, and avoid impulsively making decisions based on short-term market movements. You can also take breaks when you feel overwhelmed.

What are the best risk management strategies for new traders?

For new traders, one of the best risk management strategies is using stop-loss orders. This ensures that you limit your losses on each trade. Additionally, only risk a small percentage of your total capital on each trade, and diversify your trades to minimize exposure.