Trading is a mental game. Whether you are a seasoned trader or just starting out, one truth remains constant: your psychological state plays a huge role in the success or failure of your trades. Fear, greed, overconfidence—these emotions can push you to make impulsive decisions that have long-term consequences. But how do you find the right balance between bold decisions that can lead to big rewards and the necessary safety measures to protect your investments?

The problem lies in the psychological drivers that influence risk-taking in trading. Many traders act based on emotions, making hasty decisions without proper risk management. Overcoming this tendency is crucial to building a long-term, successful trading strategy.

The solution? A deep understanding of your emotional triggers and a strategic approach to balancing boldness with safety. By learning how to manage your emotions and implement proven techniques for calculated risk-taking, you can make smarter, more consistent decisions in the markets.

- Fear and Greed: The Emotional Drivers of Risk-Taking

- Common Cognitive Biases in Trading

- Techniques for Managing Emotional Triggers

- Building a Risk Management Strategy that Works

- Developing a Resilient Trading Mindset

In this guide, you’ll discover how psychological factors influence risk-taking, how to manage your emotions during trading, and the strategies that can help you make informed decisions for long-term success. Let’s dive in!

The Role of Emotion in Trading Risk

When it comes to risk-taking in trading, emotions are the primary drivers. Two key emotions—fear and greed—often lead to impulsive decisions that can significantly affect your success. Let’s break these down:

Fear and Greed: The Key Emotional Drivers of Risk-Taking

Fear and greed are often in direct conflict with one another. Greed can push you to take risks you shouldn’t, in the hopes of achieving large rewards. On the other hand, fear can make you overly cautious, causing you to exit trades too soon or avoid potentially profitable opportunities altogether.

Overcoming these emotional impulses is one of the biggest challenges traders face. I’ve personally experienced both extremes—making risky trades driven by fear of missing out (FOMO) and hesitating to act because of the fear of loss. Recognizing when fear or greed is influencing your decision-making is the first step toward becoming a more disciplined trader.

Cognitive Biases in Trading: How Overconfidence and Loss Aversion Affect Decisions

Cognitive biases—mental shortcuts that help us make decisions quickly—can often work against us in trading. Overconfidence bias, for example, leads traders to believe they can predict the market better than they actually can, causing them to take larger, riskier positions than they should.

Similarly, loss aversion is a bias where traders feel the pain of losses more intensely than the joy of gains. This often results in holding onto losing positions too long, hoping the market will turn around, or cutting profitable trades too early to avoid potential losses.

The Illusion of Control: Why Many Traders Overestimate Their Predictive Abilities

Many traders believe they can control or predict the market, which leads to risky behavior such as overtrading or using excessive leverage. The reality is that the markets are unpredictable, and no one can consistently forecast their movements. Understanding this is crucial for managing risk in trading.

Recognizing Emotional Triggers in Trading

Successful traders are not just adept at technical analysis—they also understand their emotional triggers and know how to manage them. Recognizing these triggers before they impact your trading decisions can help you maintain control and stick to your trading plan.

Identifying Personal Emotional Triggers: What Makes You Take Unnecessary Risks?

Each trader has their own emotional triggers. For example, some traders become overly confident after a few successful trades, leading them to take on more risk than they should. Others might trade more aggressively after a loss, trying to recover their losses quickly. Identifying these triggers in yourself is key to preventing them from influencing your decisions.

Managing Emotional Responses During High-Stakes Trading Situations

High-stakes situations—such as seeing your trade heading into the red or being caught in a volatile market—can provoke emotional responses like panic, anger, or frustration. These feelings can cloud your judgment, leading you to make snap decisions that are not in line with your trading strategy.

In these moments, taking a step back and focusing on your predefined risk limits and trading plan can help you regain control. I’ve found that even a brief pause can help clear my mind and make more rational decisions.

How Emotional Awareness Improves Decision-Making in Trading

Self-awareness is the first step in emotional control. By recognizing when fear or greed is influencing your decisions, you can pause and reassess the situation. Over time, I’ve learned that practicing mindfulness—whether through meditation or simple breathing exercises—can help me stay focused during emotional high points in trading.

Techniques for Balancing Boldness and Safety in Trading

To be a successful trader, you must find the right balance between boldness and safety. This requires a disciplined approach to risk management and decision-making.

Predefined Risk Limits: The Importance of Setting Clear Boundaries Before Trading

One of the most important techniques for managing risk is to define your risk limits before entering a trade. This includes deciding in advance how much you are willing to lose on a single trade and setting stop-loss orders to enforce this limit. By doing this, you prevent emotions from driving your decisions once you are in the trade.

Personally, I’ve found that setting these boundaries ahead of time has kept me from making impulsive decisions during high volatility moments.

Position Sizing: A Method to Control Risk Without Compromising Potential Gains

Position sizing is another crucial aspect of risk management. By adjusting the size of your position based on your risk tolerance and the volatility of the market, you can limit the potential loss without sacrificing the chance for gains. Many traders make the mistake of risking too much on a single trade, which can lead to significant losses when things go wrong.

Using Stop-Loss/Take-Profit Orders to Enforce Discipline

Stop-loss and take-profit orders are essential tools for managing risk in trading. These orders automatically close a position once it reaches a certain level of profit or loss, taking emotions out of the equation. For example, if a trade hits your stop-loss level, the position closes, preventing further losses. Similarly, take-profit orders lock in your profits once your target is reached.

These tools are my safety net. They help me stick to my trading plan and avoid getting swept up in the emotional highs and lows of trading.

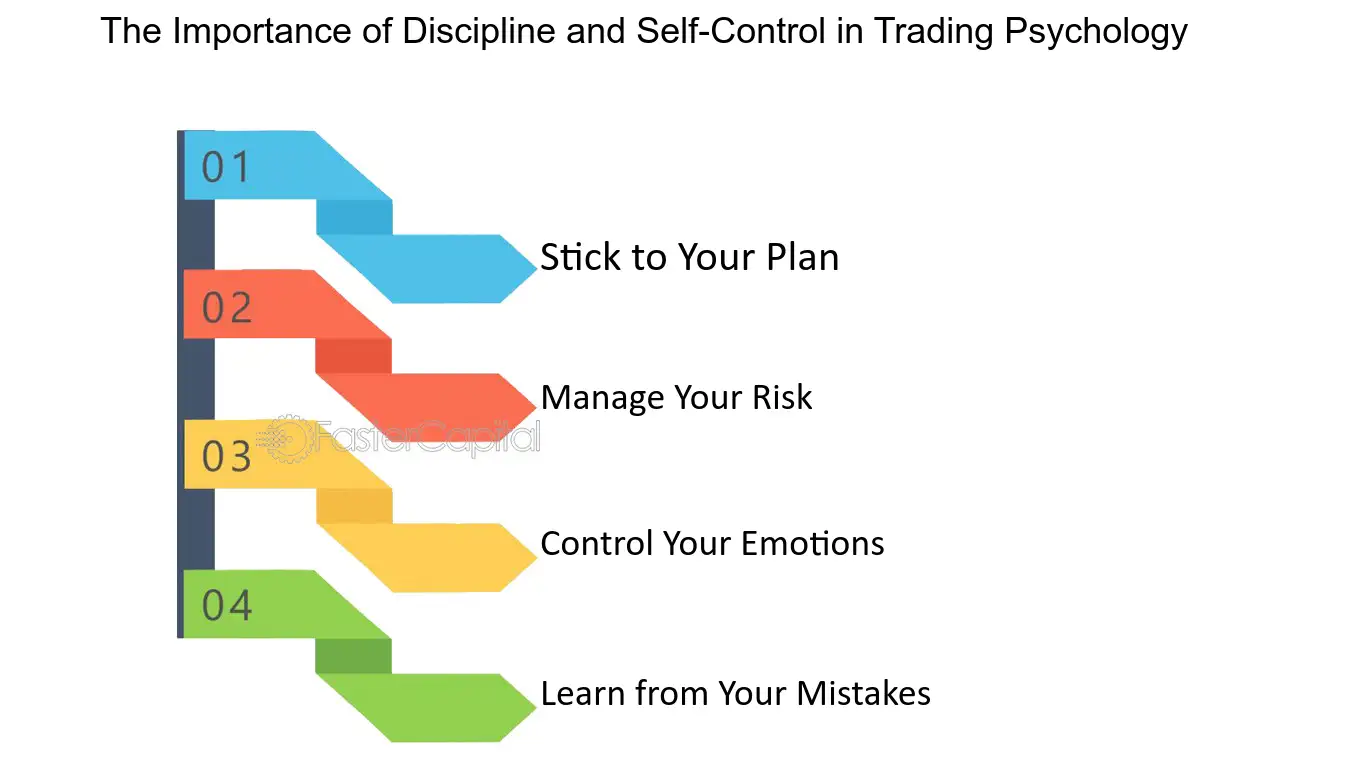

Building a Risk Management Strategy that Works

A solid risk management strategy is the cornerstone of successful trading. It’s not enough to have a few techniques in place—you need a comprehensive plan that integrates emotional control, risk limits, and position sizing. Over time, you’ll refine your strategy as you learn more about your trading style and the markets you trade in.

How to Develop a Strong Trading Mindset

To succeed in trading, you need more than just technical knowledge and strategies. You also need a strong mindset—one that can handle the ups and downs of the market without letting emotions take over. Developing mental resilience is key to navigating the psychological challenges that every trader faces.

The Importance of Self-Reflection: Improving Your Trading Discipline

Self-reflection is a powerful tool that can help you improve as a trader. By regularly reviewing your trades—whether they were successful or not—you can identify patterns in your decision-making process. This includes understanding when emotions like fear or greed affected your choices and learning from them.

I’ve personally found that after each trading session, taking time to reflect on my actions has been invaluable. I ask myself questions like: Was I too eager to make a trade? Did I let my emotions drive my decision? This introspection helps me make more disciplined choices moving forward.

Keeping a Trading Journal: How Tracking Emotions Leads to Better Risk Management

Many successful traders keep a trading journal. This journal not only tracks trades but also records the emotions and thought processes behind them. By documenting how you felt before, during, and after each trade, you can identify emotional triggers that affect your performance.

For me, my trading journal has been a crucial tool in becoming more self-aware. It allows me to see when my trading decisions were influenced by emotions rather than logic, helping me avoid those mistakes in the future.

Practicing Patience and Discipline for Long-Term Success

Patience and discipline are two of the most important traits a trader can develop. In a world where the pressure to make quick decisions is constant, practicing patience can be difficult. But I’ve learned that successful trading is not about rushing to make the next big move. It’s about sticking to a plan and waiting for the right opportunities to present themselves.

As I’ve gained more experience, I’ve realized that the best trades often come after waiting for the right conditions to align. Discipline helps me stay focused on the long-term goals rather than getting caught up in short-term fluctuations.

Building Resilience and Reducing Emotional Volatility

Trading will test your mental fortitude. The markets are unpredictable, and it’s easy to feel overwhelmed during periods of volatility. But building emotional resilience is essential for navigating these challenges successfully.

The Power of Mindfulness in Trading: Staying Calm Under Pressure

Mindfulness has become an essential part of my trading routine. By focusing on the present moment and not getting distracted by past losses or future uncertainties, I can stay calm during stressful times. Practicing mindfulness techniques such as deep breathing or meditation has helped me reduce stress and maintain a clear, focused mindset.

Techniques to Control FOMO (Fear of Missing Out) and Avoid Premature Exits

FOMO is a common emotion that many traders struggle with. It can push you to enter trades based on a fear of missing out on potential profits, often leading to rash decisions. I’ve been guilty of jumping into trades just to avoid being left out, only to regret it later. Learning how to control FOMO has been one of the hardest but most rewarding parts of my trading journey.

Now, I make it a point to follow my trading plan and avoid making decisions based on fear. When I feel that urge to act out of FOMO, I remind myself of the risk I’ve already assessed and trust that opportunities will come again.

The Role of Consistency in Successful Risk Management

Consistency is a trait that sets the best traders apart. By sticking to your trading plan and managing your emotions consistently, you build a solid foundation for long-term success. The markets are full of ups and downs, but maintaining a consistent approach helps you weather those storms.

For me, the more consistent I’ve been with following my plan, the more confident I’ve become in my decisions. I know that I can’t control the market, but I can control my actions and stay true to my strategy.

Applying Psychological Insights to Your Trading Strategy

Understanding the psychology behind risk-taking is only the first step. To truly succeed, you need to integrate this knowledge into your trading strategy. This means aligning your risk-taking with your overall trading goals and personality while using psychological insights to guide your decisions.

Aligning Your Risk-Taking with Your Trading Goals and Personality

Your risk tolerance should be aligned with your trading goals and your personality. If you’re a conservative person, it’s important to recognize that taking large risks may not suit your style. On the other hand, if you thrive on adrenaline and have a high tolerance for risk, a more aggressive approach might be appropriate.

Personally, I’ve realized that the more I tailor my risk-taking to my personality and goals, the more comfortable I feel with my decisions. For example, my conservative approach means I avoid high-leverage trades, which allows me to sleep better at night.

How to Make Bold Decisions Safely Using Data and Analysis

Boldness in trading doesn’t have to mean recklessness. You can make bold decisions safely by using data and analysis to back up your choices. This means assessing risk properly and making sure that you have a well-defined exit strategy. I often use technical indicators and fundamental analysis to ensure my bold moves are calculated rather than impulsive.

The Benefits of a Controlled Risk Approach for Sustainable Trading Growth

A controlled risk approach allows for sustainable growth. By not overexposing yourself to risk, you give yourself the best chance to profit over time. Instead of making huge, high-stakes bets, focus on consistent, smaller wins that add up in the long run. This approach allows you to stay in the game longer and adapt to market changes as they come.

As I’ve grown as a trader, I’ve found that controlled risk not only protects my capital but also gives me the peace of mind to make better decisions. The slow and steady approach might not be flashy, but it’s proven to be effective in the long run.

FAQ

What is the best way to control emotions while trading?

The best way to control emotions while trading is by practicing mindfulness and staying focused on your predefined trading plan. Keeping a trading journal, practicing self-reflection, and setting risk limits can help manage emotions during high-stress situations. Deep breathing exercises or meditation can also calm the mind and reduce impulsivity.

How can I avoid making emotional decisions in forex trading?

One of the best ways to avoid emotional decisions is to stick to your trading plan and avoid impulsive actions. Predefine your risk limits, use stop-loss orders, and take profits at predetermined levels. If you feel emotions like fear or greed creeping in, step away from the screen for a few minutes to regain clarity.

What are some effective risk management strategies for beginners?

For beginners, effective risk management strategies include setting risk-reward ratios, using stop-loss orders, and never risking more than a small percentage of your trading capital on a single trade. It’s also important to start with smaller positions until you become more experienced and comfortable with the markets.