The forex market is this enormous beast—bigger than anything I’d ever seen when I first started trading. And yet, like many new traders, I assumed it was just me versus “them.” But who exactly is “them”? That question changed the way I viewed every single trade I’ve ever made.

It’s not just banks and brokers out there. The forex market is a network of layered participants—from the ones pulling the biggest strings to the rest of us trying to make our piece of the pie. If you’ve ever wondered who’s really behind the moves you see on your charts, you’re not alone.

I remember watching a sudden USD/JPY spike and thinking, “Was that retail traders like me?” Spoiler: it wasn’t. Turns out, understanding who the key players are can literally change the way you trade. I’m breaking it down below, from the powerhouses to the hidden helpers.

- How central banks control currency through policy

- Why investment banks dominate trading volume

- What role corporations and funds play in market direction

- Where retail traders like you and me fit in

By the end, you’ll have a crystal-clear view of who moves the market and how to trade smarter around their moves. Let’s get into it.

Introduction to Forex Market Structure

The Decentralized Nature of Forex

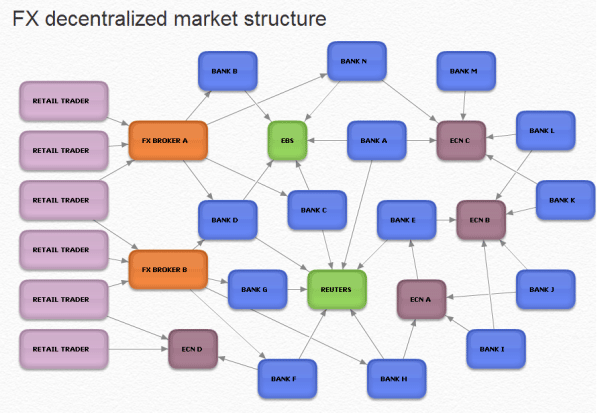

Forex isn’t like your local stock exchange. There’s no one building, no central headquarters. It’s decentralized, meaning it operates through an electronic network of banks, brokers, institutions, and individual traders all over the globe. That’s why it’s open 24 hours a day, five days a week.

Why the Roles of Participants Matter

Once, I thought price action was just the result of “demand and supply.” Technically, that’s true. But more accurately, it’s who creates that demand and supply. When I learned that a central bank could move billions in minutes—or that a hedge fund could influence a short-term trend—it shifted my trading mindset completely.

Daily Turnover and Market Share

Every day, the forex market turns over more than 6.6 trillion USD according to the Bank for International Settlements. Over 80% of this volume is driven by just a few top-tier participants. Let’s look at who they are.

Tier 1: Institutional Powerhouses

Central Banks

If there’s one participant with the power to shake the market, it’s a central bank. Think of the US Federal Reserve, the European Central Bank, or the Bank of Japan. These institutions control interest rates, print money, and intervene when their economies demand it. I remember the day the Fed announced a rate hike—I saw the EUR/USD plunge in real-time. That’s the kind of influence we’re talking about.

They don’t trade for profit. Their mission is to control inflation, stabilize their currency, and support economic growth. But in doing so, they affect traders like us big time.

Commercial and Investment Banks

These are the titans of forex volume. Banks like JPMorgan Chase, Deutsche Bank, and Citi don’t just process client transactions. They trade for their own accounts too—what’s called proprietary trading. I used to wonder who I was trading against in major sessions—turns out, it was often these guys.

They provide liquidity to the market, which helps keep spreads tight and trades moving smoothly. They also set exchange rates that affect our orders. So even if you’re trading from your laptop, your price is coming from their book.

Governments and Sovereign Wealth Funds

Sometimes, it’s not just central banks getting involved. Governments themselves enter the forex market to manage reserves or push national policy. Sovereign wealth funds—like Norway’s Government Pension Fund—also make massive currency allocations as part of their portfolio strategy. It’s all about preserving and growing wealth across different currencies.

Tier 2: Market Movers and Hedgers

Multinational Corporations (MNCs)

Ever bought something from Apple? Ever flown Airbus? These corporations deal in different currencies all the time. When they pay vendors or receive revenue across borders, they need to exchange money. That’s where forex comes in.

I used to think only traders used forex. Then I saw how MNCs hedge currency risk. It blew my mind that behind every quarterly earnings call, there might be millions in FX transactions just to protect against losses.

Institutional Investors

Now this group fascinates me. Hedge funds, pension funds, mutual funds—they all trade forex. Some do it to hedge their equity portfolios. Others, like George Soros back in 1992, do it for speculative profit. That legendary “Black Wednesday” trade? That was institutional speculation at its finest.

What’s wild is how much influence these funds can have in the short term. I remember watching a week where GBP spiked with no obvious news—turned out a London-based fund had placed a large position. That’s the kind of power institutional flows can have.

Tier 3: Retail Market Access Facilitators

Retail Forex Brokers

Without these guys, I wouldn’t be writing this article. Brokers like IG, FXCM, or OANDA make it possible for you and me to trade from home. They connect us to the broader market—sometimes directly (ECN brokers) or via their own internal systems (market makers).

Back when I first downloaded MetaTrader 4, I had no clue what a broker even did. Now I know they don’t just provide access—they offer tools, leverage, charts, and even educational content. But you need to know how they make money. That way, you understand spreads, swaps, and what execution really means.

Prime Brokers and Liquidity Providers

This one took me a while to grasp. Prime brokers work behind the scenes. They’re like VIP brokers—serving hedge funds, institutional clients, and even other brokers. They offer deeper liquidity and better execution, which trickles down to us as retail traders too.

Liquidity providers—often big banks or financial institutions—are the ones quoting prices constantly. Without them, the market would freeze. So even though you may never see them, they’re the lifeblood of every trade that gets filled.

Tier 4: The Retail Crowd

Retail Traders (You)

This is where you and I come in. We’re the everyday folks trading from laptops, phones, and maybe even a second monitor setup. While we don’t move markets the way central banks do, the retail crowd has grown fast—especially since the pandemic. Platforms like MetaTrader 4 and apps like eToro have made forex trading super accessible.

But let’s be real—retail traders still only account for a small slice of the total volume. According to BIS data, institutional players still dominate. That said, our numbers give us a voice. Especially in times of volatility, retail sentiment can push prices in surprising ways.

Summary Table of Forex Market Participants

| Participant | Main Role | Market Impact |

|---|---|---|

| Central Banks | Monetary policy, intervention | Very High |

| Commercial/Investment Banks | Liquidity, trading, market making | Very High |

| Multinational Corporations | Hedging, transactions | Moderate |

| Institutional Investors | Speculation, hedging | High |

| Governments | Reserve management | Moderate |

| Retail Brokers | Market access | Low/Moderate |

| Retail Traders | Speculation | Low |

| Sovereign Wealth Funds | Investment, diversification | Moderate |

| Prime Brokers | Trade facilitation, liquidity | Low/Moderate |

Who are the biggest players in the Forex market?

The biggest players are central banks and commercial/investment banks. Central banks set monetary policy and can influence exchange rates directly through interventions. Meanwhile, major banks like JPMorgan or Citi handle most of the daily trade volume, both for clients and on their own behalf. Together, they account for over 80% of the global forex volume.

What role do central banks play in Forex?

Central banks manage their national currencies. They adjust interest rates, control inflation, and may intervene in the forex market to stabilize their currency. For example, the Swiss National Bank has intervened to keep the Swiss franc from appreciating too much. These decisions can lead to huge shifts in currency pairs.

Can retail traders really impact the Forex market?

While retail traders like you and me don’t move the market the way institutions do, our presence still matters. We add liquidity, and our collective sentiment can influence short-term moves—especially during periods of low institutional activity or major news events. The 2020 retail boom showed just how fast we can react—and sometimes surprise the market.

Recap of Key Points

Understanding the forex market isn’t just about indicators or chart patterns—it’s about people. Real players with real motives drive every pip movement you see. From central banks adjusting rates to corporations hedging risk and retail traders placing their daily trades, everyone contributes to this massive global system.

Final Takeaway

If you want to trade smarter, start by knowing who’s on the other side of your trade. Learn how they behave, when they act, and why they do what they do. That knowledge alone puts you ahead of most beginners in the game.

Closing Thought

You’re not just a small fish in a big ocean—you’re part of a living, breathing ecosystem. Learn it. Respect it. And use it to your advantage. When you understand who the key participants in the forex market are, you stop trading blindly—and start trading with purpose.