When I first got into forex trading, I was obsessed with catching the right price. I’d sit for hours watching charts, convinced I had to jump in right now or miss out forever. I didn’t understand order types — I just hit “buy” or “sell” and hoped for the best.

That strategy backfired. A few quick losses later, I realized I needed more control over how and when my trades were executed. Learning about forex order types changed everything for me. It gave me a real edge — and peace of mind.

If you’ve ever placed a trade and instantly regretted it or wondered why your trade didn’t go through, chances are it had to do with using the wrong order type.

Here’s what you’re going to walk away with today:

- What forex order types are and why they matter

- How market, limit, and stop orders work — with real-world examples

- Advanced tools like trailing stops and stop-limit orders

- How to choose the right order type for your trading style

Whether you’re just starting out or want to trade smarter, understanding these order types can save you money, reduce risk, and make your whole trading life less stressful.

What Are Forex Order Types?

Every time you buy or sell a currency pair, you’re placing an order. But not all orders work the same way. Order types tell your broker how to carry out your trade — immediately, at a specific price, or only under certain conditions.

And here’s the kicker: the type of order you choose directly affects your price, execution speed, and risk exposure. Market orders give you speed. Limit orders give you control. Stop orders give you protection.

But that’s just the surface. Let’s dig into each one so you can decide which fits your strategy best.

Market Orders: Fast But Unpredictable

When you place a market order, you’re saying, “Get me in or out right now — I don’t care about the price.” It’s fast, simple, and often used when you just want in on a move before it’s too late.

I remember using a market order during a Non-Farm Payrolls announcement. The price was flying. I hit “buy” — and got filled way higher than I expected. That’s called slippage, and it happens a lot during high volatility.

Examples of Using Market Orders

Here’s what to consider when placing a market order:

Quick Execution in Fast Markets

If you’re scalping or chasing a breakout, speed might matter more than price. Market orders shine here — you’ll get in fast, but not necessarily at your target price.

Understanding Slippage

Slippage is when your trade executes at a worse price than you clicked. It’s common in volatile markets and low-liquidity pairs. That’s the tradeoff with speed — you give up price certainty.

Why Market Orders Can Be Risky

They skip price filters. In a slow market, that’s no big deal. But in fast-moving markets, you could enter far from where you intended — which means greater risk from the start.

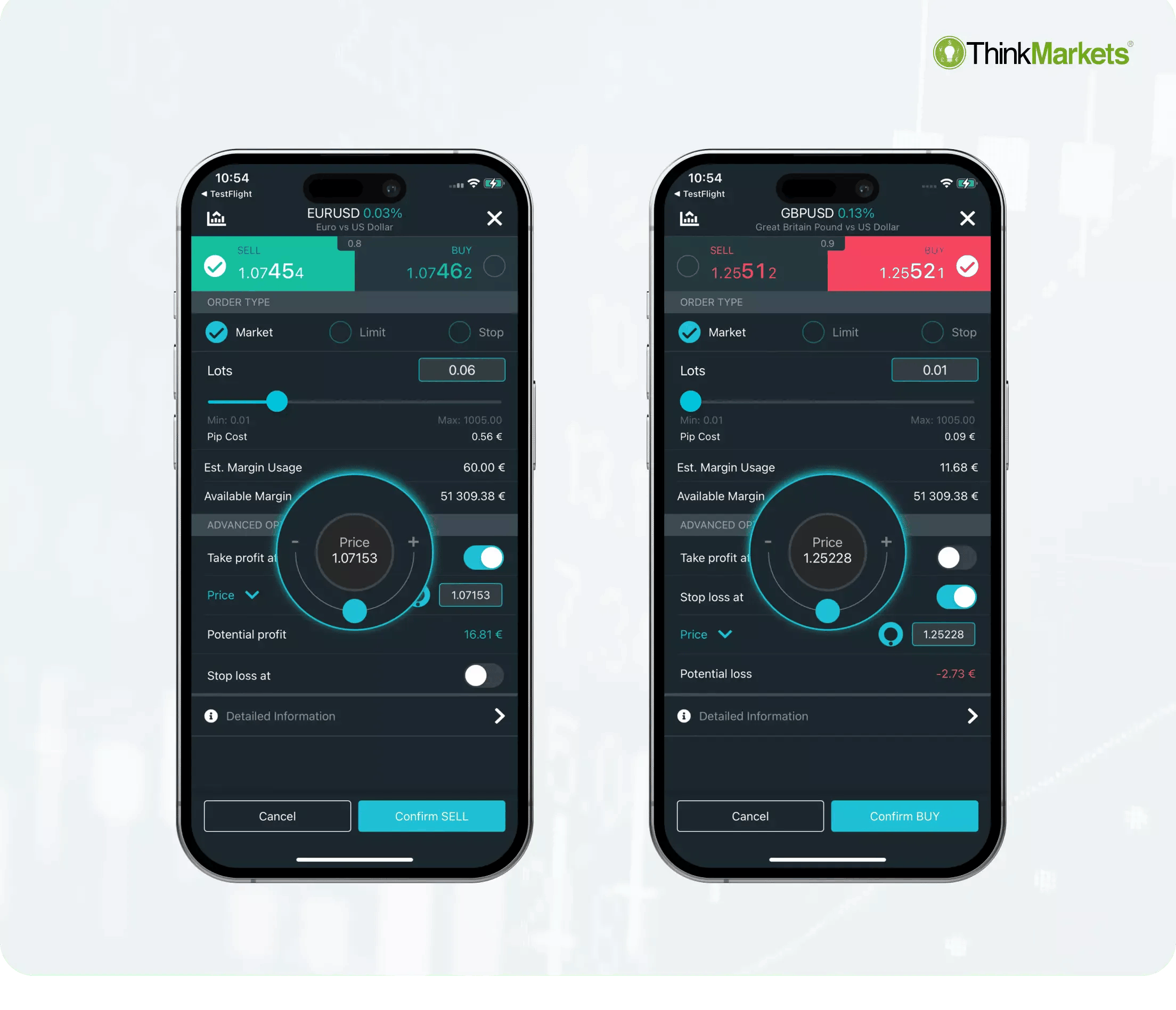

Limit Orders: Precision Control

With a limit order, you tell your broker to only execute your trade at a specific price or better. You’re in control — but your order might never fill if the market doesn’t reach your price.

I use limit orders all the time when I’m waiting for pullbacks. Let’s say EUR/USD is at 1.0900. I want to buy at 1.0880. I just set a buy limit at that price and walk away. If price dips, I’m in. If it doesn’t — no harm done.

Tips for Using Limit Orders

Set Realistic Price Levels

If your limit is too far from the current market price, your order may never trigger. Balance patience with probability. Look at support/resistance zones and recent volatility when placing limits.

Managing Risk and Reward

Limit orders let you enter at better prices, improving your reward-to-risk ratio. I often use them along with stop-loss orders to define my risk upfront.

When Limits Don’t Fill

It can be frustrating when price almost hits your limit and then runs away. That’s normal. No fill means no entry — which is still safer than jumping in blindly.

Stop Orders: Smart Risk Management

Stop orders activate once the market hits a certain price. Think of them like tripwires — they trigger action only when price moves past a point you care about. The most common stop order is the stop-loss, which is crucial for protecting your account.

But there’s also the stop-entry, which lets you catch breakouts, and trailing stops that move with the market. I use all three depending on what I’m trading.

Stop-Loss Orders in Action

Cutting Losses Automatically

A stop-loss order closes your trade when price moves against you. If I buy GBP/USD at 1.2800 with a stop at 1.2750, I’m protected from a big drop. It’s like a safety net you set before you fall.

Trailing Stops to Lock in Profits

Trailing stops adjust as the market moves in your favor. I often use them when I’m already in profit and don’t want to manually manage the trade. They’re great in trending markets.

Stop-Entry for Breakout Strategies

Want to buy when EUR/USD breaks 1.1000? Place a buy stop at 1.1001. Your trade triggers only when that level’s hit. These are perfect for momentum trades but must be paired with tight risk control.

| Order Type | Purpose | Risk Level | Best Use Case |

|---|---|---|---|

| Market Order | Instant execution at current price | High (due to slippage) | Breakout trades, fast markets |

| Limit Order | Set a precise entry/exit level | Low | Pullbacks, take-profit levels |

| Stop-Loss | Protect against large losses | Low (if placed wisely) | Every open trade |

| Trailing Stop | Lock in profit as price moves | Moderate | Trending markets |

Advanced and Conditional Order Types

Once I got comfortable with the basics, I started exploring more advanced tools. These order types don’t just help you enter or exit trades — they let you automate your strategy and reduce screen time.

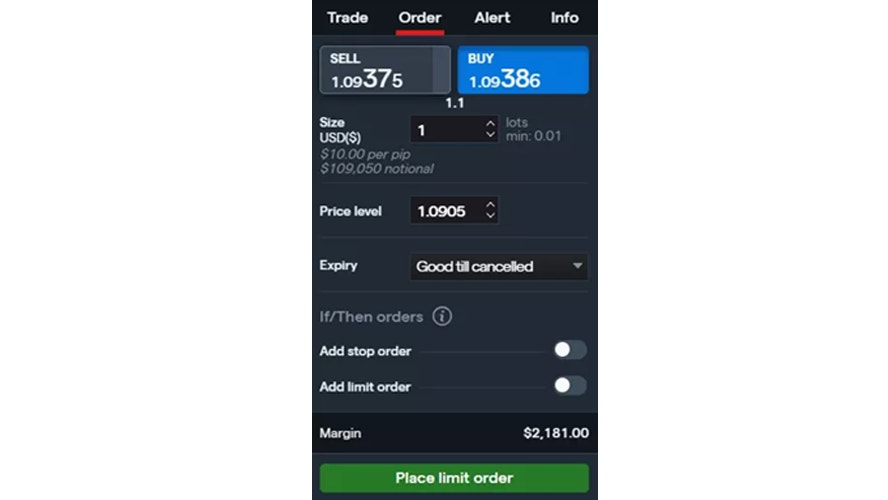

Let’s walk through two of the most powerful: stop-limit orders and conditional (or “if-then”) orders.

Stop-Limit Orders Explained

This is a hybrid between a stop order and a limit order. You set a stop price to trigger the order, and then a limit price to control the exact execution level.

For example, let’s say you expect EUR/USD to break above 1.1000 but don’t want to pay more than 1.1010. You can set a stop-limit order: stop at 1.1001 and limit at 1.1010. If the market gaps up too high, your trade won’t execute — saving you from overpaying.

But here’s the catch: this order might not get filled at all if the market skips your limit. That’s the tradeoff for added precision.

Conditional / If-Then Orders

These are game-changers. They allow you to place an order only if another one triggers first. I use them to automate entry, stop-loss, and take-profit all in one move.

Say you want to buy USD/JPY if it hits 150.00, but only if that happens, then you also want to place a stop-loss at 149.50 and a target at 151.00. You can set up this chain using an if-then order — your strategy runs on autopilot from there.

Managing Multiple Trades Efficiently

I trade several pairs at once, so I can’t watch them all. Advanced orders help me set conditions in advance and walk away. If price does X, then do Y. It’s like programming your strategy without coding anything.

FAQ

What is the safest forex order type for beginners?

Hands down, a limit order combined with a stop-loss. That combo lets you control your entry and cap your losses — perfect for learning without taking big hits.

Can a stop-loss guarantee protection?

Not completely. In fast-moving markets, your stop might fill at a worse price due to slippage. But using stops is still the most effective way to control downside risk.

Why didn’t my limit order execute?

Because the market didn’t hit your price. Limit orders only trigger if price touches or improves your level. Think of them as “permission slips” — your broker waits until the conditions are met.

How do I place a trailing stop in MetaTrader?

Right-click on your open trade in the terminal window, choose “Trailing Stop,” then select a pip value. It’ll move automatically as your trade becomes profitable. You can also custom-set it in MT5. Here’s the full guide from MetaTrader’s official site.

Recap of Key Points

Forex order types are more than just tech terms. They shape your trades, control your risks, and define your results. Let’s rewind what you’ve learned:

- Market orders = speed but less price control

- Limit orders = better price but no guarantees

- Stop orders = protection and strategic entries

- Advanced types like stop-limit and conditional orders let you automate smart decisions

Final Takeaway

If you’re serious about forex trading — even as a beginner — mastering these order types is non-negotiable. Don’t leave your trades to chance. Learn when to use each tool so your strategy works with you, not against you.

Closing Thought

I wish I had known this stuff sooner. It would’ve saved me some early mistakes (and money). But now that you do, you’re already ahead of the curve. Go test these out on a demo account. See how they behave. Then use them to trade smarter, safer, and more confidently.