Choosing a trading platform was one of the first major decisions I had to make when I started Forex trading. Back then, I didn’t know the difference between MT4 and MT5—and trust me, it showed. I opened an account with a broker using MT5 without really understanding what that meant. Within a week, I realized I was missing out on features that didn’t matter to me yet and struggling with a steeper learning curve than I expected.

That’s why I’m writing this—to help you avoid making a blind choice between MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Picking the right platform upfront can save you stress, lost time, and missed trades down the road.

If you’re confused by broker options and platform features, you’re not alone. Many traders wonder:

- Is MT5 really better than MT4?

- Do all brokers offer both?

- Which one is better for beginners?

In this guide, you’ll learn what sets MT4 and MT5 apart, which is best for your trading goals, and how brokers play into the decision. I’ll break it all down with real examples, a personal story, and a comparison table you’ll want to bookmark.

Overview: Why Your Platform Choice Matters

Think of MT4 and MT5 like two toolkits. They’re both built by MetaQuotes, but each serves a different type of trader. MT4 was designed with Forex in mind. MT5 opens the door to multi-asset trading like stocks and futures. If your broker only offers one, your strategy may be limited.

I started with MT4 because I was focused purely on currency pairs. It was clean, fast, and loaded with tools for technical analysis. But once I wanted to backtest multi-symbol strategies and follow broader markets, I had to switch to MT5—and let me tell you, that transition takes time.

Core Differences Between MT4 and MT5

Market Focus

MT4 is built specifically for Forex traders. It’s perfect if you only care about trading EUR/USD, GBP/JPY, and so on. MT5, on the other hand, supports a wide range of markets—stocks, bonds, futures, and even crypto with some brokers.

If you plan to expand beyond currency pairs, MT5 gives you more runway. But if you’re just getting started and want to keep it simple, MT4 still reigns supreme for FX-only traders.

User Interface and Learning Curve

MT4 has a simpler, cleaner layout. When I opened MT5 for the first time, I was overwhelmed by the extra tabs, chart settings, and trading modes. It’s more powerful, but it takes longer to learn.

New traders often find MT4 easier to navigate. If you’re focused on fast learning and fewer distractions, MT4 might be the smoother entry point.

Indicators and Timeframes

MT4 includes 30 built-in indicators and 9 timeframes. That’s enough for most beginner to intermediate traders. But MT5 pushes that up to 38 indicators and 21 timeframes. If you’re a chart junkie like me, you’ll love the extra resolution MT5 gives you.

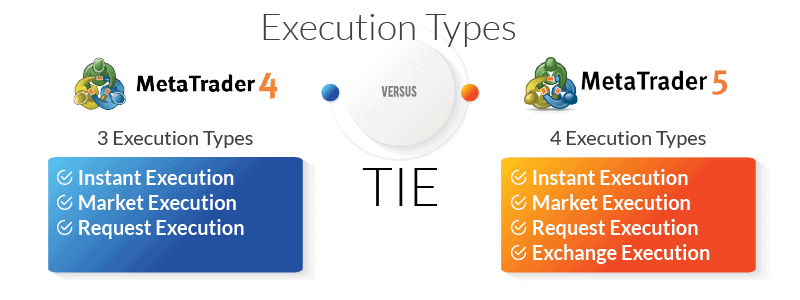

Order Types and Execution Models

One of the big surprises for me was MT5’s extra order types. MT4 lets you place basic market, stop, and limit orders. MT5 adds stop-limit orders and supports both hedging and netting systems, depending on your broker’s setup.

I like having the flexibility of stop-limit orders in volatile markets. But if you’re just learning how to place trades, you might not need these yet.

Backtesting and Speed

Backtesting on MT4 is single-threaded—you can only test one symbol at a time, and it’s slow. MT5 is a beast in comparison. It’s multi-threaded and allows backtesting across multiple symbols with real tick data. If you plan to use Expert Advisors (EAs), MT5 will save you hours.

I remember running a backtest on MT4 that took 25 minutes. The same strategy on MT5 finished in 4. That’s a game-changer when optimizing your bots.

Programming Language and EA Support

MT4 uses MQL4, and MT5 uses MQL5. While they sound similar, MQL5 is more complex and powerful. I started coding basic EAs in MQL4 and found it pretty approachable. When I moved to MQL5, I needed to relearn a lot of syntax. It supports object-oriented programming, which is great if you’re a coder—but frustrating if you’re not.

The MT4 community is larger and has more free indicators and EAs. But MT5 is catching up fast with cleaner code and more robust logic.

Broker Compatibility and Support

Which Brokers Offer MT4 vs MT5

Most major brokers offer both platforms, but some are starting to move away from MT4. MetaQuotes stopped selling MT4 licenses in 2018, so newer brokers may only offer MT5.

If your preferred broker supports both, that’s great—you can test each with a demo account. But be aware that some brokers tweak platform features. Always check their version details before committing.

Differences in Broker Execution Speed

Execution speed isn’t just about the platform—it also depends on your broker’s server setup. That said, MT5 supports multi-threaded architecture and 64-bit processing. I’ve personally seen trades execute slightly faster on MT5 under high volatility.

Still, a well-optimized MT4 setup from a good broker can be just as fast. Look for low latency, data centers near your region, and a fast VPS if you’re using EAs.

Platform Stability and Resource Usage

MT4 runs well on older machines. If you’re using a laptop with 4GB RAM and an old processor, it’ll work just fine. MT5 needs more power. I had to upgrade my PC to fully enjoy its speed and backtesting capabilities.

Also, MT5 supports more charts and symbols open at once without crashing. If you’re a heavy multitasker, that’s something to think about.

When to Choose MT4

Ideal for Forex-Only Traders

If you’re only trading currencies and you value simplicity, MT4 still delivers. Most EAs, indicators, and signal services still prioritize MT4. The learning curve is gentle, and you can get up and running quickly.

Simplicity and Speed

Less is more when you’re just starting. MT4 opens fast, uses less CPU, and has fewer distractions. It’s like a stripped-down race car that just gets the job done.

Community and Support

MT4’s user base is massive. You’ll find more tutorials, free indicators, and answers to questions online. Whether you’re tweaking an EA or trying to debug a connection issue, chances are someone’s posted a fix already.

When to Choose MT5

Multi-Asset Trading Needs

When I wanted to start trading indices and stocks alongside forex, MT5 made that easy. Unlike MT4, which is forex-focused, MT5 supports a broad range of assets. Some brokers offer access to futures, bonds, and even crypto directly inside the MT5 terminal.

If you’re looking to build a diverse portfolio, MT5 is definitely the better long-term solution. It’s a platform that grows with you.

Advanced Technical Features

MT5 comes packed with extras: 21 timeframes, an integrated economic calendar, and more chart objects. I especially love the calendar—it lets me track high-impact news without leaving the platform. And the Depth of Market (DOM) feature helps me get better insight into liquidity levels before entering a trade.

If you thrive on technical analysis, MT5 offers a more complete toolbox.

Future-Proofing and Scalability

MetaQuotes is putting all future development energy into MT5. They’ve stopped issuing new MT4 licenses and updates are rare. If you’re in this game for the long haul, it makes sense to learn MT5 sooner rather than later.

I made the switch after realizing I was spending more time retrofitting my EAs for MT4 than just building them fresh for MT5.

MT4 vs MT5: Which is Right for You?

Summary Comparison Table

| Feature | MT4 | MT5 |

|---|---|---|

| Asset Support | Forex only | Forex, stocks, CFDs, futures |

| Indicators | 30 built-in | 38 built-in |

| Timeframes | 9 | 21 |

| Backtesting | Single-threaded | Multi-threaded, multi-symbol |

| Order Types | Basic | Includes stop-limit, hedging & netting |

| Programming Language | MQL4 | MQL5 (more advanced) |

| System Requirements | Lower | Higher |

Match Your Platform to Your Strategy

If you’re scalping or swing trading forex pairs only, MT4 is all you need. It’s efficient, stable, and has a massive support ecosystem. But if you plan to explore automated strategies, trade non-forex assets, or build complex setups, MT5 offers a future-proof path.

I use MT5 now because I need multi-asset access and faster backtests. But I still keep MT4 installed for testing old indicators or checking strategies where simplicity wins.

What Most Brokers Recommend

Some brokers push MT5 as the “latest and greatest,” while others continue to support MT4 due to its popularity. From what I’ve seen, more brokers now offer both platforms. However, newer firms or those focused on stocks and crypto lean toward MT5.

Always ask your broker whether features like hedging, EAs, and third-party tools are enabled on both versions.

FAQs

Is MT4 still supported in 2025?

Yes, MT4 is still supported by many brokers. But MetaQuotes has stopped issuing new licenses, which means some new brokers may only support MT5. If you already have MT4, you can keep using it without problems.

Can I use the same EA on MT4 and MT5?

No. MT4 uses MQL4, and MT5 uses MQL5. The programming languages are different. Most EAs need to be rewritten or recompiled to work on MT5. Always check with the EA developer before switching platforms.

Do all brokers offer both platforms?

No. While many major brokers do, not all support both. Some new brokers only offer MT5 because it aligns with MetaQuotes’ long-term plans. Always verify platform availability before opening an account.

Which is better for copy trading: MT4 or MT5?

It depends on the copy trading service. Many legacy services still use MT4, but newer platforms are increasingly integrating with MT5. MT5 offers more data and flexibility, but MT4 has broader community support.

Let’s Wrap This Up

We’ve looked at MT4 and MT5 from every angle—market support, order types, indicators, broker compatibility, and real-world use cases. Here’s what it comes down to:

- MT4 is ideal if you’re focused on Forex, want simplicity, and value community support.

- MT5 is the better choice if you need more assets, faster tools, or plan to automate.

Both platforms have their strengths. I’ve personally used both, and switching to MT5 unlocked deeper testing, broader markets, and more flexibility. But I still recommend MT4 to friends just starting out because it’s fast, familiar, and easier to master.

If you’re still unsure, grab demo accounts for both. Test your strategies. See which one fits your flow. Because in the end, the right platform is the one that makes your trading simpler, smoother, and more profitable.