The first time I heard about the Forex market, I thought it was something only Wall Street types with shiny suits could touch. I was wrong. You don’t need a finance degree to understand it—and once I figured out the basics, it all clicked. I realized that Forex isn’t some mysterious beast; it’s just people, like you and me, buying and selling currencies. But here’s the deal: if you jump in without knowing how it works, you’re basically gambling. And trust me, leverage can make you feel like a genius one minute and wipe your account the next.

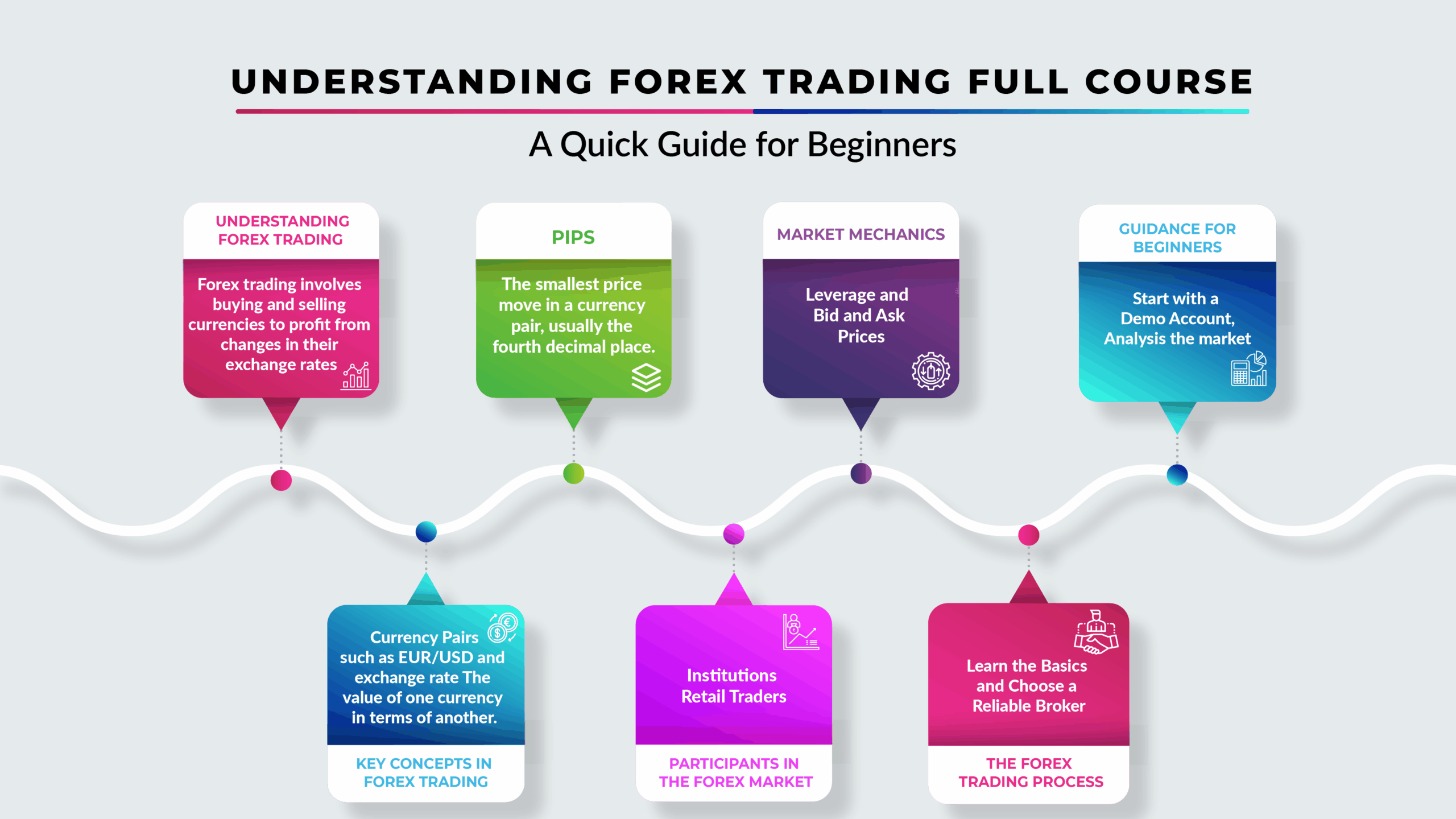

Here’s what confused me at first: What is Forex? Why does it trade 24/5? What do EUR/USD or USD/JPY even mean? I was overwhelmed. But once I broke it down, I started making smarter trades—and I want that for you too.

Let’s cover:

- How currency pairs work (and what they tell you)

- Who actually trades Forex (it’s not just pros)

- Leverage, liquidity, and how they impact your trades

- Different types of Forex markets: spot, futures, and more

- What makes currencies rise or fall

If you stick with me, you’ll walk away feeling confident—like you can finally make sense of this $6 trillion-a-day market. I’m not here to sell you dreams. Just real talk, real knowledge, from someone who’s been there.

What Is the Forex Market?

The Forex market, or foreign exchange market, is where currencies are traded. Think of it like a global store where money is the product. Every time you exchange dollars for euros at the airport or use your card abroad, you’re participating in Forex—just on a tiny scale.

But online, traders speculate on whether one currency will go up or down against another. It’s the largest financial market in the world, with over $6 trillion traded every single day (BIS).

How Currency Pairs Work

This was the part I struggled with most when I started. Currencies trade in pairs, like EUR/USD or GBP/JPY. The first is called the base currency, and the second is the quote currency. The pair’s price shows how much of the quote you need to buy one unit of the base.

So, if EUR/USD is at 1.10, it means 1 euro = 1.10 US dollars. You’re betting on whether that number will go up or down.

Who Trades Forex?

You’d be surprised. It’s not just big banks and hedge funds. Everyday people—students, freelancers, even full-time parents—are trading Forex from their phones. There are two main groups:

- Retail traders like me and you, trying to profit from small currency moves.

- Institutions like banks, corporations, and governments, hedging risk or making bulk exchanges.

Most of the action is digital, decentralized, and super fast. There’s no “New York Stock Exchange” of Forex—just a network of traders around the world, 24 hours a day.

Key Forex Market Features

Let’s break down some traits that make Forex unique—and a little intimidating at first.

Market Hours and Sessions

The Forex market is open 24 hours a day, 5 days a week. That’s because it follows the sun across time zones: it starts in Sydney, moves to Tokyo, then London, and ends in New York.

If you’re in the U.S., the London/New York overlap (around 8 a.m. to noon EST) is often the busiest—and best—time to trade.

Liquidity and Volume

Because it’s so big, Forex is crazy liquid. You can buy or sell major pairs like EUR/USD or USD/JPY instantly. That means tighter spreads (lower costs) and fewer delays.

:max_bytes(150000):strip_icc()/forex-market.asp-Final-c0a3fc00430a4ffcaed044e63f3385f2.jpg)

The Role of Leverage

Leverage is both your best friend and worst enemy. It lets you control big trades with small money. For example, with 1:30 leverage, you can open a $30,000 trade with just $1,000 in your account. Sounds great, right?

But here’s what I learned the hard way: it amplifies losses too. A small move against your position could wipe out your entire balance. Use it wisely, or don’t use it at all until you’re confident.

Types of Forex Markets

This part confused me early on. Not all Forex trades are the same. Here’s how they break down.

Spot Market

This is the most common type. You buy or sell currencies at current prices for delivery in a couple of days. It’s fast, simple, and what most retail traders use. Think of it as “instant” Forex.

Forward and Futures Market

Forwards are private contracts to buy/sell currencies at a set price in the future. Futures are similar, but they trade on exchanges and follow standard rules. Big players use these to lock in prices and reduce risk—especially if they’re doing business in foreign countries.

Options Market

Options give you the right, but not the obligation, to buy/sell at a set price before a specific date. These are complex but super helpful for managing risk. I don’t use them much yet, but they’re great tools once you’re more advanced.

Risks and Considerations

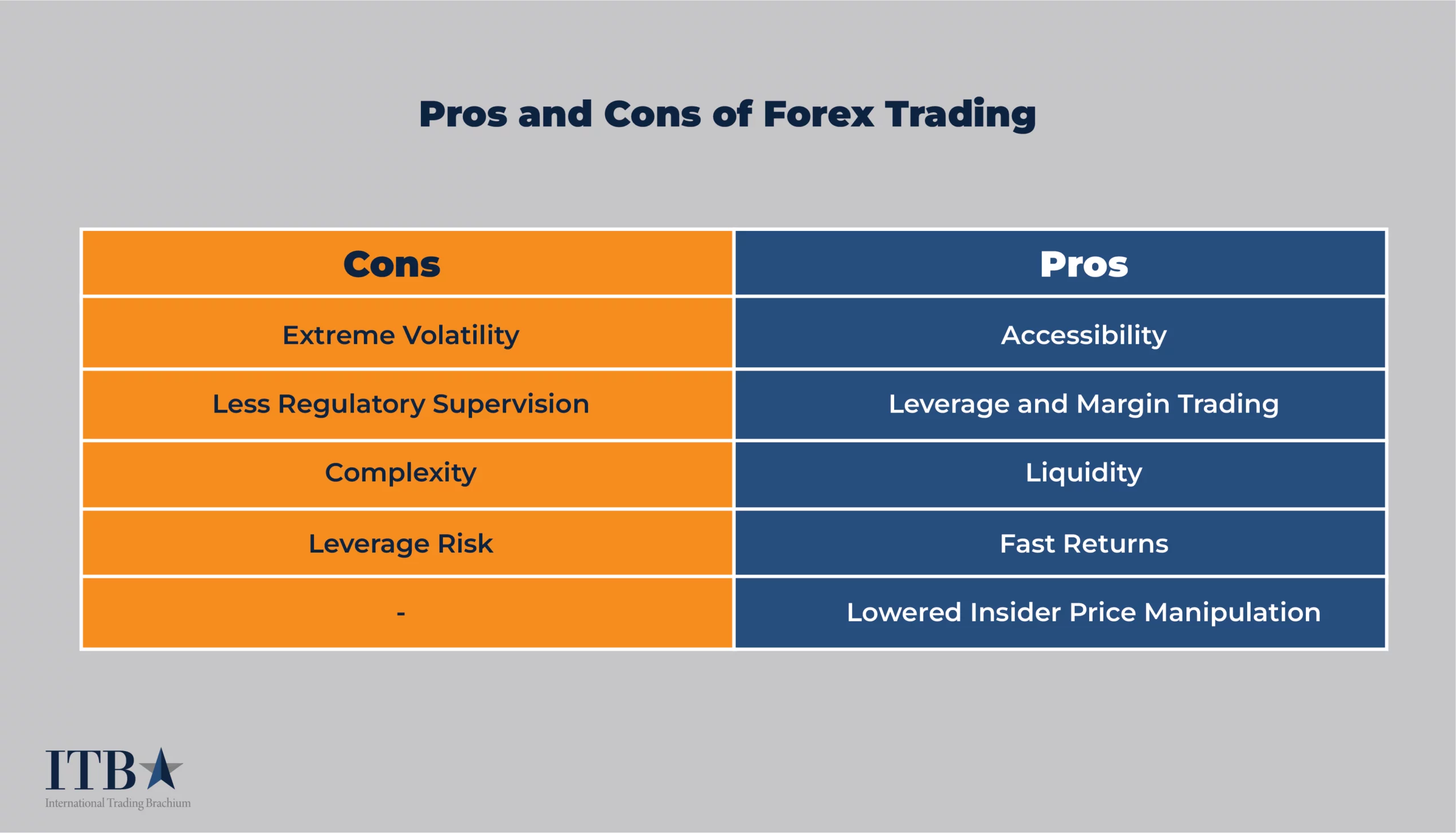

Let’s be real. Forex isn’t just about charts and numbers. It’s about risk. If you don’t respect it, you’ll lose.

What Moves Currency Prices

I used to think price movements were random. They’re not. News events, interest rate changes, inflation reports—these things hit the market hard.

For example, when the U.S. raises interest rates, the dollar often strengthens. When political drama erupts in the EU, the euro might drop. Learn to watch the calendar and track economic indicators—it’s a game changer.

Risks of Using Leverage

I can’t stress this enough. Leverage increases your exposure. A move of 1% might not sound like much, but with 1:100 leverage, that’s your whole account gone.

Always use a stop-loss. Always. I learned that after blowing two demo accounts and one small real account. Don’t let it be you.

Understanding Bid/Ask Spread

Here’s something no one told me early on: there’s always a tiny cost to enter a trade. That’s the spread. It’s the difference between the price you buy at (ask) and the price you sell at (bid).

Major pairs like EUR/USD have tight spreads (less than 1 pip). Exotic pairs like USD/TRY have wide spreads—and that means more cost and more risk. Don’t ignore this.

Forex Market Comparison Table

| Market Type | Delivery Time | Used By | Risk Level |

|---|---|---|---|

| Spot Market | Immediate (T+2) | Retail Traders | Medium |

| Forward Market | Future Date | Corporations & Institutions | High |

| Futures Market | Future Date (Standardized) | Hedge Funds, Traders | Medium-High |

| Options Market | Before Expiry | Advanced Traders | Variable |

FAQs About the Forex Market

What is the best time to trade Forex?

The best time is when the market is most active—and that’s during session overlaps. Personally, I’ve had the best results during the London and New York overlap (8 a.m. to 12 p.m. EST). Spreads are tighter, volume is higher, and movements are more predictable.

Is Forex trading risky for beginners?

Absolutely. If you don’t know what you’re doing, the combination of leverage and fast-moving prices can drain your account. That’s why I started with demo trading and stuck with low-risk pairs like EUR/USD. Education is your best defense.

How do I read a currency pair quote?

Let’s say EUR/USD = 1.1000. That means 1 euro is worth 1.10 US dollars. If you believe the euro will go up, you buy. If you think it’ll go down, you sell. The quote always tells you how much of the second currency you need for one of the first.

Can you trade Forex without leverage?

Yes, and I recommend it when you’re just starting out. Trading without leverage keeps your risk in check. Sure, your profits will be smaller, but so will your losses. Once you’re more confident, you can test low leverage ratios like 1:5 or 1:10.

What’s the difference between retail and institutional forex trading?

Retail trading is what most of us do—small trades using apps like MetaTrader. Institutional trading involves banks, hedge funds, and corporations moving huge sums for profit or hedging. They get better pricing and access but follow many of the same principles.

Behind the Scenes: Why I Trust ChronosTrading

Before I found ChronosTrading, I was bouncing between Reddit threads and shady YouTube channels. The site’s broker reviews were a game-changer for me. They’re unbiased, detailed, and written by folks who actually tested the platforms. No fluff—just real talk.

They also separate editorial from advertising. That matters when you’re trying to make smart decisions with real money. It’s part of what makes them a trustworthy source, especially with Forex being so saturated with misleading advice.

Why This Article Stands Out

Most Forex intros out there either drown you in jargon or feel like a sales pitch. I wrote this based on everything I wish I knew when I started—what I learned from losing trades, late-night research, and finally, steady wins.

I’ve backed up what I said with sources like the BIS report, visuals that make concepts clearer, and a table that compares market types. That’s how I know this content gives more value than what you’ll find in most articles out there.

Epic Recap

Let’s go over what we covered:

- You learned how currency pairs work and what drives their value.

- You now understand key Forex features like leverage, liquidity, and spreads.

- We explored different market types—spot, forward, futures, and options.

- You discovered the real risks (especially leverage) and how to manage them.

- I answered some of the most common beginner questions you probably had too.

At the end of the day, Forex isn’t magic. It’s about staying informed, managing risk, and learning as you go. This guide won’t make you rich overnight—but it will make you smarter than most new traders starting out.

If you’re still curious, take your time. Re-read this. Try a demo account. Dig into the economic calendar. And remember, the more you understand, the less you’ll fear—and the better you’ll trade.

6 Comments

Pingback: Who Are the Key Participants in the Forex Market? - Chronos Trading

Pingback: 7 Key Factors That Move Forex Prices Daily - Chronos Trading

Pingback: Forex Leverage Explained: How It Works, Benefits, and Risks - Chronos Trading

Pingback: Introduction to Forex Indicators: Tools for Market Analysis - Chronos Trading

Pingback: Common Forex Order Types Explained: Market, Limit, Stop & More - Chronos Trading

Pingback: How Central Banks Influence the Forex Market - Chronos Trading