When I first got into forex trading, the term “leverage” confused the heck out of me. Everyone kept throwing around numbers like 100:1 or 400:1, and I had no idea how that would affect my money. Sound familiar?

At first, I thought leverage was just a way to “boost” trades. Turns out, it’s a double-edged sword. I learned the hard way that while it can amplify your wins, it can just as quickly wipe out your account. That experience? It changed the way I approach every single trade.

So, let’s make this simple and clear. If you’ve ever wondered:

- What forex leverage actually is

- How it affects your trades

- Why it’s both powerful and risky

- What you can do to manage that risk

You’re in the right place. I’m going to walk you through exactly how leverage works, its major benefits and downsides, and what I wish someone had told me when I first started trading.

By the end, you’ll know how to use leverage wisely—and protect your account while you’re at it.

What Is Forex Leverage?

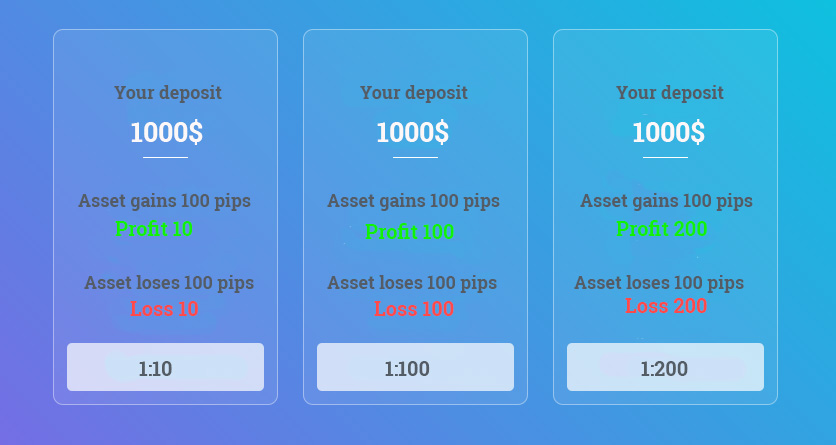

Leverage lets you control a big position with a small amount of money. In simple terms, it’s borrowed capital from your broker. For example, with 100:1 leverage, a $1,000 deposit lets you trade $100,000 worth of currency. Pretty wild, right?

But here’s the kicker: while you’re only risking your margin (your deposit), your profit or loss is calculated on the full trade size—not your small deposit. That’s where things get intense.

How Leverage Works in Forex Trading

Let’s say I had $500 and used 100:1 leverage. That gave me access to a $50,000 position. If the currency pair moved just 1%, I either made $500… or lost it.

Here’s a visual breakdown of how leverage ratios relate to required margin:

| Leverage Ratio | Margin Required (% of Position) |

|---|---|

| 400:1 | 0.25% |

| 200:1 | 0.50% |

| 100:1 | 1.00% |

| 50:1 | 2.00% |

Leverage and Margin: What’s the Difference?

Don’t confuse leverage with margin. Margin is the money you need to open and hold a position. It’s your skin in the game. Leverage, on the other hand, is the multiplier.

Think of margin as your down payment, and leverage as the loan you get from your broker to “buy” more currency than you could afford on your own.

Benefits of Forex Leverage

I’ve used leverage to grow small accounts fast. It’s tempting—and sometimes necessary. But it only works when you’re disciplined and cautious.

Amplified Profits

Let’s be real: without leverage, forex wouldn’t be as exciting. A small move like 0.5% wouldn’t mean much on a $1,000 trade. But with leverage? That same move could earn you $50, $500, or more—depending on your position size.

I once turned a $200 win into $800 in a day because of leverage. It felt like magic. But it also made me overconfident. Spoiler alert: I lost it two days later.

Lower Capital Requirements

You don’t need a huge bankroll to trade like the pros. Thanks to leverage, I started trading standard lots (100,000 units) with as little as $1,000. That’s a big deal when you’re new and don’t have much to invest.

It’s also what lets many beginners get in the game without needing tens of thousands upfront. Just remember—it’s not free money. It’s borrowed power.

Increased Market Access & Flexibility

Leverage gave me the ability to test different strategies across multiple currency pairs, even with a tiny account. I could diversify, hedge, and trade both short and long positions without overextending myself—at least, not right away.

That flexibility is what kept me engaged in trading. Without leverage, I probably would’ve lost interest—or just couldn’t afford to experiment.

Risks of Forex Leverage

Let’s not sugarcoat it: leverage can destroy your account just as fast as it can grow it. And I’ve been there—watching a winning trade turn into a margin call in minutes.

Magnified Losses

Losses don’t happen on your $1,000 deposit—they happen on the full leveraged amount. A 1% move against you on a $100,000 position? That’s a $1,000 loss. You’re wiped out. Just like that.

I’ve lost entire positions in seconds because I didn’t use stop-loss orders. Trust me, seeing “margin call” on your screen is a lesson you never forget.

Margin Calls and Liquidation

When your losses reduce your equity below a certain level, your broker can issue a margin call. That means you’ve got to deposit more money—fast—or your positions will be closed automatically.

That happened to me once when I was on a long weekend and didn’t check my trades. Came back Monday to a nearly empty account. It was brutal.

Emotional and Technical Risks

Here’s what nobody talks about: the psychological pressure. When you’re leveraged 100:1, even a tiny move can give you anxiety. It makes you react emotionally—cutting wins early or letting losses run.

And don’t forget the technical side. If your platform freezes or slippage hits during fast markets, your leveraged position can take a huge hit before you even see it coming.

How to Manage Leverage Responsibly

Now that I’ve seen both the upside and the crash-and-burn side of leverage, here’s what I do differently—and what I recommend to every trader I talk to.

Risk Management Tips

Start small. Seriously. I don’t use more than 1–2% of my account on any trade now. Ever. I also set stop-loss orders for every position. No exceptions.

One thing that helped me a ton was journaling every trade. I’d jot down why I entered, what the leverage was, and how I felt. Seeing patterns in my own behavior taught me to tighten up my game.

Here’s the checklist I follow now before opening a leveraged trade:

- Is my stop-loss set?

- Am I risking less than 2% of my capital?

- Is this part of a proven strategy or an emotional move?

If I can’t answer yes to all three, I don’t place the trade. Period.

Choosing the Right Leverage Ratio

More isn’t always better. In fact, now I mostly trade with 10:1 or 20:1 leverage. It gives me room to breathe and protects my capital.

Here’s what I’ve learned:

- 50:1 or higher: Super aggressive. Not beginner-friendly.

- 20:1 to 30:1: Balanced risk and flexibility.

- 10:1 or less: Safer. Ideal for long-term and swing trading.

Most beginners chase high leverage, but smart traders use what fits their risk profile—not what looks impressive.

Broker Features and Protection

One of the biggest upgrades I made was switching to a broker that offers negative balance protection. That means even if a trade goes south fast, I’ll never owe more than I deposited.

Make sure your broker is regulated in your region. Look for those with transparent margin policies, fast execution, and responsive support.

FAQ

What is the best leverage for a beginner?

Stick to 10:1 or 20:1. It’s enough to grow your account without blowing it up. I started with 100:1 and regret it. Lower leverage gives you more time to learn without big losses.

Can I lose more than I deposit in forex trading?

Yes—if your broker doesn’t offer negative balance protection. That’s why I only trade with brokers who cap losses at your account balance. It’s peace of mind I won’t trade without.

Is high leverage better than low leverage?

Not really. High leverage = high risk. It can make you money fast but can wipe you out even faster. Low leverage gives you more control and better long-term sustainability.

What happens if I get a margin call?

You’ll be asked to add more funds. If you don’t, your broker might close your positions automatically to limit further losses. It’s a gut punch, trust me.

Are leveraged forex accounts legal in my country?

That depends. In the U.S., leverage is capped at 50:1 for major pairs. In Europe, it’s even lower. Always check with your local financial regulator and your broker’s terms.

Recap of Key Points

Leverage can boost your profits—but it can also sink your account in a flash. I’ve lived both ends. It’s powerful, but only when used wisely.

Final Takeaway

Respect leverage. Don’t fear it. Learn it. Control it. It’s a tool—not a shortcut to riches. When you treat it that way, you’ll stay in the game longer and trade smarter.

Closing Thought

Every blown account taught me something I use today. If you’re just getting started, let my scars be your guide. Trade safe, use leverage wisely, and never stop learning.