When I started trading Forex, I had no clue what made one broker better than another. I picked the first one with a sleek website and big promises—and it was a mess. Slow withdrawals, terrible support, and wide spreads ate up half my profits. That mistake taught me something priceless: choosing the right broker is not about hype—it’s about trust, tools, and how well a broker fits your style.

Here’s the thing—there are hundreds of brokers out there. Some are amazing. Some are shady. And most? Somewhere in between. If you’re feeling lost, I get it. But don’t worry. This guide will walk you through it step-by-step. We’ll cover everything from regulations and fees to customer service and platform tools, based on what really matters for traders like us.

- Figuring out your trading style and needs

- Understanding regulation and broker safety

- Comparing fees, spreads, and commissions

- Testing platforms like MT4 and demo accounts

- Evaluating customer service, leverage, and more

This isn’t another generic article. I’ll share what I’ve learned the hard way and help you avoid rookie traps. Ready? Let’s dig into what makes a broker worth your trust—and your trades.

Step 1: Know Your Trading Style and Needs

If you’re new, you might not know yet whether you’re a scalper, a swing trader, or someone who just wants to copy trade and chill. That’s okay. The key is to start figuring out how you want to trade so your broker supports you, not the other way around.

Day Trader, Swing Trader, or Investor?

Personally, I started out trying to scalp but hated the stress. Now I lean toward swing trading—fewer trades, more thoughtful entries. If you’re the kind of person who checks charts every 15 minutes, you’ll need low spreads and fast execution. But if you’re more into long-term moves, that matters less.

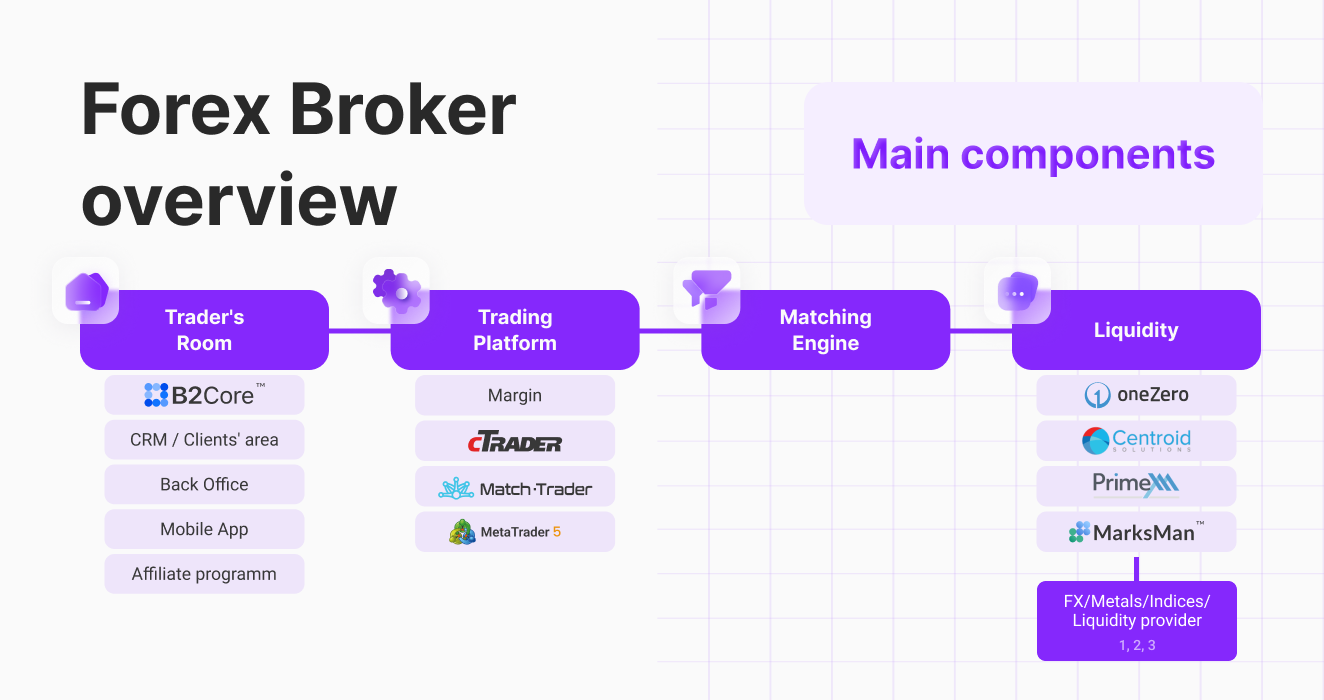

Trading Tools You Might Need

Some brokers offer MetaTrader 4 (MT4), MetaTrader 5 (MT5), or even their own platforms. I recommend starting with MT4—it’s stable, beginner-friendly, and supports EAs (Expert Advisors). You may also want tools like copy trading, automation, or economic calendars. If the platform feels clunky, skip it.

What Devices Do You Trade On?

Don’t overlook mobile access. I trade on my phone a lot when I’m out. Make sure your broker’s platform has a decent mobile app with fast execution and full charting. If you can’t monitor your trade properly on mobile, that’s a dealbreaker.

Step 2: Verify Broker Regulation and Security

This part is non-negotiable. Always check if the broker is regulated by a top-tier authority. I once signed up with an offshore broker with flashy leverage—big mistake. No protections. My deposit vanished after they suddenly shut down.

Top Regulatory Authorities

Look for regulation from:

- FCA (UK)

- ASIC (Australia)

- NFA/CFTC (USA)

- BaFin (Germany)

- CySEC (Europe)

These regulators enforce rules that protect your money, like keeping client funds in separate accounts. Some even offer compensation schemes if your broker goes bust.

How to Check Regulation

Go to the regulator’s website and search for the broker’s name or license number. Don’t just trust what’s on the broker’s homepage. Fake claims are common.

Step 3: Understand Fees, Spreads, and Trading Costs

Trading costs will eat into your profit, fast. I didn’t realize this early on, and boy did it sting. Wide spreads and hidden withdrawal fees drained my account more than any losing trade did.

Spreads vs Commissions

Some brokers charge a fixed spread. Others offer low spreads but charge a per-trade commission. I prefer ECN-style brokers with tight spreads and visible fees. It feels more honest.

Hidden Fees to Watch Out For

Look out for:

- Inactivity fees (if you don’t trade for 30–90 days)

- Withdrawal processing charges

- Overnight swap/rollover fees

Ask before you deposit. Good brokers list all fees openly. Shady ones hide them in fine print.

Trading Cost Comparison Table

| Broker | Typical Spread (EUR/USD) | Commission (Per Lot) | Inactivity Fee |

|---|---|---|---|

| Broker A | 1.2 pips | $0 | $10/month |

| Broker B | 0.2 pips | $7 | None |

| Broker C | 1.5 pips | $0 | $25/quarter |

Step 4: Evaluate Trading Platforms and Tools

I always test a broker’s demo account first. If their platform glitches or lags, that’s a red flag. The platform is where you spend hours analyzing, entering trades, and managing risk. It needs to be rock solid.

Top Platforms: MT4, MT5, and Others

MetaTrader 4 (MT4) is still my go-to. It’s fast, reliable, and supports automated strategies. MT5 is more advanced, with better backtesting and more assets. Some brokers push their own platforms, but they often lack features or plugins.

Charting and Analysis Features

Here’s what to look for:

- Custom indicators and drawing tools

- Multi-timeframe support

- Access to news and economic calendars

You need a platform that helps you make smart decisions, not just execute trades.

Why a Demo Account Matters

Demo accounts are your test drive. Use it to try order execution speed, charting, and strategy tools. I usually spend a full week on demo before considering real money. And if the demo lags? I walk away.

Step 5: Review Available Assets and Account Types

Some brokers limit you to 30 currency pairs. Others give access to 100+ instruments, including crypto, indices, metals, and CFDs. The broader the menu, the better your chances to diversify.

What Can You Trade?

Check for:

- Major pairs (EUR/USD, GBP/USD)

- Minors and exotics (USD/TRY, EUR/PLN)

- CFDs: indices, commodities, crypto

If you’re into gold or Bitcoin CFDs, make sure your broker offers those. Some don’t.

Different Account Types

Brokers usually offer:

- Standard Account: good for most traders

- Micro/Mini Account: low capital entry

- VIP/ECN Account: for high-volume or pro traders

I started with a micro account, which helped me test live trading with just $50. No pressure. Once I got better, I moved to a standard account with better spreads.

Step 6: Understand Leverage and Margin Requirements

Leverage lets you trade bigger positions with a small deposit. It’s tempting—especially when a broker flashes 1:1000 on the homepage. But here’s my honest take: high leverage is a double-edged sword. It can magnify profits, sure—but it can wipe your account faster if the market turns against you.

How Leverage Works

If your broker gives you 1:100 leverage, you can control a $10,000 trade with just $100 in your account. Sounds great, right? But if the market moves 1%, you could gain—or lose—$100 instantly. That’s why new traders often blow accounts fast.

Leverage Limits by Region

Different regulators cap leverage. For example, the ESMA limits EU brokers to 1:30 for retail traders. U.S. brokers often cap it at 1:50. Offshore brokers offer higher ratios, but with less protection. I stick with conservative leverage—usually under 1:20—especially when testing a new strategy.

Margin Calls and Risk

When your losses eat up your margin, the broker can close your trades. This is called a margin call. It’s not fun. I’ve been there. The key is to use leverage wisely and never risk more than you can lose.

Step 7: Test Broker Customer Support

Customer support might not seem like a big deal—until something breaks. I once had a trade stuck mid-execution during NFP news. It took my broker over an hour to reply. That trade cost me $200 I never got back.

Response Time and Support Channels

Test live chat, email, and phone before opening a real account. Ask a real question—like how to withdraw funds or change leverage. If they answer fast and clearly, that’s a green flag.

Language and Time Zone Coverage

Some brokers have multilingual support, which is super helpful if English isn’t your first language. Also, check if support is 24/5 or 24/7. If you trade weekends or odd hours, you’ll need round-the-clock access.

Community and Knowledge Base

Good brokers have FAQs, help centers, or even trader forums. I’ve solved most of my tech issues by reading help docs. It’s a sign the broker invests in their users.

Step 8: Check Deposit and Withdrawal Options

If you can’t get your money out easily, don’t even bother. I once waited 9 business days for a withdrawal to hit my account. Turns out, the broker used third-party processors with shady reputations. Never again.

Payment Methods

Look for options like:

- Bank transfer

- Credit/debit cards

- Skrill, Neteller, PayPal

- Crypto (BTC, ETH)

More options = more flexibility. I usually use PayPal or bank wire. Fast and safe.

Withdrawal Timeframes

Fast brokers process withdrawals in under 24 hours. Others can take days—or worse, require multiple approvals. Always read the fine print and test a small withdrawal first.

Minimum Deposits and Fees

Some brokers let you start with $10. Others require $500 or more. Choose what matches your budget. Also, ask about withdrawal fees. These add up over time.

Step 9: Research Reputation and Reviews

Before signing up, I always read user reviews—especially from places like Forex Peace Army or Reddit. Look for common complaints: slippage, withdrawal issues, platform downtime. If multiple traders mention the same issue, it’s probably real.

How to Spot Red Flags

Here’s what makes me walk away:

- Unregulated or offshore-only license

- Too-good-to-be-true promises (like guaranteed profits)

- Lots of complaints about blocked accounts

Don’t rely only on the broker’s website or testimonials. Those can be fake. Go deeper.

Trust Signals and Longevity

I also check how long the broker’s been around. A broker operating since 2005 with thousands of users is usually more legit than a new one with flashy marketing.

Step 10: Start Small and Scale Up

Don’t throw in your whole savings right away. Start small. I began with $100 and tested everything—execution speed, platform bugs, withdrawal process. It gave me peace of mind before committing more.

Why a Demo Account First

This is your sandbox. Use it to practice strategies, test indicators, and get used to the broker’s vibe. If anything feels off, stop. Switch brokers.

Live Account with Minimum Deposit

Once you’re confident, fund the account with the minimum and place small trades. This is where you check for things like real-time slippage and platform bugs during news events.

Scale Up When Ready

Only after months of successful trades did I scale up my account. By then, I knew what I was doing—and trusted the broker completely. That confidence made all the difference.

FAQs

What is the safest forex broker for beginners?

Safe brokers are regulated by top-tier authorities like FCA, ASIC, or NFA. Look for brokers that offer negative balance protection, low minimum deposits, and excellent customer support.

How do I know if a broker is regulated?

Search the broker’s license number on the regulator’s website. Never trust logos alone. Regulated brokers clearly display their credentials and offer links to verify them.

Should I use a broker with high leverage?

As a beginner, probably not. High leverage increases both risk and reward. Start small—like 1:10 or 1:20—until you’re confident. Most losses come from misusing leverage, not bad trades.

What are the most common hidden fees?

Watch out for inactivity fees, high spreads, withdrawal fees, and overnight swap charges. Transparent brokers list all fees upfront, so always read their terms carefully.

What We’ve Covered

Choosing a forex broker can feel overwhelming—but it doesn’t have to be. You’ve now learned how to:

- Match a broker to your trading style

- Check regulation and safety

- Understand fees and platforms

- Test support, deposits, and real reviews

- Start small and grow smart

Your broker is your trading partner. They should earn your trust, not just your deposit. Use this guide to find one that fits your goals, tools, and risk appetite.

Final Takeaway: The right broker won’t make you profitable—but the wrong one can definitely hold you back. Choose wisely. Test everything. And always put your safety first.

You’ve got this.