Forex trading can feel overwhelming at first. I remember the first time I opened MetaTrader 4—I stared at the blinking candles and thought, “What now?” If you’ve felt the same, you’re not alone.

Like many beginners, I didn’t know where to start. I lost money because I didn’t understand what I was trading or how leverage worked. I jumped in without a plan, and that was a mistake.

But once I slowed down and actually learned how the forex market works, things clicked. I’m going to show you the exact steps I followed—and still follow—every time I trade.

In this guide, you’ll learn:

- How currency pairs work

- What “buy” and “sell” really mean in forex

- Why leverage can be both useful and dangerous

- How to choose a broker and open a real or demo account

- Simple risk management tricks that saved me from blowing up

This guide is for you if you’ve ever Googled “how does forex trading work” and ended up more confused than before. I’m here to make it simple, beginner-friendly, and based on real experience—not just theory.

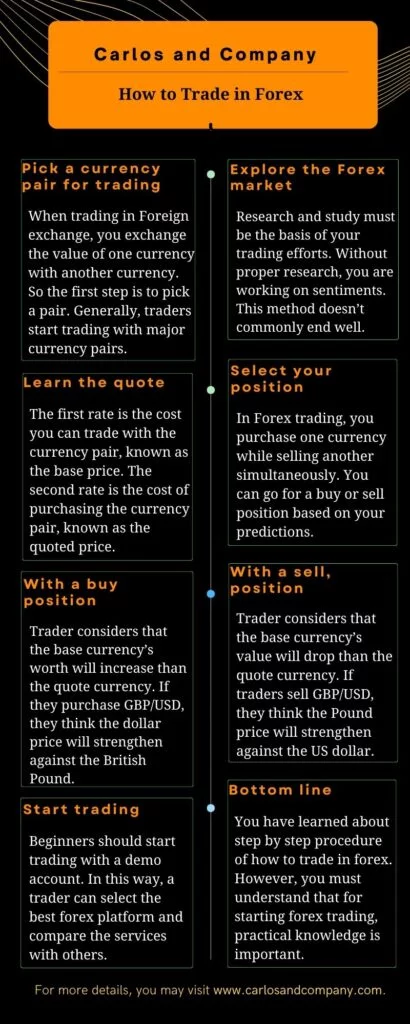

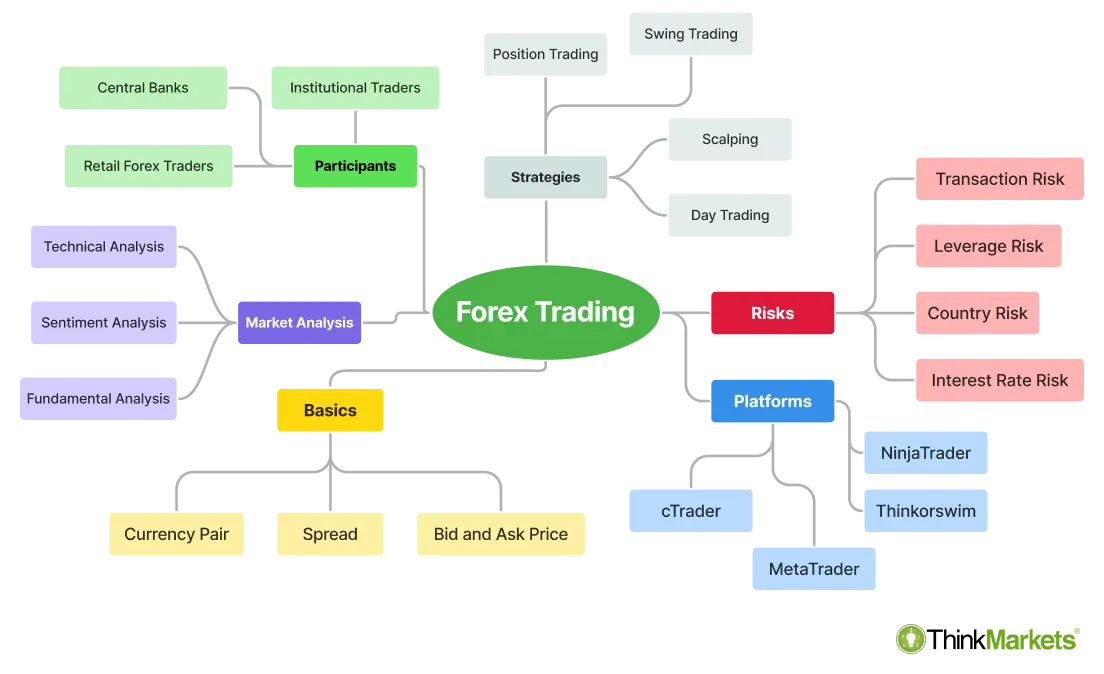

Understanding Currency Pairs

What is a currency pair?

In forex, you always trade two currencies at once. This is called a currency pair. The first currency is the base, and the second is the quote. If EUR/USD = 1.1128, that means one euro costs 1.1128 US dollars.

Major, minor, and exotic pairs

When I started, I stuck with majors like EUR/USD and GBP/USD. They’re less volatile and have tighter spreads. Exotic pairs like USD/TRY can swing wildly and aren’t great for beginners.

Real-world example

When I lived in Spain, I got paid in euros but traveled to the US often. Watching EUR/USD rates helped me decide when to exchange currency. Trading works the same way—you’re betting one currency will rise or fall against the other.

Buy or Sell: Making Your First Trade

Going long vs going short

Buying a pair (long) means you think the base currency will go up. Selling (short) means you think it will go down. For example, if you buy EUR/USD and it rises, you profit. If it drops, you lose. Simple as that.

My first trade

I remember buying EUR/USD at 1.1128. It moved up to 1.1140. I made a few bucks and felt like a genius. Then it dropped the next day, and I gave it all back. That’s when I learned: set your stop-loss.

Reading the spread

The spread is the difference between the buy (ask) and sell (bid) price. If EUR/USD is 1.1128/1.1130, the spread is 2 pips. This small gap can eat into profits, especially with scalping.

Choosing a Forex Broker and Platform

Why your broker matters

I once used an offshore broker with high leverage and got re-quoted constantly. Big mistake. Now I use a regulated broker with a good reputation. Look for regulation, execution speed, and support.

Demo vs live account

Start with a demo account. Seriously. It’s like trading with monopoly money but using real prices. It helped me build confidence before going live. Just remember—emotions kick in when real money’s on the line.

Popular platforms

MetaTrader 4 (MT4) is beginner-friendly and widely used. I still trade on MT4 today. eToro and IG Trading also offer easy-to-use platforms with built-in education tools.

Leverage and Risk: What You Must Know

What is leverage?

Leverage lets you control a large trade with a small deposit. For example, 50:1 leverage means a $100 margin controls $5,000. Sounds cool, right? But it cuts both ways.

The lesson I learned the hard way

I used 100:1 leverage on a $200 account. One bad trade wiped out half my balance. I felt sick. Since then, I never risk more than 1-2% of my account per trade.

Using a forex calculator

Use tools like a forex profit calculator or position size calculator. It helps you stay disciplined. I plug in my risk, stop-loss, and it tells me how much to trade. No more guessing.

Basic Terms Every Trader Should Know

| Term | Meaning |

|---|---|

| Pip | Smallest price movement (usually 0.0001) |

| Lot | Standard trade size (100,000 units) |

| Margin | Amount needed to open a leveraged trade |

| Stop-Loss | Price level where your trade automatically closes to limit loss |

| Take-Profit | Price level where your trade closes to secure profit |

Developing Your Forex Trading Plan

Why you need a trading plan

When I started trading without a plan, I let emotions guide my decisions. That didn’t end well. A trading plan gave me structure and confidence. It’s like a map—it keeps you from getting lost in the charts.

What to include in your plan

Your plan should outline your goals, risk per trade, preferred pairs, and strategies. I also include when I’ll trade—London open? New York overlap? Planning avoids random trades.

My go-to strategy

I mainly trade breakouts using support and resistance. I set alerts at key levels and wait for confirmation. It’s not always exciting, but it works. Having a simple system is better than chasing every signal.

Placing and Monitoring Your Trade

Placing an order

When I place a trade, I always enter three things: entry price, stop-loss, and take-profit. If I’m risking $20, I want to know I could make $40. That’s a 2:1 reward-to-risk ratio.

Managing open positions

Don’t just “set and forget.” I check price action, news, and spreads. Once I’m in profit, I sometimes move my stop-loss to break even. That way, I can’t lose on that trade.

When to close a trade

I used to close trades too early from fear. Now, I let the plan decide. If my TP gets hit, great. If price reverses and hits my SL, I move on. No revenge trading allowed.

Example: One of My Real EUR/USD Trades

Setup and entry

I saw EUR/USD sitting on major support at 1.0900. Price formed a pin bar and bounced. I entered long at 1.0912, SL at 1.0872, TP at 1.0992.

Trade management

Price hovered for a bit, then surged. I moved my SL to breakeven after 30 pips. It eventually hit my TP, locking in 80 pips. That felt good—not because of the profit, but because I stuck to my plan.

What I learned

The lesson? Patience. I waited two days for that setup and watched it work beautifully. That’s the power of rules and risk management.

Common Mistakes to Avoid

Overtrading

I’ve blown accounts just by trading too much. If you don’t see a high-probability setup, skip it. Boredom is not a reason to click buy or sell.

Ignoring news

Once, I held a trade during NFP (Non-Farm Payroll). Price spiked 50 pips in seconds—and not in my favor. I always check the calendar now. Tools like ForexFactory’s calendar are super helpful.

Risking too much

Risking 10% per trade might seem like a shortcut to big profits. It’s also a shortcut to blowing your account. I never risk more than 1–2%, no matter how good the setup looks.

Final Takeaways on Forex Trading

Recap of Key Points

We covered how currency pairs work, how to place trades, what leverage means, and why a trading plan is essential. I also shared one of my real trades and lessons from my biggest mistakes.

Final Thought

If you’ve made it this far, you’re already ahead of most beginners. Forex isn’t about luck—it’s about learning, practicing, and managing your risk. Start with a demo, build your plan, and take your time. There’s no rush to “make it.”

When I finally stopped chasing trades and focused on building skill, things changed. That’s what I want for you too. Slow is smooth, and smooth is profitable.

FAQ: Forex Trading Basics

What is forex trading in simple terms?

Forex trading is buying one currency while selling another to make a profit. You’re trading currency pairs like EUR/USD based on how their values move.

How do I start forex trading?

Start by choosing a regulated broker, opening a demo account, and learning the basics of how currency pairs and leverage work. Then practice with a strategy that suits your style.

How much money do I need to start?

Many brokers let you start with as little as $100. But for realistic learning, I’d suggest at least $500. That gives you room to trade safely without overleveraging.

Is forex trading risky?

Yes, especially with leverage. You can lose more than you deposit if you’re not careful. That’s why it’s crucial to manage risk and use stop-losses.

Can I trade forex on my phone?

Absolutely. Apps like MetaTrader 4, IG, and eToro let you trade and manage positions from your phone. I use MT4 on mobile when I travel, but prefer desktop for analysis.

Helpful Resources and Tools

- ForexFactory Economic Calendar – Track market-moving news

- BabyPips School of Pipsology – Learn forex from scratch

- Investopedia: Forex Explained – In-depth definitions and examples