If you’ve ever tried to grow a tiny account quickly, you probably looked at leverage. I’ve been there. I remember blowing my first $50 account in three trades using 1:1000 leverage—no risk management, no clue what I was doing. But I also remember using the same leverage, a few years later, to turn $200 into $1,100 in just over a week. The difference? I finally understood the risks and picked the right broker.

Most new traders don’t realize how much leverage can work against them. And let’s be real—many brokers offering crazy leverage are based offshore and operate in the gray. But there are *some* brokers that get it right. This guide helps you find them.

- What leverage actually means in Forex

- Why high leverage can be dangerous but powerful

- The 6 best brokers offering up to 1:1000 (and even 1:2000!)

- Regulation, spreads, execution—what to check before opening an account

I’ve tested these brokers myself or spoken to real users who have. Below, you’ll meet names like PrimeXBT and FXTM that keep coming up among high-leverage traders for good reason. I’m going to show you how to get the upside without getting wiped out.

What Is High Leverage in Forex Trading?

Leverage lets you control a bigger trade size than your actual balance. If you’ve got $100 and your broker offers 1:1000 leverage, you can open a position worth $100,000. But that power cuts both ways. Gains? Bigger. Losses? Way bigger.

How Does Leverage Work?

Let’s say you buy EUR/USD with 1:1000 leverage. A 0.1% move (10 pips) in your favor doubles your account. But the same move against you? Game over.

This is why most regulated brokers cap leverage at 1:30 in places like the UK or EU. But offshore brokers don’t. They’ll give you 1:500, 1:1000, even 1:2000—if you’re bold enough to use it.

Why Traders Use High Leverage

I like high leverage for small accounts. It gives you flexibility. But I never go all-in. Instead, I use tight stops, micro lot sizing, and treat every trade like it could blow the account. Because with high leverage, it absolutely can.

The 6 Best High Leverage Brokers in 2025

All of these forex brokers offer high leverage. But more importantly, they offer control. Tight spreads. Clean execution. Some are regulated, some aren’t—but I’ll tell you where each one stands.

| Broker | Max Leverage | Min Deposit | Regulation | Key Features |

|---|---|---|---|---|

| PrimeXBT | 1:1000 (up to 1:2000) | $5 | Unregulated (crypto-focused) | Crypto deposits, multi-asset platform |

| FXTM | 1:2000 | $10 | FCA, CySEC, FSCA | Floating leverage, fast execution, top-tier education |

| ActivTrades | 1:1000 | $100 | FCA, SCB | 0.5 pip spreads, no forex commission |

| IFC Markets | 1:400 | $1 | CySEC, BVI FSC | Secure environment, competitive spreads |

| FP Markets | 1:500 (pro) | $100 | ASIC, CySEC | ECN conditions, low spreads |

| BlackBull Markets | 1:500 | $200 | FMA NZ, FSCA | Institutional liquidity, fast execution |

1. PrimeXBT

I tested PrimeXBT when I wanted to trade both crypto and forex in the same platform. Their 1:1000 leverage got my attention—but what surprised me was the 1:2000 option for select accounts. They don’t ask for much upfront, either. With just $5, you’re in.

The platform is slick, and you fund it with BTC, ETH, or USDT. That said, it’s not under any formal regulatory umbrella. So if you value trust over flexibility, this might not be for you. Still, for experienced risk-takers, it’s hard to beat.

2. FXTM

FXTM has been around for a while, and they play the long game. I liked how they balance risk and flexibility with floating leverage that adapts to your balance. Up to 1:2000 if you keep your exposure tight.

They’re regulated by top-tier bodies like the FCA and CySEC. Spreads are solid. Execution? Fast. And they’ve got educational content that actually teaches, not just sells. If you want both leverage and safety, FXTM’s a strong pick.

3. ActivTrades

I used ActivTrades back when I wanted to switch from MT4 to their web platform. What I noticed right away? Speed. Orders go through instantly. And spreads start at 0.5 pips with zero commissions on forex—seriously rare.

Leverage tops out at 1:1000, which is more than enough. They’ve been in business for over 20 years, which gives me confidence they’re not going anywhere. I trust them for larger trades.

4. IFC Markets

This one’s not the flashiest, but it’s solid. IFC Markets offers up to 1:400 leverage, which isn’t 1:1000 but still pretty generous for a regulated broker. What I liked most was their security focus—they’ve got a great regulatory history and a wide asset list.

If you’re looking for less hype and more stability, IFC Markets is a good fit.

5. FP Markets

FP Markets gives you ECN-style trading at very low cost. Their Raw account spread starts at 0.0 pips with a small commission, and leverage up to 1:500 for pros. I like the platform choices here too—MT4, MT5, and IRESS if you’re into shares.

Regulated by ASIC and CySEC, they’ve built a solid name in Australia and beyond. I’ve seen very little slippage with them during volatile news events. That matters.

6. BlackBull Markets

Based in New Zealand, BlackBull hits that sweet spot between retail access and institutional features. I’ve had no trouble with slippage or liquidity. They offer 1:500 leverage and fast execution through Equinix servers in NY and London.

Spreads are tight. Commissions are fair. Their ECN account setup feels like a pro environment—perfect if you’re scaling your trades.

Key Considerations When Choosing High Leverage Brokers

Just because a broker offers 1:1000 or 1:2000 leverage doesn’t mean it’s right for you. I learned that the hard way. These days, I always check a few core things before funding an account.

Regulation and Safety

Are they regulated by a tier-1 body like the FCA or ASIC? If not, you’re on your own if something goes wrong. Offshore brokers often offer the highest leverage—but you’re taking a risk. I personally use offshore brokers only with money I’m willing to lose.

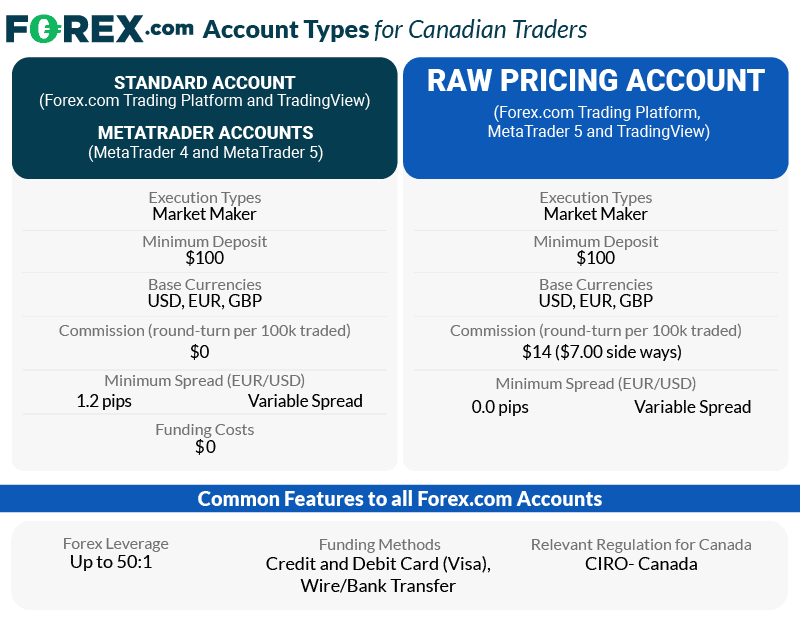

Account Types and Minimum Deposits

Some brokers like PrimeXBT let you start with $5. Others require $200 or more. Choose based on your risk appetite and strategy. Micro accounts give you room to learn without blowing up fast.

Spreads, Commissions, and Execution Speed

I can’t stress this enough—tight spreads and fast execution make or break high-leverage trades. One second of slippage on a 1:1000 trade can cost you everything. ECN brokers like FP Markets or BlackBull give you cleaner fills under pressure.

Who Should Use High Leverage (and Who Shouldn’t)?

Here’s the truth: high leverage isn’t for everyone. I’ve seen traders make it big and others blow accounts in minutes. So let me break down who can actually benefit—and who should stay away.

If You’re Experienced and Disciplined

You’ve been trading a while. You understand risk management. You’re not tempted to go full margin. In that case, high leverage can give you flexibility without needing to overfund your account. I personally only use high leverage with tight stop losses and very small position sizes.

If You’re New to Forex Trading

Stay away. Seriously. If you’re still figuring out how to use MT4 or understanding pip values, then 1:1000 leverage is a fast way to lose your money. I recommend starting with 1:50 or 1:100 until you get your feet under you.

For Small Account Traders

If you’ve only got $50 or $100 to start, high leverage can give you a fighting chance. But only if you treat every trade like it matters. I started out this way and it taught me discipline fast. Just don’t expect to get rich overnight.

FAQs About High Leverage Forex Brokers

What is the highest leverage offered in forex?

Some offshore brokers like PrimeXBT and FXTM offer leverage up to 1:2000. That means you can trade $200,000 with just $100 of margin. But remember, that kind of power can wipe you out fast.

Is 1:1000 leverage legal in my country?

Depends on where you live. In the EU, UK, and Australia, regulators cap leverage for retail traders at 1:30. To get higher leverage, you’ll need to use an offshore broker or qualify as a professional client. Always check your local rules before signing up.

Are high leverage brokers safe to use?

Some are. Some definitely aren’t. Look for brokers with strong reputations, verified user reviews, and ideally some form of regulation—even if it’s offshore. I avoid brokers that have no public contact info or hide their location. That’s a red flag.

Recap of Key Points

We covered a lot, so let’s bring it all together. High leverage can be a powerful tool when used correctly. Brokers like FXTM, PrimeXBT, and FP Markets offer flexible conditions, with leverage up to 1:2000 in some cases. But it’s not just about the numbers—look for regulation, execution speed, and overall transparency.

Final Takeaway

If you’re experienced, disciplined, and looking to maximize small capital, high leverage brokers can give you the edge. But never forget—leverage magnifies *everything*. Your wins and your mistakes. Choose wisely.

Closing Thought

I’ve used both low-leverage, high-trust brokers and offshore high-leverage platforms. Each has its place. The most important thing? Know what you’re trading, why you’re trading, and always protect your downside. No broker or leverage setting will save you from bad habits.

So take your time. Research. Test on demo. Then when you’re ready, step in—with both eyes open.