Ever felt stuck deciding between Forex or stock trading? I’ve been there too. Back when I started trading, I was overwhelmed by charts, jargon, and people swearing by both sides. Some of my friends were all about stocks—they loved following company earnings and watching their dividends grow. I, on the other hand, was drawn to the fast pace of Forex.

Here’s what I found out: picking the right market isn’t about what’s “better” in general. It’s about what fits YOU. Are you a night owl who likes fast action? Forex might suit you. Prefer stable growth over time? Maybe stocks are your thing.

But let’s not guess. Below, you’ll get a full breakdown of both markets—straight from someone who’s tried both.

- What Forex and stock markets are all about

- How they compare in terms of liquidity, volatility, and trading hours

- The risks that come with each

- Tips to match your trading style with the right market

By the time you finish reading, you’ll feel a lot more confident choosing the market that fits your goals and lifestyle.

What Are Forex and Stock Markets?

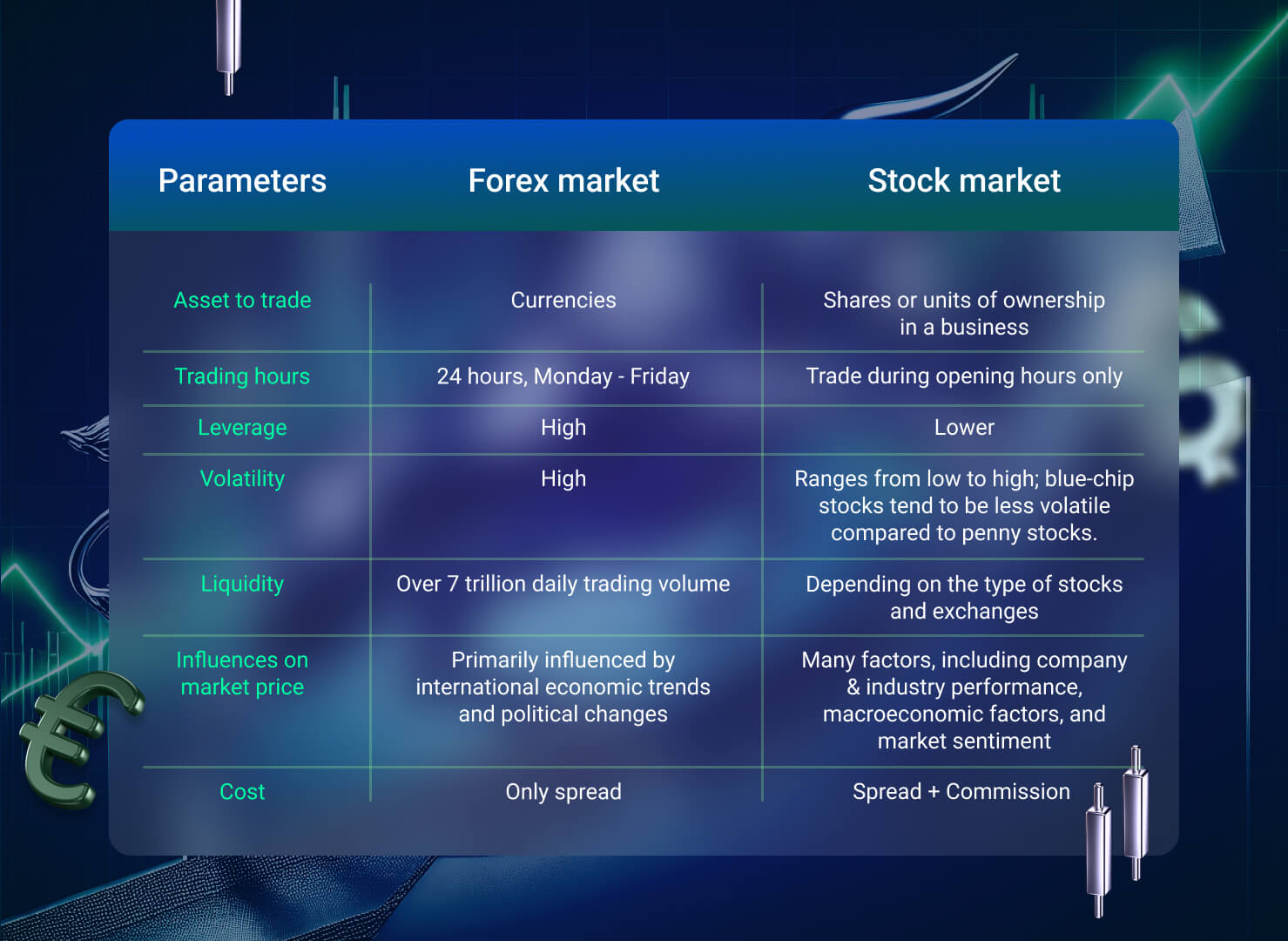

Before I even made my first trade, I had to learn what these markets really are. The Forex market is where people trade currencies like the USD, EUR, or JPY. It’s the most liquid market in the world, running 24 hours a day during the workweek. It’s decentralized, which means there’s no central exchange like the stock market.

On the flip side, stock trading is all about buying shares of companies like Apple, Google, or Tesla. You’re investing in a piece of a company and usually trading during set hours on regulated exchanges like the NYSE or NASDAQ.

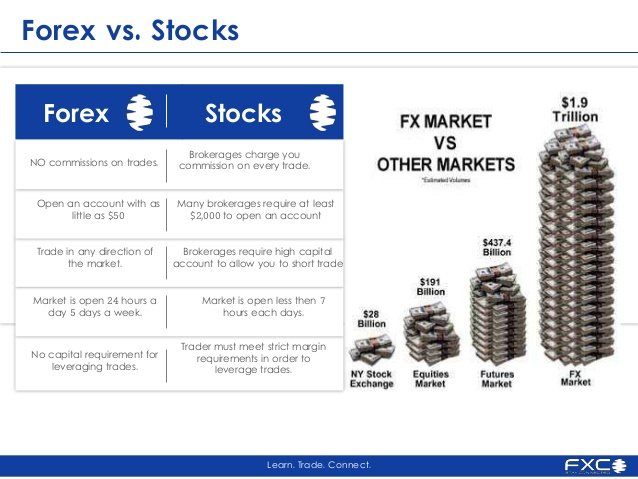

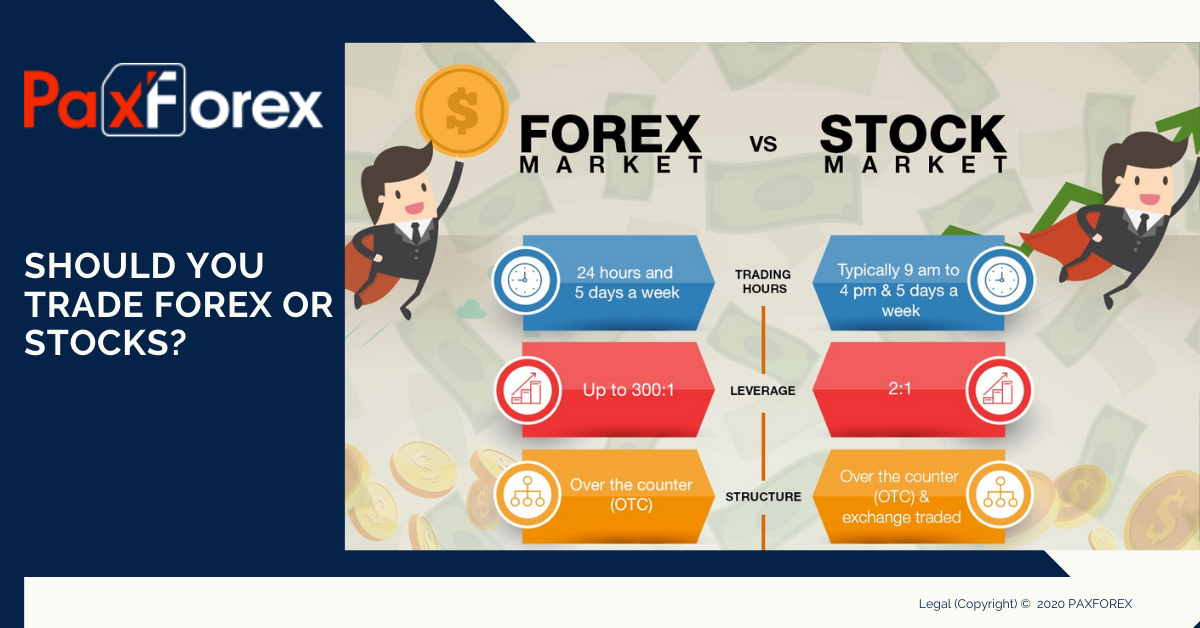

Here’s a quick breakdown of the two:

| Aspect | Forex | Stocks |

|---|---|---|

| Assets Traded | Currency pairs (e.g. EUR/USD) | Shares of companies (e.g. AAPL, TSLA) |

| Market Hours | 24/5 | Limited to exchange hours |

| Liquidity | Extremely high | Moderate to high |

| Leverage | Up to 200:1 | Usually up to 2:1 |

| Volatility | High | Moderate |

Source: PaxForex, XM.com, BrokersView

Key Differences Between Forex and Stock Trading

Market Access and Hours

One of the reasons I fell for Forex early on was the round-the-clock access. You can trade from Sunday night to Friday evening. That worked perfectly for my schedule back when I worked a 9–5 job. Stocks? Not so much. They’re limited to 6.5 hours per day, Monday through Friday, and only during local exchange times.

Leverage and Margin

In Forex, brokers offer **massive leverage**, sometimes up to 200:1. I once turned $100 into over $800 in a single week—of course, I also lost half of that the week after. High leverage can give big wins but can wreck you if you’re careless. Stocks, on the other hand, tend to max out around 2:1 unless you’re using margin accounts or options.

Trust me, if you’re just starting out, understand leverage deeply. Use tools like a forex margin calculator and never risk more than you can lose.

Costs and Spreads

Forex spreads are usually tight—think 1 to 3 pips for major pairs. Most brokers are commission-free, which I loved starting out. But with stocks, you’ve got commissions, SEC fees, and sometimes ECN charges depending on your broker. The costs do add up unless you’re using a zero-commission broker like Robinhood or Webull.

Risk Factors in Forex vs Stocks

Volatility and News Sensitivity

I remember this one Thursday when the Bank of England dropped a surprise rate cut. I was in a EUR/GBP long and the market whipped down 150 pips in seconds. That’s the kind of news-driven volatility you get in Forex. You need to follow economic calendars like it’s your religion.

Stocks move too, especially around earnings reports. But the triggers are usually company-specific. Unless there’s a market-wide panic, individual stocks don’t react as explosively as currencies during major economic releases.

Trader Psychology

Honestly, Forex messed with my head at first. The constant movement, tight spreads, and fast execution made it easy to overtrade. With stocks, I found myself more patient, especially when holding solid companies long-term.

If you’re someone who reacts emotionally to wins and losses, know this: Forex will test your discipline. It rewards the calm, punishes the impulsive. With stocks, the pacing allows more room to breathe.

Which Is Better for You?

For Beginners

If you’re just dipping your toes, start with demo accounts. I began on MetaTrader 4, trading fake money for weeks before risking real cash. You can do the same with stocks using platforms like Thinkorswim or TradingView.

What I liked about Forex was how quick the feedback loop was. You could see how news moved the market within minutes. But that also made mistakes happen faster. Stocks felt safer at first—less leverage, more stable assets, and tons of public info available.

For Active Traders

If you like action, Forex is your playground. Scalping and day trading are common and supported by most brokers. I loved using TradingView and MetaTrader with custom indicators. On the stock side, you’re looking more at swing trading or holding through earnings cycles.

Each has its tools—economic calendars for Forex, earnings reports for stocks. Both require sharp focus, but Forex is definitely more high-speed.

Time Commitment and Lifestyle Fit

Back when I was juggling a full-time job, Forex’s 24/5 schedule was a blessing. I could trade early mornings or late nights. Stocks didn’t offer that kind of flexibility unless I wanted to trade after-hours with less liquidity and higher spreads.

If you’ve got a routine that’s packed during market hours, Forex might fit better. But if you prefer slower decisions and watching companies grow over time, stocks could match your pace more.

FAQs

Is Forex more profitable than stock trading?

It can be—but only if you manage risk well. Forex allows high leverage, which means higher potential returns… and bigger losses. Stocks tend to be steadier, with long-term growth and dividends. So, Forex might offer faster gains, but it also comes with more volatility.

What’s riskier: Forex or stocks?

Forex is riskier, especially for beginners. The high leverage and fast price swings can wipe out accounts fast. Stocks are more stable and regulated, making them safer for most new traders. But both require education and discipline.

Can I trade both Forex and stocks at the same time?

Absolutely—I did for over a year. But it’s a lot to manage. You’ll need to track both economic calendars and earnings reports. If you’re just starting, focus on one first, then diversify once you’re comfortable.

What tools do I need to get started in each?

For Forex, I recommend MetaTrader 4 or 5, an economic calendar, and a solid demo account. For stocks, platforms like Thinkorswim, Webull, or Robinhood are easy to use. You’ll also want access to earnings reports, financial statements, and analyst reviews.

Recap of Key Points

Let’s run it back. Forex and stocks each have unique perks. Forex runs 24/5, offers high leverage, and suits active traders who thrive in fast-paced environments. Stocks are great for long-term growth, offer dividends, and are easier to digest for beginners.

Final Takeaway

The better choice depends on YOU. What’s your schedule like? How much risk can you handle? Do you prefer chasing short-term trades or building a portfolio for the future?

Closing Thought

I’ve traded both. Some weeks I’m in and out of EUR/USD positions; other months, I’m holding tech stocks through earnings season. What matters most is understanding the market you’re in and sticking to a strategy that matches your goals and lifestyle. Start small, stay smart, and keep learning. Your trading path is yours to build—just make sure it fits you.