When I started out in Forex, I had no clue what I was doing. I jumped between strategies like a kid in a candy store, hoping something would click. It didn’t—until I sat down, picked five solid strategies, and tested each one like my trading account depended on it (because it did). What I learned changed how I trade forever.

Most beginners get stuck in the same trap: jumping into trades with no plan and chasing random indicators. That’s where the losses begin. Without a proven strategy, it’s like sailing with no compass—you drift until you sink.

In this guide, I’m going to break down five battle-tested Forex strategies that helped me stop bleeding money and start trading with confidence. These aren’t random internet theories—they’re real methods I tested myself using demo accounts, real-time data, and a lot of personal trial and error.

Here’s what you’ll learn:

- How to identify which strategy fits your personality

- Step-by-step tools and indicators for each approach

- My personal experience testing them all

- Risk levels, time commitment, and expected returns

If you want to trade smarter, not harder, these strategies are where you begin. Let’s break them down one by one.

What Makes a Good Forex Strategy?

It Fits Your Lifestyle and Personality

I’ve learned the hard way that a strategy can be “proven” but still wrong for you. Scalping stressed me out—it didn’t fit my schedule or temperament. You need a strategy that suits your routine and mindset. Are you calm during fast moves? Can you sit on a trade for days? Your answers guide your path.

It’s Testable on a Demo Account

Before risking real cash, I tried each strategy on demo accounts for at least two weeks. You’d be amazed how much you learn when there’s zero emotional pressure. I used MetaTrader 4 for all my testing—it’s free and super flexible.

It Has Clear Rules and Tools

Any good strategy uses set tools—like RSI, MACD, or moving averages—to make entry and exit decisions. If a strategy feels vague or changes daily, it’s probably not for you. Clarity breeds consistency. And consistency makes profits.

1. Trend Following Strategy

Trend following was the first strategy that gave me a “click” moment. I remember using the 50-day moving average to ride an upward EUR/USD trend, locking in +90 pips in just three days. Simple tools, powerful outcome.

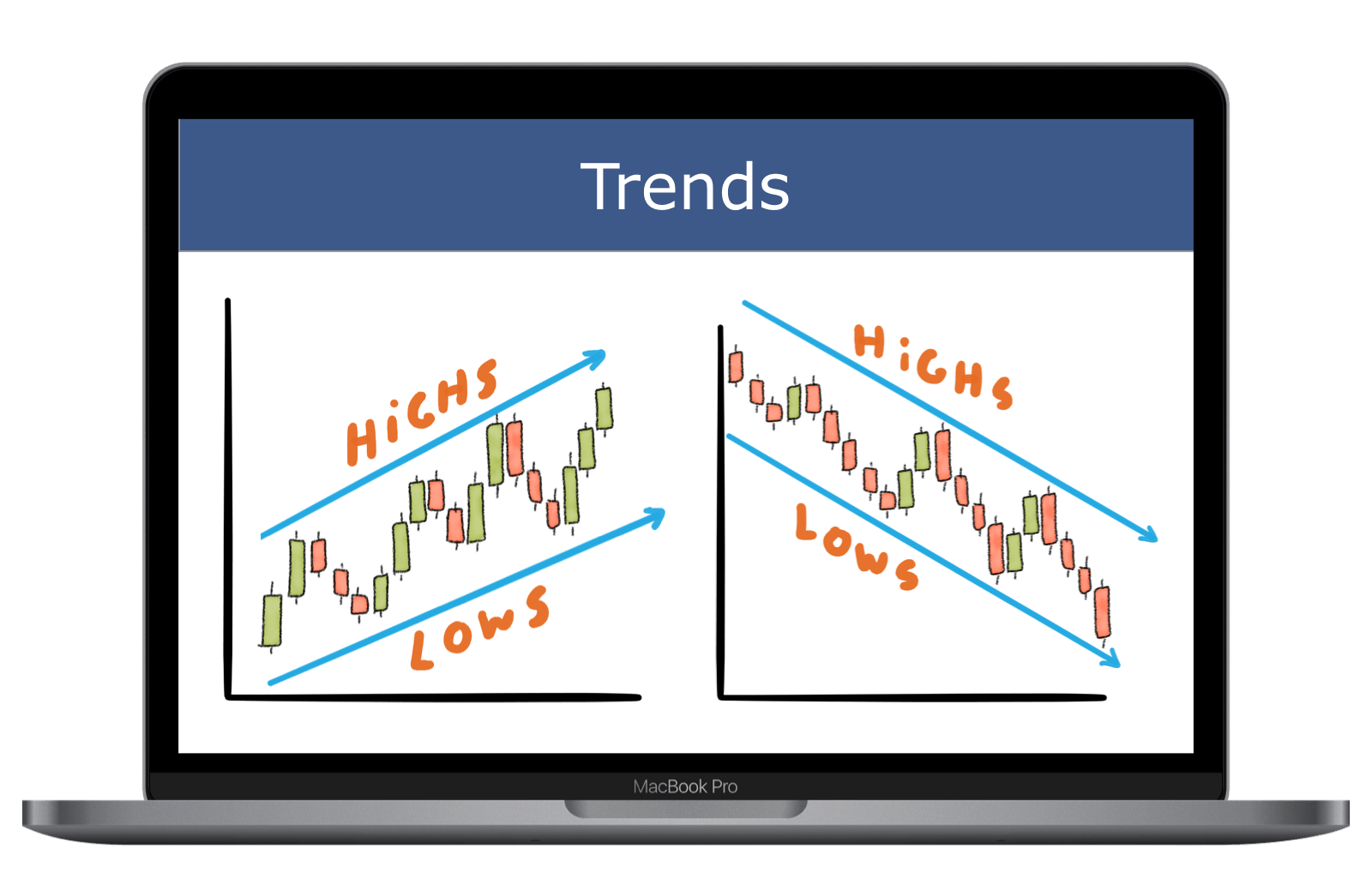

What It Is and Why It Works

You’re trading in the direction of the overall market move—up or down. I use this when markets are moving cleanly, not choppy. It’s based on the principle that prices tend to continue in one direction more often than they reverse.

Tools You’ll Need

I stick with moving averages (20 EMA, 50 SMA), and confirm signals using the MACD or ADX. If the 20 EMA crosses above the 50, and MACD shows momentum, I get ready to enter.

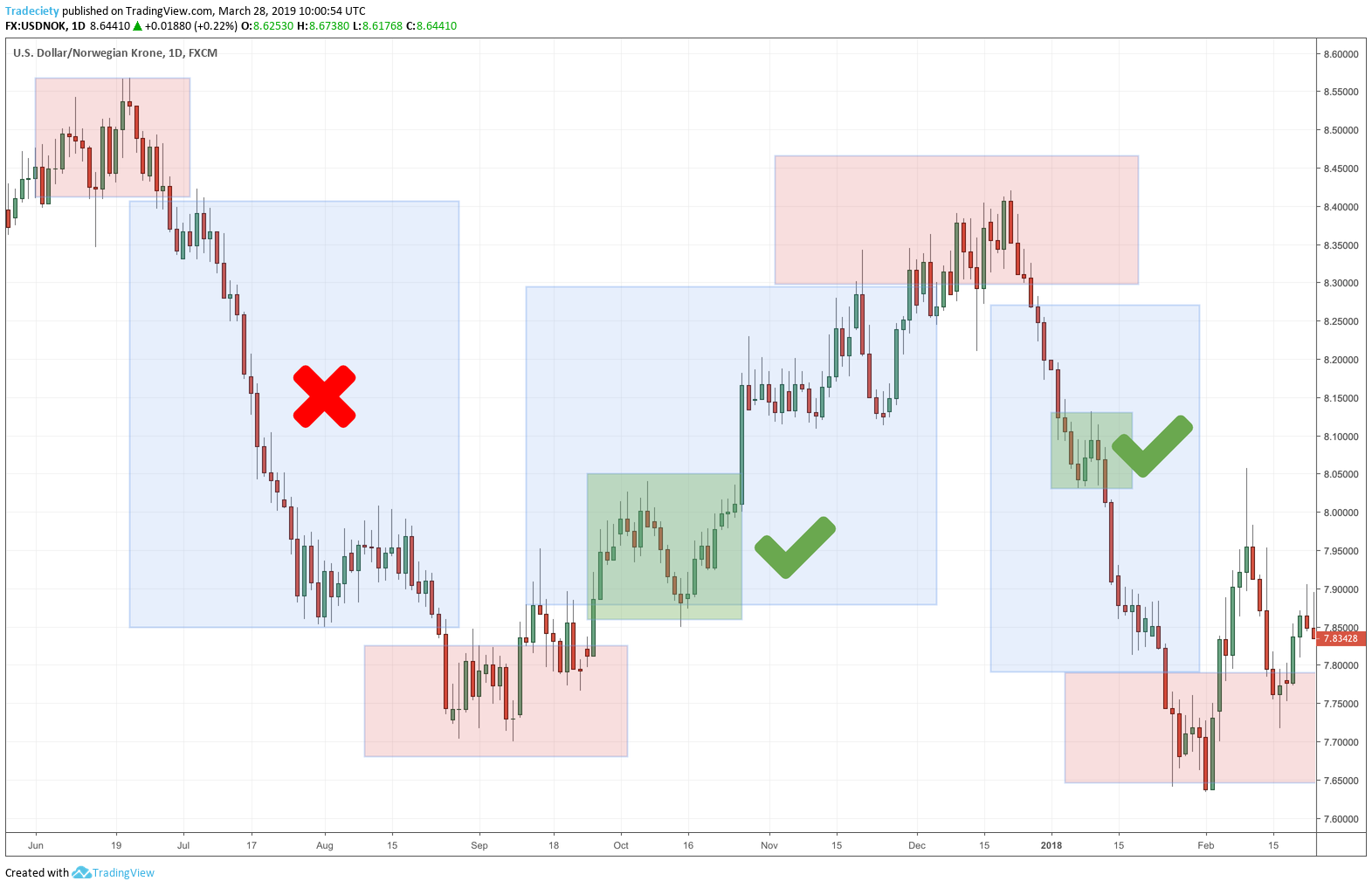

Entry, Exit, and Visual Example

Here’s a sample of what trend following looks like in action:

Entries happen on pullbacks to moving averages. I usually place stops just below the last swing low and use a 1:2 risk-reward ratio. If the trend holds, you ride it. If not, you limit your loss.

2. Scalping Strategy

Scalping was exciting—but brutal. I’d open trades, stare at the screen for 30 minutes, and close with a tiny profit. Sometimes I won. Often, I just paid the spread. It’s fast, intense, and not for everyone.

Who Should Use It?

If you love adrenaline and can focus like a sniper for long periods, this is for you. Scalping involves entering and exiting trades within minutes, making profits from small price changes.

What You Need to Make It Work

I used Bollinger Bands, the Stochastic Oscillator, and 1-minute charts. You want high liquidity pairs like EUR/USD or GBP/USD and low spreads—otherwise, fees eat your gains.

Pros, Cons, and Pitfalls

Pros: Quick returns, lots of trading opportunities.

Cons: Mentally exhausting, high spread sensitivity.

Pitfalls: Overtrading. I blew a demo account in two days trying to “win back” a loss. Don’t do that.

3. Day Trading Strategy

Day trading felt like a natural balance. Not too fast like scalping. Not too slow like swing trading. I could open a trade after breakfast and be done before dinner. That felt good.

How It Differs from Scalping

You hold trades for hours instead of minutes. You’re still avoiding overnight risk but giving trades more room to breathe. This lets you catch larger moves, with fewer trades.

Tools That Helped Me Most

Fibonacci levels helped me nail reversals and targets. I combined that with price action and news events. I watched the economic calendar like a hawk—especially NFP days.

Discipline and Emotional Control

The hardest part? Not touching the trade once I set it. I used to micromanage and close early. But once I started trusting the setup and sticking to my rules, results improved fast.

4. Swing Trading Strategy

Swing trading finally gave me breathing room. I could trade while keeping my day job. Less screen time, fewer decisions. I’d enter on a Monday and check again on Thursday. That’s freedom.

Why I Recommend It for Busy Traders

If you’ve got a 9-5 or family time to protect, swing trading is ideal. You hold trades for several days, aiming for bigger moves and clearer patterns.

Indicators That Worked Best

I used RSI to spot overbought or oversold conditions. Combined with clean support/resistance zones, it gave solid entries. I avoided signals below 50 on RSI unless the trend was clearly down.

Handling Overnight Risk

Yes, you’ll hold trades overnight. But you can manage that risk with wider stops and lot sizing. I learned not to overleverage—sleeping peacefully matters more than squeezing every pip.

5. Breakout Trading Strategy

Breakout trading was my wild card. It’s thrilling when it works—but frustrating when it doesn’t. It’s all about catching big moves when price breaks through a key level. Like fireworks—short, loud, and powerful.

What Breakouts Look Like

Imagine price hovering near a resistance zone. Suddenly, it bursts upward with volume. That’s your signal. I wait for confirmation candles to avoid fakes.

Spotting Reliable Setups

I rely on clean consolidation ranges and volume spikes. The moment price breaks and closes beyond resistance or support, I enter—with tight stops just inside the range.

To avoid false breakouts, I always confirm with volume and the direction of the higher time frame trend. If the daily chart disagrees, I sit it out.

Which Strategy Is Best for You?

If you want speed and action, try scalping. If you’re calm and methodical, swing trading is your friend. For balance, I recommend day trading. Breakouts are great if you have time to monitor key levels. And trend following? Honestly, it’s my personal favorite—it’s simple, logical, and works across all pairs.

Test each one using a demo account first. And if you’re into automation, explore expert advisors (EAs) to hybridize strategies and reduce emotional trades.

| Strategy | Trade Duration | Skill Level | Best For | Risk |

|---|---|---|---|---|

| Trend Following | Days to weeks | Beginner+ | Low-stress, visual learners | Low |

| Scalping | Seconds to minutes | Advanced | High focus traders | High |

| Day Trading | Hours | Intermediate | Traders with flexible schedules | Moderate |

| Swing Trading | Days | Beginner+ | Busy professionals | Moderate |

| Breakout | Minutes to hours | Intermediate | Momentum seekers | High |

What Strategy Gave Me the Best Results?

After testing all five, trend following turned out to be the most consistent for me. It didn’t give me wild, fast profits like breakout trading or scalping, but it gave me something better—peace of mind.

With trend following, I was able to build routines, journal every setup, and improve week after week. I used the TradingView platform to spot trends and confirm signals. My win rate improved by over 20% once I started respecting the trend and stopped trying to outsmart the market.

But here’s the truth: your best strategy might be different than mine. That’s why testing is everything. Whether it’s swing trading or scalping, you won’t know until you try.

EEAT: How I Built Trust in My Trading

Trusted Tools and Platforms

I relied heavily on tools like MetaTrader 4 and TradingView—platforms widely used and trusted by traders worldwide. Their charting tools, indicators, and news integrations kept me grounded and informed.

Authoritative Data and Learning

I constantly referenced reliable sources like Investopedia for definitions, and BabyPips for tactical insights. These helped me double-check my strategies and make sure I wasn’t trading based on guesswork.

My Trading Journey and Lessons

I started in 2020, lost a lot early, and finally went back to the basics. My turning point came when I documented every trade in a spreadsheet and reviewed my performance weekly. My results weren’t amazing overnight—but they were real, and they kept growing. That’s what experience looks like in Forex.

FAQs

What is the easiest Forex strategy to learn?

In my experience, trend following is the easiest for beginners. It uses simple tools like moving averages, and you follow what the market is already doing instead of trying to predict reversals.

Can I combine multiple strategies?

Absolutely. I started with pure trend trading, then added breakout entries when I spotted good setups. Combining strategies lets you adapt to different market conditions while sticking to clear rules.

How long should I test a strategy before going live?

I recommend testing for at least 2 to 4 weeks on a demo account. Track every trade, journal your logic, and analyze results. Once you’ve got consistency, go live with a small account to manage real emotions.

Helpful External Resources

Here are some trusted sources that helped me on this journey:

- BabyPips Forex Education – Beginner-friendly lessons

- Investopedia Forex Definitions – Clear definitions and examples

- MetaTrader 4 – Free trading platform

- TradingView – Powerful charting tool

Recap of Key Points

We covered five proven Forex strategies that traders of all levels can use to build a solid trading foundation. From quick-paced scalping to more laid-back swing trading, each method has its place. You’ve seen the tools, the trade examples, and my personal experience with each strategy.

Final Takeaway

You don’t need to master all five strategies. What you need is to test them, find what suits your goals, and stick to it with discipline. Start with a demo, study your outcomes, and make steady improvements.

Closing Thought

The best strategy isn’t the most complex—it’s the one you can follow consistently. Stay patient, stay curious, and always trade with a plan. That’s how you turn Forex from a gamble into a skill.

2 Comments

Pingback: What is Forex Scalping? Strategies, Tools & Tips Explained - Chronos Trading

Pingback: How to Succeed in Swing Trading Forex: A Step‑By‑Step Guide - Chronos Trading