Back when I first dipped my toes into Forex trading, I made every mistake in the book. I trusted the wrong broker. I let my emotions take control. I even ignored the news—yep, the same news that sent currency pairs crashing or flying. I lost more than just money. I lost confidence. But I learned. And now I’m here to help you avoid the same traps.

Forex trading can be exciting, even life-changing. But it’s also full of danger, especially if you don’t understand the risks. Every choice—from choosing a broker to using leverage—can either build your account or blow it up.

The good news? You don’t have to learn the hard way. In this article, I’ll walk you through the top risks in Forex trading and exactly how you can avoid them. These aren’t just textbook risks—I’ve seen them play out in real time, both in my own trades and others’.

- Broker scams and fraud traps

- Platform failures and technology breakdowns

- Leverage and margin dangers

- Volatile markets driven by politics and economics

- Emotional and psychological pressure

Stick with me and you’ll walk away not only knowing what the risks are—but with real, tested ways to protect your trades and your sanity.

Understanding the Risky Nature of Forex

What Makes Forex Risky?

Forex is decentralized. There’s no single exchange, like the stock market. You’re trading directly through brokers, and that means less regulation and more room for manipulation if you’re not careful.

Plus, Forex runs 24 hours a day, five days a week. That sounds great until you realize your trades can get hammered while you’re asleep. I’ve woken up to wiped-out positions more than once because I forgot to set a stop-loss.

Forex Is a High-Leverage Game

Leverage lets you control huge positions with a small deposit. Sounds amazing, right? But it’s a double-edged sword. If you’re wrong—even just a little—you can lose your entire account.

Once, I overleveraged a position during a Bank of England rate decision. A tiny 30-pip swing wiped out 40% of my balance. That was the moment I learned to respect leverage, not abuse it.

Broker and Fraud Risk

Common Forex Scams

Not all brokers play fair. Some delay your orders, mess with price feeds, or worse—vanish with your funds. Fake platforms, “guaranteed profit” schemes, and shady signal sellers are everywhere.

One trader I mentored lost $2,000 to a broker offering “instant withdrawals” and “bonus doubling.” They disappeared overnight. No license. No support. Nothing.

How to Avoid Broker Fraud

Before I trust a broker, I ALWAYS check if they’re licensed by authorities like the FCA or NFA. Look them up. Don’t just take their word for it. Use watchdogs like the CFTC Red List.

| Feature | Regulated Broker | Unregulated Broker |

|---|---|---|

| Withdrawals | Fast, transparent | Often delayed or blocked |

| Trade Execution | Market-based, fast | Slippage, re-quotes |

| Customer Support | Available and professional | Unreachable or dismissive |

Platform and Technology Risk

Common Platform Failures

I’ve seen platforms crash during major news events. One time, during a US Jobs Report release, my MT4 froze right when I wanted to close profit. By the time it unfroze, I was down. That one hurt.

What You Can Do

Use a broker with a solid tech reputation. Ask in forums, test their demo, read real reviews (not just the ones on their own site). And if you’re trading big money, consider using a VPS (Virtual Private Server) to reduce latency and downtime.

Leverage and Margin Risk

Why Leverage Can Destroy Accounts

Forex brokers often offer 50:1 or even 500:1 leverage. With $100, you can control a $50,000 position. Sounds good, but it’s also how people go broke fast. One wrong move and a margin call forces your trade to close at the worst possible moment.

Smart Ways to Manage Leverage

I keep my risk per trade under 2%, sometimes 1% if the market feels jumpy. I also use a position size calculator and plan every trade before I click the button. No guessing. No hoping.

Market Volatility and News Impact

High-Impact News Events

Things like Non-Farm Payrolls (NFP), FOMC decisions, and rate changes can swing the market in seconds. I’ve seen spreads widen to 20+ pips during these events. One friend tried to scalp during NFP and ended up with -$300 in slippage. Brutal.

How to Stay Protected

Know the calendar. Sites like Investing.com offer real-time event alerts. I either stay out during high-impact times or use a tight stop-loss and lower leverage. Some traders hedge—open opposite positions on correlated pairs—but that’s advanced stuff and takes practice.

Political and Country Risk

How Geopolitics Hits Currencies

Forex isn’t just about charts. It’s about countries, economies, and global politics. When a nation is unstable—military coups, debt defaults, or political scandals—its currency takes a hit.

I remember the Turkish lira collapse in 2018. Traders holding TRY positions lost big overnight. One colleague told me they had no idea the country was even in crisis. That’s how fast it can blindside you.

Diversify and Reduce Exposure

I never put all my trades into a single currency, especially emerging markets. I mix in majors like EUR/USD or USD/JPY and avoid pairs tied to unstable economies. A well-diversified portfolio helps balance the shocks.

Emotional and Psychological Risk

Common Trading Mindset Traps

Fear. Greed. FOMO. I’ve felt them all. Once, I chased a EUR/USD move just because everyone on Twitter was screaming “bullish breakout.” Lost 120 pips in 10 minutes. That’s how fast emotions can wreck you.

Revenge trading is another trap. After a loss, you open bigger trades hoping to “get it back.” I did this in 2022—lost two days of profit in one night.

Build a Resilient Trading Mindset

Now, I journal every trade. Win or lose, I write down the “why.” I follow a plan and walk away when I hit my daily limit. Trading isn’t about being right—it’s about being consistent.

And if you’re feeling emotional? Step away. No shame in taking a break. Some of my best trades came after cooling off and resetting my mindset.

Liquidity and Transaction Risk

What Happens in Low Liquidity

Ever tried to close a trade only to watch your broker delay or slip the execution? That’s liquidity risk. It happens during off-hours or when you trade exotic pairs. The spread widens, and your profits vanish before your eyes.

How to Avoid It

I stick to high-volume times—like the London or New York sessions. And I mostly trade major pairs (EUR/USD, USD/JPY, GBP/USD) because they have tighter spreads and more liquidity.

Also, watch for weekends and holidays. Liquidity dries up, and execution gets sketchy fast.

Counterparty Risk

This one’s sneaky. You trade through a broker, but they’re also your counterparty. If they go under, your funds might be gone. Remember, Forex isn’t traded on a central exchange like stocks.

That’s why I only use regulated brokers. I check that they offer segregated accounts—meaning your funds aren’t mixed with company money. If something goes wrong, you’re protected (at least somewhat).

Risk Management and Prevention Tips

Key Tools and Strategies

If there’s one thing I wish someone had hammered into me early, it’s this: manage your risk before you manage your profits.

Here’s what works for me:

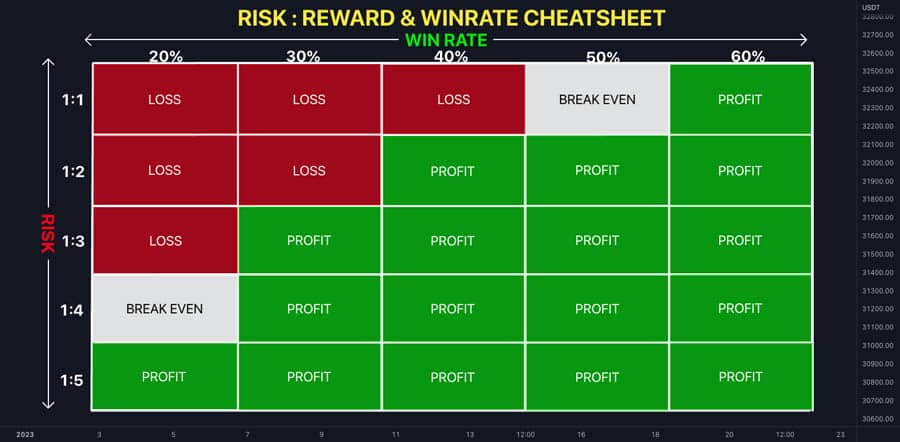

Risk/Reward Ratio

I never take trades unless the potential reward is at least twice the risk. A 2:1 ratio keeps me profitable even with a 50% win rate.

Position Sizing

Use a position size calculator. Don’t guess. I risk no more than 2% of my capital on any single trade—usually less.

Stop-Loss Discipline

Set it. Stick to it. Don’t move it. If I get stopped out, I accept it and move on. Chasing losses has burned me too many times to count.

FAQs About Forex Risks

What is the riskiest part of Forex trading?

Honestly? It’s you. The trader. Most losses come from emotional decisions—overtrading, revenge trading, or ignoring your plan. The market doesn’t beat you. You beat yourself.

How do I know if a broker is legit?

Check for regulation. Use tools like the FCA Register or CFTC Red List. Read independent reviews and join trading forums to see what real users say.

Can I lose more than I invest in Forex?

Yes, especially if you use high leverage and don’t use stop-losses. Some brokers offer negative balance protection, but it’s not guaranteed. Always check your broker’s policy.

How much leverage is too much?

If you’re new, anything over 10:1 is risky. I stick to 5:1 or less on most trades. High leverage is tempting but dangerous.

What’s the safest way to start Forex trading?

Use a demo account. Learn the platform. Create a trading plan. When you go live, start small. Focus on consistency—not big wins.

Recap of Key Points

We’ve covered a LOT. From broker fraud to emotional blowups, you now know the major Forex trading risks—and how to beat them. You’ve got tools like position sizing, stop-losses, and trading journals to guide you. You know when the market is most dangerous—and what to do about it.

Final Takeaway

Forex trading isn’t just numbers on a screen. It’s part skill, part mindset, and part survival. If you stay informed, stay disciplined, and never stop learning, you’ll protect your capital—and your sanity.

Closing Thought

Trading is a journey. You’ll take hits. But every mistake is a lesson—IF you pay attention. Learn from others. Learn from me. And keep your focus where it belongs: not on profits, but on managing risk like a pro.