Back when I first started trading Forex, I’d open MetaTrader at random hours, excited and clueless. I couldn’t understand why sometimes everything moved fast — lots of trades, lots of energy — and other times, it felt like watching paint dry. Turns out, I was missing the most important piece of the puzzle: timing.

Forex trading isn’t just about indicators or economic news. It’s about when you trade. The global Forex market runs 24 hours a day, five days a week, but not all hours are created equal. Some sessions buzz with life; others barely move. And if you’re not aligned with the market’s rhythm, you’re probably leaving money on the table or taking unnecessary risks.

In this guide, I’ll show you what I learned the hard way:

- How Forex market hours actually work

- Why timing impacts spreads and volatility

- Which overlapping sessions offer the best action

- What the top traders focus on during different times of the day

- And how to pick the right hours based on your time zone

This isn’t just another boring breakdown of session times. This is a walkthrough from someone who’s been there, tested the waters, and now trades with the clock instead of against it. Whether you’re a night owl or an early riser, I’ll help you spot the exact windows when the Forex market wakes up and gives you the best shot at success.

What Are Forex Market Hours?

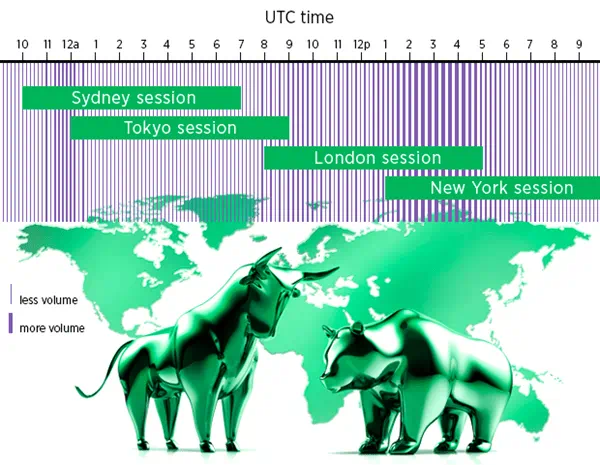

Forex markets don’t sleep — but that doesn’t mean they’re always alive. The Forex market runs continuously from Sunday 5 PM EST to Friday 5 PM EST, cycling through four main trading sessions: Sydney, Tokyo, London, and New York.

The 4 Major Forex Trading Sessions

Here’s a quick breakdown of when each session opens and closes (all times in UTC):

| Session | Open | Close |

|---|---|---|

| Sydney | 10:00 PM | 7:00 AM |

| Tokyo | 12:00 AM | 9:00 AM |

| London | 8:00 AM | 5:00 PM |

| New York | 1:00 PM | 10:00 PM |

Each session reflects its local financial activity. For example, the London session sees heavy movement on EUR, GBP, and CHF pairs, while the Tokyo session gives life to JPY crosses.

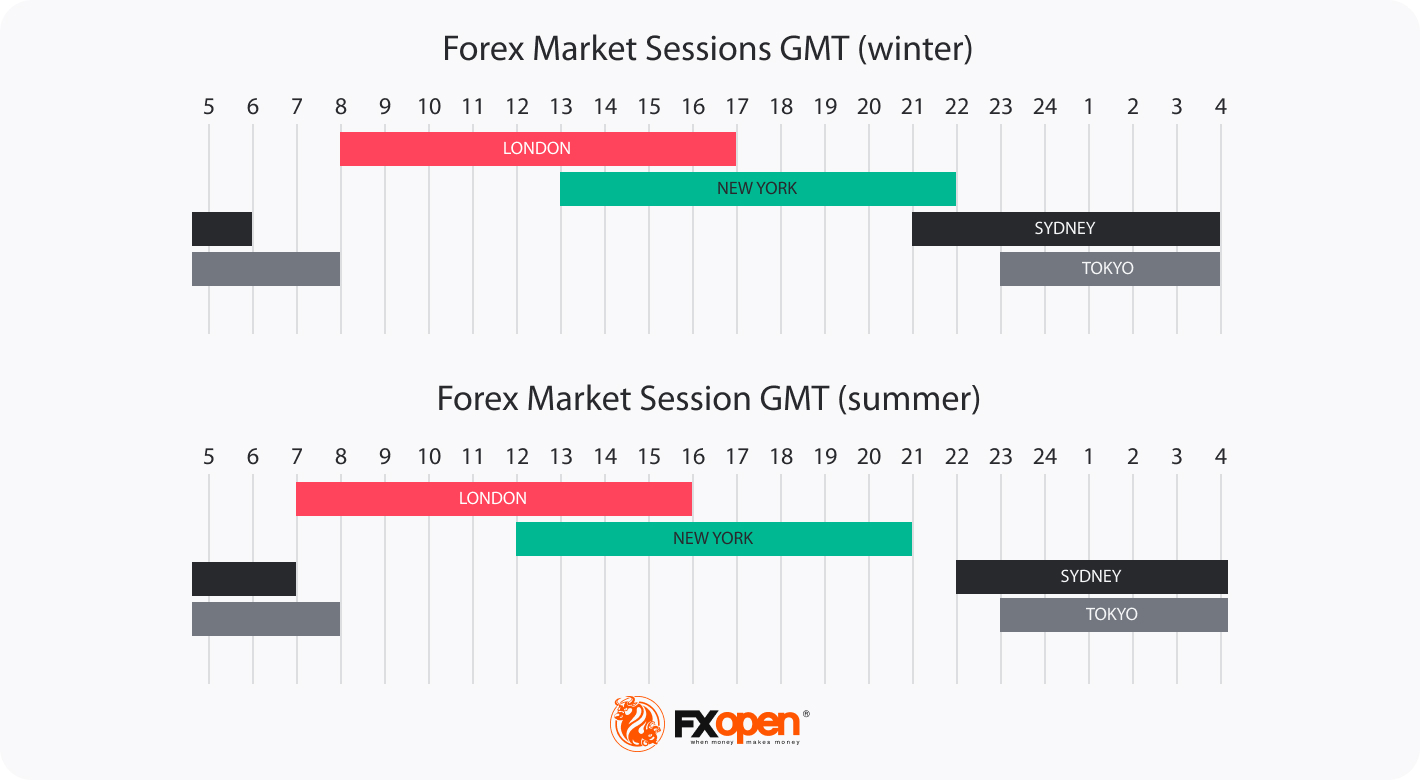

How Time Zones Affect Trading Hours

When I moved from Spain to New York, my trading routine needed a total reset. Suddenly, what was once morning volatility became a sleepy late-night grind. Forex session times are fixed in UTC, but you trade in your local time zone — so you’ve got to align your clock.

Here’s a trick: Convert session hours to your own time zone and write them on a sticky note. I still keep mine on my monitor. If you’re in EST, for example, the London session runs from 3 AM to 12 PM — rough if you like to sleep in, but golden if you’re an early riser.

Why Timing Matters in Forex Trading

I used to wonder why spreads were wide during certain hours. I even blamed my broker once — until I learned how liquidity and volatility shift throughout the day. The truth is, trading outside peak hours can cost you more in spreads and give you fewer price movements to work with.

Liquidity and Spread Differences by Session

During high-volume sessions like London or New York, spreads on major pairs like EUR/USD or GBP/USD are often razor-thin. But outside those windows, especially during the Sydney session, you might see spreads balloon.

Here’s a look at average spreads during different sessions:

| Currency Pair | London/New York Overlap | Asian Session |

|---|---|---|

| EUR/USD | 0.9 pips | 2.0 pips |

| USD/JPY | 1.2 pips | 1.8 pips |

| GBP/USD | 1.1 pips | 2.2 pips |

Source: CashbackForex

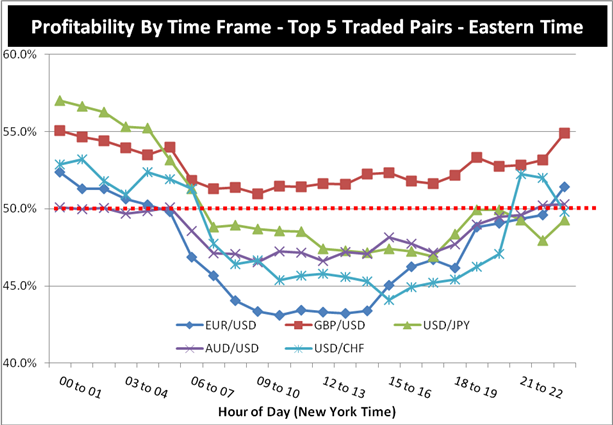

Currency Pair Behavior by Session

Certain pairs love certain sessions. If you trade EUR/USD, the London-New York overlap is your best friend. For USD/JPY, try Tokyo-London. When I focused on GBP/JPY, I quickly noticed wild moves early in the London session.

Keep this in mind when picking trades. The more that pair’s home country is active, the more movement you’ll likely see. And remember, volatility isn’t just noise — it’s opportunity.

Overlapping Forex Sessions: Peak Trading Windows

The real magic happens when two sessions overlap. That’s when traders from both regions jump in, liquidity surges, and the charts actually move. I build my entire trading routine around these periods now.

London and New York Overlap

This is the busiest time in Forex. From 8 AM to 12 PM EST, both the UK and US traders are active. You’ll see huge volume on EUR/USD, GBP/USD, and USD/JPY. This is where I’ve had some of my biggest wins — and losses too, when I wasn’t careful.

During this overlap, you get the best of both worlds — European economic news early and U.S. releases mid-session. But that also means it’s fast and volatile. If you can’t handle sharp reversals or whipsaws, sit tight and wait for clearer setups.

Tokyo and London Overlap

This overlap (8 AM to 9 AM UTC) is shorter and less wild, but still useful. I use it for scalping JPY pairs like EUR/JPY or GBP/JPY. The movement isn’t explosive, but it’s smooth and often more predictable.

Sydney and Tokyo Overlap

Early birds or Asian-based traders often start here (12 AM to 7 AM UTC). It’s a quieter time with lower spreads on AUD/JPY or NZD/USD. I personally avoid this unless I have a strong catalyst — like a central bank statement out of Japan or Australia.

Best Times to Trade by Region

When I started trading while traveling, one of the hardest parts was figuring out the “right” time to sit down and trade. Depending on where you live, the best Forex trading window changes. Below, you’ll find a breakdown of optimal local trading times in the U.S., Europe, and Asia-Pacific. This helped me stop missing key setups just because I was in the wrong timezone.

United States (EST/PST)

If you’re based in the U.S., your golden window is between 8:00 AM and 12:00 PM EST. This is the London/New York overlap and offers the tightest spreads and highest volatility for pairs like EUR/USD and USD/JPY.

Here’s how it breaks down by U.S. time zone:

| Time Zone | Best Trading Window |

|---|---|

| Eastern (EST) | 8:00 AM – 12:00 PM |

| Central (CST) | 7:00 AM – 11:00 AM |

| Mountain (MST) | 6:00 AM – 10:00 AM |

| Pacific (PST) | 5:00 AM – 9:00 AM |

Europe (CET/UTC)

In Europe, your best action comes right when London opens at 8:00 AM UTC. That’s when I saw big movement in EUR/USD and GBP/USD while living in Madrid. Stay sharp through the first few hours of London, especially when economic news hits.

Asia-Pacific (JST, AEST)

If you’re in Asia or Australia, your prime session will be Tokyo’s open. It starts at 9:00 AM JST. Pairs like USD/JPY, AUD/JPY, and NZD/USD are most active then. I’ve found this session calmer, more technical — perfect for traders who dislike chaos.

When to Avoid Trading

I’ve lost more trades than I care to admit during “dead” hours — usually out of boredom or impatience. The worst times to trade are when no one else is trading.

Low-Volume Hours

Between 2:00 PM and 5:00 PM EST, right after the New York lunch lull and before Sydney opens, things slow down. Spreads widen. Price action becomes choppy. Unless there’s unexpected news, I usually avoid this window like the plague.

Weekend Gaps and Rollovers

Forex closes Friday at 5:00 PM EST and reopens Sunday at 5:00 PM EST. Gaps often occur when markets digest news over the weekend. I once held a trade over the weekend — big mistake. It gapped 50 pips against me. Lesson learned: don’t leave positions open unless you’re ready for surprises.

Also, rollover happens at 5:00 PM EST daily, and spreads can spike. Avoid entering trades around this time unless you enjoy paying swap fees or dealing with odd price moves.

FAQ: Smart Answers to Common Questions

What time is the Forex market most active?

The most active time is during the London/New York overlap, from 8:00 AM to 12:00 PM EST. You’ll see the highest liquidity and volatility here, especially for major pairs like EUR/USD and GBP/USD.

Can I trade Forex on weekends?

No. The market closes on Friday at 5 PM EST and reopens on Sunday at 5 PM EST. Any trades placed during this time won’t be processed until the market reopens. But news can cause weekend gaps, so always close risky positions before the weekend.

Is it bad to trade during low-volume hours?

It can be. During low-volume hours, spreads widen, and price movement is unpredictable. If you trade then, you may get poor fills and fewer opportunities. It’s usually better to wait for active sessions unless you have a specific reason or strategy.

Here’s What I Want You to Remember

The Forex market is open 24 hours — but that doesn’t mean you should trade 24 hours. Time is your edge. If you match your trading sessions with peak volume and volatility, you’ll see clearer setups, tighter spreads, and more opportunities.

Let’s recap the most important stuff:

- Forex has four major sessions: Sydney, Tokyo, London, and New York

- Session overlaps (especially London/New York) are the most active

- Your timezone affects when you should trade — adjust your schedule

- Trading during low-liquidity hours usually means wider spreads and more risk

If I had to give you one final tip — build your trading plan around time. Not just entry and exit times, but the very hours you sit down to trade. That shift alone helped me become way more consistent and way less stressed.

So go ahead — check your local time, mark your best sessions, and show up when the market is alive. Because timing, just like price, matters.