When I first started trading Forex, I remember thinking the only fee I had to worry about was the spread. Turns out, I was wrong—very wrong. Broker fees can sneak into your trades in ways that are subtle, complex, and sometimes downright confusing.

Many traders—especially beginners—don’t realize just how much broker fees can eat into your profits. You might think you’re getting a good deal, but if you’re not looking closely, those small costs can pile up fast.

So let’s clear the fog. This guide will walk you through every major type of Forex broker fee, from the obvious to the hidden. And I’ll show you how I learned to spot them, reduce them, and avoid the common traps.

- Spreads: What they are and how they’re measured

- Commissions: When they apply and how they differ

- Hidden fees: Slippage, swap charges, and surprise admin costs

- Broker models: How ECN and Market Makers structure fees

- Practical tips: How to reduce trading costs like a pro

If you want to trade smarter and keep more of your profits, understanding fees isn’t optional—it’s essential.

What Are Forex Broker Fees?

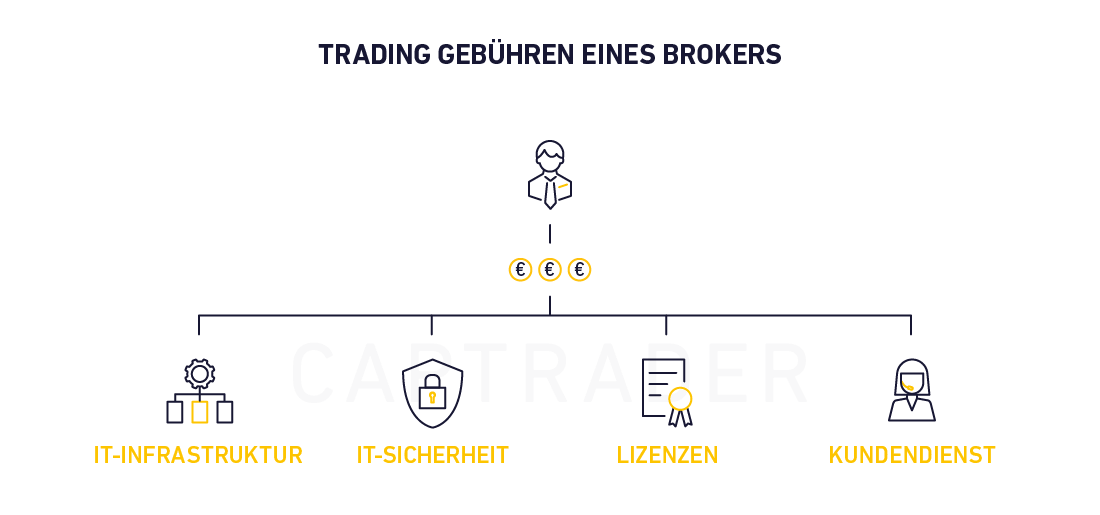

Forex broker fees are the costs you pay to place trades in the currency market. They’re how brokers make money. Some are upfront and visible. Others are hidden deep in the details.

I didn’t fully understand this until I switched brokers and suddenly noticed my balance was lower than expected—despite winning trades. That’s when I learned that not all fees show up in obvious ways.

Why Fees Matter in Forex Trading

Every pip counts. That’s not just a saying—it’s the truth. Whether you’re scalping or swing trading, fees chip away at your bottom line. For example, a 2-pip spread on EUR/USD means you start every trade 2 pips in the red.

Over hundreds of trades, this adds up fast. Trust me—I’ve been there. Your edge might be solid, but if your fees are too high, you’re still bleeding money.

Different Broker Models: ECN vs. Market Makers

Let’s talk about how brokers actually structure their fees.

ECN brokers connect you directly to the market. They usually charge tight spreads but add a commission per trade. I switched to an ECN model once and loved the precision—but the commissions surprised me.

Market Makers offer fixed or variable spreads. They don’t charge commission, but the spread can be wider—especially during news events. It’s simpler, but you might pay more in the long run.

Spreads: The Most Common Forex Fee

A spread is the difference between the bid (sell) and ask (buy) price. It’s measured in pips, the smallest price movement in most currency pairs. If the bid is 1.2000 and the ask is 1.2002, that’s a 2-pip spread.

Spreads are baked into your trade. You pay it up front—no invoice, no reminder. It just happens.

Fixed vs Variable Spreads

Fixed spreads stay the same, even during volatile markets. I used a fixed-spread broker early on. It was predictable but slightly more expensive per trade.

Variable spreads change depending on market liquidity and volatility. They’re tighter during calm periods but can widen fast during news releases. If you’ve ever traded NFP, you know exactly what I mean.

How Spreads Are Measured in Pips

One pip is typically 0.0001 for most currency pairs (except JPY pairs, where it’s 0.01). So a 3-pip spread on EUR/USD equals 0.0003. It sounds tiny—but in a $100,000 trade, that’s a $30 cost right there.

Commissions: Flat Fees or Per Lot

Some brokers use commissions instead of (or in addition to) spreads. These are flat charges per trade, usually calculated per “lot.” One standard lot equals 100,000 units of the base currency.

When I moved to a broker offering 0.1 pip spreads but charging $7 per lot round trip, I had to rethink how I measured my cost per trade. It wasn’t better or worse—just different.

When You Pay a Commission

You’ll pay a commission when using ECN brokers. This setup is common with platforms like MetaTrader 4 and cTrader. Most commissions are charged “round trip”—meaning one fee for entering and exiting a trade.

Comparing Spread-Only vs Commission-Based Brokers

| Broker Type | Spread (EUR/USD) | Commission | Total Cost (per standard lot) |

|---|---|---|---|

| Market Maker | 1.5 pips | $0 | $15 |

| ECN | 0.3 pips | $7 round trip | $10 |

As you can see, ECN brokers can be cheaper. But you have to factor in both the spread and the commission to get the full picture.

Hidden & Additional Costs You Should Know

This is where things get tricky. I once held a trade overnight and got hit with a swap fee that wiped out half my profit. I had no idea it was coming.

Overnight Swap Fees Explained

If you hold trades overnight, your broker might charge you a swap fee (also called a rollover fee). This is based on the interest rate difference between the two currencies in the pair.

Sometimes, you earn money instead of paying it—but more often than not, it’s a cost. These fees are charged daily at a set time, typically 5 pm EST.

Slippage and Its Cost

Slippage happens when your order is filled at a worse price than expected. It’s common during high volatility and low liquidity. I’ve had trades move 5 pips against me in less than a second—just from slippage.

It’s not always avoidable, but using limit orders or trading during active sessions (like London or New York) helps reduce it.

Other Fees: Deposits, Withdrawals, Admin Fees

Let’s not forget the annoying little charges:

- Withdrawal fees — Some brokers charge $5–$30 per withdrawal

- Inactivity fees — Charged if your account sits idle too long

- Maintenance or wire transfer fees — Rare but real

Always check a broker’s fee schedule before signing up. Don’t rely on just the trading platform interface.

How to Reduce Your Trading Costs

I’ve spent years testing brokers, switching accounts, and tweaking my strategy. Along the way, I picked up some simple ways to cut costs—without compromising on execution or safety.

Choosing the Right Broker

Start by researching broker fee structures. Look beyond flashy spreads. Read the fine print. A broker offering 0 pip spreads but charging $10 per lot might not be cheaper than one with a 1-pip spread and no commission.

I like to test brokers using small accounts. If possible, use a demo account to test spreads and slippage. Then compare their actual execution to the rates shown on sites like MyFXBook or ForexPeaceArmy.

Tracking Costs With a Forex Fee Calculator

One tool that helped me was a simple Forex trading cost calculator. You plug in the spread, lot size, and commission—and it shows your total cost per trade. It’s eye-opening when you see how quickly things add up over time.

You can find calculators online from brokers like IG or OANDA, or use a spreadsheet to track your own trades and fees.

FAQs

What is the difference between spread and commission in Forex?

The spread is the difference between the bid and ask price—it’s baked into every trade automatically. A commission is a separate charge per trade, often used by ECN brokers. Some brokers charge only a spread, some only a commission, and others charge both.

Do all brokers charge overnight fees?

No, not all. Some brokers offer swap-free accounts (often called Islamic accounts) that don’t charge overnight fees. But most standard accounts do. These charges depend on the interest rate differential between the two currencies in a pair.

Can I avoid hidden fees with any broker?

You can minimize them by reading a broker’s full fee disclosure before opening an account. Choose brokers that are regulated, offer transparent pricing, and publish real-time spread data. Also, test slippage by trading around news events or low-liquidity hours.

What’s the cheapest way to trade Forex?

There’s no one-size-fits-all answer, but here’s what’s worked for me:

- Use a regulated ECN broker with tight spreads and low commissions

- Trade during high-liquidity sessions (like London-New York overlap)

- Avoid holding trades overnight unless necessary

- Use limit orders to reduce slippage

The key is to test, track, and adjust as you go.

Recap of Key Points

Forex broker fees come in many forms—and understanding them is crucial if you want to keep more of your profits. Whether it’s the spread you pay on every trade, commissions from ECN brokers, or hidden charges like swap fees and slippage—they all impact your bottom line.

Final Takeaway

I used to think I could ignore the small stuff—until I saw how much those “small” costs added up. Now, I choose brokers with intention. I read the fee schedules. I test with real money. I use tools to track my costs. And you should too.

Closing Thought

You don’t need to be an expert to avoid getting burned by fees. You just need to stay curious, ask questions, and run the numbers. In the world of trading, details aren’t just important—they’re everything.