If you’re anything like me, finding the right Forex broker can feel like hunting for a needle in a haystack. I’ve tested, reviewed, and even lost trades with dozens of brokers before I found ones I could trust. And the truth is—some brokers really do make it easier (and cheaper) to trade than others.

Choosing poorly? That can mean slippage, wide spreads, or worse—getting stuck with an unregulated platform that vanishes when you need support.

So I put together this guide to help you compare Forex brokers the way I do: hands-on, unbiased, and with a trader’s mindset.

Here’s what I’ll break down:

- How spreads and account types affect your costs

- Where you can legally access higher leverage

- Which trading platforms (like MT4 or TradingView) give you an edge

- How to evaluate a broker’s safety and regulation

- What tools and features matter for YOUR strategy

By the end, you’ll have everything you need to make a confident choice—and stop second-guessing your broker.

What to Look for in a Forex Broker

Spreads Make a Bigger Difference Than You Think

I used to think a few tenths of a pip didn’t matter. But when I started scalping EUR/USD on a 0.0 pip ECN account vs a standard 1.2 pip account, my results spoke for themselves. Low spreads mean faster break-evens—and lower costs per trade. Brokers like FP Markets and Tickmill consistently offer 0.0–0.1 pip spreads on majors [source].

Leverage Isn’t Evil—But It’s Not for Everyone

If you’re outside the EU or US, you’ve probably seen brokers offering 1:500 or even 1:1000 leverage. Tickmill and Exness top that list. I’ve used 1:500 during major news events—but only with small capital and tight stops. Just remember: more leverage = more risk. Regulated regions like the US limit leverage to 1:50 for good reason [source].

Trading Platforms Matter More Than You Think

If you’ve only used MetaTrader 4, you’re missing out. Don’t get me wrong—I love MT4’s custom indicators. But TradingView’s sleek charts and Tickmill Trader’s built-in analytics changed the way I trade. If speed and ease-of-use matter to you, test different platforms. Some brokers, like FP Markets, offer all of them—MT4, MT5, cTrader, and even TradingView integration.

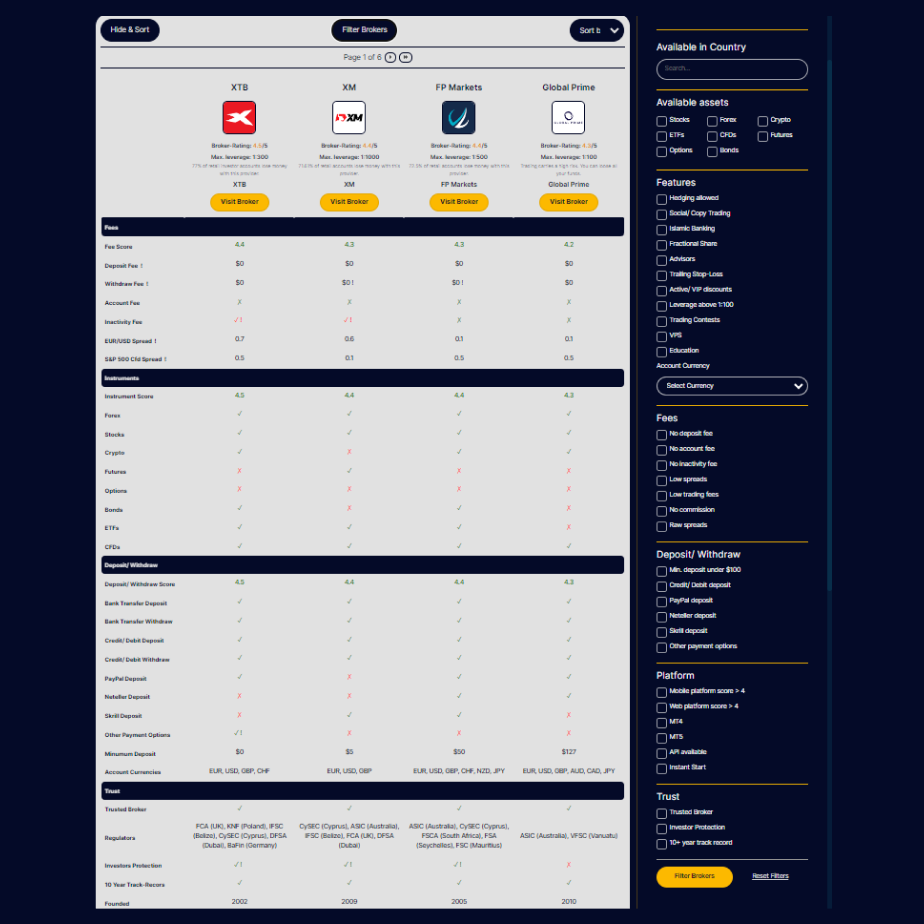

Best Forex Brokers in 2025 (Side-by-Side Comparison)

I built this table to compare top Forex brokers on what matters most—cost, leverage, platforms, and safety. All data was cross-verified from official broker pages and regulatory sites.

| Broker | Typical Spreads (EUR/USD) | Max Leverage | Platforms | Regulators | Minimum Deposit |

|---|---|---|---|---|---|

| FP Markets | 0.0 pips (Raw) | 1:500 | MT4, MT5, cTrader, TradingView | ASIC, CySEC | $0 |

| Tickmill | 0.0 pips (Pro) | 1:1000 | MT4, MT5, Tickmill Trader | FCA, CySEC | $100 |

| Fusion Markets | 0.1 pips | 1:500 | MT4, MT5 | ASIC | $0 |

| XTB | 0.1 pips | 1:500 | xStation 5, MT4 | FCA, CySEC | $0 |

| Exness | Variable, ultra low | Unlimited* | MT4, MT5, Exness Terminal | FCA, CySEC, FSCA | $10 |

Platform and Tool Offerings

When I started out, I only cared if a broker supported MT4. Now, I test brokers based on their execution speed, charting tools, and copy trading systems. Tickmill has a solid built-in copy trading system, while FP Markets offers TradingView integration for advanced charting. If you’re using automated bots (like EAs), make sure the broker supports fast, low-latency execution.

Regulation and Safety

This one’s non-negotiable for me. I only use brokers regulated by top-tier bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). They offer stronger protections like negative balance protection and fund segregation. If a broker doesn’t clearly state their regulator, that’s a red flag. Check sites like FCA UK or CySEC for license confirmation.

How to Choose the Right Broker for You

Start with Your Strategy

If you scalp, you need tight spreads and fast execution. If you swing trade, platform tools and swap rates might matter more. I had to learn the hard way when a broker’s overnight fees wiped out my swing trade profits. Know your needs first.

Test With Demo Accounts

Before I funded any account, I tested the broker’s execution, slippage, and customer service on a demo. Some brokers like XTB and OANDA offer unlimited demos. You’ll feel the difference in platform speed right away.

Customer Support and Education

In my early days, I leaned heavily on broker tutorials. Brokers like FOREX.com and IG offer full education hubs. Others like Fusion Markets skip education but focus on ultra-low spreads. Pick what helps you grow. And test customer support—I once had to wait 48 hours for a reply. That’s not okay.

What is the Difference Between Raw Spread and Standard Accounts?

I used to think all spreads were created equal—until I tried a Raw account. A standard account wraps broker fees into the spread, meaning you’ll pay slightly more per trade without seeing a line-item commission. With Raw or ECN accounts, spreads are near zero, but the broker charges a flat commission per lot. If you’re a high-frequency or scalping trader, Raw accounts usually end up cheaper over time. For casual traders, standard accounts might be simpler.

What is the Safest Leverage to Use in Forex Trading?

There’s no one-size-fits-all answer, but I’ve found anything above 1:100 starts getting risky, fast. Personally, I stick to 1:50 or lower for most trades. That gives me flexibility while protecting my account from overexposure. Remember, higher leverage can amplify profits—but it also magnifies losses. Always match your leverage to your risk tolerance and experience.

Which Brokers Are Best for Beginners?

If you’re new to trading, you want a broker that offers:

- A low or no minimum deposit

- Simple platform like MT4 or a proprietary app

- Great customer support and easy funding options

Based on my testing, I’d recommend Fusion Markets (no deposit, clean MT4 setup) or XTB (great for educational content and beginner tools). Both are regulated and beginner-friendly. And yes, I’ve opened live accounts with both.

How Do I Verify If a Broker Is Regulated?

Always start by scrolling to the bottom of the broker’s homepage. Legit brokers will list their regulation licenses—like “FCA #509956” or “ASIC License No. 287081.” Then, go to the official regulator’s site (like FCA or CySEC) and search the broker’s name. If you can’t find them? Walk away.

Recap of Key Points

We covered a lot, so let’s keep it tight. Spreads impact your trading costs—Raw accounts usually win on price. Leverage gives you power, but with risk. Your trading platform should match your strategy. Regulation isn’t optional—it’s your first line of defense. And always test brokers before going live.

Final Takeaway

Don’t choose a broker just because it’s “popular” or ranked #1 on some affiliate site. Choose based on what YOU need as a trader. Use comparison tables. Ask questions. Read the fine print.

Closing Thought

I’ve spent years reviewing brokers—sometimes winning big, sometimes learning the hard way. But if there’s one thing I know for sure, it’s this: the right broker won’t make you a profitable trader overnight, but the wrong one can break you fast. Choose wisely. And if you’re still unsure, test a demo. That small step could save your whole account.