As a trader, have you ever found yourself acting impulsively after hearing about a hot trade, just because everyone else is talking about it? If you have, then you’ve experienced FOMO—Fear of Missing Out. It’s a real psychological hurdle that can negatively impact your trading decisions, leading to overtrading, increased risks, and ultimately, losses. But it doesn’t have to be this way. Understanding and managing FOMO in trading can lead to more informed, rational decisions, and even greater success.

FOMO can sneak up on even the most experienced traders, causing them to take unnecessary risks or deviate from their well-laid trading plans. This article will guide you through the psychology of FOMO and show you how to manage it so that you can make more consistent, profitable trades.

Key Topics

- What FOMO is and how it impacts trading decisions.

- Recognizing the signs of FOMO in your trading behavior.

- Practical steps to overcome FOMO and improve your trading psychology.

- Mindfulness practices to help control impulsive decisions.

- Why long-term goals are crucial in avoiding FOMO-driven trades.

Value Proposition

By understanding FOMO, you’ll be better equipped to maintain a steady, strategic approach to trading. This not only improves your profits but also helps in developing a healthy, long-term mindset towards the market.

Understanding FOMO and Its Impact on Trading

What is FOMO?

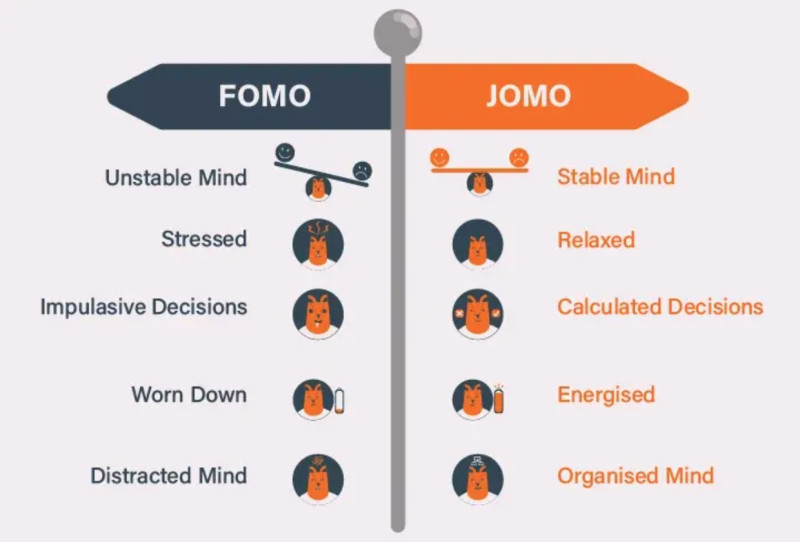

FOMO, or Fear of Missing Out, refers to the anxiety or regret experienced when you believe that you’re missing out on a potentially profitable opportunity. It often arises when you see others profiting from a trade that you did not make. In trading, this can manifest as a sudden urge to jump into a trade just because others are doing so, regardless of your trading plan or strategy.

Why FOMO is Dangerous in Trading

Acting on FOMO is detrimental to your trading performance. FOMO often causes traders to make hasty decisions, which can lead to entering poorly timed trades, overleveraging, or breaking risk management rules. These impulsive decisions increase the likelihood of losses, especially in volatile markets.

The Psychological Drivers of FOMO in Traders

Several factors fuel FOMO in trading. One of the biggest culprits is the influence of social media and forums. Hearing stories of massive profits can trigger FOMO, even when the trade does not align with your strategy. It’s crucial to recognize that not every opportunity is the right one for you, no matter how enticing it may seem in the moment.

Recognizing Signs of FOMO in Your Trading Behavior

Impulsive Decisions

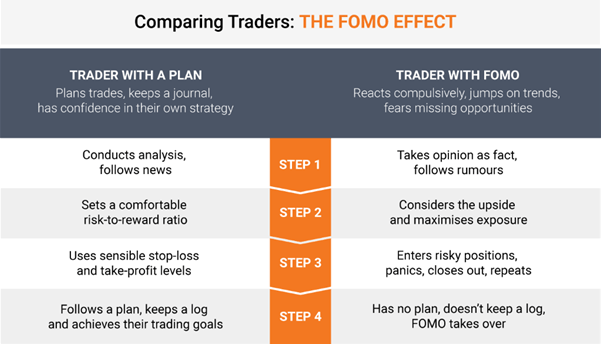

If you find yourself rushing into trades without proper analysis, it could be a sign of FOMO. Impulsive decisions often arise from a desire to “catch up” or “not miss out,” but these trades are rarely part of a solid plan. Impulsive trading is a hallmark of FOMO-driven behavior.

Overtrading and Revenge Trading

Another sign of FOMO is overtrading—placing trades simply because you’re afraid of missing out. This often leads to revenge trading, where you take excessive risks to recover from a previous loss. Both are destructive behaviors that can quickly deplete your capital.

Comparing Yourself to Others

It’s easy to get caught up in what others are doing, especially when you see someone else making a profitable trade. But comparing your performance to others only increases the pressure to act on FOMO. It’s important to remember that everyone’s trading journey is different, and it’s okay to let go of missed opportunities.

Steps to Overcome FOMO and Improve Your Trading Psychology

Pause and Reflect

The first step to overcoming FOMO is recognizing it. Once you feel the urge to act impulsively, take a moment to pause and reflect. This cooling-off period gives you time to assess the situation logically and stick to your plan.

Stick to a Trading Plan

A well-crafted trading plan is your best defense against FOMO. The plan should outline your entry and exit points, risk management strategies, and trade size. By following your plan, you’ll avoid the temptation of acting impulsively based on external pressures.

Focus on Long-Term Goals

Instead of chasing every opportunity, keep your eyes on the bigger picture. Your long-term success is far more important than any short-term gain. Focusing on long-term goals helps you stay grounded and avoid making decisions based solely on FOMO.

Practical Strategies for Handling FOMO in Trading

Use Stop-Loss and Risk Management Tools

Risk management is essential in protecting your trading capital. By using stop-loss orders, you can ensure that your losses are limited, even in volatile market conditions. This minimizes the impact of impulsive decisions driven by FOMO.

Set Clear Entry and Exit Points

Before you enter any trade, define your entry and exit points. By doing so, you remove the uncertainty and emotion from the decision-making process. This makes it much easier to avoid acting on FOMO.

Limit Social Media Exposure

Excessive exposure to social media, trading forums, and market news can amplify FOMO. Limit your time on these platforms to reduce the temptation to jump into trades that aren’t part of your strategy.

Mindfulness and Emotional Discipline: A Trader’s Secret Weapon

The Role of Mindfulness in Trading

Mindfulness is about being aware of your thoughts and emotions in the moment without letting them control you. By practicing mindfulness, you can gain better control over impulsive reactions, especially when you feel the pull of FOMO.

Journaling and Reflection

Keeping a trading journal is an excellent way to reflect on your emotions and actions. It allows you to track your emotional state before and after trades, helping you learn from your mistakes and avoid repeating them in the future.

Stress Management Techniques

Stress is inevitable in trading, but managing it is key to avoiding FOMO-driven decisions. Breathing exercises, physical activity, and adequate rest can help you maintain a calm and focused mindset, no matter the market conditions.

When to Walk Away from a Trade

Recognizing When You’re in a FOMO Cycle

Sometimes, it’s not enough to simply pause for a moment. If you find yourself repeatedly looking for opportunities based on fear rather than strategy, it’s time to step back. Recognize when you’re in a cycle of chasing every opportunity and force yourself to take a break. Walking away might be the best thing you can do to clear your head and reset your mindset.

The Power of Patience in Trading

In trading, patience is more than a virtue; it’s a necessity. Missing out on one trade isn’t going to ruin your career. By practicing patience, you give yourself the best chance to wait for high-probability trades that align with your strategy. Trust that there will always be other opportunities in the market.

Learning to Let Go of Missed Opportunities

It’s natural to feel regret after missing a trade, but holding on to that feeling can cloud your judgment. Acknowledge the missed opportunity and move on. There will always be another trade, and by letting go, you free yourself from the emotional baggage that could cause poor decision-making in the future.

The Benefits of Managing FOMO for Your Trading Success

Increased Confidence in Your Decisions

By managing FOMO and sticking to your trading plan, you’ll start to notice an increase in your confidence. No longer will you second-guess every decision based on external noise. When you trade with confidence, you’ll be able to make better decisions with a calm and focused mind.

Better Risk Management

With a clear plan and emotional control, you will be able to better assess the risks involved in any trade. Instead of diving into a trade on a whim, you’ll take calculated risks that align with your risk tolerance and strategy. Better risk management reduces the potential for large losses and helps preserve your capital.

Sustainable Long-Term Profits

Focusing on long-term success rather than short-term wins is the key to sustainability. Managing FOMO ensures you don’t get caught up in the fleeting opportunities that can distract you from your bigger goals. By sticking to your strategy, you can consistently build profits over time while avoiding the pitfalls of emotional trading.

Frequently Asked Questions

How can I stop feeling pressured to trade in the market?

Feeling pressured to trade often comes from FOMO or external influences. One of the best ways to stop feeling pressured is by sticking to a trading plan. Make sure to have a clear strategy with predefined entry and exit points, and remind yourself that missing one trade doesn’t define your success. By focusing on your long-term goals, you’ll be able to resist the pressure of making impulsive trades.

Is it normal to feel FOMO as a beginner trader?

Yes, FOMO is especially common among beginners who are still learning the ropes of trading. It’s easy to get swept up in the excitement of the market and feel like you’re missing out. However, understanding FOMO and learning to control it is part of the trading process. As you gain more experience, you’ll become better at recognizing and managing FOMO, leading to better decision-making in your trades.

What are the best tools to help manage FOMO in trading?

Risk management tools like stop-loss orders are invaluable for managing FOMO. These tools ensure you exit trades if things go wrong, limiting the impact of impulsive decisions. Additionally, using a trading journal and setting clear entry and exit points for every trade can help you stay disciplined. Staying off social media and focusing on your personal strategy will also reduce FOMO triggers.

How can I deal with the urge to chase a trade after seeing others’ success?

It’s easy to feel the urge to chase a trade when you see others profiting. To counter this, remind yourself of your trading plan and focus on the bigger picture. Take a break from social media and forums, where success stories can often amplify FOMO. Trust that your strategy will bring success over time, and remember that one missed trade is not a lost opportunity.

Epic Takeaway: Managing FOMO for Success

Recap of Key Points

Managing FOMO is all about maintaining control over your emotions, staying patient, and sticking to your trading plan. By recognizing the signs of FOMO, practicing mindfulness, and focusing on long-term goals, you can overcome impulsive decisions and trade more strategically. Risk management tools and reducing external distractions like social media are essential in this process.

Final Takeaway

Overcoming FOMO in trading takes time and practice, but it’s absolutely worth it. By trading with a clear mind, a solid strategy, and emotional discipline, you’ll increase your chances of success and create a more sustainable trading career. The market will always present opportunities, but it’s up to you to choose which ones align with your goals and your strategy.

Closing Thought

Remember, trading is a marathon, not a sprint. Managing FOMO ensures that your decisions are rooted in strategy and long-term success, not fleeting impulses. Embrace the journey, and don’t let FOMO control your trades!