When I first started trading, I didn’t realize just how powerful my emotions could be. I’d enter a trade with confidence, only to bail out too soon because of fear. Or worse, I’d hold on way too long, convinced I’d hit a jackpot, driven purely by greed. Sound familiar?

It turns out, fear and greed are the biggest saboteurs in trading. These emotions sneak in, cloud your judgment, and trick you into making moves that don’t align with your plan. But the good news is, they can be managed.

Through trial, error, and guidance from mentors, I’ve learned a few powerful ways to quiet the noise in my head and trade more like a calm strategist and less like a casino addict.

In this guide, you’ll learn how to:

- Understand how fear and greed show up in your trades

- Build a trading plan that reduces emotional decision-making

- Recognize emotional triggers before they wreck your trades

- Adopt tools that ground you during high-stress sessions

Let’s break it down together so you can trade with more confidence, clarity, and consistency—even when the market’s going nuts.

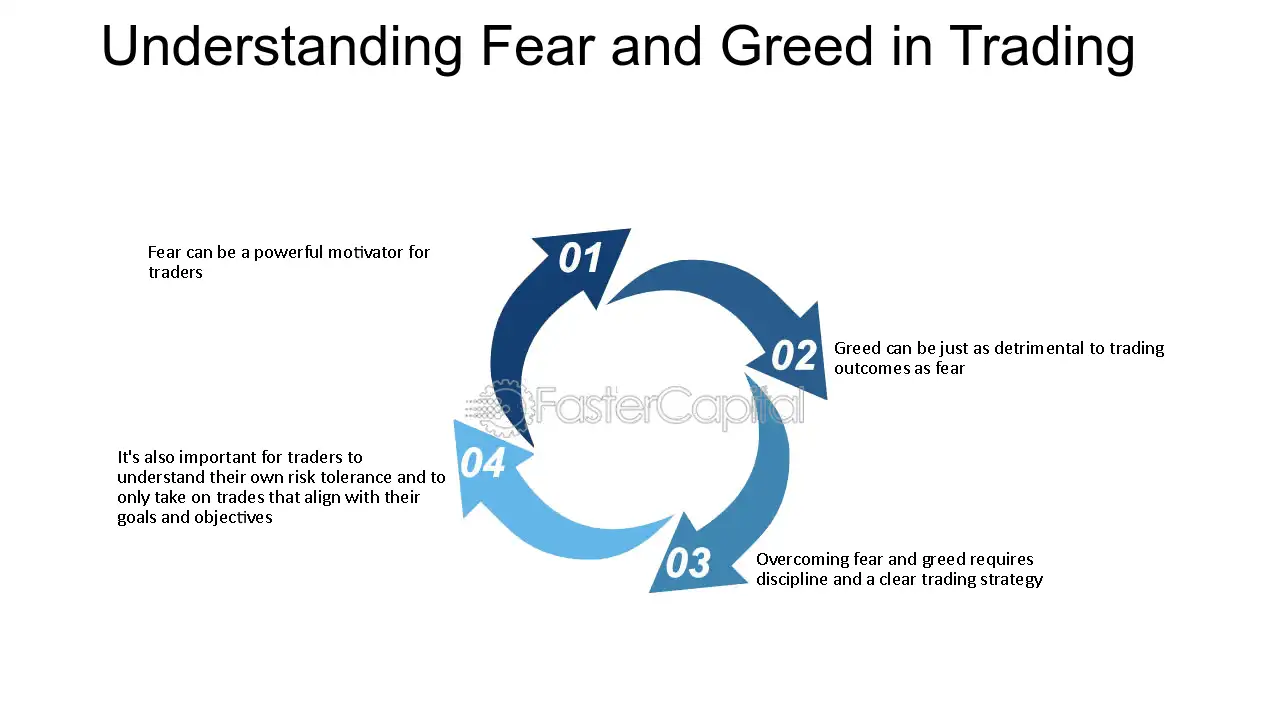

Fear and Greed in Trading

Why Fear and Greed Sabotage Traders

Understanding Emotional Bias

Trading isn’t just numbers and charts—it’s psychology. Your emotions can hijack your logic without warning. Fear creeps in when you’re losing or unsure. Greed? It usually shows up when you’re winning and feeling invincible. Recognizing this emotional bias is step one to staying grounded.

The Fear Response in Trading

I used to exit trades too early because I was afraid of losing profits. Fear made me ignore my plan and second-guess my setups. It’s not just me. Many traders hesitate to enter good trades or cut them short, fearing they’ll lose money. This emotional paralysis can cost you big opportunities.

How Greed Takes Over

Greed convinces you that one more pip is worth the risk—even when your chart screams “get out.” It’s that voice saying, “Let’s double down,” even though your position is already bloated. I’ve been burned here too, especially when overleveraging, chasing unrealistic returns, or skipping stop-losses.

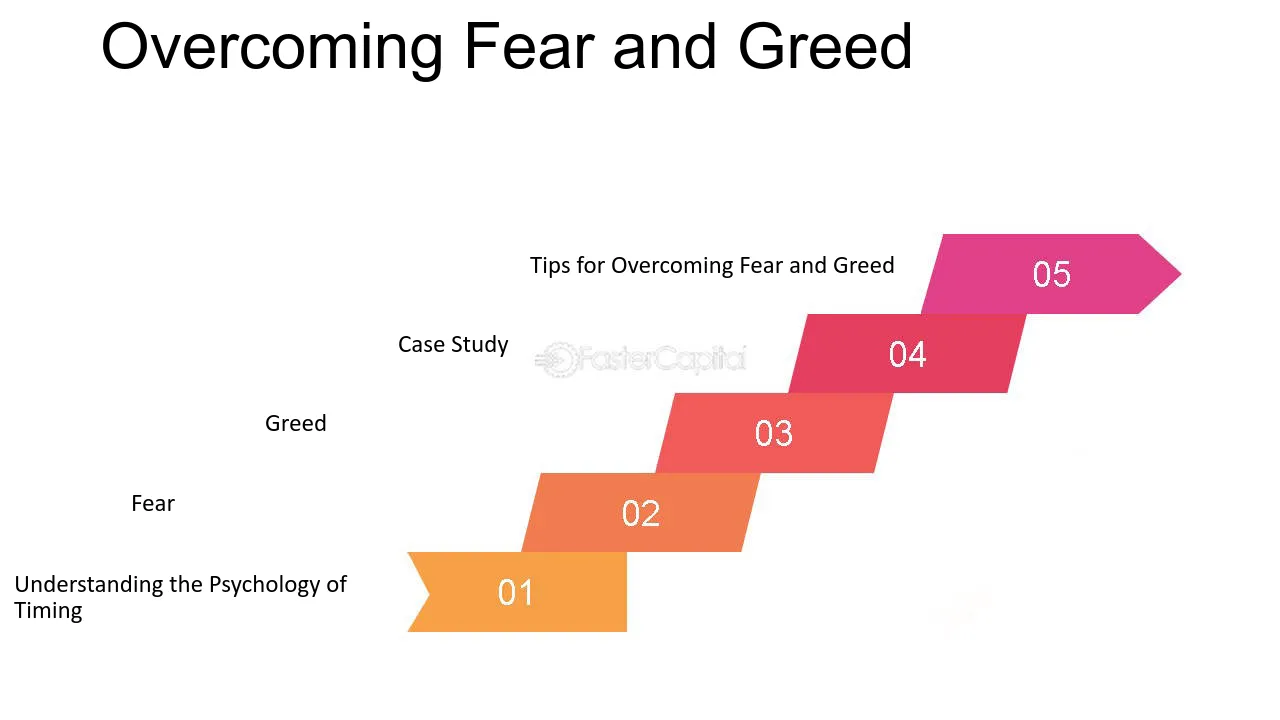

Step-by-Step Strategy to Control Emotions

Step 1: Create a Solid Trading Plan

This changed everything for me. When I began writing down my entry points, exit strategies, and risk rules, I stopped guessing. A solid plan tells your emotional brain to take a back seat. Include these in your plan:

- Clear entry/exit rules

- Risk per trade (1-2% max of your capital)

- What to do if a trade goes south

Having this roadmap gave me structure and consistency. No more reacting to FOMO or panic candles.

Step 2: Use Proactive Risk Controls

Risk management is your emotional safety net. I learned to always use stop-loss and take-profit orders. This way, I didn’t have to watch every tick and stress about pulling the trigger. Proper position sizing also helped me stay cool—I wasn’t sweating every pip.

Diversification was key, too. Instead of putting all my hopes into one high-risk trade, I spread my bets across different setups. It made losses easier to handle and wins more balanced.

Step 3: Build Emotional Awareness

You can’t change what you don’t notice. I started journaling my trades—and not just the numbers. I’d write how I felt when I entered, during the trade, and after. Over time, patterns emerged. I noticed I got greedy when I was overconfident, or fearful when I was trading money I couldn’t afford to lose.

I also tried short mindfulness breaks before trading. Just two minutes of quiet breathing helped me reset and stay present. Emotional awareness isn’t soft; it’s strategic.

Step 4: Focus on Process, Not Profits

I used to obsess over profit goals. When I hit them, I’d push for more. When I missed them, I’d chase losses. Either way, it was a loop of bad decisions. Switching to a process-oriented mindset changed my game. Now, I focus on executing my plan perfectly, even if the trade loses. That’s a win in my book.

Trusting your process also takes the pressure off. You’re not trying to “win” every trade—you’re trying to be consistent over time. That mindset alone cut my stress in half.

Step 5: Learn and Review Constantly

Every loss became a lesson once I started reviewing my trades weekly. I’d look at what went wrong—but more importantly, how I felt during the trade. Did I follow my plan? Did I ignore red flags out of greed?

It wasn’t about shaming myself. It was about understanding and adjusting. I’d tweak my plan based on recurring emotional triggers. That’s how growth happens—through self-honesty, not perfection.

| Key Technique | How It Helps Overcome Fear/Greed |

|---|---|

| Solid Trading Plan | Reduces impulsive, emotion-driven decisions |

| Strict Risk Management | Limits losses and overexposure |

| Emotional Awareness | Helps recognize and manage emotional triggers |

| Focus on Process | Builds consistency and resilience |

| Continuous Learning | Turns setbacks into growth opportunities |

| Peer Support | Provides perspective and emotional balance |

Step 6: Get Support and Mentorship

This one’s huge. I joined a trading Discord community, and it changed my mindset fast. Watching others go through the same struggles helped me feel normal. Getting real feedback, encouragement, or even a “don’t do that again” nudge from experienced traders sped up my growth.

If you can find a mentor, even better. Someone who’s been in the trenches can show you how to manage trades with clarity and calm, not just theory. Emotional discipline gets stronger when you’re not doing it alone.

Common Triggers and How to Deal with Them

Dealing with Market Volatility

Volatile markets used to make me panic. One second, I was up. The next, my stop-loss was triggered. It felt chaotic. But once I accepted that volatility is normal—and adjusted my strategy—I felt way more in control.

Now I widen my stop-loss slightly during news events and reduce my position size. I also avoid revenge trading after a big move goes against me. Volatility isn’t something to fear—it’s something to prepare for.

How to Handle Winning and Losing Streaks

After a few wins, I used to feel invincible. That’s when greed kicked in. I’d ignore my plan, overtrade, and give everything back. During losing streaks, fear would make me hesitate or skip valid setups entirely. It’s like a psychological seesaw.

What helped? I started treating wins and losses the same. I log every trade and detach emotionally. One or two outcomes don’t define my edge—it’s the next 100 trades that matter.

Recognizing FOMO and Greed Before They Take Over

FOMO—fear of missing out—is sneaky. A trade moves fast, and suddenly you feel like you’ll “miss the train.” That’s when I’d jump in late and usually regret it. Now, I watch for these mental cues:

- Feeling rushed to enter

- Ignoring my rules just this once

- Telling myself “this setup looks different” when it’s not

Once I feel any of these, I step back. I remind myself: if this setup isn’t in my plan, I don’t need it. There will always be another trade.

Tools and Techniques to Stay Grounded

Journaling and Mindfulness

This practice is gold. After every trading session, I jot down what I did, why I did it, and how I felt. Even just two minutes of reflection helps me spot patterns. It’s helped me separate smart trades from lucky ones—and emotional decisions from strategy.

On top of that, I’ve started doing short mindfulness exercises before the market opens. A quick breathing session resets my mindset. No screens. No alerts. Just a pause to get centered.

Automation and Rules-Based Systems

If emotions keep derailing you, try automation. I use Expert Advisors (EAs) on MetaTrader to enforce stop-loss and take-profit levels. Once the trade is set, it runs without me hovering nervously over the screen.

Rules-based systems are also a lifesaver. I’ve created checklists before entering any trade. If a setup doesn’t meet my criteria—no entry. This mechanical approach reduces second-guessing and keeps my discipline tight.

Trading With a Routine

I’ve learned that routine is the antidote to chaos. I wake up at the same time, review economic news, analyze key levels, and execute during specific hours. No more random trades at midnight. Having a routine reduces surprises and builds trust in your own process.

FAQ

What causes fear in trading?

Fear often comes from uncertainty or past losses. It’s your brain’s way of protecting you from pain. In trading, that fear can make you hesitate, exit early, or avoid valid setups. You can reduce fear by having a clear trading plan, managing risk, and gaining experience over time.

How can I stop letting emotions affect my trades?

The best way to do this is by having a repeatable system, journaling your emotions, and sticking to defined rules. Mindfulness practices, trading with smaller risk, and reflecting on your past trades also help you stay grounded during high-pressure moments.

Is there a tool to manage emotional trading automatically?

Yes. Trading automation tools like EAs (Expert Advisors) or rule-based alerts on platforms like MetaTrader 4 or TradingView help reduce emotional interference. They execute your plan mechanically, which can prevent last-minute emotional changes to your trade setup.

Why do traders lose money even with a good strategy?

Because execution is everything. A solid strategy won’t help if fear makes you exit early or greed makes you overtrade. Success lies not just in having a good system—but also in sticking to it. Emotional discipline is the missing link for most traders.

Recap of Key Points

We’ve unpacked how fear and greed can sabotage your trades—and more importantly, how to take back control. You’ve learned how to:

- Spot emotional triggers in real time

- Develop a strong trading plan with clear rules

- Use risk management to feel safe and steady

- Stay grounded with mindfulness and journaling

- Rely on automation and routines to reduce impulsivity

Final Takeaway

Emotions are part of trading, but they don’t have to run the show. With awareness, structure, and the right mindset, you can build discipline that outlasts any market swing. I’ve been there—overwhelmed, anxious, and frustrated. But with the tools I’ve shared here, I finally started trading with clarity and confidence.

If you only remember one thing, let it be this: your edge isn’t just your strategy—it’s how well you can follow it when emotions run high. Get that part right, and everything else starts to fall into place.

Learn trading psychology.