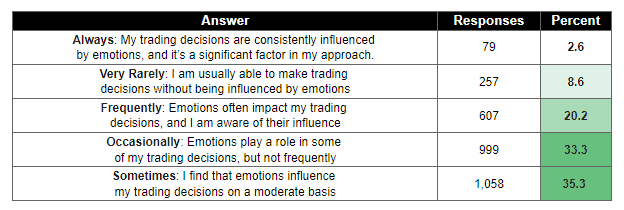

When I started trading Forex full-time, I thought technical skills were all I needed. But over time, I realized that the biggest threat to my profits wasn’t the market—it was my own emotions. If you’ve ever closed a winning trade too early or doubled down on a losing one, then you know what I mean. Fear, greed, regret… they all sneak into your decisions and quietly wreck your strategy.

Trading isn’t just about charts and indicators. It’s about what’s going on in your head—especially when money’s on the line. Emotional trading leads to rushed decisions, inconsistent results, and sometimes devastating losses.

What helped me regain control was understanding how emotions affect my trades—and building tools to stay objective.

In this guide, you’ll discover:

- Why emotions hijack your trading logic

- The most common emotional pitfalls (fear, greed, regret, and more)

- What you can do right now to take back control

- Real tools and mindset shifts that work in live market conditions

By the end, you’ll not only recognize your emotional patterns, but you’ll have strategies to trade with clarity—even when things get intense.

Why Emotions Matter in Trading

I used to think my strategy would shield me from bad trades. But when I saw a big red candle on my screen, all that logic vanished. That’s the thing about emotions—they’re powerful. And in the fast-moving world of Forex, they don’t just influence you. They dominate you if you’re not prepared.

Every decision you make—whether to enter, hold, or exit a trade—is filtered through your emotions. When fear kicks in, we get risk-averse. When greed takes over, we take reckless chances. And when regret lingers, we overcompensate.

Emotional trading creates a loop. One bad decision leads to another, fueled by more emotion. Breaking that loop starts with understanding how these feelings show up.

Common Trading Emotions and Their Impact

Fear

Fear shows up in many ways. Sometimes it’s panic selling during a pullback. Sometimes it’s freezing up and missing an entry altogether. I remember closing a perfectly good trade early because I was afraid of “giving back profits.” I avoided risk—and missed reward.

Fear clouds judgment. It makes you focus on what could go wrong. You hesitate. You exit too soon. Or worse—you avoid placing the trade entirely. And all of that robs you of consistency.

Greed

I’ve been guilty of letting a winning trade run way past my take-profit level because I wanted “just a bit more.” Sound familiar?

Greed makes you ignore your plan. You double your position size after a win. You take setups that don’t align with your edge. And it often ends the same way: a huge reversal wipes out your gains—and then some.

It’s not just about chasing money. Greed convinces you that you’re smarter than the market. That’s when things get dangerous.

Hope and Regret

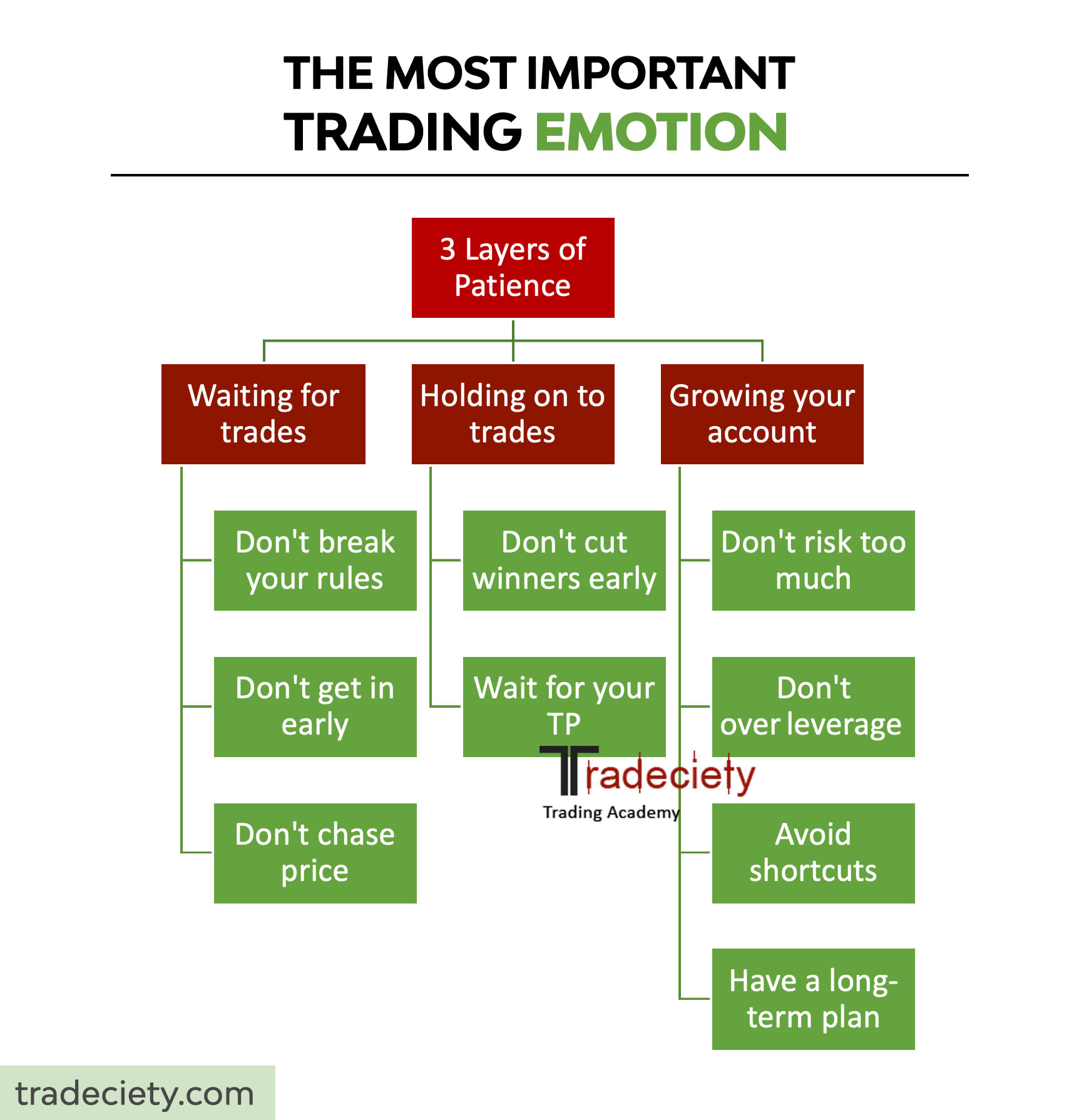

Hope is that little voice saying, “It’ll come back.” I’ve held onto losing trades way longer than I should have, praying for a reversal. I wasn’t trading—I was wishing.

Regret hits after the fact. You missed a great entry, so you jump in late. You cut a winner short, so you chase the next one. It pushes you to act from emotion, not logic. And before you know it, your strategy’s out the window.

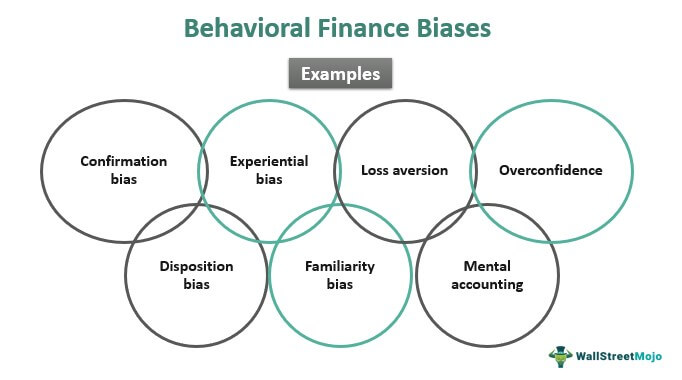

Overconfidence and Impatience

After three green trades in a row, I felt invincible. I cranked up my lot size and ignored my stop-loss. The next loss? It stung—and it was entirely preventable.

Overconfidence gives you a false sense of control. You ignore warnings. You override your system. And impatience pushes you to force trades that aren’t even there.

Both emotions come from ego. And if your ego runs your trades, your account balance won’t last long.

Table: How Emotions Affect Trading Outcomes

| Emotion | Common Behavior | Result |

|---|---|---|

| Fear | Hesitation, premature exits | Missed gains, locked-in losses |

| Greed | Overtrading, holding too long | Larger-than-expected losses |

| Hope | Holding losers too long | Deep drawdowns |

| Regret | Impulsive trades, chasing | Inconsistent performance |

| Overconfidence | Ignoring rules, high risk | Big wipeout losses |

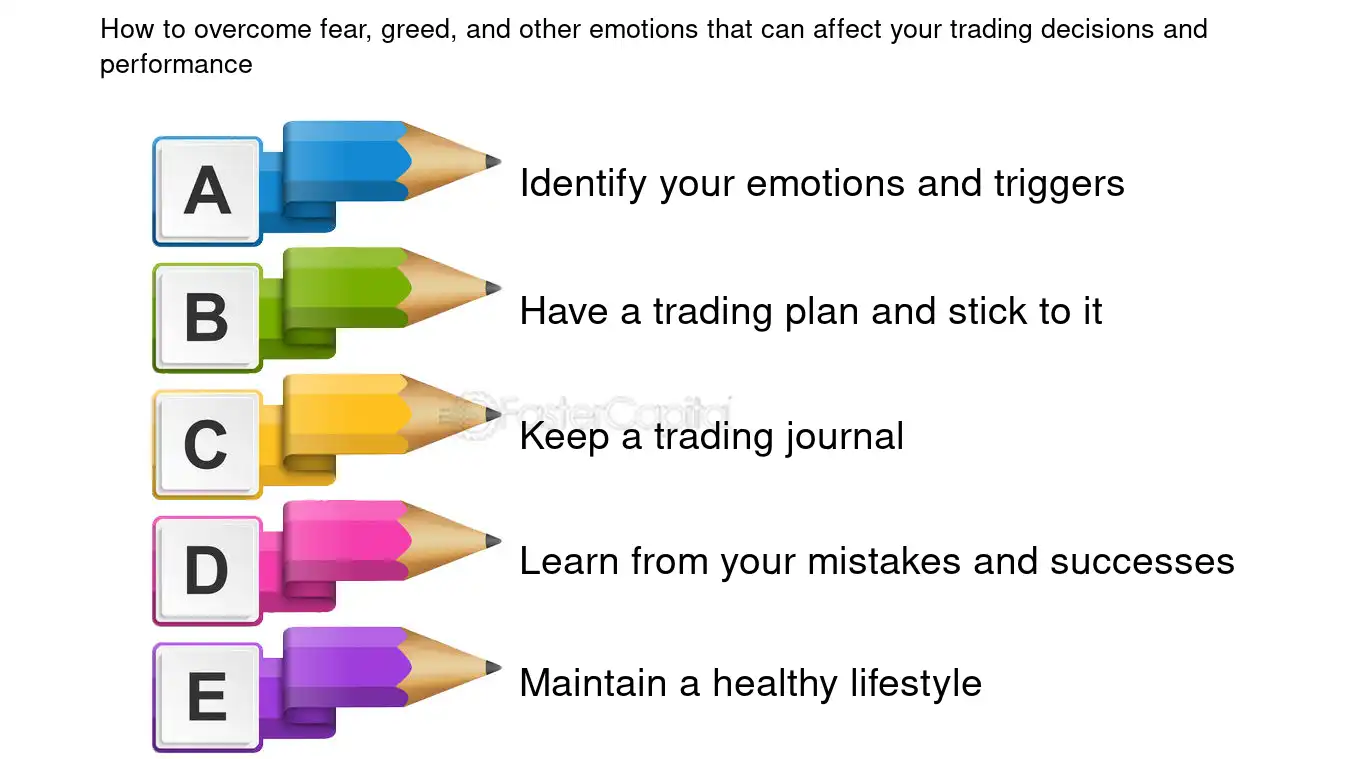

Strategies to Control Emotions While Trading

Have a Solid Trading Plan

When I finally sat down and wrote a detailed trading plan, everything changed. Knowing my entry, exit, and stop before I place a trade takes emotion out of the moment. The plan protects me from myself.

And I backtest it religiously. If a setup doesn’t match the plan, I pass. Simple as that. No second-guessing. No FOMO.

Use Risk Management Tools

One of the best ways I’ve calmed my nerves is by managing position size. I trade small. I always use a stop-loss. And I accept that losses happen.

That mindset shift removed the fear of being wrong. Every trade became just one of many. Not some high-stakes gamble.

Keep a Trading Journal

This was the hardest but most helpful habit: journaling. Not just the trade itself—but how I felt when I took it.

After a few weeks, patterns appeared. I’d rush trades after a win. I’d hesitate after a loss. The emotional triggers were right there in black and white. And that awareness helped me change.

Emotional Reset Techniques

Some days, the markets just get under your skin. When I feel myself getting frustrated or tilted, I step away. Literally. A five-minute walk or a few deep breaths helps reset my mind.

I’ve also used mindfulness techniques—nothing fancy, just focused breathing or short meditations before high-volatility sessions. It brings me back to center and helps me stay grounded. When you treat trading as a process, not a battle, emotions lose their grip.

FAQ: Mastering Emotions in Trading

How do I stop trading with emotions?

Start by building awareness. Journaling your emotional state before and after each trade helps uncover your patterns. Then set strict rules for entries, exits, and risk. Sticking to your plan, even when emotions scream otherwise, builds discipline over time.

What is the most dangerous emotion in trading?

Overconfidence. It sneaks in after a few wins and convinces you the rules don’t apply anymore. That’s when traders go full risk-mode and blow up accounts. Staying humble—even when you’re on a roll—is key.

Can meditation improve trading performance?

Yes, absolutely. Short breathing exercises or 2–5 minutes of mindfulness can help reduce cortisol and sharpen your focus. I’ve personally used this before big news releases, and it helped me stay cool while others panicked.

How does overconfidence ruin traders?

It blinds you. You start ignoring signals, increasing lot sizes, and skipping risk checks. The market punishes that kind of arrogance—hard. I’ve seen it turn a good month into a disaster in a single afternoon.

More Tools That Help (Information Gain)

Real-Life Journal Example

Here’s an actual log from one of my trades:

- Setup: EUR/USD breakout at 1.09500

- Emotion Pre-Trade: Nervous due to last loss

- Result: Closed too early, missed full TP

- Lesson: Fear made me exit early—follow the plan, not the panic

This kind of honest reflection is pure gold. It helps you grow fast—and keeps your ego in check.

Case Study: Overcoming Revenge Trading

One trader I coached had a nasty habit: every time he lost, he’d immediately try to “win it back.” After three weeks of journaling and setting a 2-loss daily max rule, his performance leveled out. He went from 38% win rate to 52% just by removing revenge trades. That’s emotional discipline in action.

Recap of Key Points

Let’s bring it all together. Trading emotions like fear, greed, and regret are normal—but they don’t have to control you. By building a trading plan, using smart risk management, journaling your emotional state, and resetting your focus, you take back the wheel.

Final Takeaway

What separates consistent traders from the rest isn’t just strategy—it’s emotional mastery. The tools are simple. The discipline? That takes work. But once you develop it, everything changes.

Closing Thought

The market doesn’t care how you feel. It just moves. So when you feel fear, greed, or doubt creep in, pause. Breathe. Stick to your process. That’s how you stop trading on emotion—and start trading with purpose.

Learn more about trading psychology.