When I started trading Forex years ago, the first broker I signed up with was a Market Maker. At the time, I didn’t even know there were other types. I just picked the one with the lowest deposit requirement and flashiest website. Spoiler: that decision cost me more than a few pips.

I later switched to an ECN broker, and it completely changed how I viewed trade execution, spreads, and trust. If you’re wondering which one is better for you—ECN or Market Maker—you’re not alone. The answer really depends on how you trade, what your goals are, and how much experience you’ve got under your belt.

Here’s what we’ll explore together:

- What ECN and Market Maker brokers are

- Key differences in execution, costs, and transparency

- Pros and cons of each broker type

- Who should use what—based on real-world trading styles

- How STP and hybrid models compare

My goal? Help you pick the right type of broker so you don’t waste time (or money) like I did early on.

What Are ECN and Market Maker Brokers?

ECN Broker Defined

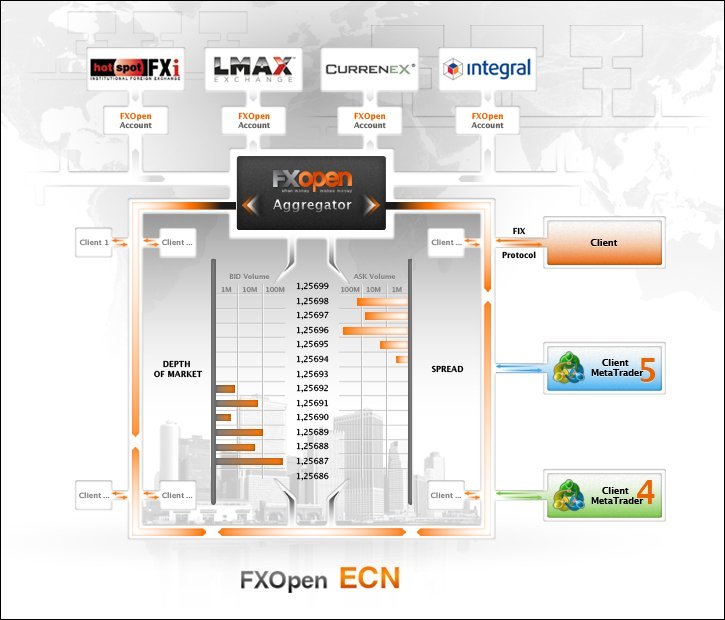

An ECN broker—short for Electronic Communication Network—connects you directly with other market participants. That means your trades are matched with real buy or sell orders from other traders, banks, or liquidity providers. No dealing desk. No one sitting behind a screen trading against you.

This setup gives you tighter spreads, access to interbank pricing, and transparency. But it comes with trade commissions and often requires a higher minimum deposit. Personally, when I shifted to ECN for my scalping strategy, I noticed how much tighter the spreads were during London open.

Market Maker Broker Defined

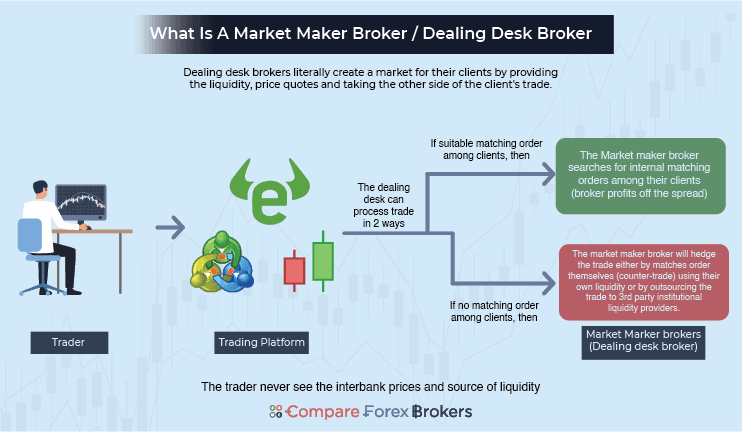

A Market Maker broker, on the other hand, sets the prices internally. They provide liquidity by taking the opposite side of your trade. That means when you buy, they sell. When you sell, they buy. This can introduce a conflict of interest, but it’s also what allows them to offer fixed spreads and no commissions.

For newer traders or those just trying to learn the ropes, Market Makers can be easier to use and more predictable when it comes to costs. I’ve used Market Makers for testing new EAs because the stable spreads made it easier to benchmark performance.

Key Differences Between ECN and Market Makers

Order Execution

With ECN brokers, your trades are executed against other participants in the network. That means fewer requotes and better conditions during fast-moving markets. I remember trading NFP once with an ECN broker and still getting in without slippage. With Market Makers, you might get a requote or worse—your order may not fill at all.

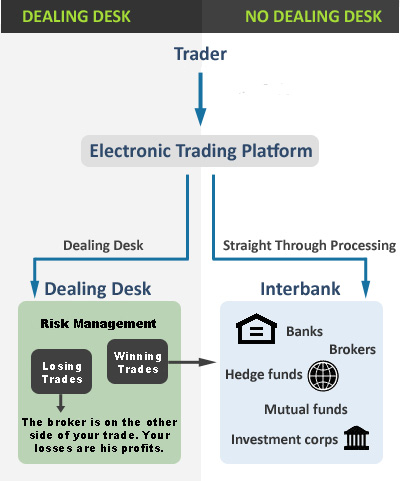

Market Makers use a dealing desk. That means there’s a human (or algorithm) managing trade execution, and yes, that opens the door for conflicts of interest, especially if your trading goes against the broker’s books.

Spreads and Costs

ECN brokers typically offer raw, floating spreads. I’ve seen EUR/USD as low as 0.1 pips. But they charge a commission per lot traded—usually around $6 to $10 per round turn. Over time, if you’re trading large volumes, this can actually be cheaper than wider spreads.

Market Makers offer fixed spreads. That’s great for budgeting costs—especially when spreads widen during news. But those fixed spreads are usually higher. And since there’s no commission, they bake their profit into the spread itself.

Transparency and Conflict of Interest

This one’s big for me. ECN brokers don’t trade against you. They make money from your commissions, not your losses. That gave me peace of mind, especially when running long-term strategies with stop losses close to entry. No more “mysterious” spikes that hit my SL and disappear.

Market Makers can profit from your losing trades. Some do this ethically. Others… not so much. That’s why it’s essential to choose a regulated broker with a solid reputation if you’re going this route.

Pros and Cons of ECN Brokers

ECN Pros

Here’s why I eventually went full ECN:

- Tight spreads, especially during liquid hours

- Direct access to the real market—no middleman

- No requotes, even during volatile news

- Zero conflict of interest with your broker

ECN Cons

But it’s not perfect. ECN brokers charge commissions, which can add up for smaller trades. Also, during low liquidity (like right before rollover), spreads can spike hard. I’ve had USD/JPY jump to 3+ pips at 4:59 PM EST—just enough to mess with a tight stop loss.

And they usually have higher minimum deposits. So if you’re just starting out with $50, ECN might not even be an option yet.

Pros and Cons of Market Maker Brokers

Market Maker Pros

Market Makers are still a solid choice for lots of traders, especially beginners. Why?

- Fixed, predictable spreads—great for planning

- No commissions—costs are included in the spread

- Low minimum deposits, sometimes as low as $5

- User-friendly platforms and easy account setup

I used a Market Maker when I first tested MetaTrader 4. The simple UI and easy deposit process helped me focus on learning instead of getting overwhelmed by tools I didn’t understand yet.

Market Maker Cons

The biggest downside? You don’t always get the best execution. During volatile times, they may freeze pricing, issue requotes, or just widen spreads significantly. I once got a 5-pip spread on EUR/USD during a Bank of England release—while my ECN broker held it at 0.4.

And if they’re not well regulated, some Market Makers may manipulate prices. That’s rare, but it happens. So again—regulation and reputation matter a LOT.

Which One Should You Choose?

For Beginners and Casual Traders

If you’re just starting out, a Market Maker broker might be the smoother entry point. I always recommend this path to friends learning Forex basics. The fixed spreads make budgeting easier, and there’s usually no commission. You don’t need a big deposit either—some brokers let you start with just $10.

Also, many Market Makers offer user-friendly platforms with built-in tutorials, demo accounts, and better customer support geared toward new traders. You can focus on learning price action and managing risk without worrying too much about execution speed or spread variability.

For Active and Experienced Traders

If you’re scalping, trading news, or just want raw pricing and zero interference—go ECN. Once I made the switch, my execution speed improved drastically. I could get in and out faster, and my stop orders were filled cleaner, even during news spikes.

Yes, you’ll pay commissions. But with ultra-tight spreads and no dealing desk interference, your strategies will perform more consistently. You also get direct market access, which just *feels* more professional once you’re used to it.

Hybrid or STP Brokers – A Third Option?

There’s also something in between: STP brokers. STP stands for Straight Through Processing. These brokers route your orders directly to liquidity providers but may still use a dealing desk model behind the scenes. They usually offer the best of both worlds—fair pricing, moderate spreads, and no visible conflict of interest.

I used an STP broker for a few months and had a decent experience. Execution wasn’t as fast as ECN, but the trading costs were manageable, and there were fewer weird price spikes than with Market Makers.

FAQ: What Traders Ask Most

What is the main difference between ECN and Market Maker brokers?

ECN brokers connect your trades directly with other participants in the market. Market Makers take the opposite side of your trade themselves. That means Market Makers set the prices and may have a conflict of interest, while ECNs offer more transparent, real-market pricing.

Is ECN better for scalping?

Absolutely. I scalp during London and New York opens, and ECN brokers consistently give me tighter spreads and better fills. Market Makers often requote or widen spreads, which ruins scalping setups.

Do Market Makers trade against you?

Yes, technically. When you buy, they sell. That doesn’t always mean foul play, but it does mean they profit when you lose. Some regulated Market Makers are ethical. Others… not so much. Choose wisely.

Can you switch from Market Maker to ECN later?

Yes, and many traders do. I started with a Market Maker, then moved to ECN once I got more confident. Some brokers even let you upgrade within the same account dashboard.

ECN vs Market Maker: Feature Comparison Table

| Feature | ECN Broker | Market Maker Broker |

|---|---|---|

| Order Execution | Direct to market (no dealing desk) | Broker is your counterparty (dealing desk) |

| Spread Type | Floating (tight, raw spreads) | Fixed (wider spreads) |

| Commission | Yes (per trade) | No (built into spread) |

| Minimum Deposit | Higher (often $100+) | Lower (as little as $5–$10) |

| Best For | Experienced traders, scalpers | Beginners, low-volume traders |

| Transparency | High (interbank pricing) | Lower (internal pricing) |

| Conflict of Interest | No | Yes |

Here’s What Really Matters

So, what did we learn?

ECN brokers offer tight spreads, faster execution, and full transparency. They’re ideal if you’re scalping, trading news, or handling big volume. You’ll pay commissions, but the costs often balance out with tighter spreads.

Market Makers offer simpler pricing and a more forgiving entry point. If you’re just getting started or want fixed costs, this setup might be better—just make sure the broker is regulated and reputable.

And don’t forget the middle ground: STP brokers. They might be your stepping stone as you evolve.

Final thought? The “best” broker isn’t the one with the flashiest ads. It’s the one that fits YOUR trading style and helps you trade smarter—not harder. I learned that the hard way. You don’t have to.