I still remember the first time I tried trading forex. I was excited, nervous, and completely clueless. I had no idea how to place a trade or what leverage meant. If you’re new to forex, I’ve been in your shoes. One thing saved me from losing money right away: a free demo account.

Let’s be honest—live trading can feel like jumping off a cliff if you haven’t practiced first. That’s why a solid forex demo account is more than a nice-to-have. It’s your training ground, your sandbox, your risk-free lab for testing strategies.

After years of testing dozens of platforms, I’ve narrowed down the BEST demo account providers out there. Not all are created equal. Some expire too fast, some don’t simulate real markets well, and others just feel clunky.

Here’s what I’ll walk you through:

- What a forex demo account is (and why it matters)

- The key features that make a demo account worth using

- Side-by-side comparison of top brokers with free demos

- Personal insights and experiences from using these accounts

- Pro tips on choosing your best fit as a beginner

If you want to practice risk-free and find the broker that works for you, this guide is your go-to resource. No fluff, no hype—just real info from someone who’s tested these accounts hands-on.

What Is a Forex Demo Account?

A demo account lets you practice forex trading with virtual money. You’re using real market data but not risking your own cash. Sounds simple, right? But it’s a game-changer, especially when you’re just starting out.

When I first opened my demo on MetaTrader 4, I made every rookie mistake possible: over-leveraged trades, random entries, emotional exits. But because I wasn’t losing real money, I could actually learn without the stress. That’s the magic of demo trading.

Traders use demo accounts to:

- Learn platform features (like placing stop-losses or pending orders)

- Backtest trading strategies with live data

- Try different brokers and compare execution speed

Think of a demo as your safety net. It gives you time to grow your confidence before jumping into real trades.

Key Features to Look for in a Demo Account

Unlimited vs. Time-Limited Access

This is huge. Some brokers only give you 30 days before shutting down your demo. Others (like OANDA and MondFX) let you use your demo forever. For me, unlimited access is ideal, especially when I’m testing long-term strategies or EA bots over multiple months.

Customizable Virtual Funds

Most demos come with preset balances—$10,000, $50,000, or even $100,000. The best ones let you tweak the amount so you can simulate your actual future trading size. I always reduce mine to $2,000 to mimic my first real account.

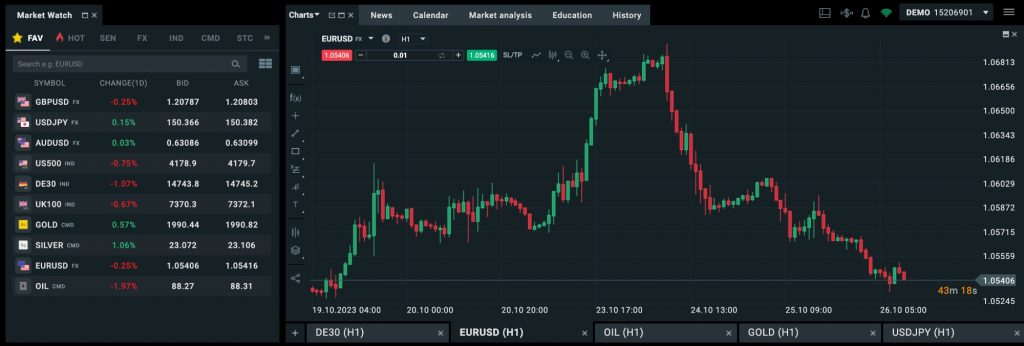

Platform Support (MT4, MT5, cTrader)

Your experience depends heavily on the platform. If you’re planning to trade with MetaTrader 4 or 5, make sure the broker supports it in demo. Some (like IC Markets) even offer cTrader and TradingView for demo, which is great if you’re visual like me.

Platform Experience & Execution Speed

You might not think latency matters in a demo. But I’ve tested some platforms where orders felt delayed or buggy. That’s a red flag. If a demo platform isn’t smooth, the live version probably won’t be either.

BlackBull Markets blew me away here. Their demo execution felt identical to live, with lightning-fast fills—even when testing scalping strategies.

Realistic Market Conditions

Some demos use delayed or fake data, but the top brokers mirror real-time spreads, slippage, and price movement. That realism gives you a much better prep for going live. Eightcap impressed me in this area, especially when I used their demo to test crypto pairs.

Top Forex Brokers with Free Demo Accounts in 2025

Broker Comparison Table

| Broker | Platform | Demo Length | Virtual Funds | Notable Feature |

|---|---|---|---|---|

| Pepperstone | MT4, MT5, cTrader | 30 days (renewable) | Unlimited (resettable) | Fastest execution, EA testing |

| IC Markets | MT4, MT5, cTrader | Unlimited | Customizable | Low spreads, realistic CFD demo |

| OANDA | MT4, TradingView | Unlimited | Flexible | Best for long-term practice |

| MondFX | MT4, MT5 | Unlimited | Standard $100,000 | Great support, education-rich |

Pepperstone

This was my first real broker—and their demo sealed the deal. They offer one of the fastest executions I’ve tested on MT4, which is perfect for trying expert advisors (EAs) or scalping strategies. Although the demo is limited to 30 days, you can request a reset or just sign up again with a new email.

IC Markets

What stood out to me about IC Markets was the combination of ultra-low spreads and access to multiple platforms. Their MT5 demo felt snappy, and even high-frequency strategies ran smoothly. Plus, I appreciated that I could practice CFD instruments beyond just currencies.

OANDA

Want to test a strategy for six months before risking real money? OANDA gives you that flexibility with their unlimited demo. I’ve used this for long-term testing with great results. It’s also ideal for beginners who aren’t in a rush to go live.

MondFX

MondFX is newer to the scene, but I was genuinely impressed by the depth of tools and unlimited demo access. The support team answered my setup questions within minutes. Their platform felt solid, and I even explored some crypto pairs on demo without issues.

Other Noteworthy Brokers

If you’re the type who likes to explore every option (like I do), here are a few more worth checking out:

LiteFinance offers unlimited demo access on MT4 and MT5. I found their market simulation impressively accurate, and the interface is beginner-friendly. Eightcap stood out for crypto traders—it’s one of the few that offers a solid crypto demo experience. Fusion Markets has a 30-day demo, but it can be reactivated after you deposit into a live account, which is helpful if you want a second round of testing.

And then there’s FP Markets. Their raw account demo includes $100,000 in virtual funds and supports multiple platforms, including TradingView. I loved testing scalping setups here because spreads are razor-thin even on the demo.

Why Use a Demo Account Before Going Live?

I’ve traded both with and without demo practice. The difference? Night and day.

Build Platform Confidence

Learning how to open, modify, and close trades on your chosen platform takes time. A demo gives you that space. Trust me, the last thing you want is to accidentally close a profitable trade or misplace a stop-loss on a live account. Been there, done that.

Test Strategies Without Pressure

Every trader has their style. Whether you’re into swing trading, scalping, or using EAs, you need to test your setup. With a demo, you can experiment without worrying about real losses. I still test new strategies in demo before going live—it’s a habit I’ll never give up.

Manage Emotions Before Money’s Involved

This one hits hard. When real money’s at stake, emotions kick in. You start doubting your plan, hesitating, overtrading. Practicing in demo helps train your discipline. It gives you a baseline. So when you do go live, you’re not caught off guard emotionally.

FAQs About Forex Demo Accounts

How long can I use a demo account?

It depends on the broker. Some, like OANDA and LiteFinance, offer unlimited demo access. Others, like Pepperstone, have a 30-day limit but allow resets or multiple sign-ups. I always recommend going for unlimited if you’re new to trading.

What happens after a demo account expires?

Usually, you’ll lose access unless you renew it manually or sign up again. A few brokers let you transfer your settings and trade history if you move to a live account. But always back up any data or strategies just in case.

Can I switch from a demo to a live account easily?

Yes. Most brokers have a seamless transition. In fact, the account interface often stays the same—you just switch the login credentials. Just double-check funding options and withdrawal rules before you go live.

Is the market data in demo accounts real-time?

For top-tier brokers, yes. The demo pulls live pricing and spreads. However, the execution might not reflect real-world slippage or liquidity gaps. That’s why it’s smart to combine demo testing with smaller live trades later.

Are demo account results realistic?

They’re directionally useful but not perfect. A winning strategy in demo won’t guarantee live profits. Market emotion, slippage, and execution delays play a bigger role in real trading. But demo is still the safest way to sharpen your edge first.

Epic Wrap-Up

So what did we cover? A lot—but here’s the quick snapshot:

- Demo accounts are essential for learning, testing, and building confidence.

- Top brokers like Pepperstone, IC Markets, and OANDA offer excellent demo options for 2025.

- Unlimited access, fast execution, and platform flexibility are key features to look for.

- Even experienced traders like me still use demos before going live.

If there’s one thing I’ve learned over the years, it’s this: trading success doesn’t start with money. It starts with preparation. And a great demo account is your best prep tool.

So go explore, test your skills, make mistakes—just do it in demo first. Then, when you go live, you’ll feel more prepared and less panicked. That’s the trader’s edge you can’t buy—but you can definitely practice.