Analysts are being subtly prompted to reconsider their presumptions by the way the Palantir share price is fluctuating. It’s not crashing with cryptocurrency volatility or soaring like a meme stock, but it is gradually gaining traction. Imagine it as a tide slowly sweeping in; it doesn’t yell, but it changes the whole landscape before you know it.

From Doubt to Plan

A few years ago, Palantir was viewed by many as a mysterious anomaly—a defense contractor with an AI focus and Silicon Valley branding. Its valuation was divisive, its public debut was contentious, and Wall Street didn’t like how closely its business model was tied to government contracts. However, the market’s perception has changed, and it’s not just the company.

| Quarter | Share Price (Start) | Share Price (End) | GAAP Profitability | Key Highlight |

|---|---|---|---|---|

| Q1 2024 | $7.90 | $10.45 | No | Commercial revenue growth exceeds 30% |

| Q2 2024 | $10.45 | $12.88 | Yes | First profitable quarter under GAAP |

| Q3 2024 | $12.88 | $14.65 | Yes | Expansion of AI platform across Fortune 500 |

| Q4 2024 | $14.65 | $16.92 | Yes | Government contract renewals surge |

| Q1 2025 | $16.92 | $19.10 | Yes | International markets fuel growth |

Putting a Large Bet on the AI Boom

Palantir is finally gaining traction with its repositioning as a full-spectrum AI platform provider. Due to the enterprise AI boom, investors who previously rejected its products as “too niche” are now reconsidering those same capabilities. Similar to how a swarm of bees collaborates flawlessly to create intricate hives, Palantir’s AI agents are exhibiting coordinated decision-making that businesses are finding more and more difficult to overlook.

Building Institutional Confidence

Large institutional investors are becoming more active, and although some hedge funds are still wary, others are describing Palantir as one of the market’s most cheap AI plays. This is a story about strategic relevance in a data-driven future, not just a tech stock story. Additionally, Palantir, who was once described as eccentric, now appears curiously well-positioned.

Numbers That Make a Statement

Strong revenue growth, rising margins, and a fourth consecutive quarter of GAAP profitability were among the impressive outcomes of Palantir’s most recent earnings report. These are signs of a maturing business getting ready to scale responsibly, not the metrics of a speculative growth stock.

What’s Creating the Hope?

Here, a combination of macro and micro forces are at work. On a larger scale, businesses with deep data infrastructure are becoming essential as the AI arms race heats up. At the micro level, Palantir is at last demonstrating the operational discipline that conservative investors prefer, including measured hiring, recurring revenue, and a focus on profitability.

A Shift from Buzz to Content

Palantir offers structured, decision-ready intelligence as a value proposition, in contrast to many other AI companies that are following the fad of generative buzzwords. Their platforms are tough instruments made to withstand high-stakes situations, such as disaster relief and military theaters; they are not ostentatious demonstrations. Defense departments, health agencies, and logistics behemoths still depend on them because of this.

Target Prices Are Increasing

Previously giving Palantir poor ratings, equity analysts are now subtly changing their projections. In addition to growth, a number of recent target raises highlight Palantir’s resilience, as it is surviving macro headwinds better than some of its more well-known rivals. And that matters to investors looking for long-term conviction.

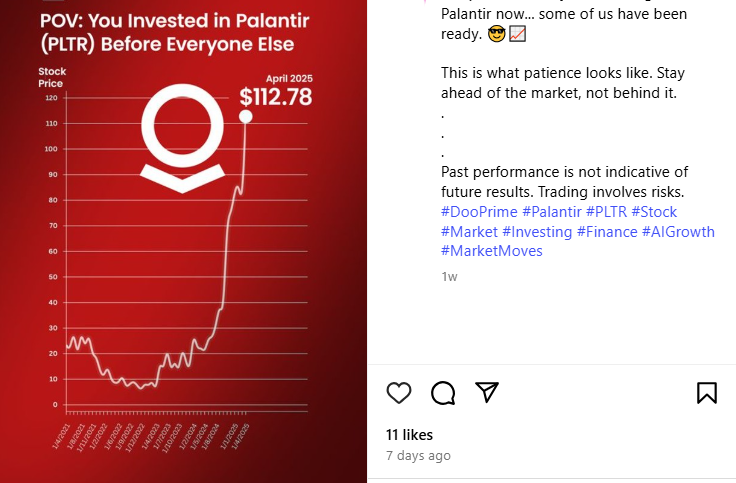

Is This the Decade’s Greatest Tech Comeback?

Palantir’s recent performance suggests something uncommon—a redemption arc with genuine legs—but it’s too soon to declare it the next Apple or Nvidia. Although there may still be inherent volatility in the share price, the fundamentals are aligning. Palantir may end the 2020s well-established as a key holding in tech-heavy portfolios if it keeps up its current pace.