BrainChip Holdings Ltd (ASX: BRN) has generated significant interest in the technology and artificial intelligence sectors, particularly because of its pioneering advancements in neuromorphic computing. BrainChip, recognized for its Akida neuromorphic processor, is leading a revolution that emulates the human brain to process information in an energy-efficient and ultra-low-power fashion. As global corporations expedite their AI endeavors, BrainChip’s stock price provides investors with a distinctive insight into the future of AI hardware.

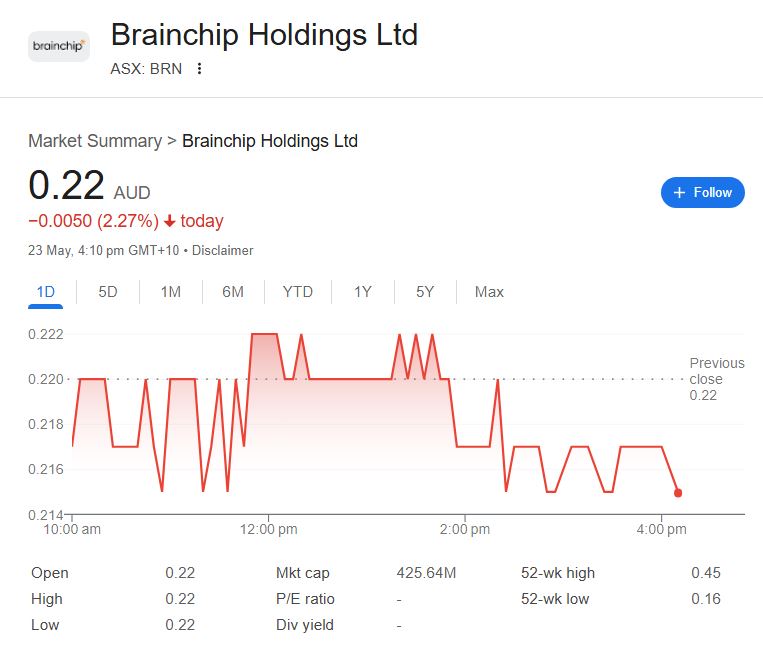

On May 23, 2025, BrainChip’s share price is AUD 0.22, indicating a decline of 2.27% for the day. In the last year, the stock has varied between AUD 0.16 and AUD 0.45. This volatility is prevalent among emerging technology firms, especially those operating in the high-risk, high-reward domain of artificial intelligence. Notwithstanding the obstacles, BrainChip’s distinctive standing in the neuromorphic computing industry may result in sustained growth potential, contingent upon the company’s ongoing market expansion.

BrainChip Holdings Ltd at a Glance

| Company Name | BrainChip Holdings Ltd |

|---|---|

| Ticker Symbol | ASX: BRN |

| Current Share Price | AUD 0.22 |

| 52-Week High | AUD 0.45 |

| 52-Week Low | AUD 0.16 |

| Market Capitalization | AUD 425.64M |

| P/E Ratio | N/A |

| EPS | -0.019 |

| Revenue (Dec 2024) | AUD 145.66K |

| Company Founded | 2004 |

| Headquarters | New South Wales, Australia |

| Website | BrainChip Inc. |

| Key Product | Akida Neuromorphic Processor |

A Trailblazer in AI: BrainChip’s Technological Advantage

The Akida processor represents a groundbreaking advancement that distinguishes BrainChip within the competitive AI sector. In contrast to conventional processors that demand substantial energy for intricate tasks, Akida processes sensory data with exceptional accuracy and efficiency. Its energy-efficient design renders it an optimal solution for edge AI applications, including autonomous vehicles, industrial automation, and robotics. By emulating the brain’s neural networks, Akida provides an exceptional capacity to analyze and respond to real-time inputs in a manner that traditional processors cannot replicate.

With the rising adoption of AI-driven solutions across industries, the demand for efficient, low-energy chips such as Akida is anticipated to increase markedly. BrainChip’s advantage in this market indicates a promising future; however, as is frequently the case with disruptive technologies, achieving commercial success will require time. Despite its undeniable potential, BrainChip’s share price fluctuations over the past year demonstrate that market sentiment is significantly influenced by overarching economic trends, corporate milestones, and investor expectations regarding future profitability.

The Volatile Fluctuations of BrainChip’s Stock Price

The volatility of BrainChip’s share price is fundamentally rooted in the capriciousness of the technology market. Notwithstanding the company’s groundbreaking technology, its stock has experienced considerable volatility. The price fluctuations, ranging from AUD 0.45 to AUD 0.16, exemplify the speculative characteristics of the AI and semiconductor industries. This can be ascribed to several pivotal factors: market sentiment, the ambiguous timeline of product commercialization, and the persistent pressure on technology stocks within a volatile global economy.

Nonetheless, for proponents of AI’s future, this volatility offers both risks and opportunities. BrainChip’s swift expansion into emerging AI sectors, combined with the prospect of strategic alliances, may substantially impact its future stock performance. Although transient stock volatility may be unsettling, investors who transcend the superficial disturbances and concentrate on the long-term prospects of BrainChip’s innovations may discover substantial rewards as the demand for AI hardware escalates.

The Prospects of Neuromorphic AI and BrainChip’s Contribution

In the future, BrainChip’s trajectory will depend on its capacity to scale the Akida processor and leverage the growing integration of AI across various sectors. As AI applications proliferate across various sectors, including healthcare and autonomous systems, the demand for energy-efficient chips capable of processing substantial data in real time will intensify. BrainChip’s advantage in neuromorphic computing, an underexplored domain, establishes it as a frontrunner in the industry.

Nonetheless, akin to other technology firms, BrainChip’s future will be influenced by market dynamics that are challenging to forecast. The company’s success will hinge on several factors, including the speed of its product expansion, the partnerships it establishes, and its ability to demonstrate the economic viability of its innovative processor. These factors will undoubtedly affect its share price trajectory in the forthcoming years.

Analyst Sentiment and Investor Perspective

Analysts possess divergent opinions regarding BrainChip’s long-term potential. The company’s innovative technology and robust market potential establish a strong basis for growth. Conversely, its relatively modest scale and constrained financial history are critical factors that cast doubt on its potential for mass-market success. Some perceive the company as a speculative investment, while others regard it as an opportunity to engage early with a potential leader in the AI hardware sector.

In conclusion, BrainChip Holdings Ltd is an intriguing entity in the AI sector, propelled by its advancements in neuromorphic computing. Despite fluctuations in its share price, the company’s future appears promising, especially with the increasing demand for low-power, high-efficiency AI chips. Investors adopting a long-term perspective may discover that BrainChip’s innovations present a distinctive opportunity in an otherwise volatile market.