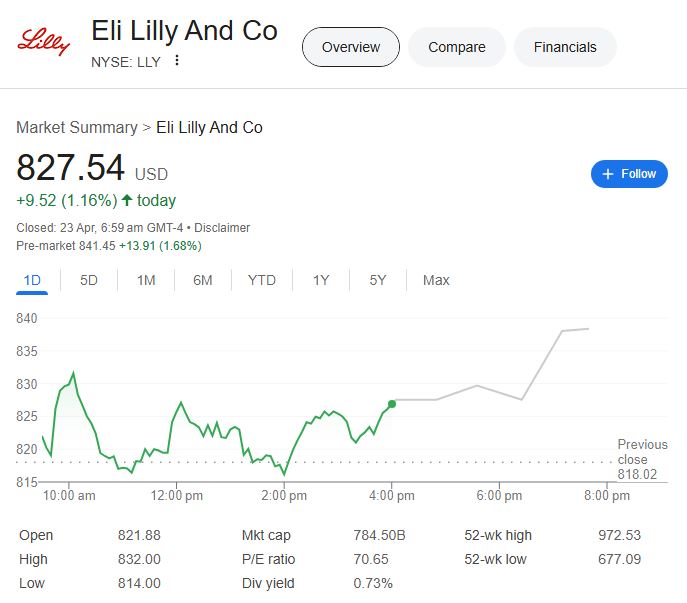

Eli Lilly & Co. (NYSE: LLY) is not only outperforming, but also redefining what it means to be a leader in the biopharma industry. With a 1.16% daily gain and a promising 1.68% spike in pre-market activity, the stock has been rising significantly and is currently trading at $827.54. Investors are responding to a business that is implementing a particularly creative growth model in an exceptionally effective way, not just to numbers.

Lilly has established a highly dependable flywheel of momentum by utilizing popular treatments like Mounjaro and Zepbound and vigorously promoting GLP-1 pipeline advancements for diabetes and obesity. With a 44.68% YoY increase in revenue to $13.53 billion in Q4 2024, the company’s 32.59% profit margin—which is exceptionally high by industry standards—has further solidified its position as a therapeutics pioneer.

Eli Lilly Stock – Key Company Data

| Attribute | Details |

|---|---|

| Ticker | LLY (NYSE) |

| Current Price | $827.54 (April 22, 2025) |

| Pre-Market Price | $841.45 |

| 52-Week Range | $677.09 – $972.53 |

| Market Cap | $784.50 Billion |

| P/E Ratio (TTM) | 70.65 |

| EPS (TTM) | $11.72 |

| Dividend Yield | 0.73% ($6.00 annual payout) |

| YTD Change | +7.19% |

| CEO | David A. Ricks (Since Jan 2017) |

| Headquarters | Indianapolis, Indiana, U.S.A. |

| Employees (2024) | 47,000 |

| Official Website | investor.lilly.com |

Eli Lilly has outperformed almost all of its peers in the healthcare industry with an astounding return of 461.48% over the last five years. This is the result of a purposefully designed business model, one that is motivated by pipeline productivity and scientific accuracy, rather than transient hype. Investors frequently express a desire for growth devoid of volatility. Lilly is strikingly similar to that ideal.

Lilly doubled down in recent years, investing heavily in AI-driven trial simulations, branching out into gene therapy, and rethinking the way treatments are found and administered, while many pharmaceutical companies were cutting back. Lilly has improved trial success rates and drastically shortened development timelines by incorporating these technologies into its R&D structure, which is a compelling financial and moral outcome.

Through strategic partnerships and acquisitions, like its growing impact in the study of metabolic diseases, Lilly has established itself as a highly adaptable player. The company’s portfolio is remarkably diverse, encompassing fields such as neurology, autoimmune therapy, and oncology. Furthermore, that adaptability is not only a competitive advantage but also a long-term requirement given the growing demands on global health.

Eli Lilly is a very resilient investment for early-stage investors. It is very effective at balancing portfolios because, with a beta of only 0.47, it moves much less erratically than many tech or biotech stocks. It’s the uncommon equity that provides both upside and shelter—stability combined with creativity.

Lilly keeps changing how pharmaceutical research relates to practical application by working with research institutes and utilizing real-time patient data. Because of this useful integration, it now resembles cutting-edge tech companies remarkably, albeit with more immediate and transformative effects.

Analysts have noticed. While other firms are pointing to a $1 trillion market cap potential as not only aspirational but also achievable, Bernstein has set a target of $1,100. Such a forecast is uncommon and exciting, especially in a defensive industry like healthcare.

Since Zepbound’s approval and Mounjaro’s wider rollout, Eli Lilly has been influencing Wall Street sentiment. It is now acknowledged as a dynamic innovator rather than just a conservative pharmaceutical behemoth. Its flexibility during the obesity treatment boom has been especially noteworthy, and as a result, public awareness has significantly increased.

FAQs – Eli Lilly Stock

- Is Eli Lilly stock a good buy in 2025?

Yes, it shows strong growth, low volatility, and high innovation potential. - What is Eli Lilly’s current dividend yield?

Eli Lilly offers a 0.73% dividend yield. - What’s driving Eli Lilly stock growth?

Blockbuster drugs, AI-enhanced trials, and expanding obesity treatment lines. - How much has Eli Lilly stock gained over 5 years?

Over 461%, making it one of pharma’s top performers. - What’s the price target for Eli Lilly stock?

Analysts project it could reach $1,100 within the next 12 months. - When is Eli Lilly’s next earnings call?

May 1, 2025, where further growth signals are anticipated.