The Tokyo Stock Exchange has undergone a dramatic change in the last few quarters. Cover Corporation, a publicly traded, data-savvy digital powerhouse, began as a niche entertainment start and is now well-known throughout the world for its virtual talent brand Hololive. Its stock, which trades at 5253.T, has come to represent Japan’s increasing adoption of character IP, virtual content, and immersive fan-based monetization.

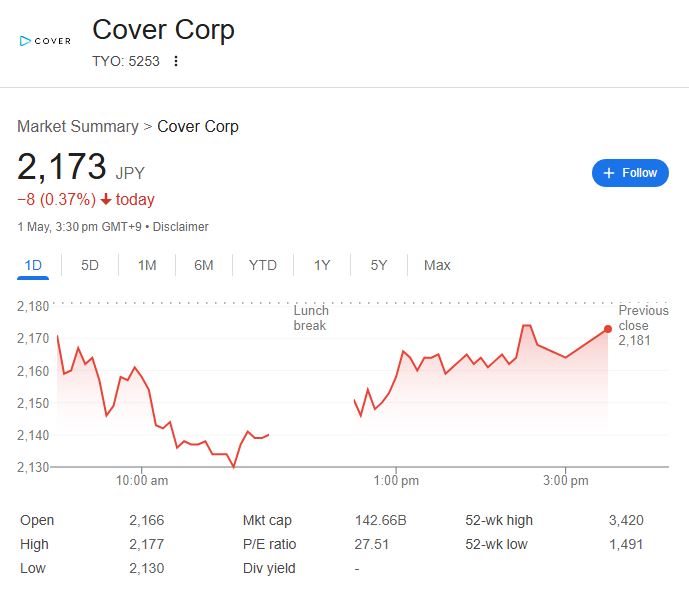

Cover has created a highly effective, content-driven engine that is quickly emerging as one of Japan’s most inventive exports by fusing pop culture sensibilities with software agility. The stock has been trading around ¥2,173 in recent days, still comfortably above its 52-week low, even though it has declined from its peak of ¥3,420. Strong quarterly results, an expanding global fan base, and strategic growth in digital commerce and AI-powered engagement are all contributing factors to the recovery.

Cover Corporation (5253.T) – Key Investment Metrics (May 2025)

| Category | Details |

|---|---|

| Company | Cover Corporation |

| Ticker Symbol | 5253.T (Tokyo Stock Exchange) |

| Current Stock Price | ¥2,173 (May 1, 2025) |

| 52-Week Range | ¥1,491 – ¥3,420 |

| Market Capitalization | ¥135.21 Billion |

| P/E Ratio (TTM) | 27.52 |

| EPS (TTM) | ¥78.95 |

| Revenue (Q4 2024) | ¥11.76 Billion (↑69.22% YoY) |

| Net Income (Q4 2024) | ¥1.66 Billion (↑71.18% YoY) |

| Net Profit Margin | 14.09% |

| Employee Count | 537 (as of 2024) |

| Core Subsidiary | Hololive Production |

| Founding Date | June 13, 2016 |

| Reference Source | Yahoo Finance – Cover Corp (5253.T) |

The Hololive Effect: The Real-World Repercussions of Virtual Stars

Cover stands out for having a very distinct value proposition in the context of Japan’s larger digital economy. The company does more than just make virtual idols; it carefully plans an ecosystem that makes money from live events, streaming, merchandise, and branded content. Millions of people found solace in Hololive characters during the pandemic; now, they are consistently topping revenue charts with a level of regularity that would make traditional media studios envious.

Cover has developed one of the most active online entertainment audiences through the use of motion-capture technology and live chat interactions. This approach enables quick international localization and is incredibly successful at increasing in-the-moment donations and product sales. The brand’s appeal has significantly increased globally, especially in Southeast Asia and North America, thanks to strategic alliances and carefully chosen voice actors.

💡 Investor Perspective: Why Tech-Forward Capital Is Attracted to 5253.T

Despite not being as large as the traditional media behemoths, Cover Corp’s market performance indicates otherwise. It is firmly ranked among Japan’s leading mid-cap growth stocks with a P/E of 27.52, and analysts have been pleased by its consistent earnings and forward guidance. With a current return on assets of 19.39%, it is substantially higher than many of its peers in the software industry, indicating that it is not only growing but also doing so with impressive discipline.

The business has been improving its live programming formats and user engagement loops by utilizing advanced analytics. This results in a highly efficient content pipeline that continuously improves viewer satisfaction while cutting down on wasteful production cycles. Long-term value creation has benefited greatly from this operational clarity.

🔮 The Path Ahead: Will ¥3,400 Change Again?

Market observers have witnessed a rollercoaster of volatility since the stock’s March 2023 public debut, but they have also noticed a recurring underlying trend: resilience. Cover Corp has already recovered from a turbulent IPO period and larger tech sell-offs. Expectations are now rising with a one-year return of more than 30% and an earnings date of May 13, 2025, approaching.

As augmented reality integrations, gamified live commerce, and AI-enhanced avatars become more popular in the upcoming years, Cover Corp’s intellectual property assets might turn out to be incredibly resilient. Should management persist in its expansion strategy, especially into Western markets and mobile-first experiences, analysts’ ¥3,687 target may not only be attainable, but also conservative.

Investors shouldn’t overlook the cultural shift that Cover Corp is quietly spearheading.

Cover Corp is creating a trend rather than merely following it. This Tokyo-based company is turning fans into shareholders and avatars into assets in a market where online presence is starting to be valued just as highly as live performance.

5253.T presents an especially novel opportunity for investors who are forward-thinking and believe in the convergence of media, software, and worldwide fandom: the opportunity to support the entertainment industry’s future at the nexus of charisma and code.