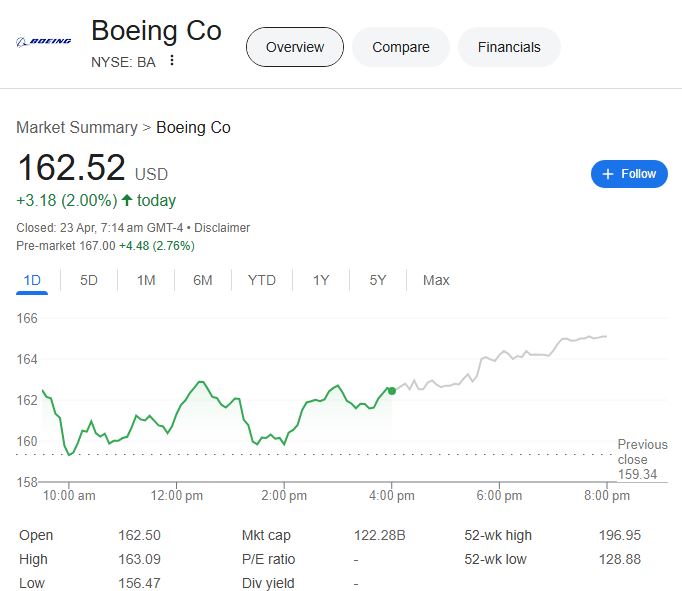

After a string of setbacks, Boeing stock (NYSE: BA) is now displaying resilience remarkably akin to a grounded aircraft roaring back to flight following a thorough overhaul. Following a significant 2.00% increase to close at $162.52 and a 2.73% spike in pre-market trading, investor interest has been rekindled—not out of nostalgia, but rather through real change.

Boeing successfully offloaded legacy drag to refocus its flight path by selling off a portion of its digital aviation business to Thoma Bravo in a $10.55 billion deal. The move is especially advantageous for liquidity and strategic clarity, much like dumping extra cargo in midair. This represents a measured shift toward resilience rather than a band-aid solution for long-suffering investors.

Boeing Stock Key Information

| Attribute | Details |

|---|---|

| Ticker Symbol | BA (NYSE) |

| Current Price | $162.52 (as of April 22, 2025) |

| Pre-Market Price | $167.06 |

| 52-Week Range | $128.88 – $196.95 |

| Market Cap | $122.28 Billion |

| PE Ratio (TTM) | N/A (due to negative earnings) |

| EPS (TTM) | -$18.17 |

| Revenue (TTM) | $66.52 Billion |

| YTD % Change | -8.18% |

| CEO | Kelly Ortberg (since August 2024) |

| Headquarters | Arlington County, Virginia, U.S. |

| Employees | 172,000 (2024) |

| Major Deal | $10.55B sale of digital aviation assets to Thoma Bravo |

Boeing’s results over the last 12 months show a business in the midst of change. Despite a strong 30.77% year-over-year increase in revenue, net income reported a sharp -$3.86 billion loss. Perhaps this paradox is comparable to a jet that is simultaneously experiencing turbulence and tailwinds—driven by robust sales but dragged down by R&D costs and restructuring.

Boeing is simplifying operations and freeing up human talent for more advanced innovation by combining automation, AI-led quality control systems, and leaner production models. This approach has shown remarkable success in improving product consistency and cutting backlogs. Such upgrades aren’t just optional for a company with defense contracts at stake and a highly competitive aviation market; they’re survival strategies.

Boeing is subtly taking back control of its future through strategic alliances, such as its most recent partnership with Thoma Bravo. The business seems to be establishing a longer-term course, one that prioritizes agility, sustainability, and digital transformation as key growth drivers, rather than being characterized by previous crises.

Long-term institutional investors are still drawn to Boeing’s stock in spite of its negative net margins and lack of dividends. A one-year price target of about $191.58 is indicated by noticeably increased analyst confidence, indicating that Wall Street is beginning to view Boeing as a turnaround story in motion rather than one that is still on the runway.

Boeing’s change is especially inventive when compared to more general trends in aerospace and defense. On paper, rivals like Lockheed Martin and Airbus might seem more stable, but few competitors have yet to match Boeing’s capacity for in-flight course correction.

The company’s commercial airline division suffered disproportionately during the pandemic. Today, as international travel picks up steam, that same segment is seeing a resurgence. Through government contracts and private-sector cooperation, Boeing’s space and defense endeavors are ascending, diversifying risk and boosting investor confidence.

Boeing’s appeal to early-stage investors stems from both its recent transformation and its brand heritage. Consider the stock as a prototype with remarkable durability that has been put through its paces and is now ready for new challenges.

Boeing has stabilized its balance sheet and revitalized its innovation culture by utilizing digital technologies and reducing operational inefficiencies. It’s not just recovering; it’s changing the way aerospace companies compete, adapt, and build.

Boeing may be the only industrial stock in the upcoming years to provide both disruptive upside and defensive stability. Boeing’s reframed narrative may prove to be very dependable for investors looking for long-term growth, especially those who are drawn to transformational narratives.