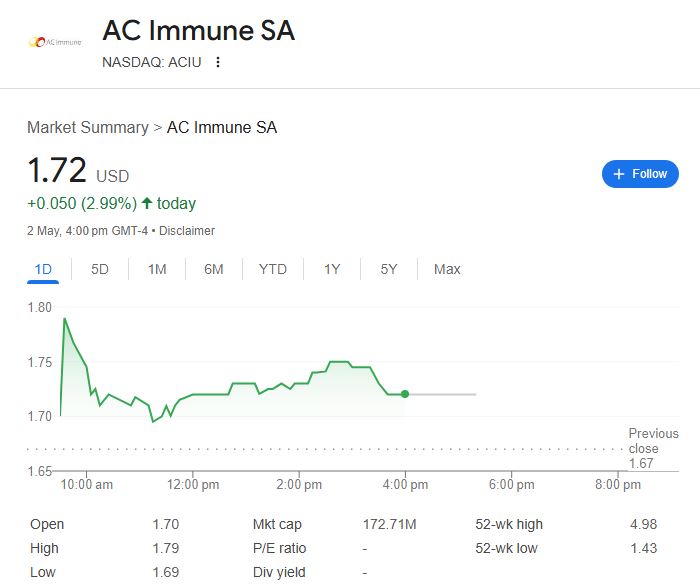

As it continues to make progress in treating Parkinson’s and Alzheimer’s, investors are becoming more interested in AC Immune SA (ACIU), a prominent biotechnology company that specializes in neurodegenerative diseases. The share price of AC Immune is currently trading at $1.72 as of May 2025, up 2.99% from the day before. The question is whether this biotech company is an undervalued asset or a risky investment waiting for a breakthrough, as this is a significant departure from its 52-week high of $4.98.

The erratic nature of the biotech industry is reflected in the volatility of AC Immune’s stock price. There is more to the story, even though its share price has dropped precipitously, most notably to $1.43 in the last 12 months. The company has great potential because of its work on innovative treatments like Parkinson’s and Alzheimer’s therapies, including ACI-24. However, there is still a lot of uncertainty about how clinical trials and regulatory approvals will turn out. Investors must assess if AC Immune’s innovative pipeline indicates that the company has a bright future.

| Category | Details |

|---|---|

| Company Name | AC Immune SA |

| Stock Ticker | ACIU (NASDAQ) |

| Current Share Price | $1.72 |

| Market Capitalization | $172.71 Million |

| 52-Week High | $4.98 |

| 52-Week Low | $1.43 |

| Revenue (TTM) | $27.31 Million |

| Net Income (TTM) | – $50.92 Million |

| Quarterly Earnings | – $19.03 Million |

| Cash Position | $165.49 Million |

| Website | AC Immune Investor Relations |

The Biotech Advancements of AC Immune: A Two-Sided Sword

AC Immune is a particularly intriguing company in the healthcare industry because of its focus on Parkinson’s and Alzheimer’s diseases. With millions of patients worldwide in dire need of efficient treatments, Alzheimer’s disease in particular offers a huge market opportunity. With its active immunotherapies, like ACI-24, which has demonstrated encouraging early results, AC Immune has made tremendous progress. Investors are especially optimistic that the company’s efforts will result in one of the first innovative Alzheimer’s treatments in a long time.

However, the path from encouraging clinical outcomes to commercially viable products is infamously drawn out and difficult. The stock’s wild swings in recent months reflect investor sentiment regarding the risks. AC Immune’s stock has had trouble keeping up with the company’s impressive $165 million cash position and strong R&D focus. With a net loss of $50.92 million over the last 12 months and revenue that fell short of market expectations, the company’s financials provide a sobering reminder. Its lackluster financial performance and promising pipeline highlight how speculative investing in biotech stocks can be.

The success of AC Immune’s treatments will have a significant impact on the company’s future in an industry where clinical trials have the power to make or break businesses. Although there is undoubtedly hope for its treatments, especially for Alzheimer’s, investors should exercise caution due to the risks that are involved.

AC Immune’s Future: Weighing Potential Benefits Against Risk

The ability of AC Immune to turn its exciting pipeline into real, FDA-approved treatments will determine its future. The company is still committed to its goal of addressing important unmet needs in neurodegenerative diseases, even though its stock has underperformed in comparison to its potential. Clinical trials and regulatory rulings will be crucial in deciding whether the business can meet its long-term goals in the upcoming years.

Additionally, the aging of the world’s population and the rise in neurodegenerative illnesses offer AC Immune a favorable environment for expansion. AC Immune stands to gain a great deal from its experience and creative methods as the market for treatments in these fields keeps growing. Investors who are prepared to take on a significant amount of risk may be able to profit from a future in which AC Immune is essential in the treatment of Parkinson’s and Alzheimer’s diseases.

Investors must, however, also be mindful of the volatility of biotech stocks. Although AC Immune has a promising R&D pipeline and cash reserves, this is a high-risk, high-reward investment due to its financial instability and the unpredictability of clinical trials. AC Immune presents an interesting, if speculative, choice for individuals wishing to get into the biotech industry.