Margin is one of those things that confused the heck out of me when I first started trading forex. I thought it was a fee or some hidden cost from the broker. Turns out, it’s way more important—and riskier—than I realized. Margin lets you trade more money than you actually have in your account. That can mean bigger profits… or bigger losses.

When I first got a margin call, it scared me. I’d over-leveraged a EUR/USD trade thinking I had more free margin than I did. My account balance dropped fast. I remember the screen flashing red and my broker automatically closing positions to stop me from going negative. That was a hard lesson—but a needed one.

If you’re new to forex, understanding margin is non-negotiable. It protects your account from going bust and helps you make smart, risk-adjusted trades. Here’s what we’re covering:

- How margin really works (and what it’s not)

- How used margin, free margin, and equity all tie together

- Why margin calls happen and how to avoid them

- How different regions set margin requirements

- How to calculate margin like a pro, with real examples

By the time you finish this page, you’ll know how margin impacts your leverage, your trades, and your risk. You’ll also learn how to protect your equity like a disciplined trader should.

How Margin Works in Forex

What Margin Really Means

Margin isn’t a fee. It’s a good-faith deposit. When you open a trade, your broker locks up a portion of your funds to cover potential losses. That’s the margin. It’s your collateral—your skin in the game.

Let’s say you want to control a $100,000 position in USD/JPY. If your broker asks for 1% margin, that means you only need $1,000 in your account to place the trade. That $1,000 is the margin.

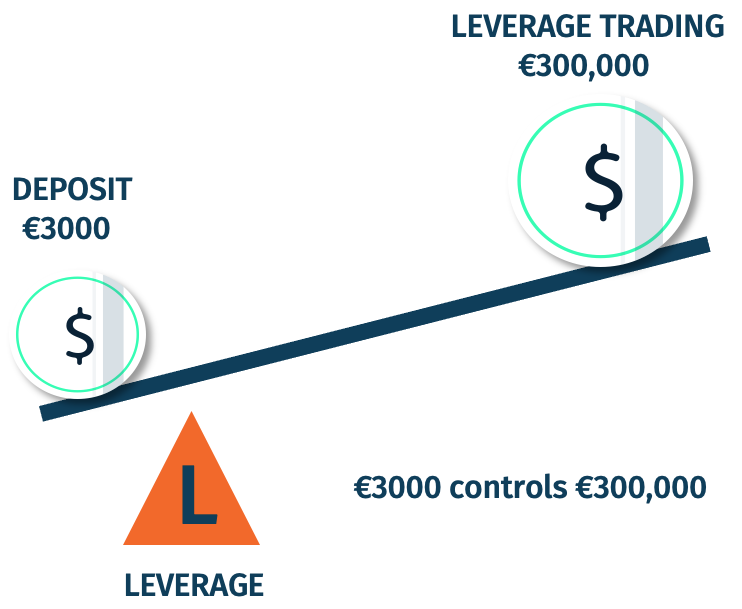

Margin vs. Leverage

This one tripped me up early on. Leverage is what margin allows. If your margin is 1%, your leverage is 100:1. The lower the margin requirement, the higher the leverage. But that also means higher risk.

Think of it like borrowing: the more you borrow (higher leverage), the less margin you need—but the faster your account can crash if the market turns against you.

It’s Not a Cost

I used to think margin was like paying a fee to the broker. It’s not. It’s your money being held aside. You’ll get it back if your trade closes in profit or breaks even. But if the market turns, your broker uses that margin to cover losses.

Margin Mechanics

Used Margin and Free Margin

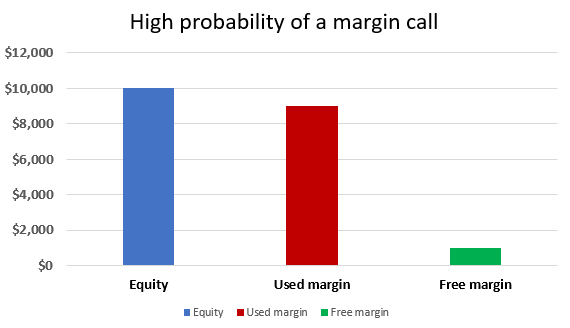

Your used margin is the amount being held for your open trades. Free margin is what’s left in your account that you can still use to open new trades.

Here’s how I track mine: I always keep at least 50% of my equity as free margin. That buffer saved me during volatile weeks like NFP or Fed meetings.

Equity and Margin Level

Equity = account balance + floating P/L. It changes constantly as your trades go up or down. Your margin level is a ratio that shows how healthy your account is. The formula:

Margin Level = (Equity / Used Margin) x 100

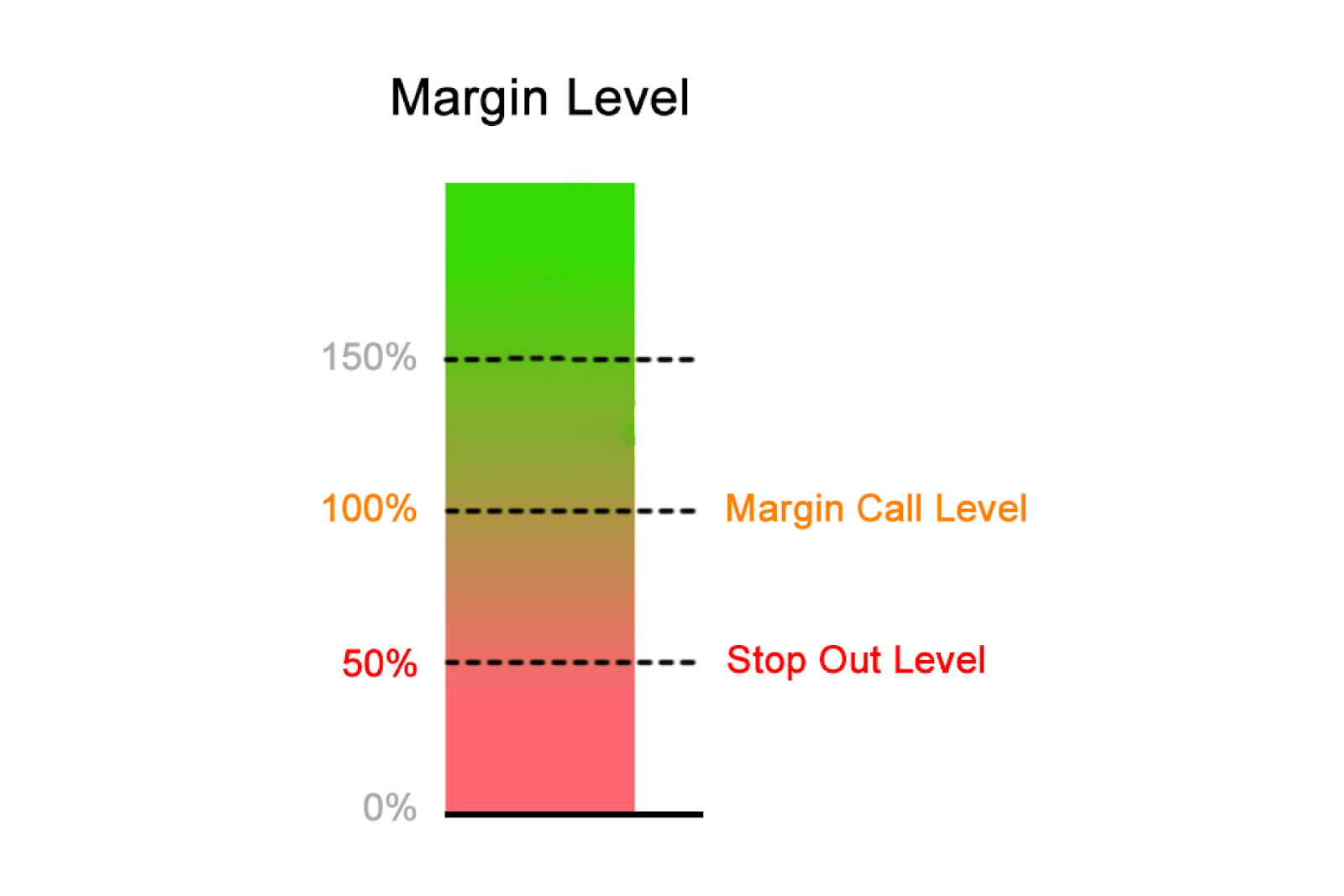

Most brokers issue a margin call when your margin level drops to 100%. Below that, your positions might get auto-closed. It happened to me once on a GBP/NZD swing trade. Never again.

Example: $100K Trade With 1% Margin

Let’s break it down:

| Trade Size | Margin Requirement | Required Margin | Leverage |

|---|---|---|---|

| $100,000 | 1% | $1,000 | 100:1 |

If equity falls to $1,000, your margin level is 100%. If it drops more, you risk a margin call.

Margin Requirements by Broker and Region

Typical Requirements

Most forex brokers set margin at 1% to 5% for major currency pairs. That’s 100:1 to 20:1 leverage. But this depends heavily on where your broker operates.

Regional Differences

In the U.S., NFA rules cap leverage at 50:1 (2% margin). Europe’s ESMA limits retail traders to 30:1 (3.33% margin). But offshore brokers? I’ve seen 1000:1 offers. Be careful with those—they’re high risk, especially without strong regulatory oversight.

Why Regulation Matters

One time I opened an account with a Cyprus-based broker offering 500:1 leverage. Sounded great. But their margin call policy kicked in at 80%, and I didn’t know until I lost two trades back-to-back. That wouldn’t happen with a U.S. or EU-regulated broker where rules are stricter and clearly disclosed.

Understanding Margin Calls

What Triggers a Margin Call?

When your margin level hits 100%, your broker may issue a warning or margin call. It’s basically them saying, “Add more funds or we’re closing trades.” I got my first one during a volatile EUR/USD session with no stop-loss set.

The 100% Threshold

If your equity = your used margin, you’re done. You can’t open new trades. The market keeps moving and if losses grow, the broker starts closing your open positions to cover it. That’s the last place you want to be.

Stop-Out Levels

Each broker sets a stop-out level, usually between 30% and 50%. If your margin level falls below that, trades are closed automatically, starting with the largest loss. It’s brutal—but it prevents your account from going negative.

Managing Margin and Risk

Why High Leverage Is Risky

I’ve used 200:1 leverage before, and it felt powerful. But it also meant that a tiny 0.5% move could wipe out 100% of my margin. High leverage can inflate your wins—but it also magnifies your losses. It’s not free money; it’s borrowed risk.

New traders often think small accounts need high leverage. I get it, I’ve been there. But trading like that is a fast track to blowing your account. Keeping leverage low and margin levels high is what actually keeps you in the game.

Watching Your Margin Level

Here’s what I do: I set alerts when my margin level drops to 150%. That gives me a heads-up before things get critical. Every good platform—like MetaTrader 4 or 5—lets you monitor this live. If you’re not watching it, you’re trading blind.

Smart Position Sizing

This is where margin meets strategy. I only risk 1-2% of my account per trade. That way, even if a position goes south, I’ve still got free margin left. Use a position size calculator—some brokers have them built in. Or just bookmark this one from BabyPips.

Tools and Calculators

Using a Margin Calculator

I use margin calculators almost daily. It tells me how much margin I’ll need before placing the trade. Saves me from nasty surprises. Here’s how it works: you input the trade size, leverage, and currency pair. It spits out the required margin instantly.

My Daily Checklist

Before every trading day, I do this:

- Check free margin and margin level

- Review any open positions

- Use calculator to size new trades

- Set alerts at 150% margin level

It takes 5 minutes. But it’s saved me thousands.

Set Margin Alerts

Most platforms let you set alerts for when your margin level drops. Use them. It’s better than finding out too late when trades start closing without warning.

FAQs

What is margin in forex trading for beginners?

Margin is the amount of money your broker locks up when you open a trade. It’s not a cost. It’s more like a deposit to cover potential losses. The bigger the trade, the more margin you need.

How do I calculate margin level?

Easy. Take your equity (account balance plus or minus open trade P/L) and divide it by the used margin. Then multiply that by 100. That’s your margin level percentage. Example: $5,000 equity and $1,000 used margin = 500% margin level.

What’s the difference between margin and equity?

Margin is how much of your money is tied up in trades. Equity is the total value of your account, including profits and losses. If your trades are losing, equity goes down—even if margin stays the same.

What happens if margin level drops below 100%?

You’ll get a margin call. The broker may ask you to deposit more funds or close trades. If you don’t act fast, they might start closing your trades for you. This prevents you from going into a negative balance.

Can you lose more than your margin deposit?

Yes, in rare cases. Especially with unregulated brokers or during extreme volatility. But most good brokers—especially regulated ones—have negative balance protection. Always check this before opening an account.

Recap of Key Points

We’ve covered a LOT about margin. You now know that margin is collateral, not a fee. You know how to calculate your margin level, how to avoid margin calls, and why leverage can be both a tool and a trap. You also saw how brokers and regions vary when it comes to margin rules—and how important it is to choose a broker you trust.

Final Takeaway

If you take one thing away, let it be this: never treat margin like a shortcut to quick profits. It’s a risk tool. Respect it. Understand it. And use it wisely to grow your account, not blow it.

Closing Thought

Trading on margin changed how I look at risk. At first, I feared it. Now, I embrace it—cautiously, strategically, and with full awareness of what’s at stake. You can, too.