When I first opened a forex chart, I kept seeing numbers changing by 0.0001 or 0.01, and I had no clue what those tiny shifts meant. Everyone talked about “pips” like it was second nature. But for a total beginner like me, it felt like a foreign language.

That confusion stuck with me until a single EUR/USD trade taught me everything I needed to know: one pip can literally decide if you profit or lose. And once I understood that, my whole approach to forex changed.

So, what’s a pip, and why should you care?

In this beginner’s guide, I’ll break down pips in the most straightforward way I can. You’ll learn:

- What a pip really means

- How it shows up in your trading charts

- Why pip value changes with currency pairs

- How to calculate your gains or losses using pips

- How not to mess up like I did

By the end of this, you won’t just know what a pip is—you’ll feel confident reading charts, calculating your pip value, and making smarter trades. I’ll even show you some real screenshots and examples so you can picture it all clearly.

What Is a Pip in Forex?

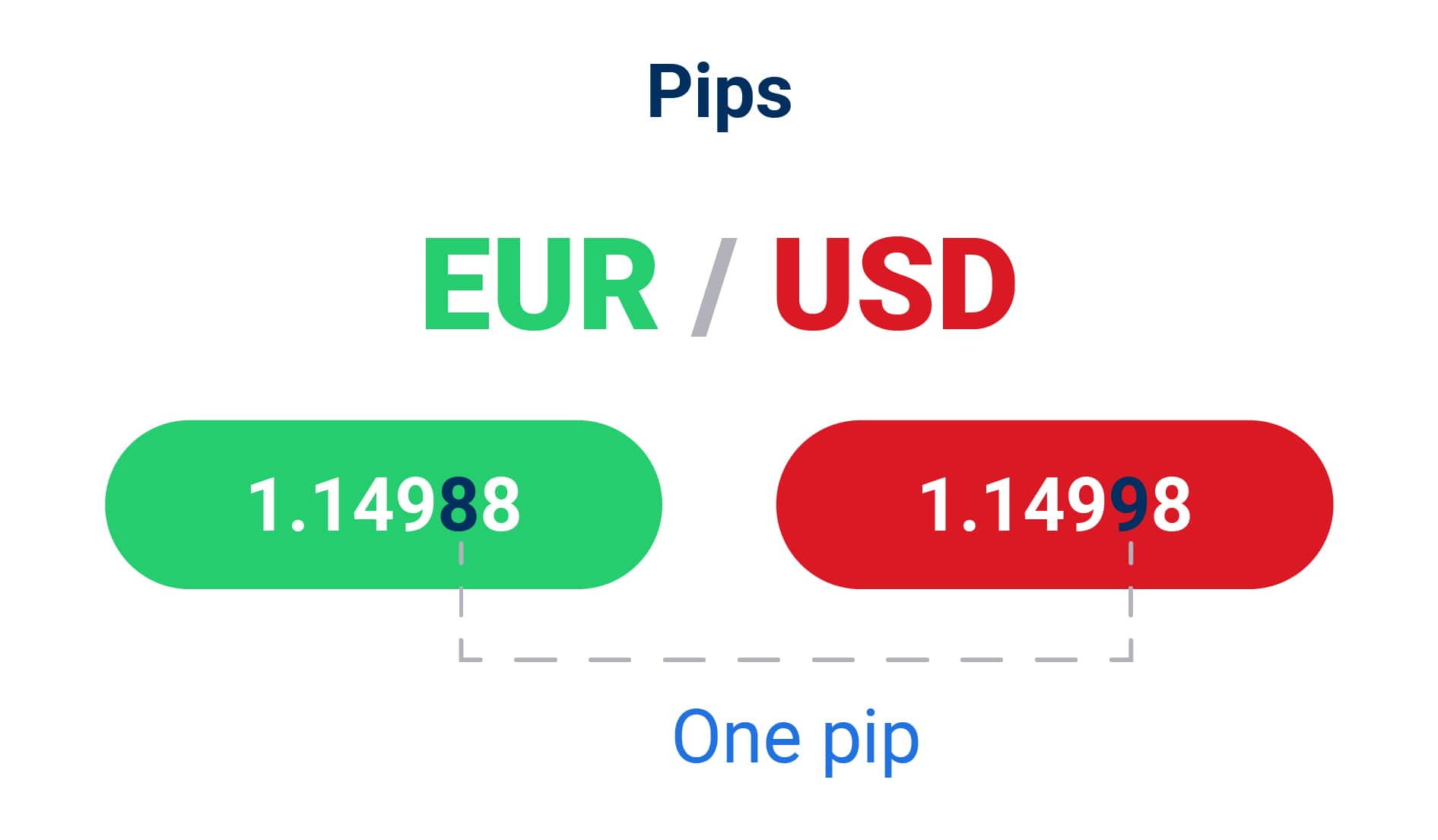

A pip stands for “percentage in point” or “price interest point.” It’s the smallest consistent price move a currency pair can make. In most cases, that’s 0.0001.

Let’s say you’re watching EUR/USD. If it moves from 1.1050 to 1.1051, that’s a one-pip increase. It may not seem like a big deal, but that tiny move can mean a $1, $10, or $100 difference depending on your lot size.

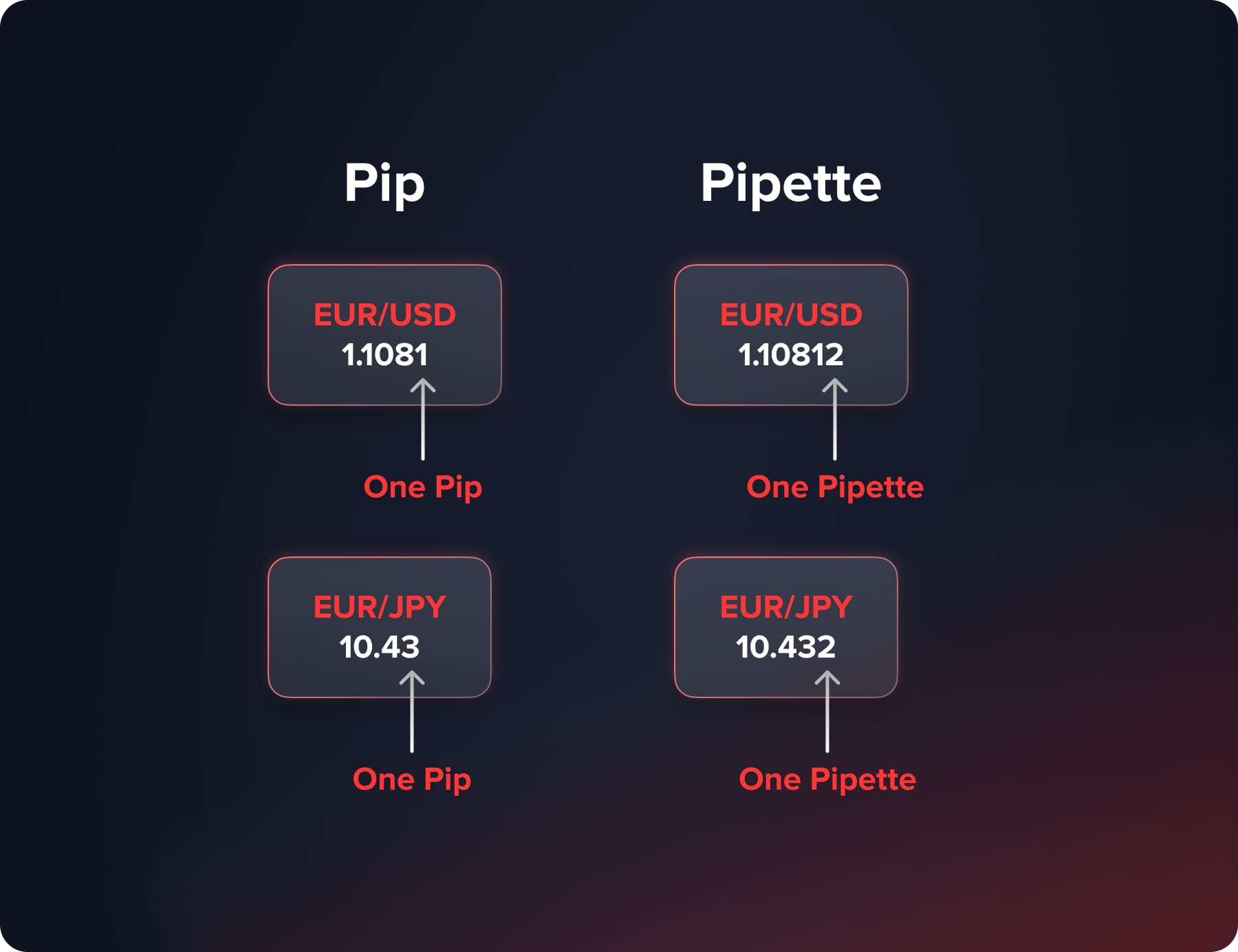

Now here’s the twist: not all pairs work the same. For Japanese Yen (JPY) pairs like USD/JPY, one pip equals 0.01 instead. That’s because of how prices are quoted.

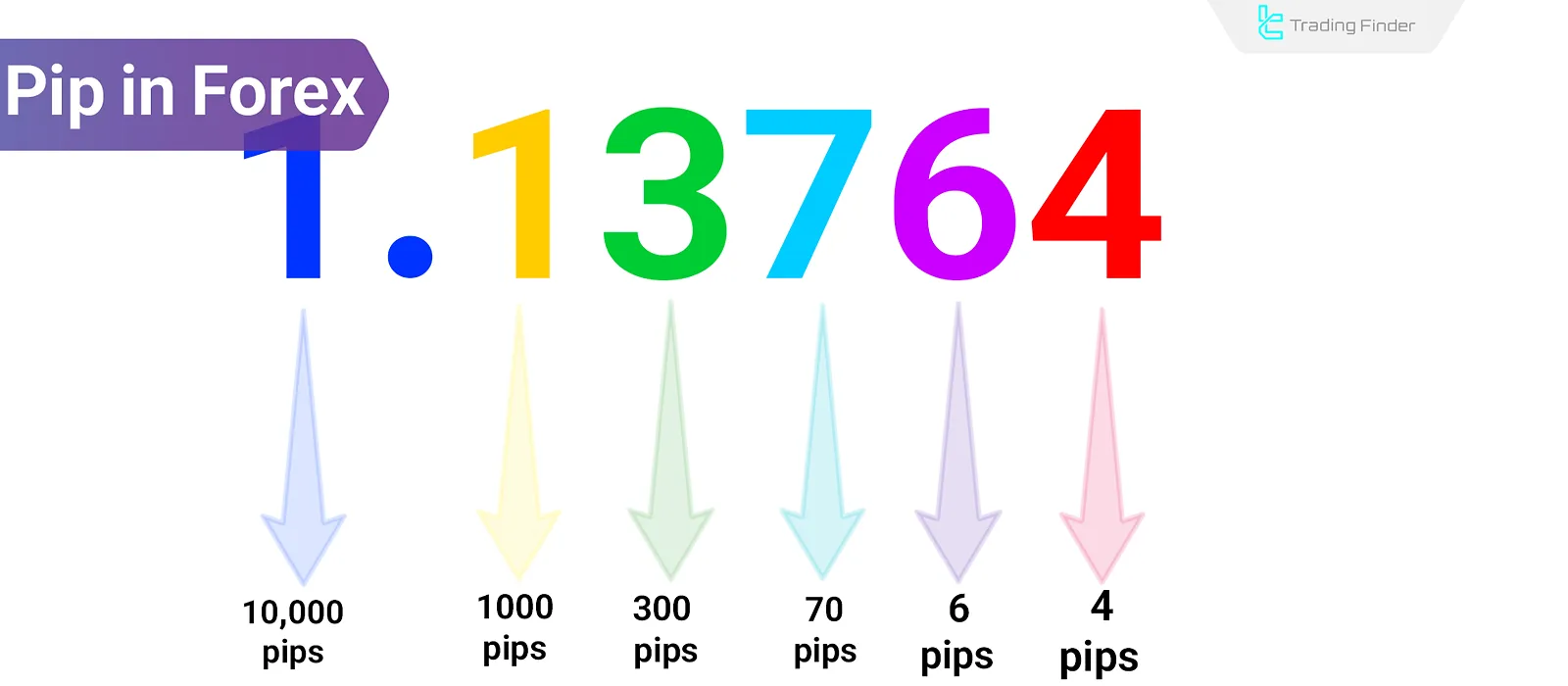

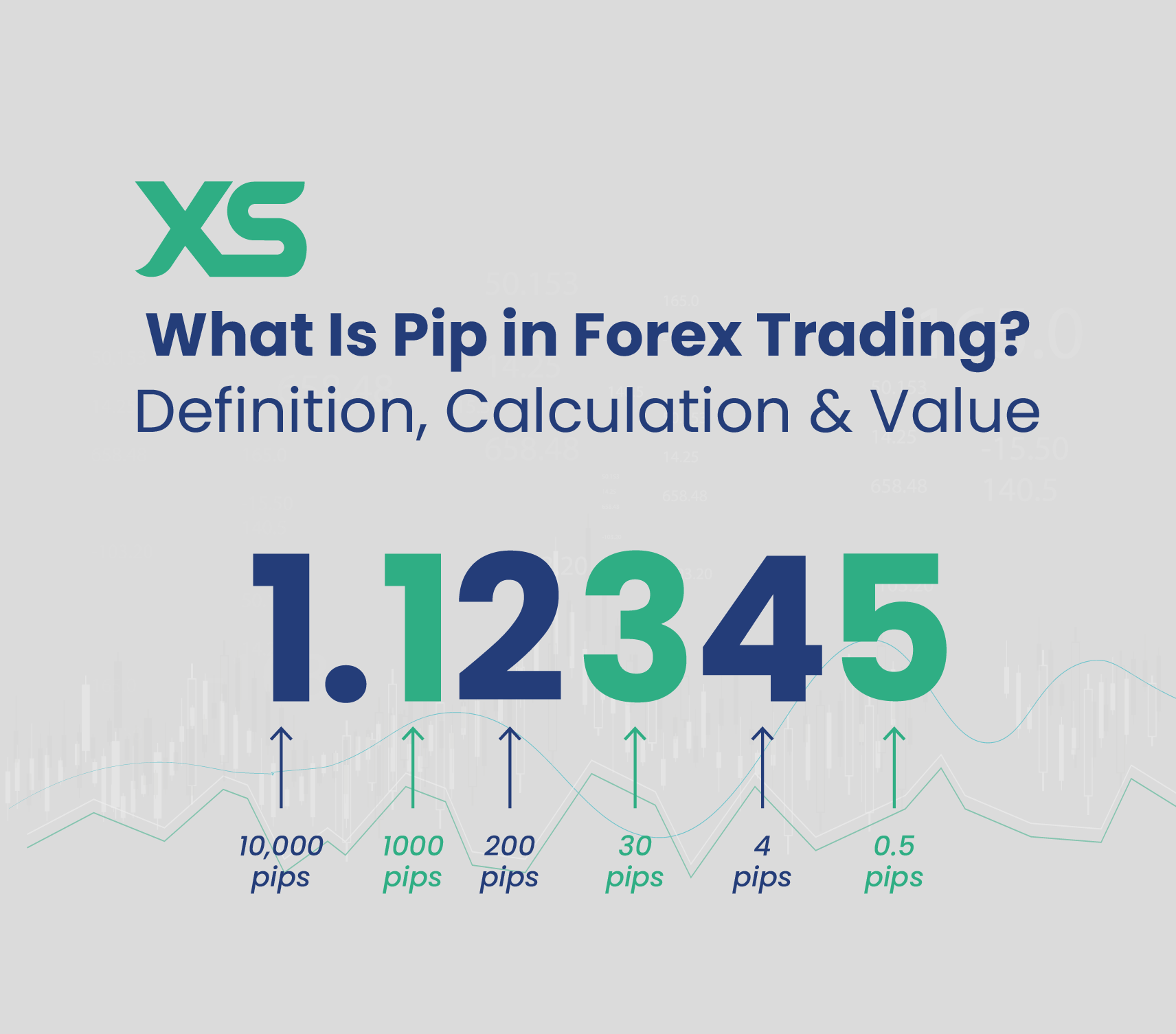

How Pips Appear in Currency Quotes

I used to think the last digit in the quote was always the pip. But no—it’s the fourth decimal in most pairs. That’s where pip movement shows.

Let me break it down for you:

Standard Decimal Quotes

Most major currency pairs are quoted to four decimal places. Like this:

EUR/USD = 1.1050 → 1.1051 = 1 pip increase.

Japanese Yen Pairs

Yen pairs, like USD/JPY, are only quoted to two decimals. For example:

USD/JPY = 132.55 → 132.56 = 1 pip increase.

Pipettes: Fractional Pips

Then there are pipettes. These are fractional pips—just one-tenth of a pip. They show up as a fifth decimal (e.g., 0.00001) in some brokers, especially ECN platforms. Super useful for precision, but they can be confusing at first.

Why Pips Matter to Traders

So why should you care about pips?

Because they affect everything—your profit, loss, spread, stop-loss, and even your confidence.

Measuring Price Movement

Pips are the ruler of forex. If EUR/USD moves 100 pips, that’s a major move. You can’t read charts without pips. They help you track volatility and time your trades better.

Calculating Profits and Losses

Your entire gain or loss in a trade comes down to how many pips the market moved in your direction (or against you). That’s why brokers and tools like pip calculators exist.

Understanding Spread and Risk

The spread is the difference between the buy and sell price—measured in pips. Same with your risk level. If you place a stop-loss 20 pips away, that’s how much you’re willing to lose.

Real-World Example: A One-Pip Move in EUR/USD

Let’s say you trade one standard lot (100,000 units) of EUR/USD. One pip equals $10.

If EUR/USD goes from 1.1050 to 1.1060, you just gained 10 pips = $100.

But if you had traded a mini lot (10,000 units), each pip is worth $1, so that same move gives you $10. Micro lot (1,000 units)? Just $0.10 per pip.

| Lot Size | Pip Value (EUR/USD) | 10 Pip Move |

|---|---|---|

| Standard Lot (100,000) | $10 | $100 |

| Mini Lot (10,000) | $1 | $10 |

| Micro Lot (1,000) | $0.10 | $1 |

How to Calculate the Value of a Pip

I remember messing this up so badly when I first started. I assumed pip value was always $1. Not true.

Standard Lot Calculation

The typical formula is: Pip Value = (Pip Size × Lot Size) / Exchange Rate

For EUR/USD (with USD as your account currency):

0.0001 × 100,000 = 10 USD per pip

Mini and Micro Lots

Use the same formula, just with smaller lot sizes. For a mini lot (10,000), it’s $1 per pip. Micro lot? $0.10 per pip.

Use a Pip Calculator

Don’t feel like doing the math? Neither do I. That’s why I always use a tool like the Babypips Pip Calculator. It does the work for you in seconds.

Factors Affecting Pip Value

Here’s where things get a little more real. Pip value isn’t static. It shifts based on a few things you need to keep in mind every time you trade.

Currency Pair

Not all pairs are created equal. If the quote currency isn’t USD (like EUR/GBP), the pip value won’t be $10 even on a standard lot. You’ll have to convert it into your account currency to get the true value.

Account Currency

If your trading account is in EUR or GBP instead of USD, the pip value changes because of the conversion. So always double-check the base currency of your account before calculating.

Lot Size and Leverage

Larger lot = bigger pip value. That’s why trading with high leverage is risky—you may only be risking 1 pip, but that pip might be worth a lot more than you realize.

Common Pip Mistakes Beginners Make

I made all of these in my first two weeks, so I’m sharing them so you don’t have to.

Confusing Pips with Percentage

This one got me the most. A pip is NOT a percentage. If EUR/USD moves from 1.1050 to 1.1060, that’s 10 pips—not 1% movement. Percent changes are much larger.

Miscalculating Pip Value

If you think one pip is always worth $1, you’re in for a surprise. That thinking can destroy your stop-loss setup or profit target. Always know the pip value of the pair you’re trading, in your account currency.

Ignoring Pips in Stop-Loss and Take-Profit

One time, I set a stop-loss 5 pips away—on a volatile pair during NFP news. It triggered instantly. Lesson? Match pip distance with pair behavior and timeframe. Don’t guess.

How to Avoid These Mistakes

Luckily, the fixes are simple once you know what to watch for.

Use Pip Calculators

Honestly, this is a no-brainer. You can get pip calculators from Investopedia or your broker’s tools. I have one saved on my phone. Always double-check before hitting “Buy.”

Practice with Demo Accounts

Try pip risk setups with zero real money on platforms like eToro or GoForex. Get used to how pips behave with different lot sizes and assets. You’ll learn fast without the pain.

Use Learning Simulators

I used the Forex Game app to get a feel for fast-moving markets. It’s like a trading playground where you learn how pips shift live—without risking your rent money.

FAQs About Pips in Forex

What is a pip in simple terms?

A pip is the smallest price change most forex pairs can make. Usually, it’s the fourth decimal place (0.0001) in a quote like EUR/USD.

How many pips is 1 dollar?

That depends on your lot size. In a micro lot, $1 equals 10 pips. In a mini lot, 1 pip equals $1. In a standard lot, 1 pip equals $10. Always use a pip calculator.

How much is 100 pips worth?

In a standard lot, 100 pips equals $1,000. In a mini lot, it’s $100. In a micro lot, just $10. The bigger the lot, the bigger the dollar value.

How do I calculate pip value?

Use this formula: (Pip Size × Lot Size) ÷ Exchange Rate. Or use a pip calculator to do it for you. Don’t guess—get the number right every time.

Why are pips important in forex trading?

Because they help you measure risk, reward, spread, and price movement. Every trade you make is tracked in pips. If you don’t understand them, you’re flying blind.

Here’s What You’ve Learned

So, here’s what we’ve covered:

- A pip is the smallest price unit in forex—usually 0.0001.

- It helps you measure profits, losses, and market movement.

- Pip value depends on your lot size, currency pair, and account currency.

- Pipettes (fractional pips) give more precision.

- You can use calculators and demo tools to get good at this—before putting real money on the line.

The Big Takeaway

If there’s one thing I wish someone had told me on day one, it’s this: **mastering pips = mastering control.** When you understand pips, you stop trading emotionally and start trading logically. You don’t just chase charts—you read them. You start setting smarter stop-losses, sizing your trades properly, and protecting your capital like a pro.

One Last Thought

I know this stuff can feel dry at first. But trust me, once you lock it in, pips become your best friend. The tiniest number on your screen might just be the biggest key to your success.