When I started trading Forex, I had no clue what a “lot” was. I just clicked the trade button and watched my balance rise or drop with every pip. Sound familiar? If you’re just starting out or even if you’ve been trading for a while, understanding lot size is *crucial* to surviving the market—let alone thriving in it.

The problem? Most people ignore lot size or misunderstand it, and that’s a surefire way to blow your account. Lot size isn’t just about the size of your trades. It directly controls how much you gain—or lose—for every pip the market moves.

I’ve made that mistake myself, overleveraging tiny accounts on large lot sizes because I didn’t get how pip value works. So in this guide, I’m going to walk you through the concept of lot sizes like I wish someone had done for me.

- What a Forex lot really is and why it matters

- The 4 main lot sizes: standard, mini, micro, and nano

- How lot size affects pip value, leverage, and risk

- Real-life examples with tables

- Tips to pick the right lot size based on your account

This guide will help you stop guessing and start choosing the right lot size *every single time*. It’s practical, easy to follow, and full of real talk—no fluff.

What Is a Forex Lot?

A lot in Forex is just the size of your trade. Think of it like the number of currency units you’re buying or selling. But instead of trading one dollar at a time, Forex brokers use lot sizes to group trades into standard units.

Here’s what that really means: when you open a trade, you don’t say “I want to buy 2,000 euros.” You choose a lot size, and the broker figures out how many currency units that equals. The bigger the lot, the bigger the trade—and the bigger your risk or reward.

Back when I first used MetaTrader 4, I didn’t realize that 1.00 meant 100,000 units. I was using a micro account and placing trades that wiped out my balance faster than I could say “margin call.” That’s why knowing what each lot means is key.

Types of Forex Lot Sizes

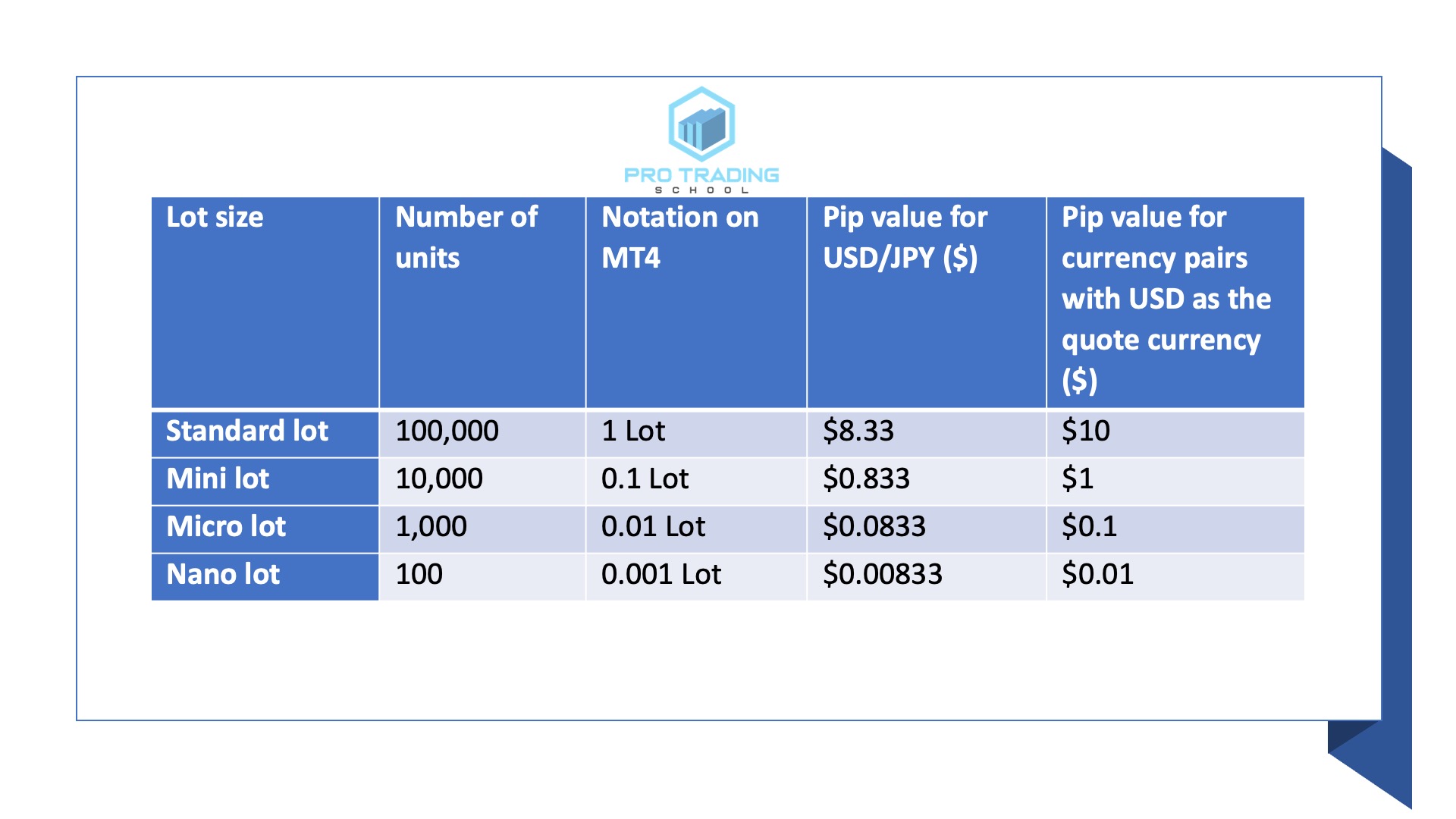

Now, let’s look at the four common types of Forex lot sizes. These aren’t just numbers—they control your pip value, required margin, and how risky your trades are.

Standard Lot

A standard lot is equal to 100,000 units of the base currency. Every pip movement is worth about $10 if you’re trading a USD pair.

Who uses it? Usually pros and institutions. If your account is under $10,000, this lot size can wreck you unless you’re very careful with stop-losses and leverage.

Mini Lot

A mini lot is 10,000 units. Each pip is worth about $1.

This was the sweet spot for me when I was building my first $3,000 account. It gave me enough movement to feel the trade, but not so much that I panicked when the market moved 20 pips against me.

Micro Lot

A micro lot is only 1,000 units. That’s just $0.10 per pip. Perfect if you’re new or testing strategies.

I still use micro lots when I’m trying out a new EA or want to dip into a volatile pair like GBP/NZD without too much risk.

Nano Lot

Nano lots are super small—just 100 units. That’s 1 cent per pip. Not every broker offers these, but if you’re practicing or trading with under $100, this is your jam.

Some brokers that support nano lots are great for demo-to-live account transitions because you can test with real money—but microscopic risk.

Why Lot Size Matters

Lot size isn’t just some number you click. It controls how much money you can make—or lose—on every single trade.

When I started using lot size calculators, I finally understood how badly I had been risking way too much for my account size. That’s when my win rate didn’t even matter—because I was blowing up on one bad trade.

Risk Management and Lot Size

Say you’re using a 50-pip stop loss on EUR/USD. If you trade 1 standard lot, you risk $500. But if you trade a micro lot? Only $5.

That’s why **knowing your lot size = controlling your risk**. Don’t just guess. Use a lot size calculator to stay within 1-2% risk per trade. That’s a rule I live by now, no matter what pair I’m trading.

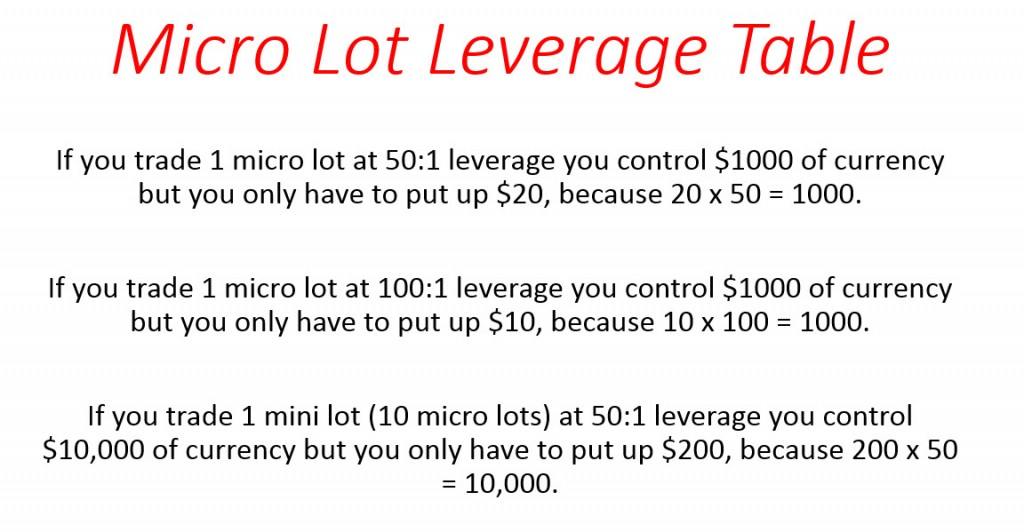

Leverage and Margin Implications

Larger lot sizes mean you need more margin. That means higher leverage. More leverage = more risk.

I once opened a 1.5 standard lot trade on a $1,000 account using 1:500 leverage. One spike and—boom—margin call. That’s how I learned that leverage isn’t power unless it’s controlled.

Choosing the Right Lot Size

There’s no one-size-fits-all. Your ideal lot size depends on your account balance, risk tolerance, and trading plan.

Examples of Lot Size in Action

Here’s how pip values translate to real profits/losses across different lot sizes:

| Lot Size | Units | Pip Value (USD) | Profit/Loss on 50 Pips | Best For |

|---|---|---|---|---|

| Standard | 100,000 | $10 | ±$500 | Pros & Large Accounts |

| Mini | 10,000 | $1 | ±$50 | Mid-Level Traders |

| Micro | 1,000 | $0.10 | ±$5 | Beginners |

| Nano | 100 | $0.01 | ±$0.50 | Testing Strategies |

As a rule of thumb, I don’t risk more than 2% of my account on a trade. With a $500 account, that’s $10. So I stick to micro or nano lots, depending on the setup.

Common Mistakes to Avoid

I’ve been there—thinking bigger lot size equals bigger profits. But honestly, that mindset almost wiped my account more than once. Let’s talk about what to watch out for.

Using Too Large a Lot Size

This is the classic mistake. It’s tempting to jump into a trade with a standard lot because you want that $100 payoff on 10 pips. But if it moves the wrong way? You’re out hundreds in seconds.

I once risked 10% of my account on one trade. It worked… until it didn’t. Now, I calculate my lot size *before* I even look at the charts. That keeps my emotions in check and my balance safe.

Ignoring Pip Value Impact

Many new traders don’t realize how much each pip is worth. Trading 0.10 vs 1.00 may not seem like a big deal—until you see the dollar difference on your account.

Understand this: every extra decimal matters. A mini lot’s $1 pip value is ten times higher than a micro lot’s. That can be the difference between a manageable drawdown and a total loss.

Forgetting About Leverage Rules

Different brokers have different leverage caps—especially in countries like the U.S., where max leverage is usually 1:50. If you’re using high leverage with a small account, even a mini lot could get you into trouble fast.

Always check your broker’s margin requirements before opening a position. And when in doubt? Go smaller. Live to trade another day.

FAQ: Real Questions From Real Traders

What lot size should I use as a beginner?

If you’re just getting started, micro lots (1,000 units) are your best friend. They keep your risk low while you learn how to trade. Some brokers even offer nano lots (100 units) for ultra-low exposure.

Is it better to trade micro or mini lots?

It depends on your account size. I personally started with micro lots until I had at least $3,000. Mini lots offer more profit per pip, but also more risk. If your trades aren’t consistently profitable yet, stick with micro lots.

How do I calculate pip value based on my lot size?

You can use free online calculators like Myfxbook’s Lot Size Calculator. Or just remember:

- Standard lot = $10/pip

- Mini lot = $1/pip

- Micro lot = $0.10/pip

- Nano lot = $0.01/pip

Can I change lot size per trade?

Yes, and you should. Your lot size should match the trade setup, account size, and your risk tolerance. I adjust mine depending on how confident I am and the distance of my stop loss.

Recap and Final Thoughts

We covered a lot, so let’s bring it all home. A lot size is how much currency you’re trading. And choosing the right one is the backbone of proper risk management in Forex trading.

Here’s what you now know:

- The 4 main lot sizes: standard, mini, micro, and nano

- How each size impacts your pip value and risk

- Why big lot sizes on small accounts are a recipe for disaster

- How to use your account balance and risk % to pick the right lot size

- What tools to use (like pip calculators) to stay safe and smart

If there’s one thing I’ve learned in my trading journey, it’s this: Consistency beats size. Lot size won’t make you rich overnight, but it *will* protect you long enough to become a better trader.

So start small. Stay in the game. And always, always know your numbers before hitting that trade button.