I still remember the first time I heard the term “Forex.” I was sitting in a coffee shop with a friend who was scrolling through an app showing charts filled with colorful candlesticks. I had no idea what I was looking at. All I knew was that it had something to do with money—and lots of it.

Back then, Forex felt like this intimidating world of jargon, banks, and financial giants. But now, having spent years immersed in trading and analysis, I’ve learned it’s not just for Wall Street insiders. And that’s exactly what I’m going to help you see today.

If you’ve ever wondered how currencies get exchanged, what causes the dollar to rise or fall, or how everyday people like you and me can actually trade them—you’re in the right place.

- What the Forex market actually is (in plain English)

- How currency trading works in real life

- The different types of Forex markets

- Who the key players are and why they matter

- What makes Forex unique and risky—but also exciting

My goal here isn’t just to give you the textbook definition. I want you to walk away feeling confident—like you’ve cracked open the door to something powerful. Let’s dive in.

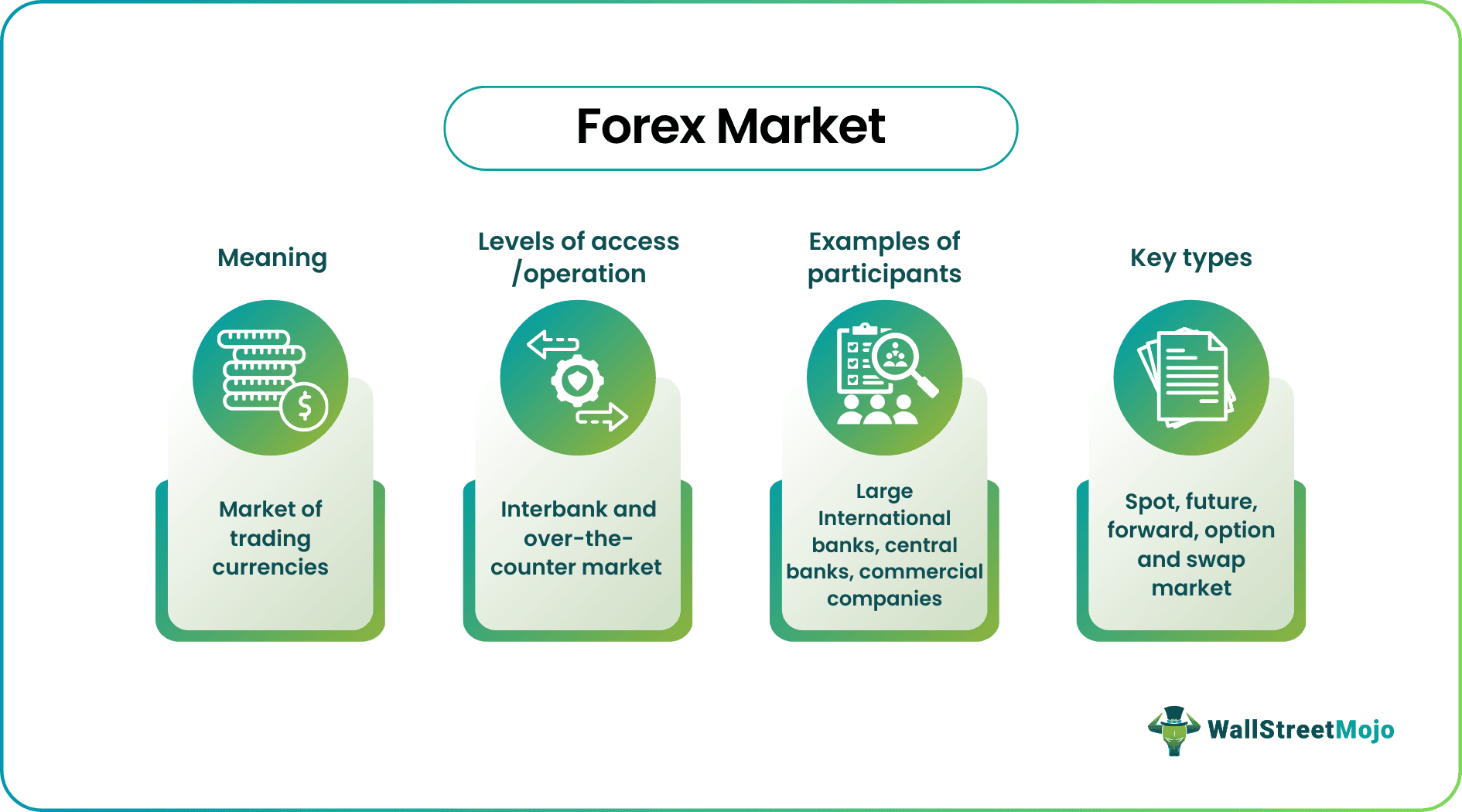

What Is the Forex Market?

The Forex market—short for “foreign exchange”—is where currencies get traded. Every time you travel abroad, use a currency conversion app, or buy an imported item, you’re bumping up against this market. But behind the scenes, it’s a monster. With over $7 trillion traded every single day, Forex is the largest and most liquid financial market in the world.

It’s also completely decentralized. That means there’s no big building or central exchange like the New York Stock Exchange. Instead, banks, corporations, governments, and regular folks like us trade currencies electronically across global networks. That’s what makes it operate 24 hours a day, five days a week.

So what’s the point? Well, imagine you’re a business in Japan buying parts from the U.S. You need dollars to pay them. Forex is the mechanism that makes that happen.

And yes, it’s the same place where traders try to profit from currency movements.

Why Forex Exists

Currencies need to be exchanged for trade, tourism, investing, and speculation. Without Forex, international business would collapse. It’s that essential. From a personal standpoint, I’ve used Forex to transfer money abroad, hedge currency risk, and yes—even try to make a little profit.

Forex vs. Stocks

Unlike the stock market, which trades specific companies, Forex trades currency pairs. And while stocks have opening bells and closing times, Forex never sleeps.

It’s fast, it’s global, and it’s unpredictable. That’s what draws many of us in—but also why it’s not something to dive into blindly.

Types of Forex Markets

Not all Forex trading happens in the same way. There are actually several different markets, and knowing the difference helps you avoid nasty surprises.

Spot Market

This is where most of the action happens. In a spot trade, currencies are exchanged “on the spot” at current prices. Think of it like exchanging cash at an airport—but digital and way more precise. I started here because it was the simplest and most accessible.

Forwards and Futures

These are contracts to exchange currencies at a later date, often used by businesses to lock in prices. If you’ve ever booked a hotel and prepaid in a different currency, you’ve experienced something similar.

Futures are more standardized and traded on formal exchanges. Forwards are customized between parties. Retail traders usually stick to the spot market unless they’re more advanced.

Options

Options give you the right but not the obligation to exchange currency at a set rate in the future. They’re mostly used by institutions and are complex—but powerful if you know what you’re doing.

How Forex Trading Works

This part tripped me up early on, so let’s break it down simply. Forex trades happen in pairs. That means you’re buying one currency and selling another at the same time. The first currency is called the base, and the second is the quote.

Example: In the pair EUR/USD, you’re buying euros and selling U.S. dollars. If that rate moves in your favor, you make money. If not, you lose. Pretty straightforward—but devilishly hard to predict.

Understanding Currency Pairs

Major pairs (like EUR/USD or USD/JPY) are the most traded. Then there are minors and exotic pairs. Beginners usually stick with majors because they’re more stable and liquid.

Bid, Ask, and Spread

The bid is the price at which buyers are willing to buy. The ask is what sellers want. The spread is the difference—and that’s how brokers make money. Think of it as a silent fee that can eat into your profits.

Leverage and Margin

This is where things get spicy—and risky. Forex brokers often offer leverage like 50:1 or 100:1, meaning you can control big trades with a small deposit. But it also means your losses can multiply just as fast.

I once made a rookie mistake by overleveraging. A small move in the market wiped out my account. Don’t be me. Start small. Understand the risk.

Table: Summary of Forex Market Types

| Market Type | Description | Typical Use |

|---|---|---|

| Spot | Immediate exchange at current rate | Speculation, retail trading |

| Forward | Customized contract for future exchange | Hedging currency risk |

| Futures | Standardized contract traded on exchanges | Hedging, speculation |

| Options | Right (not obligation) to exchange in future | Risk management, institutional use |

Who Participates in the Forex Market?

This market isn’t just made up of traders with fancy suits. In fact, the people and entities behind Forex are incredibly diverse—and knowing who’s in the game helps you understand how prices move.

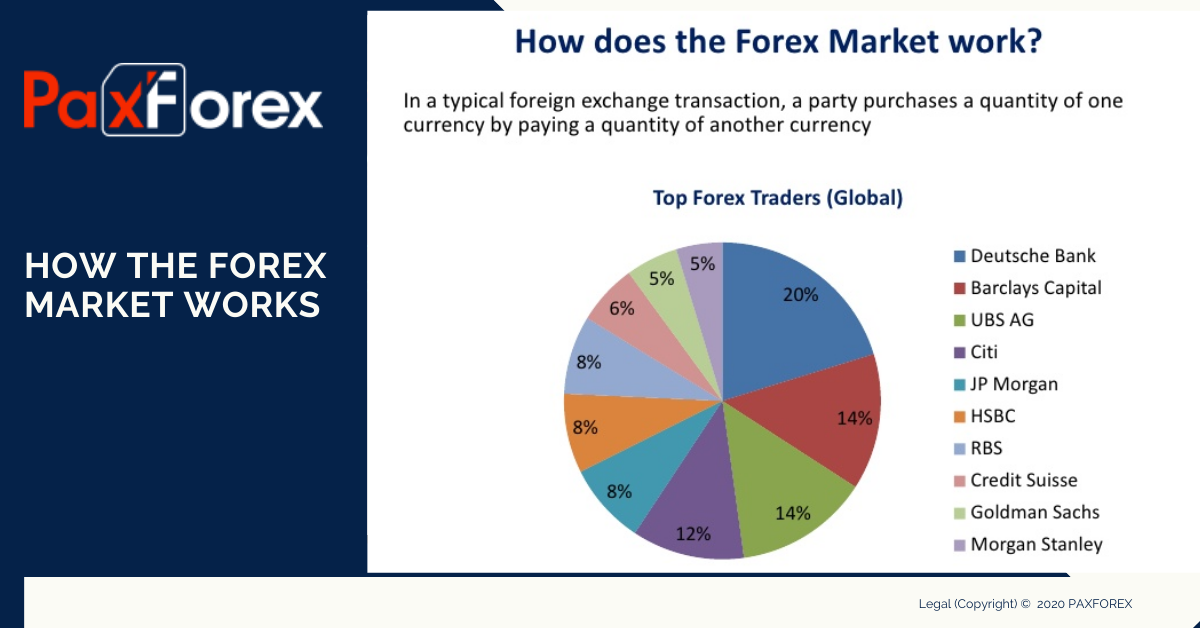

Banks and Financial Institutions

These are the big dogs. They handle the majority of global currency transactions, mostly on behalf of their clients. Ever heard of JPMorgan or Deutsche Bank? They dominate the interbank Forex space. Their trades can move the market big time.

Central Banks and Governments

These players step in when they need to stabilize their economies. For instance, the Bank of Japan has been known to intervene in currency markets to weaken or strengthen the yen. Their decisions impact interest rates, inflation, and—you guessed it—Forex prices.

Retail Traders and Brokers

This is where folks like you and I come in. We use platforms like MetaTrader or cTrader through brokers who connect us to the larger market. Brokers offer the tools, charts, and leverage—but they also make money through spreads and sometimes commissions.

Retail trading has grown fast, thanks to mobile apps and better education. Still, it’s easy to get caught up in the hype, so it’s crucial to learn before risking real money.

Why People Trade Forex

Not everyone is in it for profit. Some trade Forex to manage risk, while others speculate. Let’s break it down.

Hedging Currency Exposure

Big corporations that deal in multiple currencies use Forex to protect against currency swings. For example, an American company buying parts from Europe may lock in exchange rates to avoid future surprises.

I once worked with a freelancer who got paid in euros. She used Forex trading to convert her payments at favorable rates instead of relying on her bank. It saved her hundreds of dollars over the year.

Speculation and Profit Potential

This is the juicy part. Speculators—people trading for profit—try to predict which way a currency will go. It’s fast, exciting, and risky. I’ve had wins and losses here, but the lessons learned were priceless.

International Commerce and Investing

Without Forex, buying things across borders would be a nightmare. Whether it’s investing in overseas property or importing goods, Forex keeps the global economy spinning.

What Makes Forex Unique?

After dabbling in stocks and crypto, I can say Forex is a different beast. Here’s why it stands out.

Size and Liquidity

With more than $7 trillion traded daily, Forex offers unmatched liquidity. That means you can open and close trades fast—usually without massive slippage. It’s like trying to move a boat in the ocean instead of a small pond.

24-Hour Operation

This is one of my favorite parts. Forex runs from Sunday evening to Friday night, following global time zones. I’ve traded late at night or during early mornings—because the market never sleeps.

Volatility and Opportunity

Forex can be wild. News, elections, interest rate decisions—they all shake up prices. While that creates opportunity, it also means you have to be sharp. I’ve been burned by ignoring news, and I’ve scored wins by staying informed.

Key Benefits and Risks of Forex

Let’s talk real. Forex trading comes with perks—but also punches.

Pros of Forex Trading

You can trade with small capital, access global markets 24/5, and learn fast thanks to demo accounts. I started with just $100 on a demo and slowly learned the ropes without pressure. The barrier to entry is low, and the potential is there.

Risks and Challenges

Leverage is a double-edged sword. One bad trade and you could blow up your account. The market is unpredictable, and emotional decisions often lead to losses. I’ve had days where I felt on top of the world—and others that made me question everything.

Managing Risk Like a Pro

Use stop losses. Never risk more than 1-2% of your account on a trade. Always trade with a plan. I keep a journal of every trade—why I entered, what I saw, how it went. It’s helped me improve more than any course ever could.

FAQs

What is Forex and how do beginners start?

Forex stands for “foreign exchange” and it’s the market where currencies are traded. Beginners should start by learning the basics, practicing on a demo account, and choosing a reliable broker. Avoid jumping in with real money until you’ve built confidence and a strategy.

Is Forex trading profitable for retail traders?

It can be—but it takes education, discipline, and experience. Many traders lose money early on. I broke even my first year, and only saw consistent profits after refining my strategy and risk management.

What time does the Forex market open and close?

Forex opens on Sunday at 5 p.m. EST and runs 24 hours a day until Friday at 5 p.m. EST. The market follows global financial centers—Sydney, Tokyo, London, and New York.

How do central banks affect Forex markets?

They influence exchange rates through interest rates and monetary policy. For example, if the Federal Reserve raises rates, the U.S. dollar usually strengthens. These decisions are watched closely by traders worldwide.

What’s the safest way to start trading Forex?

Learn first. Use demo accounts. Stick to major currency pairs. Use small amounts of leverage—or none at all at the beginning. Focus on preserving your capital while learning the ropes.

Recap of Key Points

We explored what the Forex market is, how it works, and who’s involved. We covered the different market types, trading mechanics, and what makes this space unique. I shared my own wins and losses, hoping you feel less alone as you begin your journey.

Final Takeaway

Forex isn’t just numbers and charts—it’s a global network of people, businesses, and governments exchanging value. It’s powerful, accessible, and yes—risky. But with the right mindset, tools, and patience, it’s also full of opportunity.

Closing Thought

If you’re still reading this, you’re already ahead of most. Keep learning, stay humble, and never risk more than you’re willing to lose. The Forex market isn’t going anywhere—and now, neither are you.