When I first heard about Forex, I assumed it was just for Wall Street folks or people glued to financial news. I couldn’t have been more wrong. The Forex market, short for “foreign exchange,” is something anyone can learn. You don’t need a finance degree — just curiosity and a bit of guidance.

Here’s what frustrated me: every beginner-friendly guide still sounded like a textbook. I didn’t want jargon. I wanted clarity. I needed someone to walk me through it like they were teaching a friend. That’s what this guide is about.

I’ll break down how the Forex market works, using simple terms, real-life examples, and a few lessons I learned the hard way. If you’ve ever wondered how currencies are traded, or why you keep hearing about things like EUR/USD and pips, keep reading.

- What the Forex market is and why it matters

- How currency pairs work (with real examples)

- Key concepts like spreads, leverage, and lots

- What moves currency prices — and how traders profit

By the end of this guide, you’ll understand the Forex basics clearly — no fluff, no hype, just the stuff that helps you make smarter moves.

What Is the Forex Market?

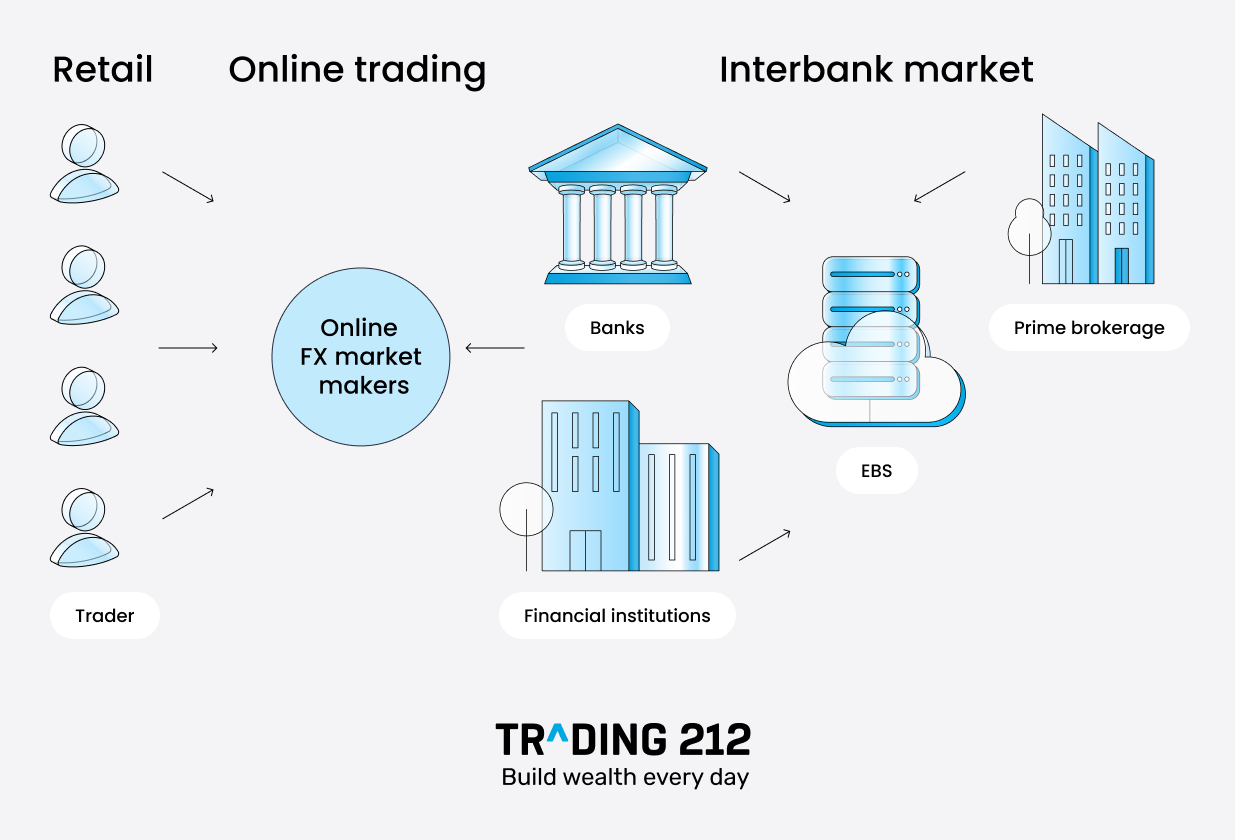

The Forex market is where currencies are exchanged. Think of it like a global marketplace that never sleeps — running 24 hours a day, five days a week. But here’s the twist: it’s completely decentralized. No single exchange. No headquarters. Just buyers and sellers trading currencies through electronic networks around the world.

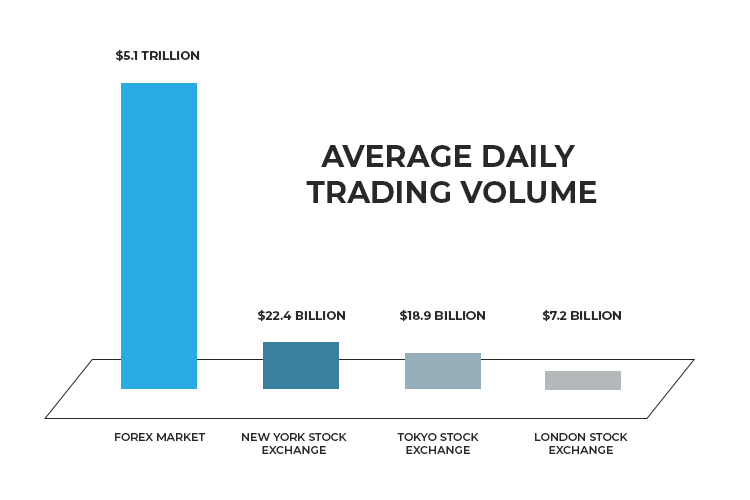

At over $7 trillion traded every single day, it’s bigger than the stock, bond, and commodity markets combined (source: BIS).

How Big Is the Forex Market?

Let’s put it into perspective. When I started exploring Forex, I learned it wasn’t just banks and hedge funds trading. Ordinary people — even folks like me — could trade currencies. What makes it even wilder is how the market keeps going around the clock thanks to time zone overlaps across major cities like Sydney, Tokyo, London, and New York.

| Market Center | Open (GMT) | Close (GMT) |

|---|---|---|

| Sydney | 10:00 PM | 7:00 AM |

| Tokyo | 12:00 AM | 9:00 AM |

| London | 8:00 AM | 5:00 PM |

| New York | 1:00 PM | 10:00 PM |

Why Do People Trade Forex?

Traders jump into the Forex market for different reasons. Some are in it for profit — buying low, selling high. Others, like multinational businesses, trade to protect themselves against currency fluctuations. Then there are folks who just want to diversify their investments. Me? I was drawn to the freedom — no centralized exchange, no closing bell.

How Forex Trading Works

When you trade Forex, you’re always dealing with a pair of currencies. You buy one and sell the other — simple concept, but there’s a bit more to it under the hood.

Here’s what really helped me: thinking of it like a barter. If I exchange U.S. dollars for euros, I’m betting the euro will get stronger. If it does, I make a profit. If not… well, I’ve been there too.

Currency Pairs Explained

Currency pairs show you how much of one currency you need to buy another. The first part is the base currency. The second is the quote currency. If EUR/USD is at 1.1000, it means 1 euro costs 1.10 dollars.

There are three types of pairs:

- Major pairs: Always include USD (like EUR/USD)

- Minor pairs: No USD, but stable (like EUR/GBP)

- Exotic pairs: Include a major plus an emerging currency (like USD/TRY)

Bid, Ask, and Spread

This part tripped me up at first. The bid is the price someone is willing to buy. The ask is what they’re willing to sell for. The spread is the difference — and that’s often where brokers make their money.

So, if you see EUR/USD quoted as 1.1000 / 1.1003, the spread is 0.0003 (3 pips). That might sound tiny, but it adds up — especially if you’re trading standard lots (more on that in a second).

Lots and Leverage

In Forex, trades are placed in “lots” — fixed sizes of currency units. Here’s what you need to know:

- Standard lot: 100,000 units

- Mini lot: 10,000 units

- Micro lot: 1,000 units

Leverage lets you trade larger amounts with a smaller deposit. I’ve used 50:1 leverage before, which means for every $1, I controlled $50. While it can boost profits, it can also magnify losses. I’ve learned the hard way — always know your risk before you click “buy.”

Types of Forex Markets

Not all Forex trading happens in real-time. There are actually three types of markets you’ll hear about:

Spot Market Overview

The spot market is where most trading happens. Prices are determined by supply and demand, and trades settle in about two business days. This is the place I started — it’s immediate, simple, and great for beginners who want to see their trades in action.

Forward and Futures Contracts

Then there’s forwards and futures. I didn’t touch these until I had some experience. Forwards are private agreements to buy or sell a currency later, at a set price. Futures are similar, but traded on public exchanges like the Chicago Mercantile Exchange. These are used more for hedging or speculation with less flexibility but more structure.

If you’re just starting, the spot market is your best bet — lower barriers, real-time action, and fewer complications.

What Affects Forex Prices?

Here’s something that took me a while to grasp: Forex prices don’t move randomly. There are real reasons behind every shift — and once I started tracking these factors, I felt way more confident.

Interest Rate Differentials

Central banks like the Federal Reserve (USA) or the European Central Bank (ECB) set interest rates that directly impact currency strength. When a country raises rates, its currency usually strengthens because investors want higher returns.

For example, when the Fed raised rates aggressively in 2022, the U.S. dollar surged. I watched EUR/USD dip below parity for the first time in decades. It was a powerful lesson in macroeconomics meets real-world impact.

Economic Data and News

Each week, countries release data like GDP growth, inflation, and employment numbers. These reports can move markets in seconds. One time, I placed a trade right before a U.S. jobs report. Bad move — I hadn’t checked the calendar. The market spiked against me in under a minute. Now, I never trade blind.

Use an economic calendar to track big events. Trust me — it’s a must-have.

Geopolitical Risk and Speculation

Political drama, elections, wars — they all send shockwaves through Forex markets. In early 2022, the Russia-Ukraine conflict caused huge volatility in EUR and USD pairs. Traders reacted not just to facts, but to fear and headlines. This is where market sentiment plays a massive role.

One trick I’ve used: follow major news outlets and Forex forums to gauge sentiment. It’s not perfect, but it keeps you plugged into the bigger picture.

FAQ

What is the best time to trade Forex?

The best time depends on when markets overlap. The London–New York overlap (from 8 AM to noon EST) has the highest liquidity. That’s when I personally see the most movement — and opportunity. Avoid late Fridays or holidays when the market can be flat or unpredictable.

Do I need a lot of money to start Forex trading?

Nope. You can start small with micro lots and a demo account. I began with just $100 using a demo to learn without risking real money. But remember — leverage can work against you. Always manage your risk.

Can you lose more than you invest in Forex?

Yes, depending on your broker and whether they offer negative balance protection. That’s why I chose a regulated broker from the start. Always read the fine print and use stop-loss orders. Safety first.

Recap and Final Takeaway

We covered a lot — and if you’re still reading, you now have a solid grip on how the Forex market works. Let’s rewind:

Recap of Key Points

- The Forex market is massive, liquid, and runs 24/5

- You trade currencies in pairs — buying one, selling the other

- Key terms: spreads, leverage, lots, bid/ask, and spot vs. futures

- Prices are driven by interest rates, economic news, and global events

Final Takeaway

Forex isn’t just for pros. If I can learn it, you can too. It’s about patience, practice, and staying informed. The market rewards knowledge — not luck.

Closing Thought

If this guide helped simplify the chaos for you, bookmark it. Better yet, try opening a demo account and placing your first trade. Start small. Ask questions. Stay curious. Because understanding how Forex works? That’s your first profitable trade.

Read more guide How to Get Started in Forex Trading (Step-by-Step)

:max_bytes(150000):strip_icc()/dotdash_RealFINAL_How_to_Build_A_Forex_Trading_Model_Jan_2020-02019399699842caa4005ac5847eec09.jpg)