The forex market never sleeps, and that used to intimidate me.

When I first started trading, I’d stay up all night thinking the more I watched, the better my odds. Spoiler: I was exhausted and broke. It took me months to realize this market is actually divided into four key sessions—each with their own rhythm, currency pair dynamics, and volatility windows.

If you’re tired of feeling like you’re trading in the dark or just not sure when to jump in, this guide is for you.

We’ll cover:

- How each trading session works: Sydney, Tokyo, London, and New York

- Why session overlaps matter so much

- What pairs are best to trade and when

- Tips from my own experience of trading these sessions

After reading this, you’ll know when to sit tight and when to strike. You’ll understand the flow, the rhythm, and the high-probability zones in the world’s most liquid market.

What Are Forex Trading Sessions?

Understanding the 24-Hour Cycle

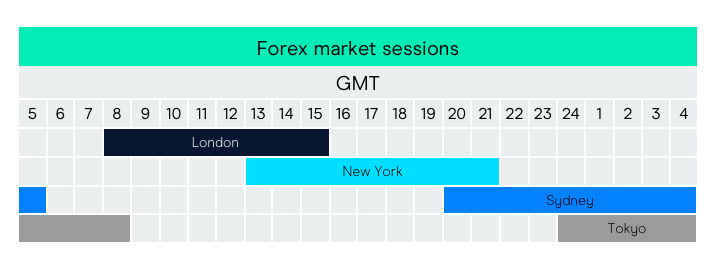

Forex market is open 24 hours a day from Monday to Friday. That doesn’t mean it’s always smart to trade. The market splits into four major sessions named after global financial centers: Sydney, Tokyo, London, and New York.

Each session has its own vibe. Liquidity, volatility, and currency pair activity vary depending on where the money’s flowing. And let me tell you from personal pain—trying to scalp during the Sydney session is like fishing in a bathtub.

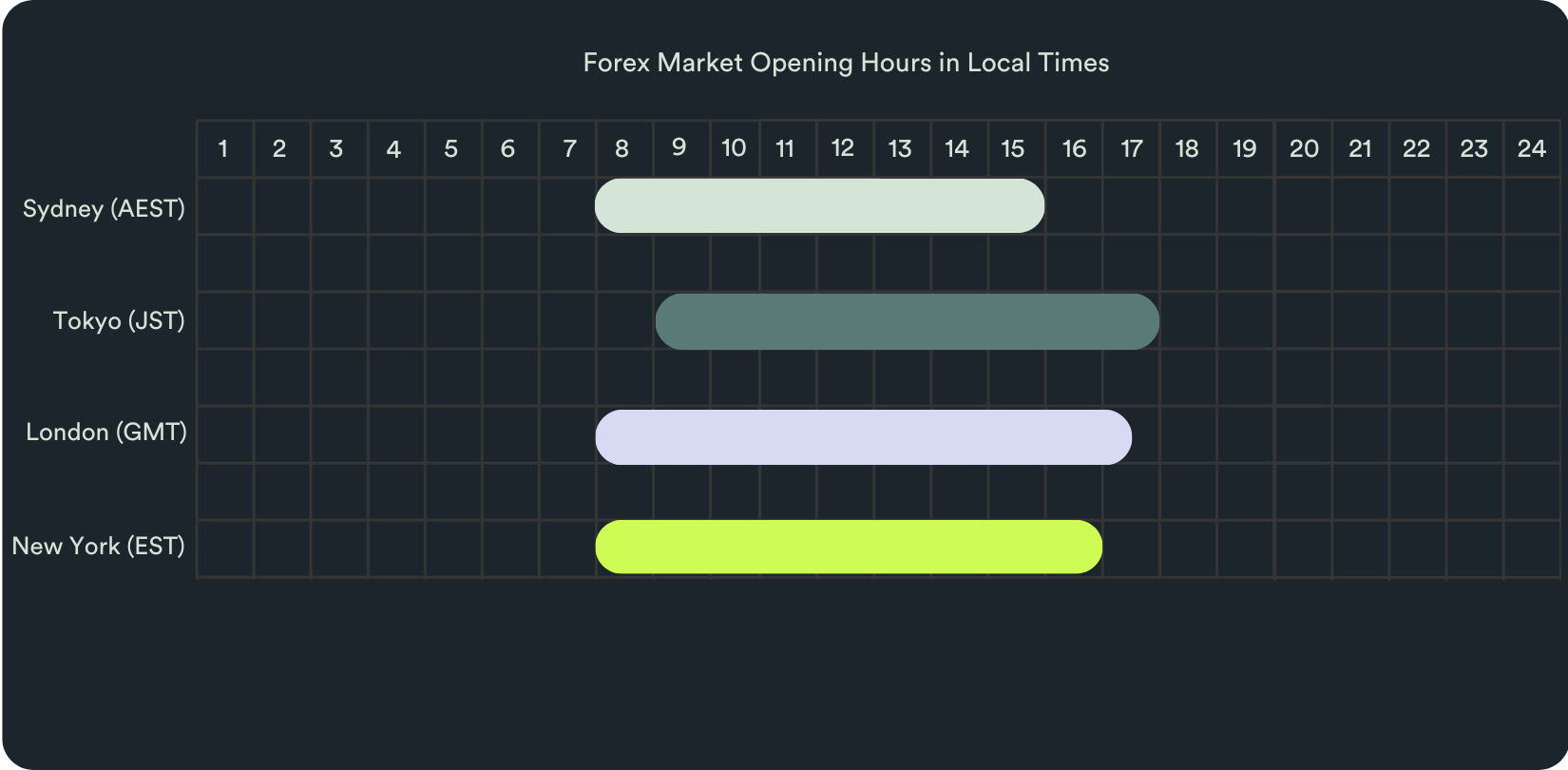

Here’s a quick table to show you when each session starts and ends:

| Session | Local Time | UTC Time | Key Features |

|---|---|---|---|

| Sydney | 7 AM – 4 PM (AEST) | 10 PM – 7 AM | Low volatility, AUD/NZD focus |

| Tokyo | 9 AM – 6 PM (JST) | 12 AM – 9 AM | JPY crosses active, steady moves |

| London | 8 AM – 4 PM (BST) | 8 AM – 4 PM | High liquidity, all majors move |

| New York | 8 AM – 5 PM (EST) | 1 PM – 10 PM | USD-heavy action, news-driven |

Why Time Zones (and Daylight Saving) Matter

Trading session times don’t stay fixed throughout the year. Countries like the U.S. and UK shift their clocks in and out of daylight saving. That one-hour shift may not seem like a big deal—until you miss the opening volatility of the London–New York overlap.

Set your trading clock to UTC, and adjust for your local time zone. Trust me, syncing your brain with the market rhythm is game-changing.

Breakdown of Each Forex Session

Sydney Trading Session

This session kicks off the trading week. It opens late Sunday if you’re in the U.S. or early Monday if you’re in Australia or Asia. It’s the quietest session, and honestly, I only trade it if I’m testing a bot or managing long-term positions.

The Sydney session offers:

- Low spreads, low noise—great for scalpers using the AUD/NZD pair

- Stable price movement with little to no news impact

- A great time to review your weekly strategy or backtest

Tokyo Trading Session

Once Tokyo opens, the market starts breathing. I like the Tokyo session for its calm, technical structure—breakouts are rare, but trend continuations happen often.

Most active pairs here include:

- USD/JPY

- EUR/JPY

- GBP/JPY

Liquidity is better than Sydney but still thin compared to London. Many Asian-based institutions are trading local currencies, and news events from Japan or China can trigger short bursts of action.

London Trading Session

When London wakes up, things get real. Spreads tighten, and liquidity floods in. This session dominates over 35% of daily forex volume, and it’s where I do most of my trading.

The best part? It’s where most major pairs show solid trends. You’ll see lots of action in:

- EUR/USD

- GBP/USD

- USD/CHF

What I love about this session is that economic releases from Europe often drive the initial direction for the day. And if you’re a breakout trader, London opens with a bang almost every day.

New York Trading Session

The New York session brings volatility. U.S. news releases, Wall Street’s opening bell, and that overlap with London create wild price swings—sometimes in your favor, sometimes not.

This is where I either make or lose the most in a single session. Trading here requires discipline, especially from 1 PM to 4 PM UTC.

You’ll find intense volume on:

- USD/CAD

- EUR/USD

- GBP/USD

During U.S. Non-Farm Payroll (NFP) announcements, I usually step back. It’s just too unpredictable unless you’re an expert with lightning reflexes.

Session Overlaps and Their Significance

Sydney–Tokyo Overlap

This overlap runs from 12 AM to 7 AM UTC. It’s quieter than other overlaps but offers consistent action for traders focusing on Asian pairs. I’ve had decent success here using trend-following systems, especially with AUD/JPY and NZD/JPY.

Because liquidity is still relatively low, slippage can happen—so set your stop losses wide enough or stay on the sidelines during news releases.

Tokyo–London Overlap

This is the shortest overlap—just an hour between 8 AM and 9 AM UTC. But don’t ignore it.

I’ve noticed some price spikes right before London fully takes over. It’s not ideal for full trades, but I use it to scalp EUR/JPY or GBP/JPY based on Asian market direction.

Think of it as a warm-up period with small breakouts or trend reversals.

London–New York Overlap

This is where the magic happens—1 PM to 4 PM UTC. It’s the most active and volatile part of the trading day. You get two major financial centers firing off at the same time, and that means tight spreads, strong liquidity, and big moves.

If you’ve only got time to trade a few hours a day, this is it. I plan my calendar around this window. Key U.S. economic data drops here, and if it lines up with EU data earlier in the day, the market explodes.

Best Practices for Trading Across Sessions

Matching Strategy to Session

If you’re scalping or doing short-term trades, you want volume and volatility. That’s London or the London–New York overlap. If you prefer swing trading or testing new systems, Sydney or Tokyo is better—less noise, more stability.

Adapting to Time Zones

This part tripped me up a lot at first. If you live in the U.S., it’s tempting to trade during New York hours. But some of the cleanest moves happen earlier, in the London session. I adjusted my sleep schedule to catch both, and it changed my performance dramatically.

Use tools like Time Zone Converters and set alerts for session openings in UTC time to stay aligned.

Risk and Volatility Planning

Volatility isn’t always your friend. During big news drops or session opens, price whipsaws are common. I’ve learned to step back 10 minutes before and after announcements. Plan your position size accordingly—smaller sizes during high-volatility windows can protect your account.

FAQs About Forex Trading Sessions

Is forex open on weekends?

No, the forex market is closed from Friday 10 PM UTC until Sunday 10 PM UTC. However, some brokers allow weekend trading on specific assets like crypto or synthetic indices. For standard currency pairs, the action stops over the weekend.

How do daylight saving changes affect forex hours?

Daylight saving can shift session times by an hour, especially in the U.S., UK, and Europe. For instance, during DST, the New York session opens an hour earlier in UTC. Always check with your broker or trading platform for updated hours in spring and fall.

What are the best pairs to trade in each session?

It depends on session liquidity:

- Sydney: AUD/USD, NZD/USD

- Tokyo: USD/JPY, EUR/JPY, GBP/JPY

- London: EUR/USD, GBP/USD, USD/CHF

- New York: USD/CAD, EUR/USD, GBP/USD

Trade the pairs that align with the financial hubs active during each session to take advantage of tighter spreads and bigger moves.

Recap of Key Points

Understanding forex trading sessions isn’t optional—it’s essential. You now know how each session behaves, what pairs to trade, and when volume and volatility peak.

Final Takeaway

Trading forex without timing awareness is like surfing with no waves. Find your rhythm. Use session overlaps to your advantage. And match your strategy to when the market is actually moving.

Closing Thought

If I could go back to the start, this would’ve been my day one lesson: trade smarter, not longer. Let the sessions guide your trades, and you’ll stop chasing the market—and start riding it.