When I first dipped my toes into forex trading, I thought it was all about watching charts and clicking “buy” or “sell.” I couldn’t have been more wrong. What I discovered pretty quickly is that without the right foundation, you’re just gambling with your money.

Many beginners dive in without really understanding how forex works — they pick the wrong broker, skip the demo phase, or don’t even know what a pip is. That was me too. I lost $300 in my first week just because I didn’t have a plan.

But once I slowed down and learned the basics, opened a proper demo account, and stuck to one strategy, my trades started making more sense — and so did my results.

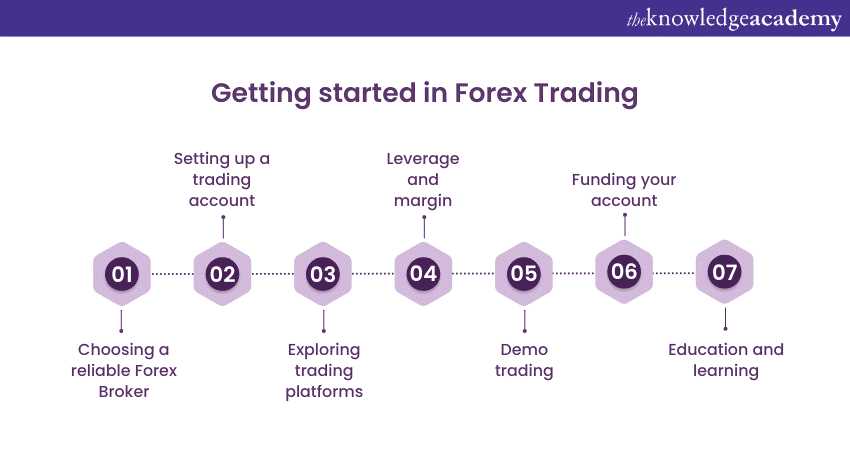

Here’s what I’ll walk you through today:

- Understanding how the forex market works

- Learning key terms like pips, leverage, and spreads

- Choosing a trustworthy broker

- Practicing with a demo account before going live

- Building your first trading plan and mastering risk

If you’ve ever felt lost looking at forex charts or broker platforms, you’re not alone. Stick with me, and I’ll show you exactly how to start with confidence — without wasting money or time.

What is Forex and How Does It Work?

Forex, or the foreign exchange market, is where you trade currencies — think USD to EUR or GBP to JPY. It’s open 24 hours a day, five days a week. Unlike stocks, you’re not buying a piece of a company. You’re betting on whether one currency will get stronger or weaker compared to another.

For example, if you think the euro will rise against the dollar, you buy EUR/USD. If it does, you make money. If not, you lose.

It’s fast-moving, highly liquid, and can be confusing if you’re not careful.

Understanding Currency Pairs and Pips

A currency pair like EUR/USD has a base currency (EUR) and a quote currency (USD). If EUR/USD is 1.1000, that means 1 euro = 1.10 dollars.

A “pip” is a tiny unit that measures price change. It’s usually the fourth decimal place. So if EUR/USD moves from 1.1000 to 1.1005, that’s a 5-pip move.

How Leverage and Margin Work

Leverage lets you control big trades with a small amount of money. Sounds great, right? But it’s also risky. A little move in the market can wipe you out fast if you’re over-leveraged. Margin is the amount you need in your account to open a position — basically your upfront deposit.

What Makes Prices Move?

Prices change based on economic news (like job reports or inflation), central bank decisions, and geopolitical events. I always keep an eye on the economic calendar and trade less during high-volatility news releases. I’ve learned that the hard way.

Step 1: Learn the Basics of Forex Trading

You wouldn’t drive a car without learning the rules of the road first, right? Same goes for forex. You need to learn how trading works before risking your money.

I started with BabyPips. It’s simple, free, and full of bite-sized lessons. I also followed trading YouTubers who explained things visually — that helped more than books.

Where to Learn (and What Helped Me Most)

Start with blogs like ChronosTrading (shameless plug, I know), BabyPips, and Investopedia for trusted basics. Use demo apps like eToro or GoForex to learn hands-on. I’d recommend NOT touching real money until you’ve logged at least 30 hours on a demo.

Best Forex Learning Apps

Apps like Forex Game and GoForex gamify learning. I used them in the mornings while commuting. They helped cement what I read the night before — and they’re risk-free.

Step 2: Choose a Reliable Forex Broker

This step is a deal-breaker. My first broker had a slick website but turned out to be unregulated and shady. I couldn’t even withdraw my profits. Lesson learned — always check for licenses.

Good brokers are regulated by trusted agencies like:

- FCA (UK)

- ASIC (Australia)

- NFA or CFTC (USA)

What to Look for in a Broker

Make sure they have:

- Low spreads and fees (these eat your profit)

- Easy-to-use platforms like MetaTrader 4 or 5

- Great customer support — test their response before depositing

- Clear demo and live account options

Top Beginner-Friendly Brokers (2025)

| Broker | Regulation | Best For | Platform | Demo Available |

|---|---|---|---|---|

| eToro | FCA, CySEC | Copy trading, social features | eToro Web | Yes |

| IG | FCA, ASIC | Education, chart tools | MT4, IG Platform | Yes |

| Forex.com | CFTC, NFA | US traders, mobile trading | MT4, MT5 | Yes |

:max_bytes(150000):strip_icc()/dotdash_RealFINAL_How_to_Build_A_Forex_Trading_Model_Jan_2020-02019399699842caa4005ac5847eec09.jpg)

Step 3: Practice with a Demo Account

If you’re skipping this step, you’re asking to lose money. Demo accounts let you practice with fake money. You can test strategies, learn the platform, and see how fast the market moves — all without risk.

I made a rule for myself: I wouldn’t trade real money until I had 20 successful trades in a row on demo. Took me a month, but it was worth it. I still use a demo to test every new strategy before I go live.

How to Make the Most of Demo Trading

Start with the same amount you’d actually deposit. Treat it like it’s your real account. Don’t get too comfortable taking wild risks just because it’s fake money. Use stop-losses and keep a journal of each trade — including why you made it.

:max_bytes(150000):strip_icc()/Forex_Final_4196203-e44848b06f2642378b12bc162951a818.png)

Step 4: Build Your Forex Trading Plan

Trading without a plan is like driving blindfolded. Early on, I would jump into trades based on gut feeling. Sometimes I got lucky, but more often I blew up my account. Everything changed when I started using a plan.

Your trading plan should cover:

- Your risk per trade (I stick to 1% max)

- Time of day you trade (I trade London open only)

- Which pairs to trade (EUR/USD and GBP/USD are my go-tos)

- Strategy (I use simple moving averages and breakout setups)

Beginner Strategies That Actually Work

You don’t need to get fancy. I started with trend trading — buying when price is rising, selling when it’s falling. Breakout trading is also great: watch for price breaking above a resistance level and ride the momentum. Range trading is trickier but can work in slow markets.

Stick with one until you know it inside out. Jumping between strategies is a quick path to confusion and losses.

Step 5: Master Risk Management

This is where most beginners mess up. I used to think risk management was optional — until I lost half my account in one night. The truth? You can have the best strategy in the world, but if you’re risking too much, you won’t last long.

I follow the 1% rule. That means I never risk more than 1% of my account on a single trade. It keeps me in the game even after a losing streak. And trust me, losing streaks happen — even to pros.

How I Use Stop-Loss and Take-Profit Orders

Every trade I place has a stop-loss and take-profit order. I never skip this. My stop-loss protects me if the trade goes bad. My take-profit locks in gains when things go well. I calculate them based on recent support/resistance levels or volatility.

And I always check the risk-to-reward ratio. If I’m risking 50 pips, I want at least 100 pips in reward — otherwise, it’s not worth it.

Keeping Emotions in Check

Forex is emotional. It’s hard to see a trade go red. I used to panic and close trades too early. Now, I trust my plan and let it play out. I keep a journal and review my trades weekly. That helps me stay calm and focused.

Step 6: Start Trading Real Money Carefully

When you’re ready to go live, take it slow. I opened a micro account with just $100. That way, I could feel the pressure of real money without losing sleep.

Start with small lot sizes. Focus on consistency, not big wins. And avoid overtrading — that’s a trap. I limit myself to 1–2 trades per day max, and only during my chosen session (London).

Stick to your demo-tested strategy and treat every trade like it matters — because it does.

FAQs About Getting Started in Forex

What’s the minimum to start forex trading?

You can start with as little as $50 on some brokers using micro or nano accounts. But I recommend at least $100–$200 so you can manage risk properly. Always test on demo first.

Can I learn forex trading on my phone?

Yes, absolutely. Apps like GoForex, MetaTrader 4, and Forex Game are great for learning and practicing on the go. I used my phone for 80% of my early training.

Is forex trading legal in my country?

It depends. Most countries allow forex trading, but always make sure your broker is licensed in a trusted jurisdiction (like the US, UK, or Australia). Check with your local regulations to be sure.

What’s the best broker for absolute beginners?

I recommend eToro or IG for beginners. They have demo accounts, great platforms, and tons of learning tools. Just make sure the broker is regulated and fits your style.

Recap of What You’ve Learned

Let’s quickly run it back. You’ve learned how the forex market works, what key terms like pips and leverage mean, how to pick a broker you can trust, why demo accounts are a must, how to build a rock-solid trading plan, and why risk management will save your account.

Final Takeaway

Starting forex trading doesn’t have to be overwhelming. Take your time, practice the right way, and learn from each mistake. I’ve been where you are — unsure, excited, nervous. But step by step, I built confidence. You will too.

Closing Thought

Every successful trader starts at zero. What separates the ones who make it isn’t luck — it’s patience, discipline, and learning from every win and loss. If you’re serious about trading, start small, stay consistent, and grow over time. You’ve got this.

7 Comments

Pingback: How the Forex Market Works (Beginner's Guide) - Chronos Trading

Pingback: Forex Terminology Explained: 25 Key Terms You Must Know - Chronos Trading

Pingback: How to Read Forex Charts: A Beginner’s Guide - Chronos Trading

Pingback: How to Learn Forex Online for Free: A Beginner’s Guide - Chronos Trading

Pingback: 10 Best Forex Books Every Beginner Should Read - Chronos Trading

Pingback: 7 Essential Forex Trading Tools Every Beginner Must Know - Chronos Trading

Pingback: How to Open a Forex Trading Account (Step-by-Step) - Chronos Trading