When I first started trading Forex, I didn’t pay much attention to the tiny difference between the buy and sell prices. I just wanted to click “Buy” or “Sell” and make a quick win. But I learned the hard way: that little number? It eats into your profits every single time.

Most beginner traders overlook the spread. You might be doing the same right now. But if you care about squeezing out more profit, you need to understand this cost. It’s quiet, constant, and always there — even when your trades look good on the chart.

Let’s break it down simply. This guide will show you:

- What a Forex spread really is (with real examples)

- How spreads are calculated in pips

- The difference between fixed and variable spreads

- Why spreads change — sometimes drastically

- How you can trade smarter by choosing tighter spreads

By the end, you’ll know how to identify when the spread’s working for you or draining your edge. And I’ll even walk you through the numbers I watch every day.

What Does “Spread” Mean in Forex?

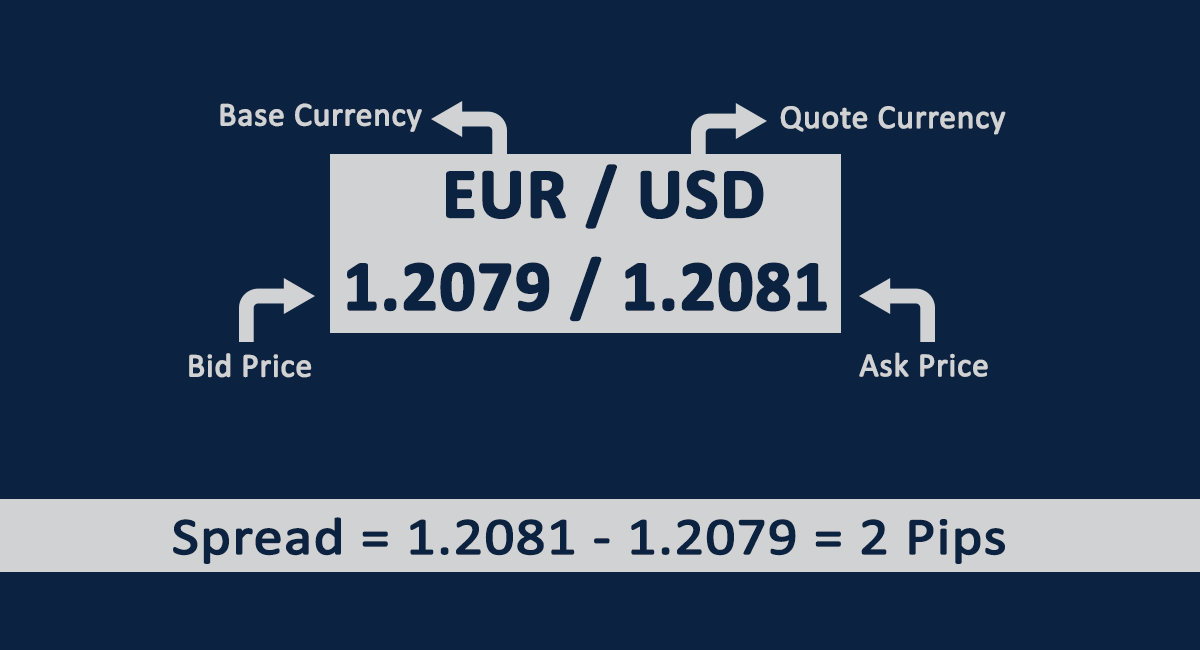

In plain English, the spread is the difference between the price you can buy a currency pair at (ask) and the price you can sell it at (bid). This difference is measured in pips — the smallest unit of price movement in Forex. Think of it like a hidden fee that gets charged every time you open a trade.

Spread Basics: Bid vs Ask

The bid price is what the market is willing to pay you if you sell. The ask price is what you’ll pay if you want to buy.

Here’s what that looks like in a quote:

EUR/USD: 1.1050 / 1.1053

The spread here is 3 pips (1.1053 – 1.1050 = 0.0003 = 3 pips).

Every time you open a trade, you start slightly in the red because of the spread. That’s your cost — before anything else happens on the chart.

Why the Spread Matters

The spread matters more than most traders realize. It affects your profit margin and adds up, especially if you’re scalping or day trading. I’ve lost trades not because I was wrong, but because the spread was just too wide for my tiny stop-loss.

If you’re trading 10 times a day and each trade costs 2 pips in spread, that’s 20 pips — just gone. You’ve got to make those back before you’re even net positive. That’s why spread awareness is critical if you want to last in this game.

How to Calculate the Spread in Forex

The formula is dead simple:

Spread (in pips) = Ask price – Bid price

Example: EUR/USD Spread Calculation

Let’s use another real example:

Bid = 1.1200, Ask = 1.1203

Spread = 1.1203 – 1.1200 = 0.0003 = 3 pips

This means you need the market to move 3 pips in your favor just to break even. On a standard lot (100,000 units), that’s a $30 fee per trade. Multiply that across your trades in a week, and you’ll feel it.

Fixed vs Variable Spreads

I’ve traded with both fixed and variable spreads. Here’s what I’ve noticed:

| Fixed Spreads | Variable Spreads | |

|---|---|---|

| Definition | Stay the same, even in volatility | Change based on market conditions |

| Best For | News traders, beginners | Experienced traders seeking lower cost |

| Risk | May be higher overall | Can widen fast in high volatility |

I prefer variable spreads during normal trading hours — especially with major pairs — because they’re often lower. But I always avoid them during high-impact news events. I’ve seen spreads spike from 2 pips to over 20 in a flash. That can ruin your stop-loss and wreck your trade plan.

What Affects the Size of a Forex Spread?

Spreads don’t just sit still. They move based on what’s happening in the market. Knowing why can help you avoid overpaying.

Market Volatility

When things get wild — like during news releases or central bank announcements — spreads widen. Brokers do this to protect themselves because pricing becomes unpredictable. I once tried to trade NFP (Non-Farm Payrolls) with a tight 5-pip stop. The spread alone hit 7 pips and stopped me out instantly. Lesson learned.

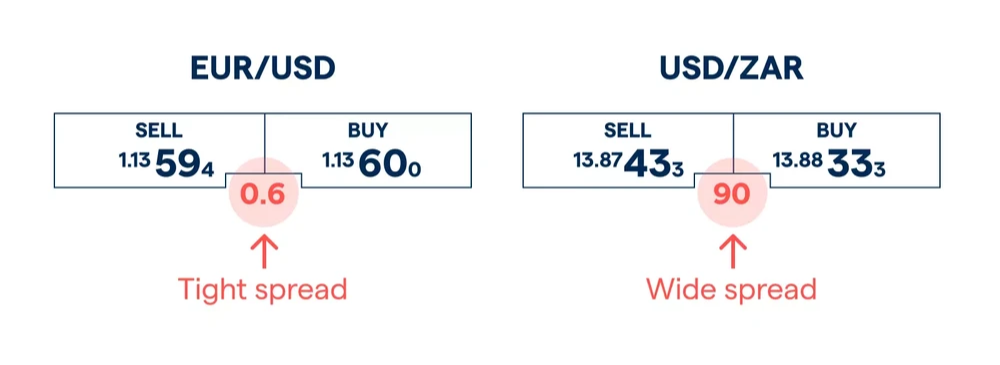

Liquidity of Currency Pairs

Some pairs trade like water — smooth and fast. Others? Like molasses. Major pairs like EUR/USD and USD/JPY have tight spreads because millions of traders are trading them constantly. Exotic pairs like USD/TRY or GBP/ZAR? Not so much.

I avoid exotics unless I’m purposely hedging or positioning long term. The wide spreads just don’t justify the risk for short-term trades.

How to Trade with Spreads in Mind

If you want to keep more of your profits, you’ve got to treat the spread like any other trading cost. Don’t ignore it. Factor it into your strategy before you enter a trade.

Compare Brokers by Spread

Not all brokers are created equal. Some advertise zero commission but hit you with wide spreads. Others keep spreads tight and charge a small fee. Personally, I’d rather pay a small commission and get a tighter spread — especially when scalping.

One of the ways I narrowed down my current broker was by comparing average spreads on EUR/USD, GBP/USD, and USD/JPY. I even tracked real-time spreads during different times of the day. There are tools like MyFXBook’s broker spread comparison that help you do exactly this.

Choose the Right Trading Time

Spreads get tighter during high liquidity. That means trading during the overlap of London and New York sessions (roughly 8 AM to 12 PM EST). Avoid weekends, holidays, and post-news chaos if you’re looking for low-cost trades.

I do most of my scalping around the London open. I’ve noticed spreads on EUR/USD can drop to 0.2 to 0.5 pips on my ECN account — barely anything. But that same trade during the Asian session might cost me 2 pips or more.

FAQs About Forex Spread

What is the typical spread for EUR/USD?

For most brokers, the average spread on EUR/USD ranges from 0.1 to 1.5 pips depending on account type and time of day. ECN accounts usually offer tighter spreads than standard ones.

Why is my spread so high during news?

Spreads widen during high-impact events because the market becomes unpredictable. Brokers raise the spread to manage risk from rapid price swings or lack of liquidity.

Is a lower spread always better?

Not always. While tighter spreads reduce your cost per trade, some brokers offer low spreads but charge high commissions. Others might have poor execution speed or slippage. Always look at the full trading conditions.

Do Forex brokers make money from spreads?

Yes. “No-commission” brokers typically earn from the spread difference. ECN brokers pass your orders to the market and make money via small commissions plus a markup on the spread.

Recap of Key Points

Let’s rewind. The spread is the cost between the buy and sell price of a currency pair. It affects every trade, whether you win or lose. Fixed and variable spreads offer different pros and cons depending on your strategy. And understanding when spreads widen — like during news or on exotic pairs — can save you real money.

Final Takeaway

As a trader, I treat the spread like rent. It’s the price of doing business. The tighter the spread, the less I pay. And when I’m stacking 10+ trades a week, those little savings snowball into real returns.

Closing Thought

If you’re just getting started, don’t let spreads be the silent killer of your trades. Learn to track them, calculate them, and make smart broker and timing decisions. It’s one of those small changes that separates struggling traders from those who grow consistently.