If you’re new to forex, currency pairs can be downright confusing. I remember staring at a trading app years ago, wondering what EUR/USD or USD/TRY even meant, let alone which one I should trade. If that sounds like you, you’re in the right place.

Most traders jump in without knowing the difference between major, minor, and exotic currency pairs. That’s a mistake I made too. And trust me, it cost me—especially when I started messing with exotic pairs like USD/ZAR without understanding the risk.

So here’s what I’ve learned: knowing which type of currency pair you’re trading isn’t just helpful—it’s essential. It affects your spread costs, volatility, and your chance of making—or losing—money.

- What forex currency pairs are and how they’re structured

- Key traits of major, minor, and exotic pairs

- Real-world examples and trading tips

- When to choose one type over another

- A table comparing liquidity, spreads, and volatility

This guide is for you if you’re tired of vague advice and want clear, hands-on insight into how currency pairs actually work in the real trading world.

What Are Forex Currency Pairs?

Understanding Currency Pair Structure

In forex market, currencies are traded in pairs. That means you’re buying one currency while selling another. The first currency in the pair is the base currency, and the second is the quote currency. So in EUR/USD, you’re buying euros and selling US dollars.

Let’s break this down. If EUR/USD = 1.1000, that means one euro equals 1.10 US dollars. Pretty simple, right? But what trips people up is the spread—that tiny difference between the buying price (bid) and the selling price (ask). That’s where your trading costs come in.

Bid, Ask, and Spread Basics

The bid is the highest price a buyer is willing to pay. The ask is the lowest price a seller will accept. The spread is the difference between the two—and it’s how brokers make money. Major pairs usually have tight spreads (1–3 pips), while exotic pairs can hit 100+ pips.

Major Currency Pairs

What Makes a Pair ‘Major’?

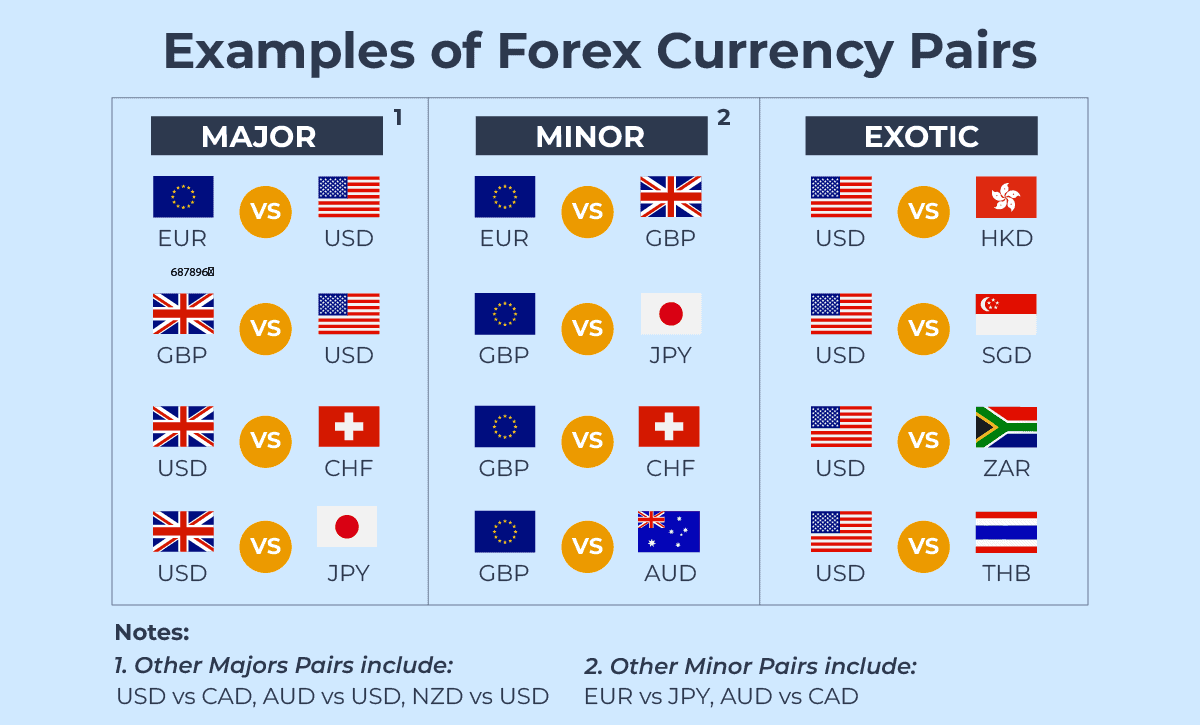

Major currency pairs always include the US dollar (USD) and another top-traded global currency. Think EUR/USD, USD/JPY, GBP/USD, AUD/USD, and so on. These pairs account for about 80% of all forex trading volume worldwide.

They’re popular because they’re stable, liquid, and cost less to trade. When I first started, I stuck with EUR/USD. The spread was low, and liquidity was off the charts—my orders executed instantly.

Liquidity and Low Spreads

These pairs are the easiest to trade. Why? Because there’s always someone on the other side of your trade. They’ve got the tightest spreads too, usually under 3 pips, which helps you keep your trading costs low.

Top Examples of Major Pairs

- EUR/USD: Most traded pair worldwide. Stable and highly liquid.

- USD/JPY: Great for low spreads and quick moves.

- GBP/USD: Volatile but still considered major.

- USD/CHF, USD/CAD, AUD/USD: Other high-volume pairs with solid liquidity.

Minor Currency Pairs

What Are Minor Pairs?

Minor pairs, or crosses, combine two major currencies but leave out the USD. For example, EUR/GBP or GBP/JPY. They make up around 15% of global forex trades.

These are good if you’re trying to avoid exposure to the US dollar. When I wanted to hedge a USD-heavy portfolio, I traded AUD/NZD for its low correlation to my other pairs.

Moderate Liquidity and Spreads

Minors don’t have the same crowd as majors, but they’re still decently liquid. The spreads are a bit wider—around 3–5 pips—but not outrageous. They’re totally tradable for swing traders or anyone looking to diversify.

Examples of Minor Currency Pairs

- EUR/GBP: Low volatility, good for range strategies.

- GBP/JPY: More movement, higher risk, higher reward.

- AUD/NZD: Popular among Oceania traders.

- EUR/CHF: Stable European cross.

Exotic Currency Pairs

What Makes a Pair Exotic?

Exotic pairs match a major currency like USD or EUR with one from a developing or emerging market. Think USD/TRY (Turkish lira) or USD/ZAR (South African rand).

Low Liquidity and High Spreads

Exotic pairs have low trading volume. That means fewer buyers and sellers, which makes it harder to exit trades fast. The spreads can be brutal—5 to 100+ pips—and slippage is common.

When to Use Exotic Pairs

These pairs aren’t for the faint of heart. They’re better suited for advanced traders who can handle big swings and high risk. But if you time it right, the returns can be wild.

Comparison Table: Major vs Minor vs Exotic Pairs

:max_bytes(150000):strip_icc()/currencypair.asp-final-dc06deceae3b4bc29a3a80915e45ce61.png)

| Characteristic | Major Pairs | Minor Pairs | Exotic Pairs |

|---|---|---|---|

| Example | EUR/USD, USD/JPY | EUR/GBP, GBP/JPY | USD/TRY, USD/ZAR |

| Liquidity | Extremely High | Moderate to High | Low to Very Low |

| Spreads | 1–3 pips | 3–5 pips | 5–100+ pips |

| Volatility | Moderate | Moderate to High | High to Extreme |

| Risk Level | Low | Moderate | High |

Comparing Major, Minor, and Exotic Pairs

Which Currency Pairs Are Best for Beginners?

When I was just starting out, I stuck with major pairs like EUR/USD. Why? Because they’re stable and predictable. The spreads are tiny, so you don’t lose much to fees, and the liquidity means fast execution.

If you’re new, I’d stay far away from exotic pairs. Sure, they might look tempting with their wild price moves, but they’re risky. One bad news headline from a developing country, and your trade could tank in seconds.

Which Pairs Offer the Most Action?

If you’re looking for adrenaline, then exotic pairs like USD/ZAR or USD/TRY might catch your eye. They’re super volatile. But I only touch them with small position sizes and tight stop losses.

Minor pairs, like GBP/JPY, also offer action—especially during major economic events. They’re less crazy than exotics but still pack a punch.

Choosing the Right Pair for Your Strategy

Here’s how I think about it:

- Scalping? Stick to majors. Low spread = less cost.

- Swing trading? Try minor pairs with bigger moves.

- High-risk, high-reward? Exotic pairs… if you dare.

FAQs About Forex Currency Pairs

What are the most stable currency pairs in forex?

Major pairs like EUR/USD and USD/JPY are the most stable. They come with tight spreads and consistent liquidity. These are the go-to choices for traders who prefer less drama and more control.

Why do exotic pairs have such high spreads?

It’s because they’re illiquid. There aren’t as many people trading them, so brokers widen the spreads to cover their risk. For example, USD/TRY can have a spread 20x wider than EUR/USD. You need big price moves just to break even.

Can beginners trade minor or exotic currency pairs?

Technically yes, but I wouldn’t recommend it. Beginners should focus on major pairs to avoid high volatility and slippage. Once you’ve built confidence and a tested strategy, you can explore minors. Exotics? Only after you’ve gained serious experience.

My Final Take

Recap of What Matters Most

We covered a lot. Here’s the quick recap:

- Major pairs: best for beginners—low cost, stable, liquid

- Minor pairs: great for diversification and mid-level volatility

- Exotic pairs: high risk, high reward—but only for advanced traders

What You Should Remember

Trading the right currency pair can be the difference between frustration and progress. I’ve blown up accounts messing with exotic pairs before I was ready. You don’t have to make that mistake.

One Last Thought

If you’re serious about trading forex, understanding how currency pairs work is not optional—it’s foundational. Stick with the majors, build your skills, and grow your confidence before exploring riskier pairs. Your future self will thank you.