I still remember the first time I signed up with a Forex broker. I was overwhelmed by fancy websites, bonuses, and platforms I didn’t understand. And yeah, I made a few mistakes. I trusted the wrong name just because they looked “big” — but that came with high spreads, slow support, and a bitter lesson.

If you’re here, you’re probably trying to avoid that same mistake. Choosing the right Forex broker isn’t just a step — it’s THE step. It’s about protecting your money, getting reliable execution, and setting yourself up to grow, not stress.

So let’s walk through this together. I’ll share what I’ve learned from years of trading, reviewing brokers, and helping others avoid the junk. Here’s what we’ll dive into:

- Why regulation isn’t just a badge, but your financial shield

- How brokers sneak in fees (and how to dodge them)

- What makes a good platform great — especially for beginners

- Why leverage can be a double-edged sword

- What to test before you go live with any broker

By the end, you’ll know exactly what to look for, what to avoid, and how to test a broker like a pro — even if you’re just starting. Let’s make sure your broker works for you, not the other way around.

Understand Broker Regulation

Here’s something I wish someone drilled into me earlier: *Unregulated brokers are a risk you don’t need to take.* Regulation protects your funds, ensures fair practices, and gives you legal recourse when something goes wrong. It’s not just paperwork — it’s peace of mind.

Look for brokers regulated by trusted authorities like:

- FCA (UK Financial Conduct Authority)

- ASIC (Australian Securities & Investments Commission)

- CySEC (Cyprus Securities and Exchange Commission)

If you’re trading in places like Zambia, Argentina, or Macau, double-check if your broker has the right licenses to serve your country legally. You can verify a broker’s license on official sites like FCA Register or ASIC Search.

I once used a broker “regulated” in Vanuatu. Big mistake. When they froze withdrawals, I had no one to complain to. Don’t be me. Stick with top-tier regulators.

Compare Trading Costs

This is where brokers love to play games. On the surface, it looks cheap. But spreads, commissions, and hidden fees can eat up your profits fast. Let me break this down clearly.

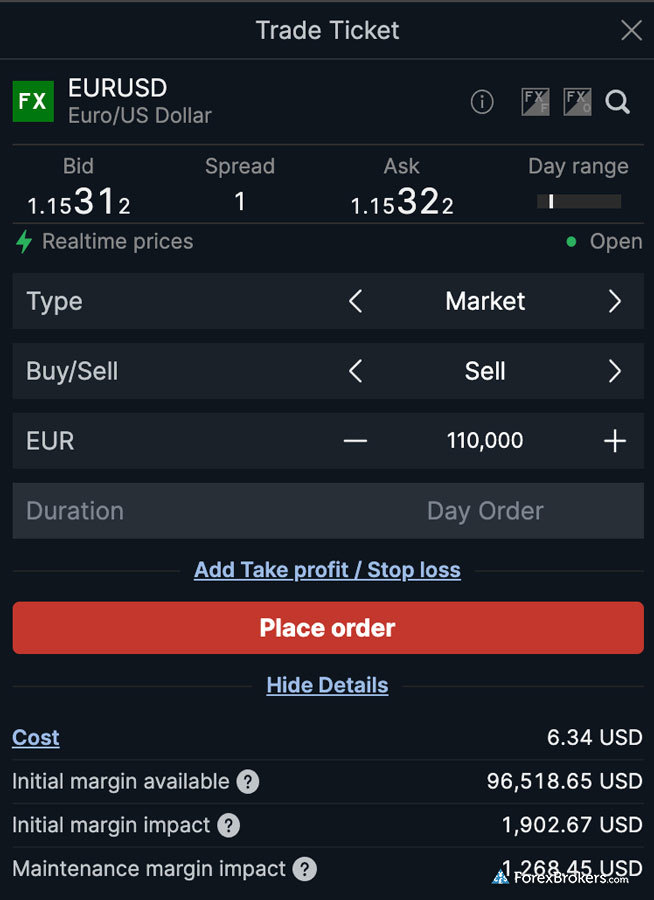

Spreads: The Invisible Fee

When you open a trade, you immediately start in the red. That’s the spread — the gap between the buy and sell price. The smaller the spread, the better for you. I always go with brokers offering tight spreads on majors like EUR/USD (ideally 0.6 pips or less).

Commissions vs. No Commissions

Some brokers offer zero commissions but widen the spread. Others charge, say, $7 round-trip per lot but offer raw spreads near 0.0. You’ll need to test both and see what works for your trading style.

Watch for Sneaky Fees

Here’s what to double-check:

- Withdrawal fees (some charge $25 per wire!)

- Inactivity fees (yes, seriously)

- Currency conversion fees

Below is a table I use to compare trading costs:

| Broker | Regulation | EUR/USD Spread | Commission | Withdrawal Fees |

|---|---|---|---|---|

| Broker A | FCA | 0.6 pips | No | $0 (bank cards) |

| Broker B | ASIC | 0.1 pips | $7/lot | $5 (bank transfer) |

| Broker C | None | 3.0 pips | No | Unlisted |

Note: That last one? Total red flag. No regulation, wide spreads, and zero transparency. Avoid it.

Evaluate Platform and Tools

Your trading platform is where all the action happens. If it’s clunky, crashes, or lacks tools — you’re set up to fail before you begin.

Most beginners (and even pros) go with MetaTrader 4 (MT4) or MetaTrader 5 (MT5). They’re rock-solid, customizable, and packed with indicators.

But don’t stop there. Try the broker’s web or desktop platform. Here’s what I look for:

Execution Speed and Stability

Laggy platforms = missed trades = lost money. Always test execution using a demo account. I once missed a 30-pip scalp during NFP because the platform froze. Never again.

Built-In Tools

Good brokers offer:

- Advanced charting

- Economic calendars

- News feeds

- Copy trading features (if that’s your thing)

Assess Market Access and Leverage

Here’s something I messed up early on: I chose a broker that didn’t offer exotic pairs — and I wanted to trade ZAR/JPY. Lesson learned. Make sure your broker gives access to the pairs or assets you want: majors, minors, exotics, or even commodities and crypto.

Why Leverage Matters

Leverage lets you control big positions with a small deposit. Sounds great, right? It can also blow your account fast. A 1:500 leverage sounds tempting — until a 20-pip loss wipes 30% of your balance.

Find Your Balance

Look for brokers that allow you to set custom leverage and explain their margin rules clearly. Use demo accounts to test before you risk real cash.

Account Options and Funding Methods

Before going live, I always open a demo account. It lets me test the platform, check execution speed, and get a feel for spreads — all without risking real money. A good broker makes demo access simple, without expiring it after a week.

Types of Accounts

Brokers usually offer different types of accounts: Standard, Micro, ECN, or VIP. If you’re starting out, I suggest going with a Standard or Micro account. Once you’re ready to scale, ECN accounts give you raw spreads with tight execution — but they often come with commissions.

Deposits and Withdrawals

I can’t stress this enough — if a broker delays or complicates your withdrawals, that’s a dealbreaker. Always look for brokers that offer fast, low-fee transfers through:

- Bank cards

- Local bank transfer

- Skrill, Neteller, or PayPal (if supported)

- Crypto (increasingly common)

I once had to wait 7 days for a withdrawal because the broker “couldn’t verify” my identity — even after submitting everything twice. Don’t get stuck like I did. Read real reviews before trusting your funds with anyone.

Customer Support and Reputation

When the market’s moving fast and your platform glitches — you want help now. That’s why responsive, 24/5 support matters. I always test this by asking pre-sale questions through live chat and email before I open an account.

What Makes Good Support?

Here’s what I personally look for:

- Live chat that responds in under 2 minutes

- Clear and helpful answers (not just scripts)

- Support in my language (English + 1 regional language)

If support is missing or vague before you sign up, it won’t get better after. Trust me — I’ve been there.

Check What Other Traders Are Saying

One of the best ways to judge a broker is by reading **real user reviews** on platforms like Forex Peace Army. Look for patterns — if many traders complain about withdrawals or slippage, stay away.

Final Checklist Before You Choose

At this point, you’ve narrowed it down. Here’s how I finalize my broker picks:

Step 1: Test with a Demo Account

Spend at least a week trading on demo. Focus on how the platform feels, if the spread matches what was advertised, and whether you can find everything easily.

Step 2: Compare Brokers Side by Side

Set up a personal table or checklist comparing your top 2–3 brokers across:

- Regulation

- Trading costs

- Platforms

- Support quality

- Funding options

Use our downloadable worksheet to make this easier (coming soon).

Step 3: Go Live — But Start Small

Even with a great broker, start small. Fund the minimum, test a few real trades, then scale up gradually. This minimizes risk while confirming that everything works as promised.

FAQs

What is the best Forex broker for beginners?

That depends on your location and trading goals. For most new traders, I recommend brokers with strong regulation (like FCA or ASIC), low spreads, a user-friendly MT4 platform, and excellent demo access. Look at eToro, IG, or Pepperstone as beginner-friendly options.

How do I know if a Forex broker is safe?

Start by checking their regulation. If they’re licensed by a major regulator like the FCA, ASIC, or CySEC — that’s a good sign. Also, read trader reviews, test support, and never trust brokers with zero transparency or off-shore “regulations” you’ve never heard of.

What’s the difference between a market maker and ECN broker?

Market makers set their own bid/ask prices and may trade against you. ECN brokers connect you directly to liquidity providers and offer raw spreads with a commission. I personally prefer ECN for serious trading — but they can be more expensive if you’re just starting out.

Do I need to pay taxes when trading Forex?

Yes, in most countries, profits from Forex trading are taxable. How much depends on where you live. Always consult a local tax professional to stay compliant.

Let’s Wrap It Up

Choosing the right Forex broker isn’t just about finding the lowest spread or flashiest website. It’s about trust, transparency, and tools that fit your needs.

Let’s quickly recap:

- Stick with regulated brokers to protect your funds

- Understand all trading costs before signing up

- Test the platform with a demo — don’t guess

- Start small, scale with confidence

At the end of the day, your broker is your partner in every trade. Choose wisely. You deserve a platform that works with you — not against you.

If this guide helped, share it with a fellow trader. Let’s raise the standard — one good broker at a time.

6 Comments

Pingback: Best Swap-Free Forex Brokers for Islamic Trading in 2025 - Chronos Trading

Pingback: 6 Best High Leverage Forex Brokers (Up to 1:1000 or More) - Chronos Trading

Pingback: Forex Broker Fees Explained: Spreads, Commissions & Hidden Costs - Chronos Trading

Pingback: Best Forex Brokers Offering Free Demo Accounts in 2025 - Chronos Trading

Pingback: Forex Broker Regulations by Country: What You Should Know - Chronos Trading

Pingback: 7 Best Forex Brokers for Beginners with Low Minimum Deposit - Chronos Trading