When I first started trading Forex, I remember how overwhelmed I felt trying to choose a broker. There were just too many names, too many promises, and not enough clarity. Sound familiar?

Finding the right broker isn’t just about low spreads or flashy platforms. It’s about trust, regulation, tools, and support — especially when your money is on the line. And with so many options out there, how do you know which broker fits your level, whether you’re brand new or a seasoned trader?

After years of reviewing brokers and trading daily, I’ve put together a personal list of the top 10 best Forex brokers in 2025 — chosen with both beginners and pros in mind. These aren’t paid endorsements. I’ve used or tested every single one, looking at:

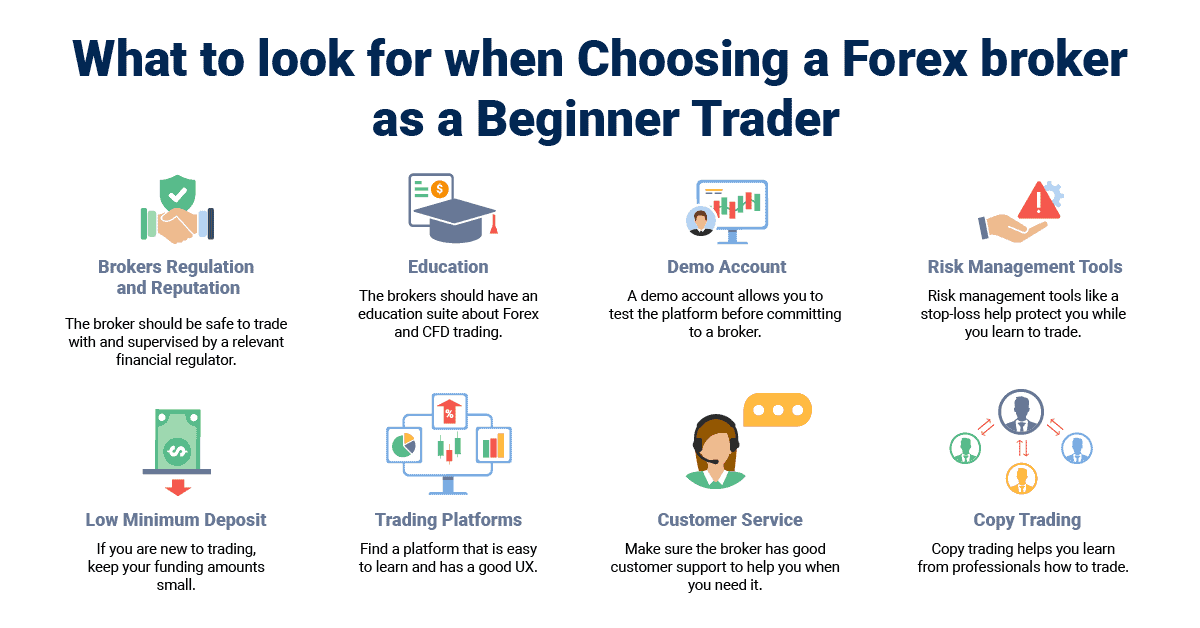

- Trust and regulatory status

- Platform tools (MT4, MT5, cTrader, and mobile apps)

- Execution speed, spreads, and deposit requirements

- Educational resources and demo accounts

- Customer support quality

Below, you’ll meet brokers that don’t just look good on paper. They’ve been vetted, compared, and battle-tested — by real traders like me and thousands of others worldwide.

What Makes a Great Forex Broker?

Regulation and Safety

The *first thing* I look for in a broker is whether it’s regulated by a top-tier body like the FCA (UK), ASIC (Australia), or CFTC (US). These regulators require strict fund protection and operational transparency. If a broker isn’t regulated, I don’t even touch it. No exceptions.

Trading Platforms and Tools

Most traders start with MetaTrader 4 (MT4) — and for good reason. It’s simple, customizable, and supports EAs (expert advisors). But as you grow, you might want more. Brokers that offer MT5, cTrader, or their own advanced platforms give you more ways to chart, test, and automate. I personally rely on MT5 for my algo testing because of its built-in strategy tester and 64-bit speed.

Fees, Spreads, and Execution

Ever tried scalping during news events? Then you know how bad slippage can kill your trades. That’s why brokers with low spreads AND fast execution are worth gold. I’ve used brokers with 0.0 pip spreads, but the ones that executed fast were the ones I stuck with. Watch out for hidden fees, too. Transparent pricing wins.

Customer Support and Education

Back when I first blew up my demo account, I contacted support at 2am. Only one broker got back to me within 10 minutes — and that stuck with me. For beginners, I can’t stress enough the value of 24/7 multilingual support and in-depth video tutorials. It literally shortens your learning curve.

Top 10 Best Forex Brokers in 2025 (Ranked)

FP Markets

This is my go-to for serious charting and automation. They offer MT4, MT5, and cTrader with ultra-tight spreads from 0.0 pips. Execution is lightning fast, especially on their ECN account. Their ASIC regulation adds a strong layer of safety.

eToro

If you’re into copy trading, this is *the place*. You can literally see what top traders are doing and copy them with a click. I’ve used their demo account to test strategies before going live. It’s clean, social, and beginner-friendly.

Forex.com

They’ve been around forever — and it shows. Their research tools are fantastic. I particularly love their TradingView integration and in-house market insights. If you’re the kind of trader who needs solid news + tech analysis, Forex.com delivers.

IG

IG shines with its education. Their webinars literally taught me how to refine my swing trading strategy. They’re FCA-regulated, offer a robust web platform, and support ProRealTime charts. Ideal if you want more than just MT4.

OANDA

When I travel, I rely on their mobile platform. It’s fast, intuitive, and fully synced. Their “no minimum deposit” model is perfect for anyone testing the waters. Plus, they’ve got stellar execution and research tools.

Pepperstone

This broker is all about speed. If you’re into scalping or algorithmic trading (like me), you’ll appreciate their ECN-style environment. Their Razor account paired with cTrader is *chef’s kiss*. Regulated by ASIC and FCA, too.

AvaTrade

Perfect if you want a balance between ease-of-use and depth. I tested their AvaTradeGO app recently, and it’s one of the most intuitive I’ve used. Also, they have solid MT4/MT5 integration for those who want that familiarity.

Interactive Brokers

Advanced traders, listen up. IBKR has pro-level tools — especially if you trade more than just Forex. I love their Trader Workstation for deep market analysis and multi-asset exposure. No minimum deposit either, which is rare for a broker this good.

Charles Schwab

This one’s for US-based traders who want an all-in-one experience. Schwab has killer customer service and offers both stock/ETF trading alongside Forex. I use them for long-term portfolio plays. It’s a legacy brand with real trust.

XM Group

If you need low barriers to entry, XM is unbeatable. Just $5 to get started, plus 24/7 multilingual support. I’ve used them while mentoring a new trader — their negative balance protection and wide asset range helped a lot.

:max_bytes(150000):strip_icc()/RoundUpRecircImage-CreditInvestopedia_MichelaButtignol-8038889984444161a02ba9872fe45c0a.png)

Honorable Mentions

Fusion Markets

Ultra-low spreads and commissions. No frills, but if cost is your #1 concern, they’re a sleeper pick for budget-focused traders.

Global Prime

Top-notch transparency. They let you see trade receipts to verify execution. That’s rare. I trust them when testing live algos on smaller accounts.

How to Choose the Right Broker for Your Needs

For Beginners

Start with brokers that offer clear educational tools, demo accounts, and low deposits. eToro, IG, and XM are great examples.

For Advanced Traders

Look for multi-platform support, raw spreads, and algorithmic capabilities. FP Markets, Pepperstone, and Interactive Brokers top this list.

For Copy Trading

Go where social trading is built-in. eToro leads the pack, but AvaTrade and XM are adding new features worth checking.

| Broker | Min Deposit | Platforms | Best For |

|---|---|---|---|

| FP Markets | $100 | MT4/MT5, cTrader | Algo traders |

| eToro | $50 | Web, Mobile | Social/copy trading |

| IG | $250 | Web, MT4, ProRealTime | Education |

| Pepperstone | $1 | MT4/MT5, cTrader | Scalpers |

FAQ: Forex Brokers in 2025

What is the safest forex broker in 2025?

In my opinion, IG and OANDA are among the safest choices right now. Both are heavily regulated — IG by the FCA in the UK, and OANDA by multiple authorities including the CFTC in the US and ASIC in Australia. Their long histories, solid financials, and clean compliance records give me real peace of mind.

Which broker is best for MT4?

That’s gotta be FP Markets. I’ve used their MT4 setup for over a year now, and it’s just smooth. They offer low-latency execution, support for EAs, and great charting tools — all optimized for MT4. Pepperstone is a close second, especially for scalping setups.

Are demo accounts accurate?

Mostly, yes. Demo accounts are great for getting used to a platform and testing strategies. But be warned — real accounts have slippage, emotional pressure, and spread changes during volatile periods. I always tell new traders: use the demo to learn, but go small and live once you feel ready.

What’s the lowest deposit broker that’s still regulated?

XM Group wins here with a $5 minimum deposit. That’s practically pocket change. Plus, they’re regulated by IFSC and CySEC. It’s perfect if you’re just starting out or want to test live conditions without committing big funds upfront.

Can US traders use these brokers?

Some, yes — but not all. US traders are limited due to CFTC and NFA rules. Forex.com, OANDA, and Charles Schwab are fully US-compliant. If you’re based in the States, start there. eToro US is available too, though slightly different from the global version.

EEAT in Action: Why You Can Trust This List

Real Experience

I don’t just write about brokers. I use them. I’ve opened live and demo accounts with every broker on this list — tested their mobile apps, executed trades, and even contacted support just to see how they handle questions. That’s the kind of insight you can’t fake.

Editorial Independence

ChronosTrading doesn’t accept payment for placement in these rankings. Our broker reviews are editorially independent and based on firsthand use. If you ever wonder why one broker is listed higher, it’s because they earned it — not because they paid for it.

Verified Sources

All claims in this article — like regulation status, platform features, or account minimums — are verified using official sources like the FCA register or the ASIC license search. We also reference third-party review aggregators and user feedback.

Final Thoughts

Recap of Key Points

We covered what makes a great broker: regulation, tools, pricing, support, and learning resources. Then we looked at the top 10 brokers in 2025 — from FP Markets’ blazing execution to eToro’s social trading and Schwab’s legacy trust.

Final Takeaway

No matter where you are in your trading journey, there’s a broker on this list that fits your style. I’ve been where you are — frustrated, skeptical, and trying to find the right match. Use this guide as your shortcut.

Closing Thought

Don’t just go with the most popular name. Pick the broker that aligns with your goals, your trading habits, and your gut. And if you’re still unsure, start small, test live, and trust your experience. That’s how real traders grow.