I still remember when I took my first swing trade in the forex market. I was staring at the EUR/USD chart, unsure if I was about to make a smart move or blow my account. Sound familiar? It’s that moment of hesitation that either breaks you—or builds you.

Most traders struggle with timing. They get in too early or exit too late. Or worse, they trade against the trend and end up confused, frustrated, and down a few hundred bucks.

Here’s the thing: swing trading can work. I’ve been doing it for years. But there’s a method to it. I’ve boiled it down into the exact process I use—no fluff, no “one weird trick” hype.

- Trade in the direction of the bigger trend

- Use key levels and technical tools for entry/exit

- Manage your risk ruthlessly

- Stick to a plan and journal your results

- Watch the economic calendar like a hawk

In this guide, I’ll walk you through how to swing trade forex the right way—just like I do it. You’ll see what works, what doesn’t, and how to avoid rookie mistakes. Ready to trade with more confidence and control?

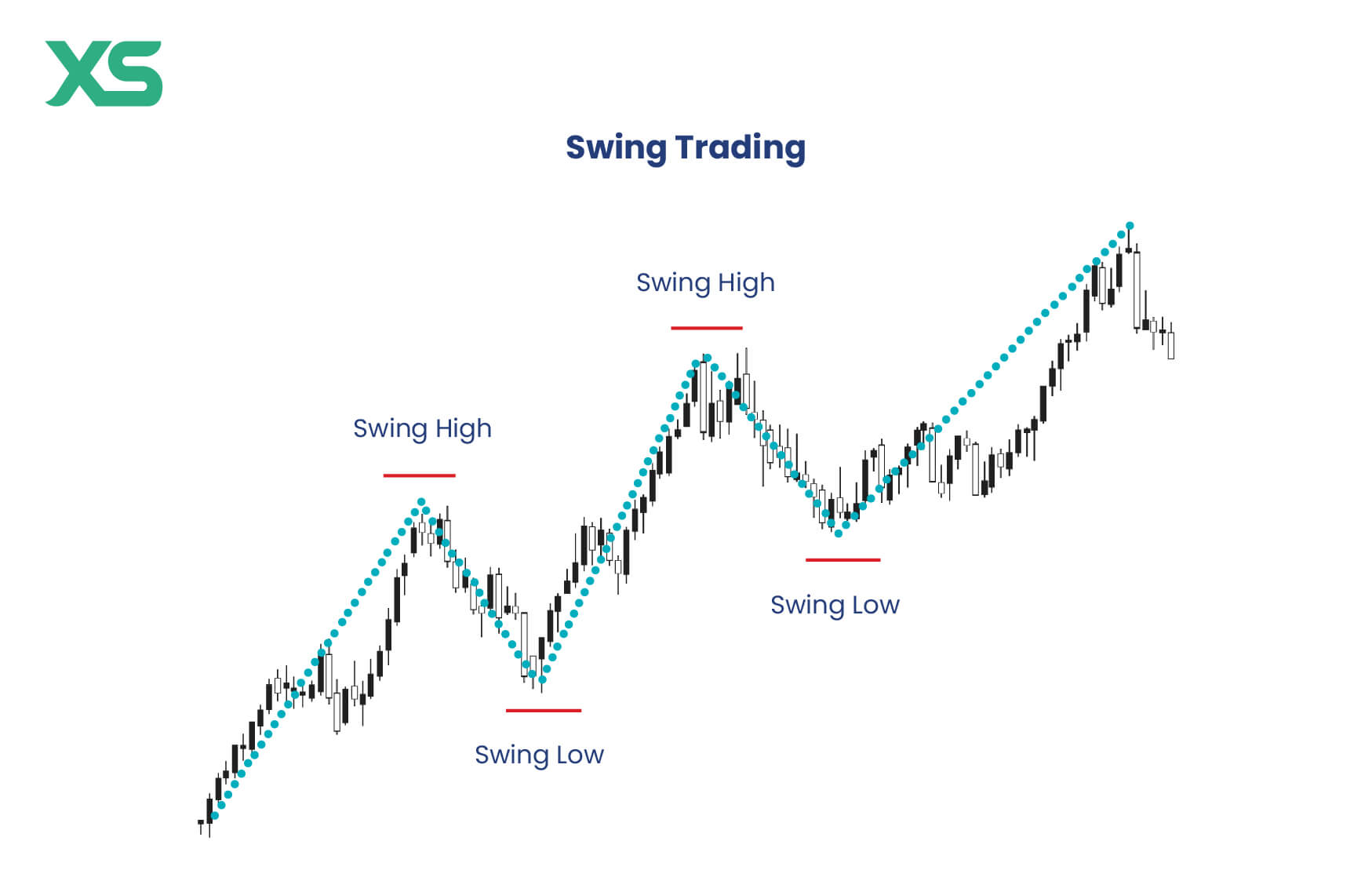

1. Understand and Trade with the Overall Trend

The #1 thing that changed my swing trading results? Aligning my trades with the dominant trend. No more guessing. I started using higher time frames to filter my trades. It’s simple, but powerful.

1.1 Analyze Higher Time Frames

I begin every trade setup by checking the daily and weekly charts. You want to make sure the trend direction on your 4-hour or daily chart matches what’s happening on the bigger time frames. This gives your trades a tailwind instead of a headwind.

Example: If the weekly chart is making higher highs and higher lows, I’m only looking for long trades. I call this trading with the tide, not against it.

1.2 Use Technical Indicators

I like to use a combination of tools:

- ADX to confirm trend strength (above 20 means solid momentum)

- 200-day Moving Average as a trend filter

- Support and Resistance to mark key zones

- RSI and MACD to find divergence or confirmation

Bollinger Bands also help me see if a pair is overextended. But I always start with structure: highs, lows, and clean chart patterns.

2. Master Entry and Exit Points

Entry is where most traders mess up—including me when I first started. I used to jump in on the first green candle. Big mistake. Now, I wait for confirmation. Every single time.

2.1 Identify Support and Resistance Zones

I draw horizontal zones—not lines—on daily and 4H charts. I look for where price has reversed or stalled 2–3 times. These zones act like magnets. If price approaches a resistance area in a downtrend, I’m watching for a reversal setup. No signal? I skip the trade.

2.2 Use Confirmation from Indicators

When price hits one of my key levels, I wait for a candlestick signal or a technical clue. My go-to combo is a reversal candle (like a pin bar) plus MACD crossover or RSI leaving overbought/oversold.

This isn’t guesswork—it’s stacking the odds.

2.3 Predefine Risk: Stop‑Loss & Take‑Profit

Before I even enter, I know where I’m wrong and where I’m taking profit. I use a simple 2:1 reward/risk ratio. If I’m risking 50 pips, I want at least 100 pips reward. No exceptions.

Here’s a simple table I use to set targets:

| Risk (pips) | Reward (pips) | Risk/Reward Ratio |

|---|---|---|

| 30 | 60 | 2:1 |

| 50 | 100 | 2:1 |

| 70 | 140 | 2:1 |

I also like to move my stop to breakeven once price moves halfway to target. This keeps me in the game even when things go sideways.

3. Prioritize Risk & Capital Management

I don’t trade to win every time—I trade to stay in the game. If you’re risking 10% of your account on each trade, you won’t be trading long. I learned that the hard way after blowing my second account.

3.1 Risk Per Trade Limits

My rule? Never risk more than 1–2% of your account on a single trade. On a $1,000 account, that’s $10 to $20 per trade. Doesn’t sound like much, but it adds up with consistency and smart setups.

3.2 Diversify Across Pairs

Another tip that’s saved me: don’t bet everything on one currency. I rotate between EUR/USD, GBP/USD, and USD/JPY. These pairs have good liquidity and tight spreads. Sometimes I’ll trade crosses like AUD/JPY if the setup is clean, but I keep it simple.

4. Watch Economic Events & Market Hours

If you’ve ever had a trade go against you instantly with no warning, chances are you weren’t watching the economic calendar. I’ve made that mistake. Once, I entered a GBP/USD short right before a Bank of England announcement. Bad move. Huge spike. Stopped out in seconds.

4.1 Plan Around Key News Events

Every Sunday, I check the economic calendar on Investing.com. I mark the high-impact events for the week—like NFP, interest rate decisions, or inflation reports. If something big is coming, I’ll either reduce position size or wait it out.

Big events can trigger massive volatility. But they’re also great setups—if you know how to play them.

4.2 Choose High‑Liquidity Sessions

I plan most of my swing trades during the London–New York overlap. That’s when the forex market is most active. You get tighter spreads, cleaner moves, and better fills. I avoid entering trades late in the day or during the Asian session unless I’m trading JPY pairs.

Timing matters. And this simple adjustment has made my trades much smoother.

5. Embrace Discipline and Maintain a Trading Plan

I used to chase trades. I’d see a candle spike and just dive in. It was emotional. It was impulsive. It was a mess. Everything changed when I started using a written plan and tracking my trades.

5.1 Create and Follow a Trading Plan

Your plan doesn’t need to be fancy, but it does need to be consistent. Mine includes:

- Timeframes I trade (daily/4H)

- Trend confirmation rules

- Indicator signals I use

- Risk per trade

- When to enter, exit, and review

Stick to your plan. Don’t make decisions mid-trade. That’s where emotions sneak in.

5.2 Keep a Trading Journal

After every trade, I write down what happened. What worked, what didn’t, and what I learned. It helps me stay honest. Patterns emerge. Mistakes become obvious. Improvement gets measurable.

This is where the real growth happens. I use screenshots and trading notes. And every weekend, I review the week’s trades. Even five minutes can make a difference.

6. Learn, Practice, Improve

Let’s be real: you won’t master swing trading in a week. And that’s okay. The key is to keep learning and practicing—without risking real money at first.

6.1 Use Demo Accounts

Before I ever put real money on the line, I practiced for two months in a demo account. I treated it like real cash. I journaled. I managed risk. And when I finally went live, I already had confidence in my strategy.

Use a demo account to test. Try new pairs. Test entry triggers. Refine stop placement. And do it all without the stress of losing real capital.

6.2 Stay Updated and Review Strategy

Markets change. A system that worked last year might not perform the same today. I make it a habit to revisit my plan monthly. I also follow updates from analysts on XS.com and other trusted sources.

Don’t assume you’ve “got it” forever. Stay curious. Stay sharp.

7. Practical Execution Checklist

Let’s bring it all together. Before I enter any swing trade, I run through a short checklist. This keeps me focused and prevents impulse decisions.

7.1 Choosing Pairs and Timeframes

I stick with major pairs—EUR/USD, GBP/USD, USD/JPY. These are liquid, active, and cheap to trade. I mark setups on the 4H chart, but confirm trends using the daily. This top-down approach keeps my analysis aligned and consistent.

7.2 Monitoring and Adjusting Trades

Once a trade is live, I don’t stare at it all day. I set alerts at key levels. If price moves in my favor, I trail my stop to lock in profit. I’m not afraid to let winners run—some of my best trades lasted 3–4 days.

But if something changes fundamentally—like unexpected news—I re-evaluate. I’d rather close early than hope and pray.

FAQ

What is the best timeframe for swing trading forex?

I use the 4-hour chart for entries and the daily chart for overall trend direction. The daily gives context, and the 4H offers precision. Together, they’re perfect for swing trades lasting 1 to 5 days.

How much capital do I need for swing trading?

You can start with as little as $500 if you’re disciplined. But I recommend $1,000–$2,000 to give yourself room for proper risk management and trade diversification. Always risk 1–2% per trade—no more.

How do economic news events impact swing trades?

Big news—like interest rate changes—can cause huge volatility. I avoid opening trades right before major announcements. If I’m already in a trade, I tighten my stop or reduce my position size ahead of the release.

How do I set my stop-loss and take-profit levels?

I base them on recent price structure—like the previous swing high or low. Then I apply a minimum 2:1 reward/risk ratio. So if I’m risking 50 pips, I want at least 100 pips in reward.

Here’s What You’ve Learned

We covered a lot—from riding the bigger trend to dialing in your entry and exit with confirmation tools. I showed you how I manage risk, track my trades, and stay out of trouble during news events. I even gave you my full execution checklist.

If there’s one thing I want you to take away, it’s this: success in swing trading isn’t about being perfect—it’s about being consistent. Small, smart decisions stacked over time make a big impact.

So grab your chart, check the trend, and start journaling. The best trades aren’t lucky. They’re earned.