I still remember the first time I heard the term forex scalping. It sounded intense — like something only speed freaks or thrill-seekers would dare to try. Turns out, it kind of is. But once I dipped my toes in, it became one of the most exciting trading approaches I’ve ever used. If you’ve ever wanted a strategy that delivers quick feedback and sharpens your instincts, you’re in the right place.

Scalping in forex is a fast-paced, high-frequency trading method. But it’s not for the faint of heart. I’ve lost count of how many trades I’ve placed that were over in under two minutes. What kept me going wasn’t just the profit potential — it was the control, precision, and adrenaline.

Still, scalping is often misunderstood. Many traders jump in blind, hoping to make quick bucks and end up drowning in spreads and stress. That’s why I put this guide together: to share what works, what doesn’t, and what you absolutely need to know if you’re thinking about scalping.

- What forex scalping really is (and how it works)

- The essential tools, timeframes, and indicators

- Top strategies like the 1-minute EMA method

- Real risk factors and how to manage them

Whether you’re just curious or dead serious about diving in, I’ll show you exactly what I’ve learned from doing this day in and day out — all while sticking to the facts and cutting through the fluff.

What is Forex Scalping?

Scalping is a trading strategy where you open and close trades within seconds or a few minutes. The goal is to take advantage of tiny price movements — often just 5 to 10 pips — and do it many times throughout the day. It’s like skimming small profits off the top, over and over.

Unlike swing or position trading, you’re not holding trades for hours or days. You’re reacting to price action in real time. That’s why speed, discipline, and the right tools are absolutely critical.

It’s not for everyone. But if you like the idea of being in control and making decisions on the fly, it might be perfect for you.

Key Elements of Forex Scalping

Ultra-Short Trade Duration

Most of my scalping trades last under 2 minutes. Some are over in 10 seconds. The key is reacting fast — no time for hesitation or second-guessing. This requires sharp focus and immediate execution.

Small Profit Targets

I usually target around 5 to 10 pips. It doesn’t sound like much, but when you stack 20 or 30 of these trades a day, it adds up. You can’t get greedy. Scalping is about precision and volume, not hitting home runs.

High-Frequency Trades

On a good day, I might take 50+ trades. That’s a lot of activity, which means more chances to be right — but also more chances to mess up. You’ve got to be consistent with your rules and trust your setup.

Execution Speed

Latency kills in scalping. You need a broker with low spreads, fast execution, and minimal slippage. I once lost a profitable streak just because my platform lagged for 3 seconds. That’s how tight the margins are.

Technical Tools for Scalping

Moving Averages

I swear by the 50 EMA and 100 EMA combo. When the 50 crosses above the 100, I look for long setups. If it’s the other way around, I get ready to short. Combine that with a fast oscillator and you’ve got a solid edge.

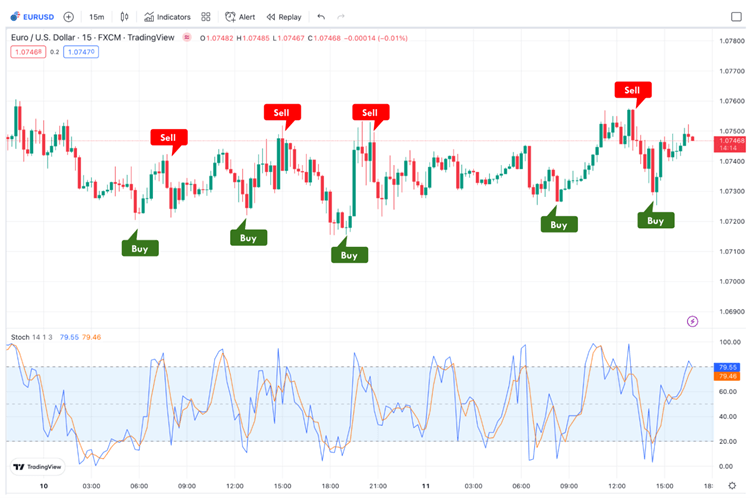

Stochastic Oscillator

This helps me avoid bad entries. I wait for it to cross above 20 (bullish) or drop below 80 (bearish). It gives you a quick pulse on momentum. Works best when price is near key EMAs.

Support and Resistance

Don’t ignore these zones. I use them to frame my trades, especially during range-bound sessions. Bouncing off these areas with volume confirmation gives me confidence to pull the trigger.

Choosing the Right Broker and Platform

Low Spreads

Every pip counts. I can’t stress this enough. I only trade with brokers offering 0.1 to 0.3 pip spreads on EUR/USD. If your spread is too wide, scalping becomes almost impossible.

Execution Speed and Reliability

Use platforms like MetaTrader 4 or cTrader. I also check broker execution stats and avoid any that delay or requote. Even a 0.5 second delay can flip a win into a loss.

Regulated Brokers

I always trade with brokers regulated by tier-one authorities like FCA or ASIC. When you’re in and out that fast, you don’t want to worry about shady practices or manipulated pricing.

Best Forex Scalping Strategies

1-Minute Scalping Strategy

This is my bread-and-butter. Here’s how I set it up:

| Chart Setup | Buy Signal | Sell Signal | Risk Management |

|---|---|---|---|

| 1-minute chart with 50 EMA, 100 EMA, and Stochastic Oscillator | 50 EMA crosses above 100 EMA, Stochastic > 20 | 50 EMA crosses below 100 EMA, Stochastic < 80 | 2-3 pip stop, target 8-12 pips |

When I first tried this strategy, I got burned because I didn’t use stop-losses. Now, I never enter a trade without one. The goal is to take small wins, not risk everything for one move.

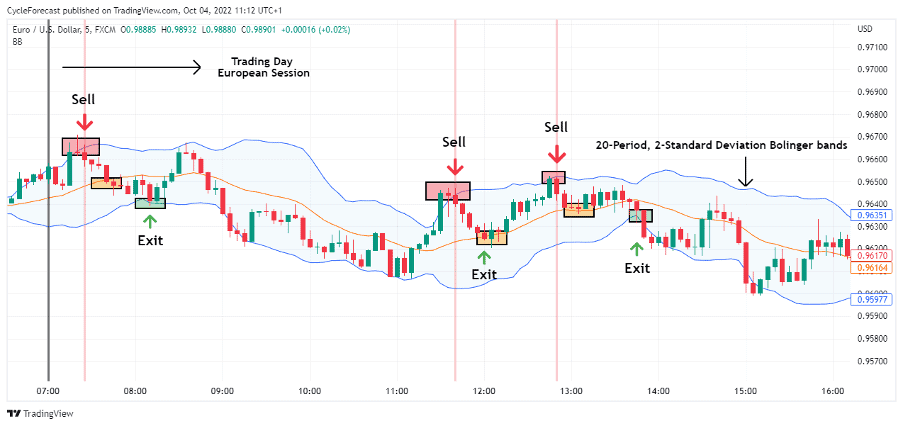

Range Scalping

This works beautifully during London lunch hours or late Asian sessions. I mark out recent highs and lows, then trade bounces within the range. I avoid trading breakouts unless there’s a strong news catalyst backing it.

News/Event Scalping

Scalping after major economic news is risky but rewarding. I use the Forex Factory Calendar to track events. I wait 30 seconds after the release and look for fast price action rejections to scalp reversals.

Pros and Cons of Forex Scalping

Why I Love Scalping

You get fast feedback. You’re not stuck watching a chart for hours. When I scalp, I feel more engaged, more present. And when done right, the profits stack up fast.

But It’s Not Perfect

Scalping can be emotionally draining. You need to stay laser-focused. And commissions can eat into your gains if you’re not careful. It’s not passive — it’s work. But it’s also damn satisfying when everything clicks.

Tips for Successful Forex Scalping

Timing Is Everything

Most of my wins happen during the first 3 hours of the London or New York session. Liquidity is highest, spreads are tight, and price action is crisp. Outside those hours? Things get choppy or too slow to scalp effectively.

Discipline Beats Emotion

When I started scalping, I’d overtrade just because I was bored. That’s how I blew my first small account. Now, I follow a simple rule: if the setup isn’t crystal clear, I skip it. Missing a trade is better than chasing a bad one.

Practice with a Demo First

This one’s non-negotiable. Before you go live, practice your strategy on a demo account. Get used to the speed, pressure, and platform features. I did this for 2 weeks straight — it saved me thousands later.

Risk Management for Scalpers

Tight Stop-Losses

I usually set my stop-loss no more than 3 pips away. Scalping doesn’t give you room to recover from a bad entry. You’ve got to cut losses fast and move on.

Proper Lot Sizing

Small profits mean you need decent trade size — but don’t go crazy. I stick to 1-2% risk per trade. That way, even a losing streak won’t wipe me out.

Avoid Overtrading

This is where many beginners mess up. Just because you can trade all day doesn’t mean you should. I limit myself to a max of 30 trades per session, and I walk away after 3 consecutive losses.

Common Mistakes to Avoid

Chasing the Market

When you see price move fast, it’s tempting to jump in late. Don’t. That’s how slippage kills your trade. Wait for confirmation and trade your plan — not your emotions.

Ignoring the News

I made this mistake early on. A surprise interest rate cut wiped out five trades in 10 minutes. Always check the news calendar before scalping. If something major is coming, wait it out.

Using the Wrong Broker

If your broker has high spreads, slippage, or slow execution, you’re dead in the water. Choose one that allows scalping and is built for fast trading. I also recommend checking their live spread stats daily.

FAQs About Forex Scalping

Is forex scalping profitable?

Yes, but only if you’re disciplined and consistent. It’s not about one big win — it’s about stacking small, frequent gains. Over time, those 5-pip wins really add up.

What is the best indicator for forex scalping?

I personally use the 50 EMA, 100 EMA, and Stochastic Oscillator combo. It’s simple, fast, and works well on the 1-minute chart. But the best indicator is the one you can read and react to quickly.

Can you scalp forex without leverage?

You can, but it’s tough. Without leverage, your gains are minimal — and since scalping involves tiny movements, it may not be worth it. Most scalpers use 1:10 to 1:50 leverage responsibly.

How much money do I need to start scalping?

You can start with as little as $100 on a micro account, but I’d recommend $500 to $1,000 for proper risk management and flexibility. Just be sure to practice first and size your trades carefully.

Recap of Key Points

Scalping in forex is all about fast decisions, tiny profits, and doing it over and over again. We walked through key tools like EMAs and stochastic, strategies like 1-minute and range scalping, and how to manage risk like a pro. We also touched on why choosing the right broker matters and how discipline is your best friend in this game.

Final Takeaway

Scalping isn’t magic. It takes effort, focus, and a bit of grit. But if you’re the kind of person who enjoys quick feedback and staying sharp, this might just be your sweet spot in trading.

Closing Thought

I’ve blown accounts, overtraded, and chased moves I shouldn’t have — but I’ve also found consistency, control, and confidence through scalping. You don’t need to be perfect. You just need to be prepared. So go test, tweak, and find your rhythm. The market’s moving — are you ready to ride the wave?