Forex trading felt like a mysterious code the first time I stumbled across it. Charts, acronyms, and currency pairs everywhere. But like anything in life, the fog cleared once I understood the basics — and that’s exactly what I want for you.

I know how frustrating it can be to dive into a world where everyone seems to speak a different language. When I started out, I kept asking: How does this actually work? Who’s trading with who? And how do I even get in?

So here’s the thing — forex trading is the process of buying one currency and selling another to profit from price changes. But behind that simple idea is a fascinating global market running 24/5 with trillions of dollars moving every single day.

In this guide, I’ll walk you through:

- What forex trading actually is (in real terms)

- Why this market is open day and night

- Who participates and how it works behind the scenes

- The essential tools and risks to know upfront

- How I got started with just a demo account and zero background

If you’ve ever felt like forex is just for financial wizards or fast-talking brokers, think again. By the end of this page, you’ll know enough to start — smartly and safely.

How Forex Trading Works

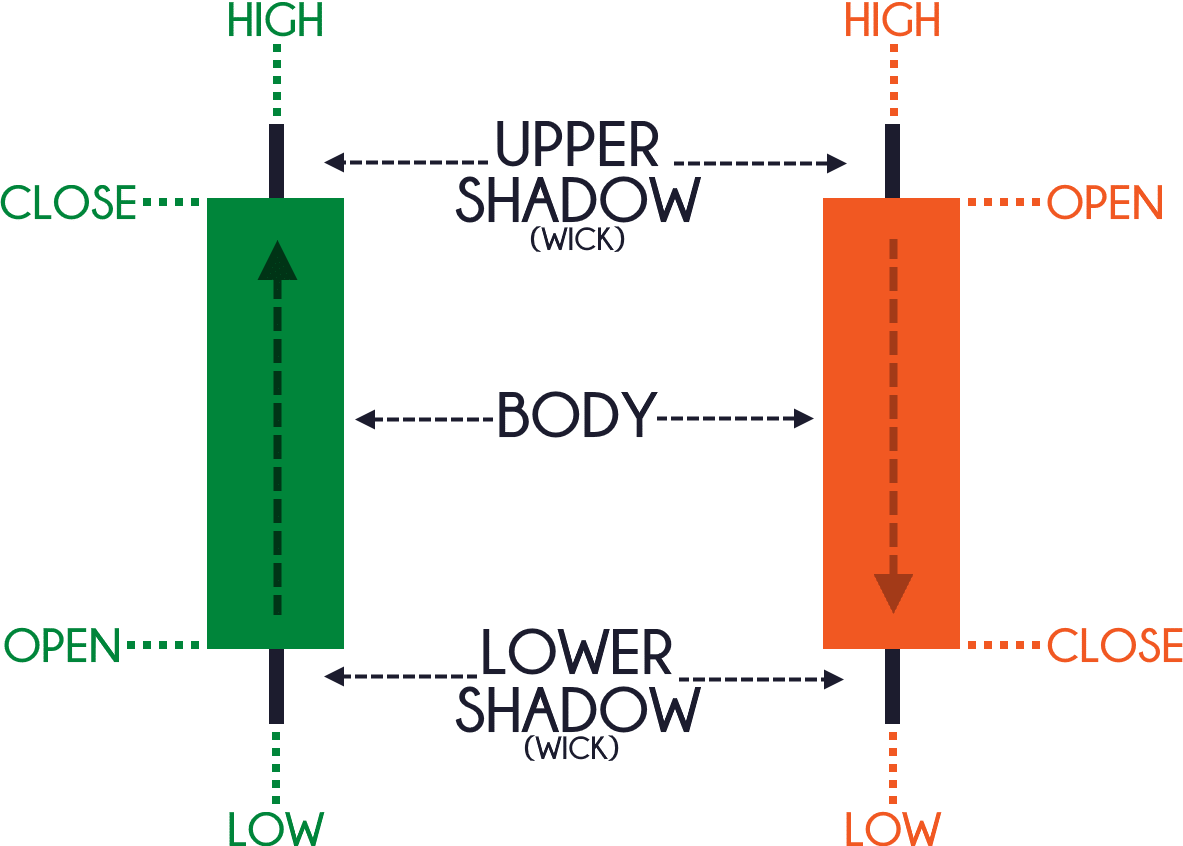

The Currency Pairs You’re Actually Trading

In forex, you always trade two currencies together, called a currency pair. For example, when you see EUR/USD, that means you’re buying euros while selling U.S. dollars. These values shift constantly based on global events, supply and demand, and investor expectations.

I personally started with EUR/USD because it’s one of the most liquid and beginner-friendly pairs. Once I got used to how the pair reacted to news — like interest rate changes — I slowly explored others like GBP/JPY.

There’s No Single Exchange — It’s All OTC

The forex market is a decentralized over-the-counter market. That means there’s no central exchange like the NYSE or NASDAQ. Instead, trades happen directly between buyers and sellers using platforms or brokers. This setup allows the market to operate 24 hours a day, five days a week.

Trust me — I’ve traded during both the London and New York sessions. Each has its own rhythm and energy. Knowing when to trade changed my results entirely.

Major Sessions Drive the Clock

Forex trading follows global financial centers. The market opens in Sydney, moves to Tokyo, then London, and finally New York. This cycle means there’s always a market open somewhere — which explains why trading is nonstop from Monday to Friday.

Who’s Trading and Why

Retail Traders Like Me and You

Most new traders, including myself, enter the market through online brokers. We trade with small amounts (thanks to leverage) and try to grow our capital by catching short-term price moves. I started with $200 on a demo account. It was enough to get my feet wet without any real risk.

Big Banks, Corporations, and Hedge Funds

While we make up the retail side, there’s a bigger crowd out there: central banks, hedge funds, corporations, and governments. They trade for different reasons — some hedge currency exposure, others invest billions based on macroeconomic trends.

The Purpose Behind Every Trade

Some traders speculate for profit. Others — like global companies — use forex to hedge. I remember reading how a European company locked in currency rates to avoid losing money on a U.S. deal. That’s real-world forex in action.

Market Size, Liquidity, and Opportunity

Why Forex is the World’s Biggest Market

The forex market trades more than $7 trillion per day. That’s more than the stock and futures markets combined. This scale means ultra-high liquidity, which I found amazing — orders get filled fast, and you can enter or exit trades easily.

Liquidity Makes All the Difference

I once had an order on EUR/USD fill instantly, even during news. That’s the power of a liquid pair. Less liquid pairs, like NZD/CHF, can show slippage, especially during off-hours.

Volatility = Risk + Reward

High volume and constant news make forex volatile. One time, I entered a trade before a U.S. jobs report. The price jumped 50 pips in minutes. Exciting? Yes. Dangerous without a plan? Also yes.

Core Components of a Smart Trading Setup

Choosing the Right Forex Broker

You can’t trade without a broker. Look for regulation, low spreads, fast execution, and good customer support. I went through five brokers before finding one that actually delivered what they promised. A broker that freezes during high volatility? Deal-breaker.

Demo Account = Your Practice Arena

Demo accounts let you trade live markets without risking real money. I practiced with fake funds for weeks — and I still use demo mode to test strategies. This isn’t just smart — it’s essential.

Essential Tools I Use Daily

Here’s what’s always open on my screen:

| Tool | Purpose |

|---|---|

| Economic Calendar | To track upcoming news events |

| Trading Journal | To record trades, emotions, outcomes |

| MT4/MT5 | To execute trades and chart analysis |

| Price Alerts | To avoid staring at charts all day |

The Real Risks in Forex Trading

Market Volatility Can Wipe You Out Fast

One of the first trades I ever made was during an unexpected central bank announcement. The market moved against me so quickly, I lost nearly 30% of my small account in a single afternoon. That’s when I learned: volatility is both an opportunity and a risk.

Forex markets react strongly to economic data, geopolitical events, and investor sentiment. Without preparation, you’re basically gambling. I’ve made peace with volatility — but only because I use tight risk management rules.

Leverage Is a Double-Edged Sword

With forex, you can trade amounts much larger than your actual balance using leverage. While this sounds great, I found out the hard way how quickly it can backfire. A 1% move in the wrong direction on a 100:1 leveraged trade? That’s your entire account gone.

These days, I rarely go above 10:1 leverage. I’d rather grow slow than blow up fast.

Risk Management Isn’t Optional — It’s Survival

I never enter a trade without a stop loss and a take profit. These two tools have saved me from disaster more times than I can count. Even on my worst days, having limits in place gave me the confidence to keep going.

Want to trade smart? Use these every time:

- Stop Loss — Cuts your loss if the market moves against you

- Take Profit — Locks in gains when your goal is hit

- Position Sizing — Keeps your risk to a percentage of your capital (I use 1%)

How to Start Your Forex Trading Journey

Open a Demo Account First

If you’re brand new, I can’t stress this enough: start with a demo account. Most brokers offer them free. You’ll learn to place trades, analyze charts, and manage positions — all without risking a dollar. I traded in demo mode for over a month before even thinking about going live.

Learn One Strategy at a Time

I fell into the trap of chasing every strategy I saw online. Scalping, swing trading, indicators everywhere. It left me confused and broke. What helped was focusing on just one method — price action on the 4-hour chart. That’s where I started finding consistency.

Pick something simple. Stick with it. Refine it. Don’t jump from system to system every week.

Track Everything You Do

My trading turned a corner when I started journaling. I wrote down every entry, exit, emotion, and reason. Over time, I spotted patterns — both good and bad. That journal became my mirror. If you want to grow as a trader, track your decisions.

FAQ: Real Questions from New Traders

What is forex trading in simple terms?

Forex trading is the act of buying one currency while selling another, hoping to make a profit from the changes in their value.

Can I start forex trading with $100?

Yes, many brokers allow small accounts. But with high leverage, that $100 can vanish quickly. Focus on learning first.

Is forex trading safe for beginners?

It’s risky, especially without education. Start with a demo, study basic strategies, and use risk management tools.

Do I need to be good at math to trade forex?

No. If you can understand simple percentages and manage a budget, you’re already equipped.

How much can I earn trading forex?

It depends on your capital, skill, and discipline. Some months I barely broke even. Others I gained 5%–10%. It’s not fast money — it’s patient money.

Recap of Key Points

We’ve covered a lot. You now understand what forex trading is, how the global market operates, who participates, and what tools and risks are involved. I’ve shared my early wins and painful mistakes to help you sidestep them.

Final takeaway? Start slow. Educate yourself. Practice on demo accounts. Track everything. And trade with rules — not emotions.

I truly believe anyone can learn forex. It’s not about being perfect — it’s about staying consistent. So, are you ready to take your first trade?

1 Comment

Pingback: How Does Forex Trading Work? A Step-by-Step Guide - Chronos Trading