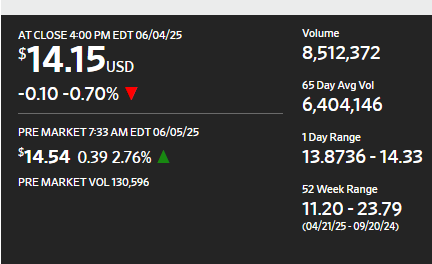

In a very traditional industry, Oscar Health has long been hailed as a promising digital disruptor. The company is displaying indications of a quiet recovery as it recently traded at $14.55, up 2.83% in premarket movement. Despite a 0.70% decline in its previous day’s close, the overall indication that Oscar might finally be fulfilling its long-held goal of simplifying the insurance process is more noteworthy than the specific figures.

Mario Schlosser, Kevin Nazemi, and Joshua Kushner founded Oscar with the remarkably clear goal of using intelligent design to make healthcare simpler. At a time when other businesses were still using fax machines and phone trees, it provided clients with an extremely effective digital-first insurance platform. That vision has steadily evolved over the last ten years into a workable, profitable reality.

Oscar Health Inc. — Key Information for Investors and Analysts

| Attribute | Details |

|---|---|

| Company Name | Oscar Health, Inc. |

| Stock Symbol | OSCR |

| Founded | October 25, 2012 |

| Founders | Mario Schlosser, Kevin Nazemi, Joshua Kushner |

| Headquarters | New York, NY |

| Market Capitalization | $3.60 Billion (as of June 4, 2025) |

| Revenue (TTM) | $10.08 Billion |

| Net Income | $123.33 Million |

| Earnings Per Share (EPS) | $0.40 |

| Return on Equity | 10.48% |

| Total Cash (MRQ) | $2.99 Billion |

| Total Debt/Equity Ratio | 26.88% |

| Price/Book Ratio | 2.70 |

| Price/Sales Ratio | 0.38 |

| Trailing P/E | 35.38 |

| Forward P/E | 19.84 |

| Website | www.hioscar.com , Instagram |

Oscar created a platform that functions more as a smart assistant than a traditional insurer by fusing cutting-edge data analytics with user-friendly design. It tracks health spending in real-time, suggests doctors, and provides clear explanations of benefits. For younger, tech-savvy users who frequently feel alienated by complicated policy language, this type of transparency is especially helpful.

Although previously a cause for concern, the company’s financials have significantly improved. Oscar’s $10.08 billion in revenue over the previous 12 months shows strong growth, particularly for a company that was still having trouble growing a few years ago. More significantly, the business reported net income of $123.33 million, signaling a change to significant, long-term profitability. Although it is not the industry leader, its 1.22% profit margin is a big step in the right direction.

Oscar’s entry into the Medicare Advantage market is especially creative. Oscar’s sleek interface and digitally guided care pathways provide a welcome alternative for retirees who are becoming more quality-conscious and smartphone-savvy, even though larger incumbents like UnitedHealth and Humana still control this market. This market entry could greatly increase Oscar’s reach and expose its model to a demographic that tech companies frequently ignore.

Oscar has made everything from member onboarding to claims processing more efficient by utilizing advanced analytics. The business forecasts member behavior, flags inefficiencies, and finds bottlenecks using algorithms rather than static paper trails. In addition to lowering operating expenses, this has improved customer satisfaction, two indicators that are becoming more and more important in determining investor confidence.

Oscar’s financial discipline is clearly getting better, in contrast to many tech-forward startups that deplete capital at startling rates. With $2.99 billion in cash on hand, it has remarkable flexibility to improve product lines, acquire niche competitors, or withstand transient macroeconomic shocks. Oscar’s ambitions are remarkably similar to those of its peers, such as Clover Health or Bright Health, but its execution is noticeably more stable.

Investors are aware. A market that is willing to believe in the company’s future earnings potential is indicated by its forward P/E ratio of 19.84, especially as digital health services become more widely accepted. Platforms like Oscar benefited greatly from the surge in remote care solutions during the pandemic. Even though it has cooled, that momentum has set a new standard for user expectations. Oscar’s ongoing investments in digital tools seem less speculative and more strategically necessary in this light.

Credibility is also increased by the brand’s support. Through his venture capital firm Thrive Capital, Joshua Kushner has backed some of the most well-known startups of the past ten years, such as Instagram and OpenAI. His participation suggests both financial resources and strategic vision. Oscar is constantly improving its platform by working with developers and behavioral economists to make insurance feel more individualized than bureaucratic.

Oscar has increased its geographic reach with little controversy by forming strategic alliances with state exchanges and providers. In a regulatory environment that is frequently antagonistic to innovation, that quiet efficiency has been especially crucial. Policymakers, consumers, and, more slowly, Wall Street have all been won over by the company’s emphasis on compliance and slick service.

Given the growing expenses of healthcare and the scarcity of employees, Oscar’s technology-driven strategy seems incredibly relevant. Scalable solutions that lower labor intensity without sacrificing care quality are desperately needed by the industry. Oscar is very versatile because it can automate back-end tasks while still providing user-friendly front-end experiences. It’s rethinking how people interact with healthcare systems, not just selling insurance.

Oscar may have more in store for him in the future than just selling insurance. In the same way that Amazon’s AWS transitioned from an internal tool to a dominant cloud service, its proprietary technology platform may eventually be licensed to smaller payors or even self-insured employers. Oscar’s current $3.60 billion market capitalization may appear remarkably conservative in retrospect if its platform turns into a white-label engine for other insurance companies.

Though its development feels unique, analysts frequently contrast Oscar with other tech-driven health initiatives. It’s more about creating an incredibly obvious alternative than it is about causing disruptions to get attention. Oscar is quietly redefining what contemporary insurance can look like by simplifying operations and releasing human talent to concentrate on high-value services.

The discourse surrounding health insurance has evolved substantially since the beginning of this decade. It was once thought of only as a cost center, but these days, more people see it as an area that is ready for data-driven innovation. Oscar occupies that space with a business plan that is both realistic and truly novel.

Oscar Health is anticipated to keep growing its technological and product offerings in the upcoming years. The company’s strategy seems to be based on reason rather than hype, whether it is through enterprise licensing, Medicare Advantage, or strengthened provider partnerships. Its strategy—less about scale for scale’s sake and more about focused, strategic growth—might serve as a model for others.

Oscar Health’s stock may have been overlooked lately, but with solid financials, an exceptionally strong digital platform, and a leadership team committed to long-term growth, it’s becoming harder to overlook. Oscar provides a particularly perceptive look at what lies ahead as technology continues to permeate every aspect of healthcare.